India Oxygen Conservers Market Size, Share, Trends and Forecast by Type, Sales Channel, Source, and Region, 2025-2033

India Oxygen Conservers Market Overview:

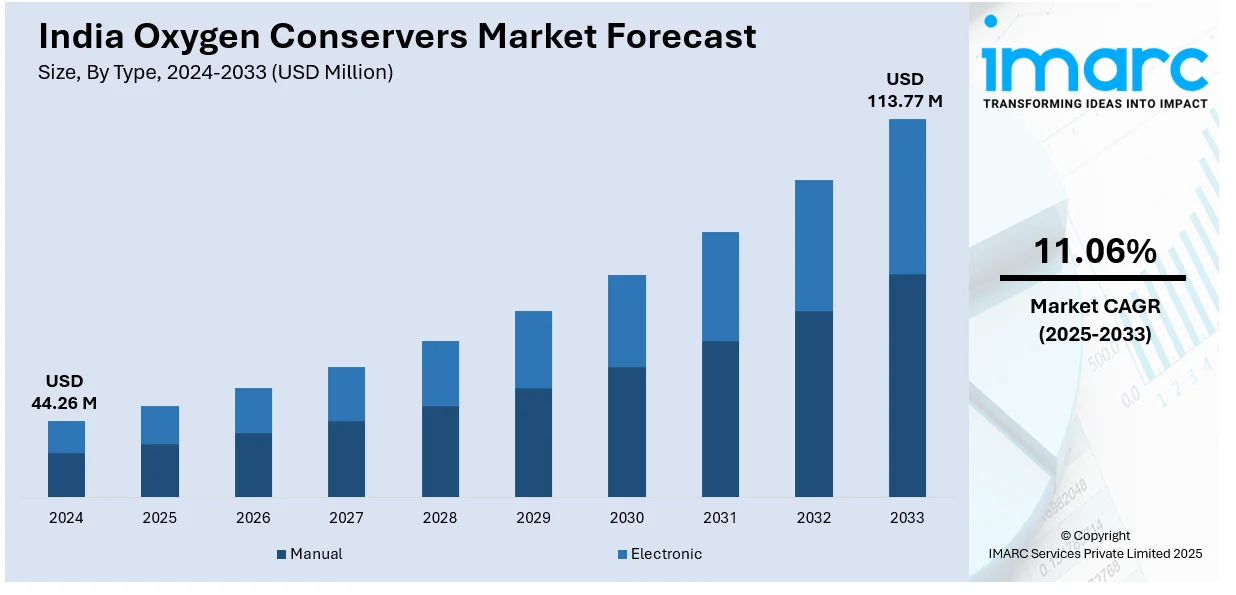

The India oxygen conservers market size reached USD 44.26 Million in 2024. Looking forward, IMARC Group expects the market to reach USD 113.77 Million by 2033, exhibiting a growth rate (CAGR) of 11.06% during 2025-2033. The rising respiratory disorders, growing geriatric population, increasing demand for home-based oxygen therapy, supportive government healthcare initiatives, expanding medical infrastructure, heightened awareness regarding oxygen therapy benefits, and the need for portable, efficient respiratory support devices across healthcare settings are some of the major factors augmenting the India oxygen conservers market share.

|

Report Attribute

|

Key Statistics

|

|---|---|

|

Base Year

|

2024

|

|

Forecast Years

|

2025-2033

|

|

Historical Years

|

2019-2024

|

| Market Size in 2024 | USD 44.26 Million |

| Market Forecast in 2033 | USD 113.77 Million |

| Market Growth Rate (2025-2033) | 11.06% |

India Oxygen Conservers Market Trends:

Shift Toward Home-Based Oxygen Therapy

The transition from hospital-centric respiratory care to home-based oxygen therapy is positively impacting the India oxygen conserver market outlook. According to an industry report, respiratory system diseases represent the largest therapeutic category in India, accounting for 15.3%. The increasing burden of chronic respiratory diseases, including COPD, asthma, and post-COVID pulmonary complications, which require long-term oxygen support. Additionally, patients and caregivers are increasingly opting for compact, easy-to-use oxygen conservers that allow greater mobility and improve quality of life without depending on hospital visits. Moreover, the cost advantage of home treatment is significant, especially in semi-urban and rural areas where hospital infrastructure is limited or overstretched. In line with this, telemedicine platforms and remote monitoring tools are also supporting this shift, enabling physicians to supervise patient progress outside of clinical settings. Furthermore, manufacturers are responding by developing lightweight, battery-efficient devices with enhanced oxygen delivery mechanisms and safety features. This trend is reshaping product innovation priorities, influencing distribution strategies, and encouraging the integration of oxygen conservers into broader homecare packages offered by healthcare service providers and medical equipment rental platforms.

To get more information on this market, Request Sample

Increasing Demand from Tier-2 and Tier-3 Cities

Oxygen conserver demand in India is rapidly expanding beyond metro cities into tier-2 and tier-3 regions. The rising health awareness, inflating disposable incomes, and government healthcare programs and rawness sessions are improving access to diagnostic and treatment services in these areas. For example, on January 8–9, 2025, the Union Health Ministry, in collaboration with the Government of Telangana, convened a National Workshop on Non-Communicable Diseases (NCDs) in Hyderabad, focusing on enhancing prevention, screening, management, and treatment strategies for NCDs. The workshop featured comprehensive discussions, field visits, and knowledge-sharing sessions addressing major NCDs, including diabetes, hypertension, chronic kidney disease, chronic respiratory disease, stroke, and cancer. In addition to this, smaller cities faced severe oxygen shortages during the COVID-19 pandemic, highlighting infrastructure gaps and accelerating the adoption of portable oxygen solutions. Moreover, state governments and district hospitals are increasingly procuring conservers for emergency preparedness, while private nursing homes and home care businesses are stocking these devices to meet local demand. Besides this, domestic players and distributors are localizing assembly units, offering service packages, and deploying mobile units for demonstrations and repairs. Also, financing options and EMI schemes from NBFCs and health tech startups further support the India oxygen conservers market growth. This enables wider adoption of oxygen conservers among patients in semi-urban and rural India.

