India OTT Media Services Market Size, Share, Trends and Forecast by Type, Content Type, Device Type, Revenue Model, and Region, 2026-2034

India OTT Media Services Market Summary:

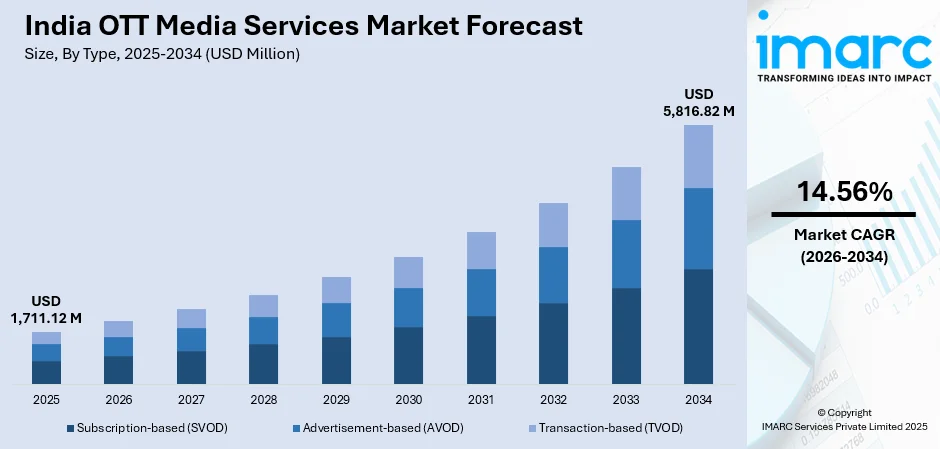

The India OTT media services market size was valued at USD 1,711.12 Million in 2025 and is projected to reach USD 5,816.82 Million by 2034, growing at a compound annual growth rate of 14.56% from 2026-2034.

The Indian OTT media service market is experiencing incredible growth owing to the proliferation of smartphones and affordable data tariffs in the country. The Indian OTT markets benefit from the country’s expanding digital infrastructure, growing internet penetration in general, and increasing demand for regional-language content. The OTT players in India have had to compete with traditional cinematic options such as cinemas.

Key Takeaways and Insights:

- By Type: Subscription-based (SVOD) dominates the market with a share of 51% in 2025, driven by consumer willingness to pay for premium ad-free content, exclusive original programming, and high-quality streaming experiences offered by leading platforms.

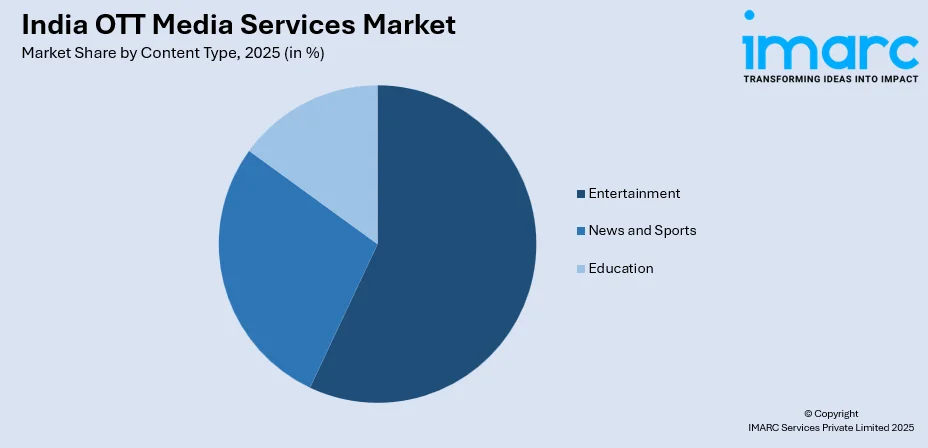

- By Content Type: Entertainment leads the market with a share of 57% in 2025, owing to strong demand for movies, web series, and original content productions that cater to diverse viewer preferences and regional storytelling traditions.

- By Device Type: Smartphones and tablets dominate the market with a share of 45% in 2025, supported by India's mobile-first digital ecosystem, affordable smartphone availability, and the convenience of on-the-go content consumption.

- By Revenue Model: Subscription revenue leads the market with a share of 64% share in 2025, reflecting growing consumer acceptance of paid streaming services and platforms' focus on premium content offerings to attract and retain subscribers.

- By Region: North India dominates with a market share of 33% in 2025, facilitated by higher urban population density, stronger digital infrastructure, greater disposable incomes, and early adoption of streaming technologies.

- Key Players: The India OTT media services market features intense competition between global streaming giants and domestic platforms. Industry participants are focusing on regional content expansion, strategic partnerships with telecom operators, and hybrid monetization models to capture diverse audience segments.

