India Over-the-Counter Pain Relievers Market Size, Share, Trends and Forecast by Drug Type, Formulation, Distribution Channel, End User, and Region, 2025-2033

India Over-the-Counter Pain Relievers Market Overview:

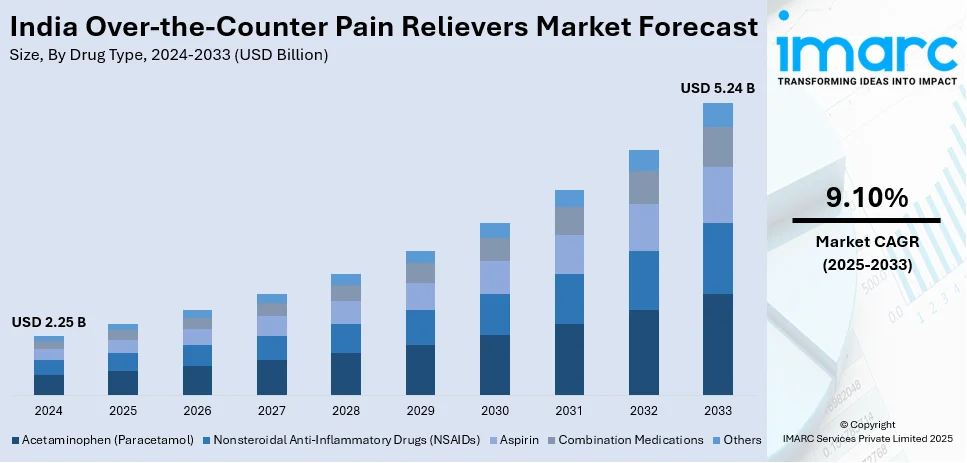

The India over-the-counter pain relievers market size reached USD 2.25 Billion in 2024. Looking forward, IMARC Group expects the market to reach USD 5.24 Billion by 2033, exhibiting a growth rate (CAGR) of 9.10% during 2025-2033. The market is driven by growing consumer health awareness regarding self-medication and the rising prevalence of common health problems such as headache, body pain, and menstrual cramps. Consumers are shifting toward convenient and affordable solutions for pain management and development of e-commerce websites have also increased access to OTC pain relievers, including those in far-flung regions, which further contribute to the India over-the-counter pain relievers market share.

|

Report Attribute

|

Key Statistics

|

|---|---|

|

Base Year

|

2024

|

|

Forecast Years

|

2025-2033

|

|

Historical Years

|

2019-2024

|

| Market Size in 2024 | USD 2.25 Billion |

| Market Forecast in 2033 | USD 5.24 Billion |

| Market Growth Rate 2025-2033 | 9.10% |

India Over-the-Counter Pain Relievers Market Trends:

Increase in Self-Medication Trends

The Indian market for over-the-counter (OTC) painkillers is witnessing huge growth, which is primarily fueled by the growing trend of self-medication among people. As healthcare expenses rise and lifestyles become hectic, people are choosing to take common conditions like headaches, body pain, and menstrual cramps in their stride with OTC analgesics. This is made possible due to the ready availability of medicines like paracetamol and ibuprofen at medical stores and online websites. Customers are increasingly getting proactive in responding to minor illnesses without a physician's prescription, appreciating the convenience and affordability that OTC painkillers provide, which is further propelling the India over-the-counter pain relievers market growth.

To get more information on this market, Request Sample

Increasing Demand for Natural and Herbal Formulas

As a reaction to growing health awareness, there is a strong move toward herbal and natural painkiller products in India. People are looking for alternatives to chemical-based drugs, preferring products that find support from traditional wellness practices and are seen as safer with fewer side effects. Herbal preparations, many of which have their origin in Ayurveda, are becoming popular for pain and inflammation management. This trend is making manufacturers innovate and diversify their product offerings to incorporate herbal and natural painkillers, in response to changing tastes of health-aware consumers. Demand for these products is also supported by influencer endorsements and increasing awareness about the advantages of natural ingredients used in pain relief.

Impact of Regulatory Policies and Market Dynamics

Regulatory policies are instrumental in determining the course of the OTC pain relievers market in India. The government's efforts to widen the list of OTC drugs aim to make drugs more accessible and affordable for the general population. In addition, the proliferation of online pharmacies and government-sponsored programs such as Jan Aushadhi are altering distribution channels, channeling OTC painkillers into a wider populace. These changes are affecting market dynamics, triggering conventional pharmacies to adapt and compete within a fast-changing retail environment.

India Over-the-Counter Pain Relievers Market Segmentation:

IMARC Group provides an analysis of the key trends in each segment of the market, along with forecasts at the country and regional levels for 2025-2033. Our report has categorized the market based on drug type, formulation, distribution channel, and end user.

Drug Type Insights:

- Acetaminophen (Paracetamol)

- Nonsteroidal Anti-Inflammatory Drugs (NSAIDs)

- Aspirin

- Combination Medications

- Others

The report has provided a detailed breakup and analysis of the market based on the drug type. This includes acetaminophen (paracetamol), nonsteroidal anti-inflammatory drugs (NSAIDs), aspirin, combination medications, and others.

