India Packaged Food Market Size, Share, Trends and Forecast by Product Type, Distribution Channel, and Region, 2025-2033

India Packaged Food Market Size and Share:

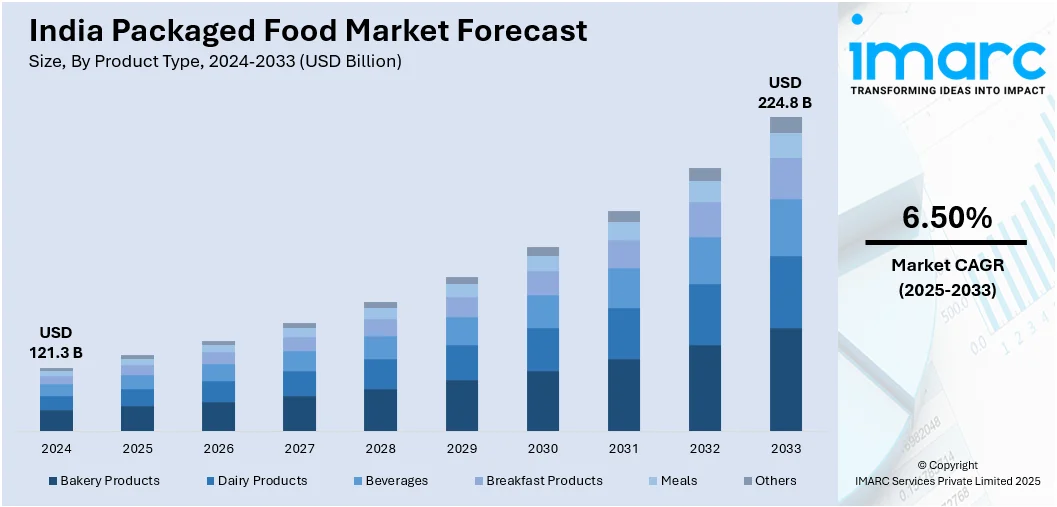

The India packaged food market size reached USD 121.3 Billion in 2024. The market is projected to reach USD 224.8 Billion by 2033, exhibiting a growth rate (CAGR) of 6.50% during 2025-2033. The market growth is attributed to rapid urbanization, changing lifestyles, increasing disposable incomes, rising demand for convenience foods, evolving consumer preferences for ready-to-eat meals, expanding retail infrastructure, growth in online food delivery, improved cold chain logistics, government support for food processing, and a growing focus on health-conscious eating.

Market Insights:

- Based on region, the market is divided into North India, West and Central India, South India, and East and Northeast India.

- On the basis of product type, the market is segmented into bakery products, dairy products, beverages, breakfast products, meals, and others.