To get more information on this market Request Sample

The India OTT media services industry has emerged as one of the fastest-growing digital entertainment markets globally, transforming how consumers access and consume media content. According to reports, in September 2025, India’s OTT audience has crossed a significant milestone of around 601 million users, including approximately 148 million active paid subscriptions. The proliferation of affordable smartphones, declining data costs, and widespread internet connectivity have democratized access to streaming services across socioeconomic segments. India's unique linguistic diversity has catalyzed significant investment in regional language content, with platforms offering programming in Hindi, Tamil, Telugu, Bengali, Kannada, Malayalam, and numerous other languages. The market is characterized by evolving business models as platforms experiment with subscription, advertisement-supported, and hybrid approaches to maximize reach and revenue.

India OTT Media Services Market Trends:

Surge in Regional Language Content Production and Consumption

Regional language content has emerged as the primary growth driver for OTT platforms in India, with vernacular programming accounting for a substantial majority of total content consumption. In December 2025, ZEE5 reported that regional languages outside Hindi now account for more than 50% of India’s paid OTT subscriptions, underscoring the shift toward language-first viewing preferences. Platforms are investing heavily in original productions across multiple Indian languages to capture audiences beyond metropolitan markets. This localization strategy resonates strongly with viewers who prefer content reflecting their cultural identities and regional narratives.

Adoption of Hybrid Monetization Models

OTT platforms are increasingly adopting hybrid business models combining subscription-based and advertisement-supported tiers to address diverse consumer preferences and price sensitivities. A notable example is the 2025 launch of JioHotstar, the merged platform of JioCinema and Disney+ Hotstar, which uses a hybrid approach that lets users watch content for free initially but then requires a subscription after certain viewing thresholds, with plans starting at ₹149. This freemium approach enables platforms to acquire mass-market users through free ad-supported content while converting engaged viewers to premium subscriptions.

Strategic Telecom Partnerships and Bundling Initiatives

Collaborations between OTT platforms and telecommunications providers have become instrumental in driving subscriber acquisition and reducing customer acquisition costs. In May 2025, Bharti Airtel launched India’s first prepaid “all‑in‑one” OTT packs, bundling 25+ streaming services with unlimited 5G data and calls. Bundled offerings that include streaming subscriptions with mobile data plans provide compelling value propositions for consumers while ensuring platform accessibility. These partnerships leverage telecom operators' extensive distribution networks and billing relationships to penetrate deeper into India's diverse consumer segments and accelerate market penetration.

Market Outlook 2026-2034:

The overall outlook for the OTT media services market in India is extremely positive as basic growth ingredients such as growing internet penetration, smartphone penetration, and consumption behavior trends are only getting more fortified. Additionally, the rollout of 5G connectivity in urban as well as new-age cities is expected to improve the streaming experience, thus paving the way for new-age immersive experiences. In addition to that, the overall development enabled by the government to build new-age digital infrastructure has helped bridge the urban-rural connectivity chasm, thus increasing the addressable market significantly. The market generated a revenue of USD 1,711.12 Million in 2025 and is projected to reach a revenue of USD 5,816.82 Million by 2034, growing at a compound annual growth rate of 14.56% from 2026-2034.

India OTT Media Services Market Report Segmentation:

|

Segment Category |

Leading Segment |

Market Share |

|

Type |

Subscription-based (SVOD) |

51% |

|

Content Type |

Entertainment |

57% |

|

Device Type |

Smartphones and Tablets |

45% |

|

Revenue Model |

Subscription Revenue |

64% |

|

Region |

North India |

33% |

Type Insights:

- Subscription-based (SVOD)

- Advertisement-based (AVOD)

- Transaction-based (TVOD)

The subscription-based (SVOD) dominates with a market share of 51% of the total India OTT media services market in 2025.

The subscription video-on-demand segment maintains market leadership as consumers increasingly recognize value in premium ad-free streaming experiences with access to exclusive content libraries. In H1 2024, Jio Cinema, Netflix, and Disney+ Hotstar captured nearly 70% of India’s premium VOD revenue, with Netflix leading SVOD monetization at 38 % through premium content. The growing middle-class population with rising disposable incomes demonstrates willingness to pay for quality entertainment, driving subscriber growth across leading platforms. SVOD services differentiate through original content investments and curated programming.

Platform strategies emphasizing exclusive releases, early access to theatrical content, and high-production-value original series strengthen subscriber retention and acquisition. The segment benefits from evolving consumer preferences favoring uninterrupted viewing experiences and personalized content recommendations powered by sophisticated algorithms. Competitive pricing and flexible subscription tiers enhance accessibility across consumer segments, driving long-term engagement and platform loyalty growth.

