India Packaged Sweets Market Size, Share, Trends and Forecast by Product Type, Ingredient Type, Packaging Type, Distribution Channel, and Region, 2026-2034

India Packaged Sweets Market Summary:

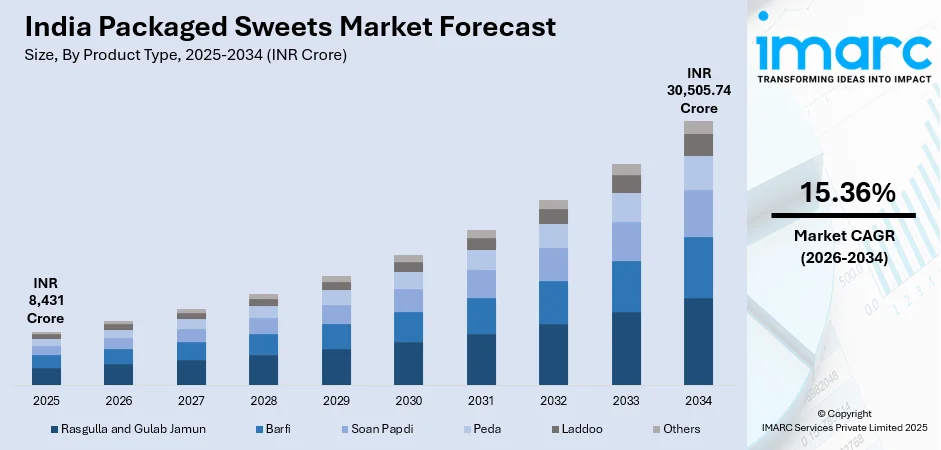

The India packaged sweets market size was valued at INR 8,431 Crore in 2025 and is projected to reach INR 30,505.74 Crore by 2034, growing at a compound annual growth rate of 15.36% from 2026-2034.

The market for packaged sweets in India is growing at a significant pace due to consumer lifestyle and demand for ready-to-eat and ready-to-consume confectionery goods. Furthermore, consumer behavior changing towards consumption of processed and packaged products and improved purchasing power and changing lifestyles are projected to boost the demand for packaged sweets and decrease the demand for loose sweets. Moreover, the significant usage of sweets in various events and celebrations is also expected to support the growth prospects and boost the overall demand within the Indian packed sweets market.

Key Takeaways and Insights:

- By Product Type: Rasgulla and gulab jamun dominates the market with a share of 28% in 2025, driven by their widespread popularity across all regions and their integral role in festive celebrations and religious offerings throughout India.

- By Ingredient Type: Milk and milk derivatives lead the market with a share of 40% in 2025, attributed to the traditional preference for dairy-based confections and the rich, authentic taste profile that milk-based sweets deliver.

- By Packaging Type: Boxes represent the largest segment with a market share of 49% in 2025, owing to their suitability for gifting purposes during festivals and their ability to preserve product freshness and presentation quality.