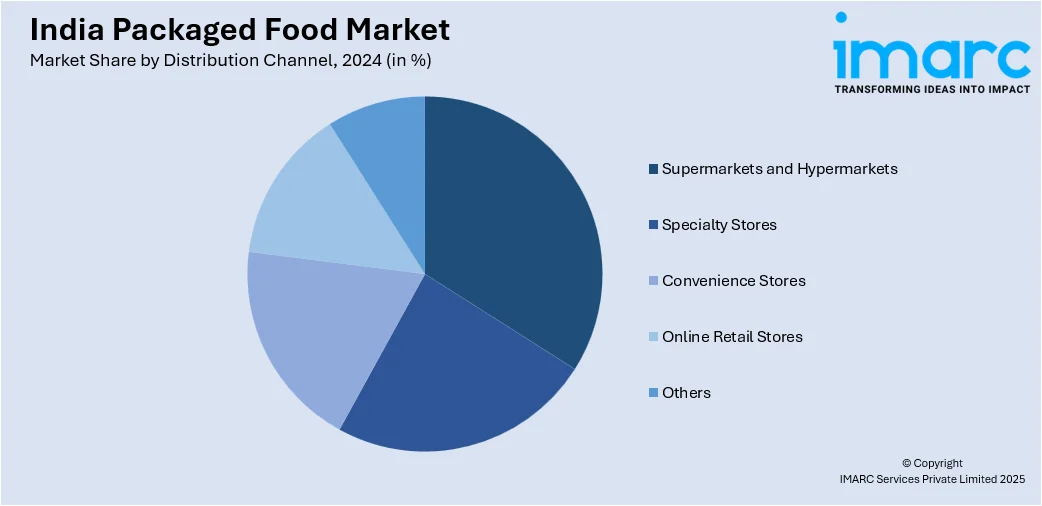

- Based on the distribution channel, the market is categorized as supermarkets and hypermarkets, specialty stores, convenience stores, online retail stores, and others.

Market Size and Forecast:

- 2024 Market Size: USD 121.3 Billion

- 2033 Projected Market Size: USD 224.8 Billion

- CAGR (2025-2033): 6.50%

Packaged food, also known as processed or convenience food, encompasses food products that are pre-prepared and sealed in packaging for sale to consumers. This type of food undergoes various processing stages, including washing, cooking, freezing, canning, or the addition of preservatives to prolong its shelf life. Packaged food is available in diverse forms, including canned goods, frozen meals, snacks, and beverages. The packaging serves the dual purpose of preserving the food and safeguarding it from contamination, thereby enhancing both shelf life and safety. Furthermore, the packaging often includes labels containing essential information such as ingredients, nutritional facts, and expiration dates, enabling consumers to make informed choices. In addition to these benefits, packaged food offers convenience and time savings in meal preparation.

To get more information on this market, Request Sample

The India packaged food market has witnessed substantial growth in recent years, propelled by evolving consumer lifestyles, urbanization, and an increasing demand for convenience. This market's expansion can be attributed to factors, such as the rising disposable incomes, the changing dietary preferences, and a surge in dual-income households, which have led to a shift in consumer behavior towards ready-to-eat and easy-to-prepare food items. Moreover, in a country as diverse as India, with a wide array of culinary traditions, the packaged food industry has adapted by offering a range of products that cater to regional tastes. This diversity in product offerings has contributed significantly to the market's robust growth. Furthermore, while the convenience factor remains a key driver in augmenting the India packaged food market share, the market has also responded to the increasing demand for healthier options. Besides this, manufacturers are incorporating nutritional enhancements, reducing additives, and introducing organic and natural ingredients to meet the evolving preferences of the health-conscious Indian consumer. Government initiatives promoting food safety standards and regulations have further instilled confidence in consumers regarding the quality of packaged food, thereby acting as another significant growth-inducing factor. Apart from this, both domestic and international players are actively participating, fostering innovation and competition, which is anticipated to fuel the market growth over the forecasted period.

India Packaged Food Market Trends:

Rising Demand for Health-Conscious and Functional Packaged Foods

A notable trend in the market is the growing consumer preference for health-conscious and functional food products. Moreover, rapid urbanization, increased lifestyle-related ailments, and heightened health awareness have shifted consumer choices toward low-fat, low-sugar, high-protein, organic, and clean-label products. Also, packaged food items fortified with essential nutrients, such as vitamins, minerals, probiotics, and dietary fiber, are witnessing rising demand among health-conscious millennials and working professionals. The COVID-19 pandemic further amplified this shift, prompting consumers to prioritize immunity-boosting and hygienically packed foods over conventional options. Apart from that, functional snacks, plant-based protein bars, gluten-free ready meals, and beverages with adaptogens are increasingly being introduced by brands seeking to align with wellness trends. Additionally, ingredient transparency and nutritional labelling are now crucial for purchasing decisions, prompting manufacturers to reformulate products and adopt clearer communication strategies.