Content Type Insights:

Access the comprehensive market breakdown Request Sample

- Entertainment

- News and Sports

- Education

The entertainment leads with a share of 57% of the total India OTT media services market in 2025.

Entertainment content dominates the OTT landscape as Indian audiences demonstrate strong appetite for movies, web series, reality shows, and original productions across multiple languages and genres. In December 2025, JioHotstar announced a planned ₹4,000 crore investment in South‑Indian content to produce 1,500 hours of new programming over the next year, responding to a significant rise in regional viewership and reinforcing platforms’ focus on localized entertainment to attract and retain subscribers. This segment benefits from platforms' substantial investments in content creation, including high-budget productions featuring popular talent that attract mass viewership.

Drama and action genres command significant viewer preferences, while comedy maintains enduring appeal across demographic segments. The proliferation of regional entertainment content has expanded the addressable audience substantially, with platforms commissioning original programming in numerous Indian languages. Binge-watching culture and on-demand access to extensive content libraries reinforce entertainment's dominant position in consumer streaming habits, further boosting platform engagement and subscriber loyalty.

Device Type Insights:

- Smartphones and Tablets

- Smart TVs

- Laptops and Desktops

- Gaming Consoles

The smartphones and tablets dominate with a market share of 45% of the total India OTT media services market in 2025.

The mobile-driven digital culture in India makes smartphones and tablets the central devices for consuming Over-the-Top content. The availability of affordable smartphones in the market, along with competitive prices for mobile data services, has made it possible for people in urban as well as rural areas to enjoy streaming services. Consumers also enjoy the flexibility offered by entertainment in their hands, which fits seamlessly into their busy lives.

The mobile viewing behavior stands out in the youth audience, where the preference for personalized content and mobile viewing surpasses viewing on television. The mobile application of the platform, which is mobile-friendly and helps in conserving mobile data through offline viewing, improves the viewing experience on mobiles. The increased availability of 4G networks and the imminent entry of 5G further consolidate the supremacy of mobile devices in shaping viewing habits for OTT in the Indian market.

Revenue Model Insights:

- Subscription Revenue

- Advertising Revenue

- Hybrid Models

The subscription revenue leads with a share of 64% of the total India OTT media services market in 2025.

Subscription revenue maintains dominant market position as platforms prioritize recurring revenue streams that enable sustained content investments and operational planning. In December 2025, the Indian government highlighted that the public broadcaster’s WAVES OTT platform has crossed 80 lakh downloads, reflecting rising digital engagement and expanding affordable content access nationwide. The model provides predictable cash flows while fostering deeper customer relationships through ongoing engagement. Premium subscribers demonstrate higher lifetime value and lower churn rates compared to advertising-dependent users.

Platforms are refining subscription strategies through tiered pricing structures that accommodate diverse consumer segments and price sensitivities. Mobile-only plans at accessible price points have proven particularly effective in expanding the subscriber base among price-conscious consumers. The emphasis on exclusive content and enhanced viewing experiences justifies subscription premiums while differentiating platforms in an increasingly competitive marketplace, driving long-term loyalty and encouraging higher engagement across multiple devices.

Regional Insights:

- North India

- South India

- East India

- West India

North India exhibits a clear dominance with a 33% share of the total India OTT media services market in 2025.

North India maintains market leadership driven by the concentration of metropolitan centers including Delhi-NCR, which demonstrates high digital adoption rates and substantial disposable income levels. The region's large Hindi-speaking population provides a substantial addressable market for mainstream content, while urban infrastructure supports reliable streaming connectivity, enabling platforms to roll out premium services and localized content effectively across key cities.

Early adoption of digital technologies and established e-commerce penetration have created consumer familiarity with subscription-based digital services in North Indian markets. The region benefits from strong telecommunications infrastructure and competitive data pricing that facilitate widespread streaming adoption. However, South India represents significant growth potential with its thriving regional language content ecosystem and expanding subscriber base across multiple vernacular markets, offering platforms opportunities to tailor content strategies and capture emerging audiences effectively.

Market Dynamics:

Growth Drivers:

Why is the India OTT Media Services Market Growing?

Expanding Digital Infrastructure and Internet Penetration

India’s digital transformation is reshaping content consumption as internet connectivity expands nationwide. Affordable 4G services and ongoing 5G rollout enable high‑quality streaming for hundreds of millions of users. Under BharatNet Phase‑3, subsidised broadband is reaching around 1.5 crore rural households, increasing access in previously underserved areas and broadening the OTT audience. Government programs bridging urban‑rural digital divides, combined with lower mobile data costs and telecommunications investments in network capacity, are democratizing digital entertainment and supporting rapidly growing video streaming consumption across the country.

