India Over-the-Counter Pharmaceutical Market Size, Share, Trends and Forecast by Product Type, Distribution Channel, Formulation, and Region, 2025-2033

India Over-the-Counter Pharmaceutical Market Overview:

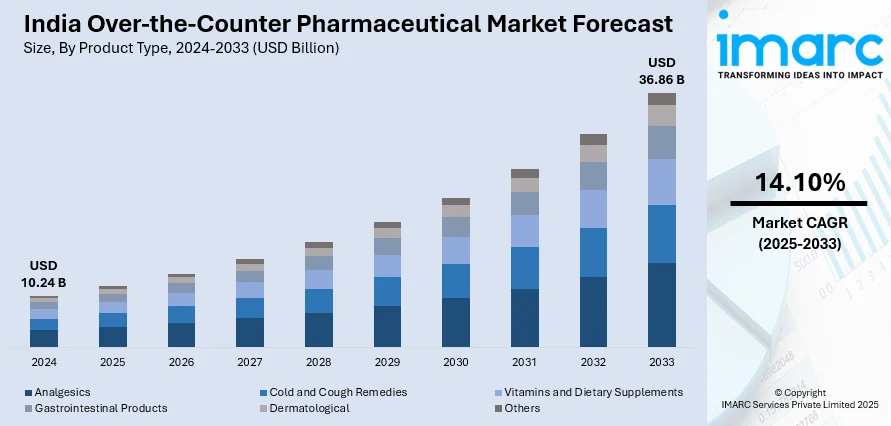

The India over-the-counter pharmaceutical market size reached USD 10.24 Billion in 2024. Looking forward, IMARC Group expects the market to reach USD 36.86 Billion by 2033, exhibiting a growth rate (CAGR) of 14.10% during 2025-2033. The increasing access to pharmacies and the emergence of online platforms are impelling the growth of the market. Moreover, Indian consumer behavior is changing, and growing health awareness, hygiene, and preventive care are actively playing a crucial role in offering a favorable market outlook. This, along with the heightened challenges faced by the healthcare system, such as overcrowded hospitals, long waiting times, and a shortage of medical professionals, is expanding the India over-the-counter pharmaceutical market share.

|

Report Attribute

|

Key Statistics

|

|---|---|

|

Base Year

|

2024 |

|

Forecast Years

|

2025-2033

|

|

Historical Years

|

2019-2024

|

| Market Size in 2024 | USD 10.24 Billion |

| Market Forecast in 2033 | USD 36.86 Billion |

| Market Growth Rate 2025-2033 | 14.10% |

India Over-the-Counter Pharmaceutical Market Trends:

Expanding Access to Pharmacies and Online Platforms

The Indian over-the-counter (OTC) pharmaceutical market is presently witnessing massive growth as a result of the increasing access to pharmacies and the emergence of online platforms. Conventional brick-and-mortar pharmacies are being established even in semi-urban and rural regions with greater frequency, thus bringing basic medicines within reach of the masses. Meanwhile, digital health platforms and e-pharmacies are expanding, providing convenience, doorstep delivery, and 24/7 service, which is improving interaction. People are also using mobile apps and online consultations, and frequently buying medicines such as painkillers, antacids, and vitamins without prescriptions. This is particularly prevalent among younger age groups who are digitally aware and opt for self-medication for their trivial ailments. Firms are building and expanding their existing web presence and making strategic partnerships with delivery companies, providing on-time delivery all over the country. In 2025, PhonePe's online shopping platform, Pincode, started a 10-minute medicine delivery service in Bengaluru, Pune, and Mumbai. It operates 24/7 and links customers with local medical stores for prescription and OTC drugs without any delivery fees.

To get more information on this market, Request Sample

Increasing Consumer Awareness and Health Consciousness

Indian consumer behavior is changing, and health awareness, hygiene, and preventive care are actively playing a crucial role in propelling the India over-the-counter pharmaceutical market growth. Individuals are always looking for health and wellness information from different sources like social media, health blogs, and TV commercials. It is making people more aware and assertive about diagnosing and treating minor ailments by themselves without consulting a doctor. Consequently, goods such as nutritional supplements, herbal medicines, antipyretics, and topical analgesics are witnessing consistent demand. Government and private campaigns are educating people on disease prevention and lifestyle maintenance on a regular basis. The middle class is specifically investing more in wellness and immunity-enhancing products. Urban lifestyles and a rapid way of life are also motivating individuals to use quick, OTC means to treat health issues, thus driving the market.

Rising Burden on Healthcare Infrastructure

India's healthcare system is continuously grappling with challenges such as overcrowded hospitals, long waiting times, and a shortage of medical professionals, especially in rural and semi-urban areas. This rising burden on the healthcare infrastructure is encouraging people to manage less serious health concerns through OTC medications rather than seeking formal medical care. People are consistently purchasing OTC drugs to treat ailments like colds, flu, headaches, stomach issues, and allergies, thereby avoiding time-consuming clinical visits. This trend is particularly prevalent during public health crises or seasonal disease outbreaks when hospitals and clinics are overwhelmed. The affordability and availability of OTC drugs are further making them a practical alternative for underserved populations. Pharmaceutical companies are taking note of this shift by diversifying their OTC portfolios and increasing public outreach. As government and private hospitals continue to experience stress, the reliance on self-medication and OTC solutions is steadily growing, reshaping the landscape of primary healthcare access. According to an article by Business Standard published in 2025, India could soon have a streamlined set of regulations on over-the-counter (OTC) medicines as the drug regulator's top advisory board of drugs has sanctioned the proposals submitted by a special sub-committee on OTC constituted by the drug regulator. Approximately 27-30 medicines, mainly analgesics, ointments for pain topically, cough-and-cold medicines, and more, might be included in India's first complete list of OTC drugs, which would also allow pharma firms to promote about these brands to generate awareness.

