India Oxygen Mask Market Size, Share, Trends and Forecast by Product Type, Material, Size, Application, End User, and Region, 2025-2033

India Oxygen Mask Market Overview:

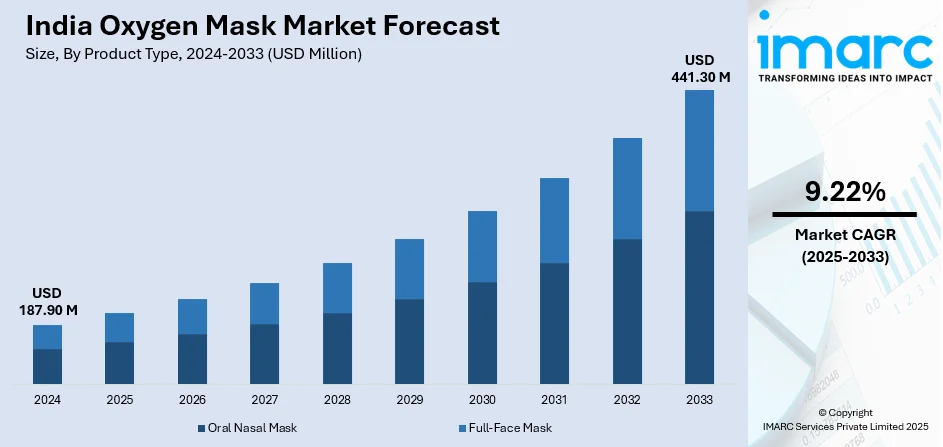

The India oxygen mask market size reached USD 187.90 Million in 2024. Looking forward, IMARC Group expects the market to reach USD 441.30 Million by 2033, exhibiting a growth rate (CAGR) of 9.22% during 2025-2033. The rising respiratory disorders, increased air pollution levels, a surge in healthcare infrastructure investments, supportive government initiatives to improve emergency medical services and the expansion of home healthcare are fueling market growth.

|

Report Attribute

|

Key Statistics

|

|---|---|

|

Base Year

|

2024 |

|

Forecast Years

|

2025-2033

|

|

Historical Years

|

2019-2024

|

| Market Size in 2024 | USD 187.90 Million |

| Market Forecast in 2033 | USD 441.30 Million |

| Market Growth Rate 2025-2033 | 9.22% |

India Oxygen Mask Market Trends:

Growing Air Pollution and Respiratory Health Awareness

India’s worsening air pollution crisis is significantly heightening respiratory health risks, thereby accelerating the demand for oxygen masks across both emergency and preventive care settings. Cities like Delhi, Kanpur, and Lucknow frequently report Air Quality Index (AQI) levels exceeding 300—classified as ‘Hazardous’ by the Central Pollution Control Board (CPCB). This environmental hazard has led to a sharp rise in respiratory conditions such as asthma and bronchitis. The Indian Chest Society noted a 17% increase in outpatient visits for respiratory issues in metro cities during the winter of 2023 alone. Alarmingly, all 1.3 billion Indians live in areas where annual particulate pollution exceeds WHO guidelines, and 67.4% reside in regions surpassing India’s standard of 40 µg/m³. Particulate pollution now poses the greatest health threat in India, reducing life expectancy by 5.3 years. In response, both urban and rural healthcare facilities are ramping up supplies of oxygen masks, while CSR efforts and government initiatives are distributing emergency oxygen kits in high-risk zones. Rising public awareness, especially among children and the elderly, is also driving the presence of oxygen masks in homes, schools, and workplaces, positioning the market for continued growth.

To get more information on this market, Request Sample

Surge in Home Healthcare and Portable Medical Equipment Adoption

The growing adoption of home healthcare services in India is significantly boosting the demand for oxygen masks, particularly for patients managing chronic respiratory conditions such as asthma, COPD, and post-COVID complications. As healthcare preferences shift toward more convenient, affordable, and personalized home-based treatment, the Indian home healthcare market is projected to grow at a robust CAGR of over 17.36% from 2024 to 2032. This surge is driven by an aging population, the rising prevalence of chronic illnesses, and the increasing ease of availability of portable medical devices. Compact, lightweight oxygen concentrators and compatible oxygen masks have made at-home respiratory care more efficient and accessible. Government initiatives under the Ayushman Bharat Digital Mission (ABDM) have also played a key role by enhancing telemedicine and home care infrastructure. As of December 2024, over 71.16 crore ABHA IDs have been created, with 3.54 lakh healthcare facilities and 5.37 lakh professionals registered, and more than 45.99 crore health records linked. The rising demand for wearable, user-friendly respiratory aids is also driving innovations in oxygen masks, further accelerating market expansion.

India Oxygen Mask Market Segmentation:

IMARC Group provides an analysis of the key trends in each segment of the market, along with forecasts at the region/country level for 2025-2033. Our report has categorized the market based on product type, material, size, application, and end user.