Proliferation of Affordable Smartphones and Connected Devices

The availability of budget‑friendly smartphones with strong streaming performance has been key to OTT market growth, with smartphones remaining the preferred device for 97 % of Indian viewers. Feature-rich handsets at accessible prices drive mass adoption of streaming apps, while the growing smart TV market complements mobile viewing, offering immersive home experiences, with connected TV. Gaming consoles and streaming devices are also gaining traction, and continuous improvements in display quality, processing power, and battery life further enhance the streaming experience across devices.

Rising Demand for Regional and Vernacular Content

India’s linguistic diversity has created significant opportunities for OTT platforms offering content beyond Hindi and English. For instance, regional OTT platform Aha, which started with Telugu and Tamil content, announced plans to invest ₹1,000 crore over the next three years to expand into additional languages and genres, highlighting the growing focus on vernacular content. Vernacular content now accounts for a majority of total streaming consumption, prompting platforms to produce originals across Tamil, Telugu, Bengali, Malayalam, Kannada, and other languages. This localization strategy engages audiences seeking culturally relevant storytelling and drives growth in regional and national OTT markets.

Market Restraints:

What Challenges the India OTT Media Services Market is Facing?

Content Piracy and Unauthorized Distribution

Digital piracy remains a significant challenge for OTT platforms, undermining subscription revenue potential and content investment returns. Unauthorized streaming websites and applications distribute premium content without compensation to rights holders, particularly affecting new releases. Despite technological countermeasures and legal enforcement efforts, piracy persists as a structural challenge requiring continued industry and regulatory attention.

Subscription Fatigue and Platform Fragmentation

The proliferation of OTT platforms has created market fragmentation that challenges consumer wallet share and attention. Users seeking comprehensive content access may require multiple subscriptions, creating subscription fatigue particularly among price-sensitive segments. Platform exclusivity strategies, while differentiating offerings, can frustrate consumers required to maintain numerous subscriptions for desired content access.

Regulatory Evolution and Content Compliance

The evolving regulatory environment for digital content creates compliance considerations for OTT platforms operating in India. Content classification requirements and self-regulation frameworks necessitate operational investments in review processes. Platforms must navigate content standards while maintaining creative freedom and audience engagement, balancing regulatory compliance with competitive content offerings.

Competitive Landscape:

The India OTT media services market exhibits intense competitive dynamics featuring global streaming giants alongside domestic platforms and regional specialists. Major international players leverage extensive content libraries, production capabilities, and global operational expertise while investing substantially in India-specific content and localization. Domestic platforms compete through deep understanding of local audience preferences, regional content expertise, and strategic partnerships with telecommunications providers. Recent industry consolidation has created larger entities with enhanced content portfolios and distribution capabilities. Regional platforms targeting specific language markets have established sustainable positions through focused content strategies and community engagement. Competition extends across content quality, pricing strategies, user experience, and distribution partnerships as platforms vie for subscriber attention and market share.

Recent Developments:

- In December 2025, Prime Video adds Moviesphere+ in India. Amazon’s Prime Video has launched Moviesphere+, a Lionsgate-powered, Hollywood-focused add-on subscription offering blockbuster films and acclaimed TV shows at an introductory price of ₹399 per year, aimed at expanding premium international content access for Indian viewers.

India OTT Media Services Market Report Coverage:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2025 |

| Historical Period | 2020-2025 |

| Forecast Period | 2026-2034 |

| Units | Million USD |

| Scope of the Report |

Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Types Covered | Subscription-based (SVOD), Advertisement-based (AVOD), Transaction-based (TVOD) |

| Content Types Covered | Entertainment, News and Sports, Education |

| Device Types Covered | Smartphones and Tablets, Smart TVs, Laptops and Desktops, Gaming Consoles |

| Revenue Models Covered | Subscription Revenue, Advertising Revenue, Hybrid Models |

| Regions Covered | North India, South India, East India, West India |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Questions Answered in This Report

The India OTT media services market size was valued at USD 1,711.12 Million in 2025.

The India OTT media services market is expected to grow at a compound annual growth rate of 14.56% from 2026-2034 to reach USD 5,816.82 Million by 2034.

Subscription-based (SVOD) held the largest share of 51%, driven by consumer willingness to pay for premium ad-free content, exclusive original programming, and high-quality streaming experiences offered by leading platforms.

Key factors driving the India OTT media services market include expanding digital infrastructure and internet penetration, proliferation of affordable smartphones and connected devices, rising demand for regional and vernacular content, and growing consumer preference for on-demand entertainment over traditional broadcast media.

Major challenges include content piracy and unauthorized distribution affecting revenue potential, subscription fatigue due to platform fragmentation requiring multiple subscriptions, evolving regulatory compliance requirements, intense competition compressing profit margins, and high content production costs necessitating substantial ongoing investments.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)