India Over-the-Counter Pharmaceutical Market Segmentation:

IMARC Group provides an analysis of the key trends in each segment of the market, along with forecasts at the country and regional levels for 2025-2033. Our report has categorized the market based on product type, distribution channel, and formulation.

Product Type Insights:

- Analgesics

- Cold and Cough Remedies

- Vitamins and Dietary Supplements

- Gastrointestinal Products

- Dermatological

- Others

The report has provided a detailed breakup and analysis of the market based on the product type. This includes analgesics, cold and cough remedies, vitamins and dietary supplements, gastrointestinal products, dermatological, and others.

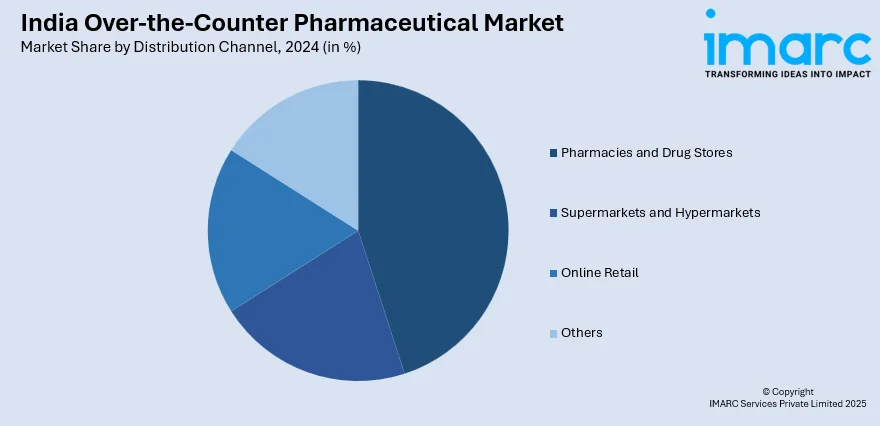

Distribution Channel Insights:

- Pharmacies and Drug Stores

- Supermarkets and Hypermarkets

- Online Retail

- Others

A detailed breakup and analysis of the market based on the distribution channel have also been provided in the report. This includes pharmacies and drug stores, supermarkets and hypermarkets, online retail, and others.

Formulation Insights:

- Tablets and Capsules

- Liquids and Syrups

- Topicals

- Creams

- Ointments

- Others

A detailed breakup and analysis of the market based on the formulation have also been provided in the report. This includes tablets and capsules, liquids and syrups, topicals (creams and ointments), and others.

Regional Insights:

- North India

- South India

- East India

- West India

The report has also provided a comprehensive analysis of all the major regional markets, which include North India, South India, East India, and West India.

Competitive Landscape:

The market research report has also provided a comprehensive analysis of the competitive landscape. Competitive analysis such as market structure, key player positioning, top winning strategies, competitive dashboard, and company evaluation quadrant has been covered in the report. Also, detailed profiles of all major companies have been provided.

India Over-the-Counter Pharmaceutical Market Report Coverage:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2024 |

| Historical Period | 2019-2024 |

| Forecast Period | 2025-2033 |

| Units | Billion USD |

| Scope of the Report |

Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Product Types Covered | Analgesics, Cold and Cough Remedies, Vitamins and Dietary Supplements, Gastrointestinal Products, Dermatological, Others |

| Distribution Channels Covered | Pharmacies and Drug Stores, Supermarkets and Hypermarkets, Online Retail, Others |

| Formulations Covered |

|

| Regions Covered | North India, South India, East India, West India |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Benefits for Stakeholders:

- IMARC’s industry report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, market forecasts, and dynamics of the India over-the-counter pharmaceutical market from 2019-2033.

- The research report provides the latest information on the market drivers, challenges, and opportunities in the India over-the-counter pharmaceutical market.

- Porter's five forces analysis assist stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyze the level of competition within the India over-the-counter pharmaceutical industry and its attractiveness.

- Competitive landscape allows stakeholders to understand their competitive environment and provides an insight into the current positions of key players in the market.

Key Questions Answered in This Report

The over-the-counter pharmaceutical market in India was valued at USD 10.24 Billion in 2024.

The India over-the-counter pharmaceutical market is projected to exhibit a CAGR of 14.10% during 2025-2033, reaching a value of USD 36.86 Billion by 2033.

The market is driven by increasing consumer preference for self-care, easier access to medicines, and growing awareness of common health issues. Urbanization and busy lifestyles encourage demand for quick remedies. Availability of OTC drugs in pharmacies and general stores, combined with marketing by pharmaceutical companies, supports market penetration across both rural and urban regions.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)