Product Type Insights:

- Oral Nasal Mask

- Full-Face Mask

The report has provided a detailed breakup and analysis of the market based on the product type. This includes oral nasal mask and full-face mask.

Material Insights:

- Plastic

- Rubber

- Silicone

A detailed breakup and analysis of the market based on the material have also been provided in the report. This includes plastic, rubber, and silicone.

Size Insights:

- Adult

- Pediatric

- Neonatal

The report has provided a detailed breakup and analysis of the market based on the size. This includes adult, pediatric, and neonatal.

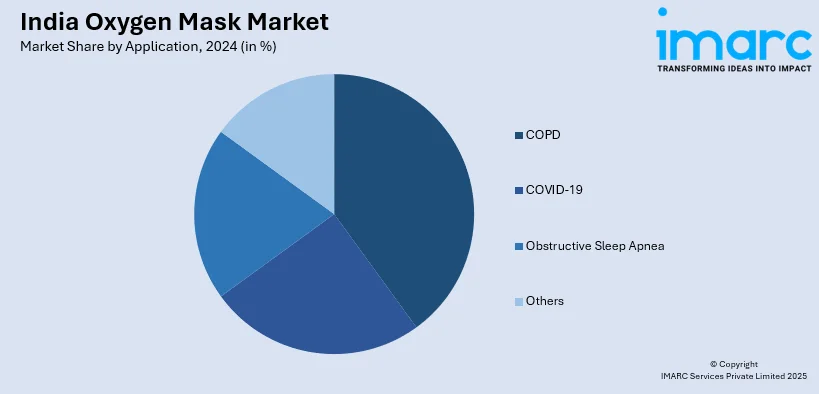

Application Insights:

- COPD

- COVID-19

- Obstructive Sleep Apnea

- Others

A detailed breakup and analysis of the market based on the application have also been provided in the report. This includes COPD, COVID-19, obstructive sleep apnea, and others.

End User Insights:

- Hospitals and Clinics

- Homecare

- Others

A detailed breakup and analysis of the market based on the end user have also been provided in the report. This includes hospitals and clinics, homecare, and others.

Regional Insights:

- North India

- South India

- East India

- West India

The report has also provided a comprehensive analysis of all the major regional markets, which include North India, South India, East India, and West India.

Competitive Landscape:

The market research report has also provided a comprehensive analysis of the competitive landscape. Competitive analysis such as market structure, key player positioning, top winning strategies, competitive dashboard, and company evaluation quadrant has been covered in the report. Also, detailed profiles of all major companies have been provided.

India Oxygen Mask Market News:

- March 2025: North India's first anti-aging Hyperbaric Oxygen Therapy (HBOT) machine was installed at the Global Hyperbaric Medical Center in Mohali. The center offers treatments where patients inhale 100% pure oxygen at increased atmospheric pressure, aiding in cell repair and healing. The therapy addresses conditions like blood pressure issues, diabetes, erectile dysfunction, cancer, and autism.

- January 2025: HCG Manavata Cancer Centre (HCG MCC) established an HBOT department to expedite healing and improve patient recovery. The innovative HBOT infrastructure at HCG MCC is designed to handle up to four patients at once, representing a considerable improvement over typical monoplace chambers and increasing demand for oxygen masks.

India Oxygen Mask Market Report Coverage:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2024 |

| Historical Period | 2019-2024 |

| Forecast Period | 2025-2033 |

| Units | Million USD |

| Scope of the Report |

Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Product Types Covered | Oral Nasal Mask, Full-Face Mask |

| Materials Covered | Plastic, Rubber, Silicone |

| Sizes Covered | Adult, Pediatric, Neonatal |

| Applications Covered | COPD, COVID-19, Obstructive Sleep Apnea, Others |

| End Users Covered | Hospitals and Clinics, Homecare, Others |

| Regions Covered | North India, South India, East India, West India |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Benefits for Stakeholders:

- IMARC’s industry report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, market forecasts, and dynamics of the India oxygen mask market from 2019-2033.

- The research report provides the latest information on the market drivers, challenges, and opportunities in the India oxygen mask market.

- Porter's five forces analysis assist stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyze the level of competition within the India oxygen mask industry and its attractiveness.

- Competitive landscape allows stakeholders to understand their competitive environment and provides an insight into the current positions of key players in the market.

Key Questions Answered in This Report

The oxygen mask market in India was valued at USD 187.90 Million in 2024.

The India oxygen mask market is projected to exhibit a (CAGR) of 9.22% during 2025-2033, reaching a value of USD 441.30 Million by 2033.

Respiratory disorder growth, growing healthcare infrastructure, and augmenting demand for emergency medical devices propel the India Oxygen Mask Market. Growing respiratory health awareness and mask technology improvement improve patient comfort and efficiency. Moreover, growing surgical volumes and critical care units spur demand for efficient oxygen delivery systems in healthcare facilities.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)