India Oxygen Conservers Market Segmentation:

IMARC Group provides an analysis of the key trends in each segment of the market, along with forecasts at the country level for 2025-2033. Our report has categorized the market based on type, sales channel, and source.

Type Insights:

- Manual

- Electronic

The report has provided a detailed breakup and analysis of the market based on the type. This includes manual and electronic.

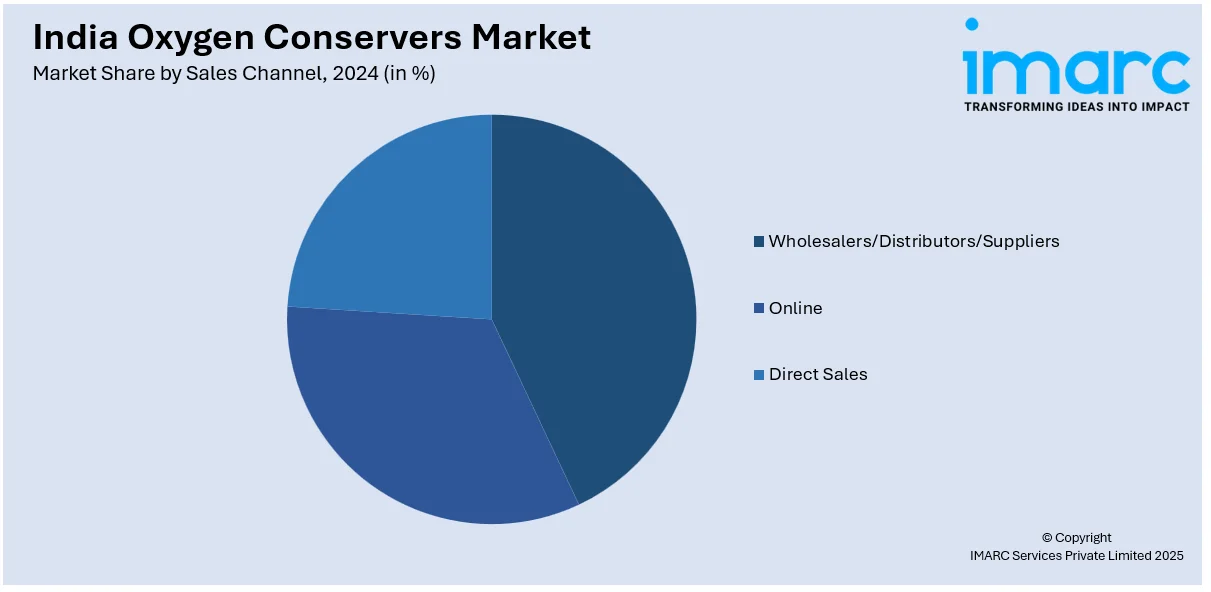

Sales Channel Insights:

- Wholesalers/Distributors/Suppliers

- Online

- Direct Sales

A detailed breakup and analysis of the market based on the sales channel have also been provided in the report. This includes wholesalers/distributors/suppliers, online, and direct sales.

Source Insights:

- Import

- Domestic

The report has provided a detailed breakup and analysis of the market based on the source. This includes import and domestic.

Regional Insights:

- North India

- South India

- East India

- West India

The report has also provided a comprehensive analysis of all the major regional markets, which include North India, South India, East India, and West India.

Competitive Landscape:

The market research report has also provided a comprehensive analysis of the competitive landscape. Competitive analysis such as market structure, key player positioning, top winning strategies, competitive dashboard, and company evaluation quadrant has been covered in the report. Also, detailed profiles of all major companies have been provided.

India Oxygen Conservers Market Report Coverage:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2024 |

| Historical Period | 2019-2024 |

| Forecast Period | 2025-2033 |

| Units | Million USD |

| Scope of the Report |

Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Types Covered | Manual, Electronic |

| Sales Channels Covered | Wholesalers/Distributors/Suppliers, Online, Direct Sales |

| Sources Covered | Import, Domestic |

| Regions Covered | North India, South India, East India, West India |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special reques |

Key Questions Answered in This Report:

- How has the India oxygen conservers market performed so far and how will it perform in the coming years?

- What is the breakup of the India oxygen conservers market on the basis of type?

- What is the breakup of the India oxygen conservers market on the basis of sales channel?

- What is the breakup of the India oxygen conservers market on the basis of source?

- What is the breakup of the India oxygen conservers market on the basis of region?

- What are the various stages in the value chain of the India oxygen conservers market?

- What are the key driving factors and challenges in the India oxygen conservers market?

- What is the structure of the India oxygen conservers market and who are the key players?

- What is the degree of competition in the India oxygen conservers market?

Key Benefits for Stakeholders:

- IMARC’s industry report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, market forecasts, and dynamics of the India oxygen conservers market from 2019-2033.

- The research report provides the latest information on the market drivers, challenges, and opportunities in the India oxygen conservers market.

- Porter's five forces analysis assist stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyze the level of competition within the India oxygen conservers industry and its attractiveness.

- Competitive landscape allows stakeholders to understand their competitive environment and provides an insight into the current positions of key players in the market.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)