Formulation Insights:

- Tablets and Capsules

- Gels and Ointments

- Sprays

- Liquids and Syrups

The report has provided a detailed breakup and analysis of the market based on the formulation. This includes tablets and capsules, gels and ointments, sprays, and liquids and syrups.

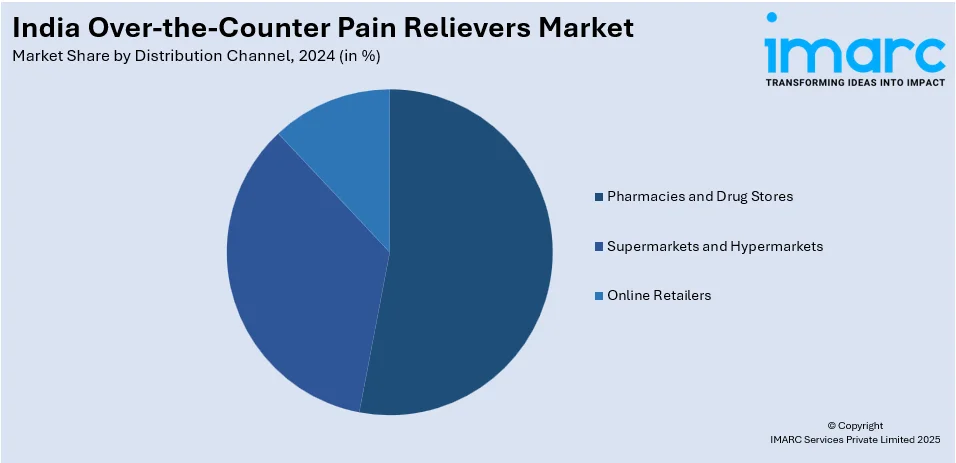

Distribution Channel Insights:

- Pharmacies and Drug Stores

- Supermarkets and Hypermarkets

- Online Retailers

The report has provided a detailed breakup and analysis of the market based on the distribution channel. This includes pharmacies and drug stores, supermarkets and hypermarkets, and online retailers.

End User Insights:

- Adults

- Pediatric

- Geriatric

The report has provided a detailed breakup and analysis of the market based on the end user. This includes adult, pediatric, and geriatric.

Regional Insights:

- North India

- South India

- East India

- West India

The report has also provided a comprehensive analysis of all the major regional markets, which include North India, South India, East India, and West India.

Competitive Landscape:

The market research report has also provided a comprehensive analysis of the competitive landscape. Competitive analysis such as market structure, key player positioning, top winning strategies, competitive dashboard, and company evaluation quadrant has been covered in the report. Also, detailed profiles of all major companies have been provided.

India Over-the-Counter Pain Relievers Market News:

- In August 2024, Saridon, the renowned pain relief brand from Bayer’s Consumer Health Division in India, launched ‘Saridon Woman,’ a groundbreaking and unique solution for period pain designed to deliver comprehensive relief from cramps, back pain, and headaches every month. Saridon Woman represents a notable advancement in the OTC market, providing a distinctive remedy for menstrual pain that merges the effectiveness of Paracetamol with the natural compound Hyoscine Butylbromide. It works quickly and provides enduring relief through a dual mechanism of action. This formulation is endorsed by the renowned worldwide association of gynecologists the Royal College of Obstetricians and Gynaecologists.

India Over-the-Counter Pain Relievers Market Report Coverage:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2024 |

| Historical Period | 2019-2024 |

| Forecast Period | 2025-2033 |

| Units | Billion USD |

| Scope of the Report |

Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Drug Types Covered | Acetaminophen (Paracetamol), Nonsteroidal Anti-Inflammatory Drugs (NSAIDs), Aspirin, Combination Medications, Others |

| Formulations Covered | Tablets and Capsules, Gels and Ointments, Sprays, Liquids and Syrups |

| Distribution Channels Covered | Pharmacies and Drug Stores, Supermarkets and Hypermarkets, Online Retailers |

| End Users Covered | Adult, Pediatric, Geriatric |

| Regions Covered | North India, South India, East India, West India |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Questions Answered in This Report:

- How has the India over-the-counter pain relievers market performed so far and how will it perform in the coming years?

- What is the breakup of the India over-the-counter pain relievers market on the basis of drug type?

- What is the breakup of the India over-the-counter pain relievers market on the basis of formulation?

- What is the breakup of the India over-the-counter pain relievers market on the basis of distribution channel?

- What is the breakup of the India over-the-counter pain relievers market on the basis of end user?

- What is the breakup of the India over-the-counter pain relievers market on the basis of region?

- What are the various stages in the value chain of the India over-the-counter pain relievers market?

- What are the key driving factors and challenges in the India over-the-counter pain relievers market?

- What is the structure of the India over-the-counter pain relievers market and who are the key players?

- What is the degree of competition in the India over-the-counter pain relievers market?

Key Benefits for Stakeholders:

- IMARC’s industry report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, market forecasts, and dynamics of the India over-the-counter pain relievers market from 2019-2033.

- The research report provides the latest information on the market drivers, challenges, and opportunities in the India over-the-counter pain relievers market.

- Porter's five forces analysis assist stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyze the level of competition within the India over-the-counter pain relievers industry and its attractiveness.

- Competitive landscape allows stakeholders to understand their competitive environment and provides an insight into the current positions of key players in the market.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)