Increasing Government Support

The Indian government has played a proactive role in enhancing the India packaged food market outlook through policy reforms, infrastructure development, and industry incentives. The Ministry of Food Processing Industries (MoFPI) has launched initiatives such as the Pradhan Mantri Kisan SAMPADA Yojana (PMKSY) to improve supply chain efficiency and reduce food wastage, which indirectly supports packaged food manufacturers. In line with this, the introduction of Production Linked Incentive (PLI) schemes for the food processing sector further encourages private investments and technological innovation. Additionally, the creation of Mega Food Parks and Cold Chain Infrastructure is improving connectivity between rural producers and urban markets. Besides, regulatory bodies like the Food Safety and Standards Authority of India (FSSAI) are also streamlining food safety norms and labelling standards to ensure consumer protection and compliance. These strategic moves are helping formalize the packaged food sector, increase market penetration, and enhance export potential, ultimately contributing to long-term industry growth.

Growth Drivers of India Packaged Food Market:

The market is experiencing strong momentum, driven by the growing demand for convenience foods amid increasingly hectic urban lifestyles. Consumers, especially in metro cities, are opting for ready-to-eat, ready-to-cook, and frozen packaged items that offer time-saving solutions without compromising on taste or nutrition. Besides this, rising internet penetration and smartphone usage among India's youth and working population are further propelling India packaged food market growth. Moreover, the rapid expansion of e-commerce and quick commerce platforms has significantly increased product accessibility, offering doorstep delivery and an array of choices. Another key driver is the shift toward sustainable and eco-friendly packaging, which resonates with environmentally conscious consumers. Apart from this, brands are increasingly investing in biodegradable, recyclable, and reusable packaging formats to align with sustainability goals. Also, health and wellness trends are spurring demand for organic, plant-based, low-calorie, and fortified food products, further propelling market development.

Opportunities in India Packaged Food Market:

The market presents ample opportunities driven by shifting consumer demographics, increasing disposable incomes, and rising health awareness. According to the India packaged food market forecast, one major opportunity lies in tier 2 and tier 3 cities, where demand for affordable, hygienically packaged, and easy-to-store food items is expanding rapidly. There is also a growing appetite for premium and specialty products such as gluten-free, organic, vegan, and protein-rich offerings, opening avenues for niche brands and innovation. With India's youth showing increased interest in global cuisines, international flavors in packaged formats are gaining traction. Moreover, digital transformation offers scope for direct-to-consumer (D2C) models, allowing brands to personalize offerings and optimize distribution. In line with this, the emphasis on sustainability further enables differentiation through eco-conscious packaging and clean-label products. Furthermore, the expansion of modern retail, coupled with rising demand for on-the-go snacks, fortified meals, and functional beverages, provides a fertile ground for both domestic and global players to scale and diversify their product portfolios.

Challenges in the India Packaged Food Market:

Despite robust growth, as per the India packaged food market analysis, the market faces several challenges that may hinder its progress. One key issue is the fragmented and price-sensitive nature of the market, which can pose difficulties for premium and niche product penetration. Additionally, inconsistent cold chain infrastructure and inadequate logistics, particularly in rural and remote regions, limit the reach and shelf-life of perishable packaged goods. Regulatory complexities, including frequent changes in food safety norms and labelling requirements, also create compliance hurdles for businesses. Consumer concerns around preservatives, artificial additives, and misleading marketing practices have heightened the need for transparency and trust-building. Moreover, intense competition from unorganized and local players adds pricing pressure and dilutes brand differentiation. Sustainability, while a driver, also brings cost challenges related to eco-friendly packaging and sourcing. Addressing these issues requires strategic investment in technology, supply chain management, regulatory alignment, and consumer education to sustain long-term growth in the market.

India Packaged Food Market Segmentation:

IMARC Group provides an analysis of the key trends in each segment of the market, along with forecasts at the country level for 2025-2033. Our report has categorized the market based on product type and distribution channel.

Product Type Insights:

- Bakery Products

- Dairy Products

- Beverages

- Breakfast Products

- Meals

- Others

The report has provided a detailed breakup and analysis of the market based on the product type. This includes bakery products, dairy products, beverages, breakfast products, meals, and others.

Distribution Channel Insights:

- Supermarkets and Hypermarkets

- Specialty Stores

- Convenience Stores

- Online Retail Stores

- Others

A detailed breakup and analysis of the market based on the distribution channel have also been provided in the report. This includes supermarkets and hypermarkets, specialty stores, convenience stores, online retail stores, and others.

Regional Insights:

- North India

- West and Central India

- South India

- East and Northeast India

The report has also provided a comprehensive analysis of all the major regional markets, which include North India, West and Central India, South India, and East and Northeast India.

Competitive Landscape:

The market research report has also provided a comprehensive analysis of the competitive landscape. Competitive analysis such as market structure, key player positioning, top winning strategies, competitive dashboard, and company evaluation quadrant has been covered in the report. Also, detailed profiles of all major companies have been provided.

Latest News and Developments:

- July 2025: Bikaji Foods International Limited and Nepal's Chaudhary Group (CG Corp Global) entered into a joint venture to manufacture, trade, and market authentic Indian snacks within Nepal. The collaboration entails a joint capital infusion to establish a state‑of‑the‑art manufacturing facility in Nepal, aimed at ensuring authentic product offerings, reduced turnaround times, improved supply‑chain integration, and enhanced market reach. This strategic alliance is positioned to accelerate Nepal's burgeoning FMCG sector.

- March 2025: PepsiCo announced that it will amplify its presence in India's packed‑food and snack sector by leveraging innovation and premiumization to sustain its double‑digit growth, tailoring offerings to the nation's varied palates across "multiple Indias". To better serve regional preferences, the company has segmented India into nine taste-based clusters and is investing substantially in consumer insights, with new manufacturing plants forthcoming in Assam and additional greenfield facilities planned for South India. Such development is expected to enhance the packaged food market size in India.

- January 2025: PepsiCo India entered into a strategic collaboration with Tata Consumer Products' Ching's Secret to launch a fusion variant of Kurkure seasoned with Schezwan Chutney across India. The partnership seeks to merge Kurkure's "masaaledaar" crunch with the bold, tangy flavors of Desi Chinese cuisine, aiming to delight evolving consumer tastes through a robust marketing push including TV, digital, and print media campaigns. This initiative underscores both companies' intent to deepen their presence in India packaged food industry.

India Packaged Food Market Report Coverage:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2024 |

| Historical Period | 2019-2024 |

| Forecast Period | 2025-2033 |

| Units | USD Billion |

| Scope of the Report | Exploration of Historical and Forecast Trends, Industry Catalysts and Challenges, Segment-Wise Historical and Predictive Market Assessment:

|

| Product Types Covered | Bakery Products, Dairy Products, Beverages, Breakfast Products, Meals, Others |

| Distribution Channels Covered | Supermarkets and Hypermarkets, Specialty Stores, Convenience Stores, Online Retail Stores, Others |

| Regions Covered | North India, West and Central India, South India, East and Northeast India |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Benefits for Stakeholders:

- IMARC’s industry report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, market forecasts, and dynamics of the India packaged food market from 2019-2033.

- The research report provides the latest information on the market drivers, challenges, and opportunities in the India packaged food market.

- Porter's five forces analysis assist stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyze the level of competition within the India packaged food industry and its attractiveness.

- Competitive landscape allows stakeholders to understand their competitive environment and provides an insight into the current positions of key players in the market.

Key Questions Answered in This Report

The packaged food market in India was valued at USD 121.3 Billion in 2024.

The India packaged food market is projected to exhibit a CAGR of 6.50% during 2025-2033, reaching a value of USD 224.8 Billion by 2033.

Rapid urbanization, changing lifestyles, and a growing preference for convenience are major drivers of the India packaged food market. Increasing disposable incomes, rising demand for ready-to-eat meals, and greater access to modern retail and e-commerce platforms also support sustained market growth.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)