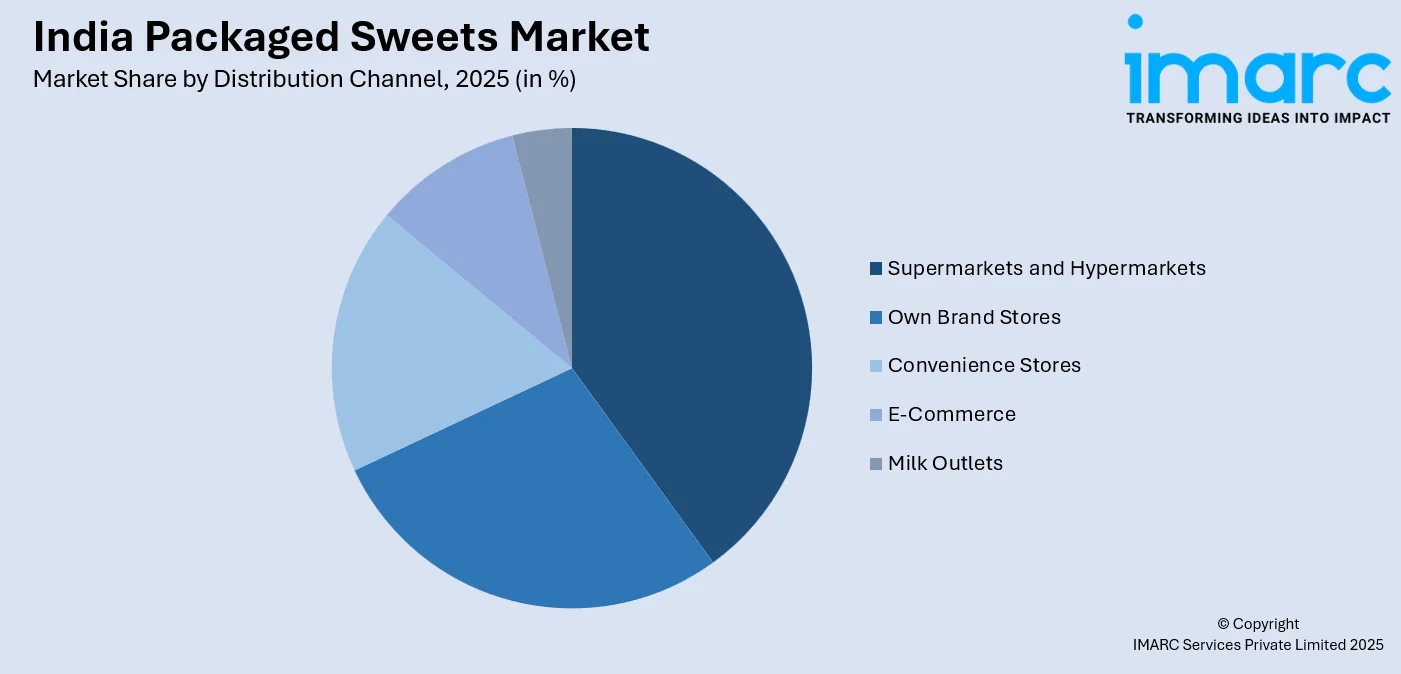

- By Distribution Channel: Supermarkets and hypermarkets lead the market with a share of 30% in 2025, facilitated by the expansion of organized retail formats and consumer preference for one-stop shopping destinations with diverse product selections.

- By Region: North India dominates the market with approximately 30% revenue share in 2025, owing to strong cultural affinity for traditional confections, well-established production facilities, and a robust network of leading manufacturers

- Key Players: The India packaged sweets market exhibits a moderately fragmented competitive landscape, with established national brands competing alongside regional manufacturers and cooperative dairy federations. Market participants are focusing on product innovation, premium offerings, and expanded distribution networks to strengthen their market presence. Some of the key players operating in the market include Banchharam, Bikanervala Foods Private Limited, Bikaji Food International Limited, Bihar State Co-operative Milk Producers Federation Limited (COMFED), Gujarat Co-operative Milk Marketing Federation Limited, Haldiram's, Karnataka Co-operative Milk Producers Federation Limited (KMF), KC Das Private Limited, Lal Sweets Private Limited, Orissa State Co-operative Milk Producers Federation Limited (OMFED), Parag Milk Foods Limited, and Tamil Nadu Co-operative Milk Producers Federation Limited (TCMF).

To get more information on this market Request Sample

The India packaged sweets market is witnessing transformative developments as manufacturers invest in modern production technologies and innovative packaging solutions. For instance, Lal Sweets has invested ₹100 crore to open two new state-of-the-art manufacturing units in Bengaluru and Greater Noida to scale up production and widen its distribution network, underscoring the growth of organised branded mithai businesses in India. Consumer awareness regarding food safety and hygiene standards has accelerated the shift towards branded packaged variants, particularly following heightened health consciousness. The market is also benefiting from the emergence of premium and artisanal sweet brands that cater to health-conscious consumers by offering sugar-free, organic, and vegan alternatives. Furthermore, the expansion of e-commerce platforms and improved cold chain logistics have enhanced product accessibility across urban and rural markets, enabling manufacturers to reach a broader consumer base while maintaining product quality and freshness.

India Packaged Sweets Market Trends:

Rise of Health-Conscious Sweet Variants

The India packaged sweets market is witnessing a significant trend towards healthier alternatives as consumers increasingly seek products aligned with their wellness goals. For instance, in October 2025, Karnataka Milk Federation’s iconic Nandini brand introduced a new range of sugar-free sweets ahead of Diwali, such as Khoa Gulab Jamun and Hale Peda, specifically designed for diabetics and health-conscious consumers and reflecting rising demand for mindful indulgence. Manufacturers are responding by introducing sugar-free, low-calorie, and millet-based sweet variants that retain traditional flavors while addressing dietary concerns. The incorporation of functional ingredients such as omega-3 fatty acids, natural sweeteners, and whole grains is gaining traction among health-aware consumers. This shift is particularly prominent among urban populations and younger demographics who desire indulgence without compromising on nutritional value.

Premiumization and Artisanal Offerings

The market is experiencing a notable shift towards premium and artisanal packaged sweets as consumers demonstrate willingness to pay higher prices for superior quality and authentic experiences. This trend is exemplified by the 2025 festive season in India, when gourmet mithai such as rose-infused kaju katli and saffron- and edible gold-topped barfi commanded prices exceeding ₹1 lakh per kilogram, reflecting how luxury sweet offerings are capturing the attention of affluent and experiential buyers. Luxury sweet brands are emerging with handcrafted products featuring premium ingredients such as exotic dry fruits, saffron, and organic dairy. Gift-worthy packaging with elegant designs and sustainable materials is becoming increasingly important for premium positioning. This premiumization trend is driven by rising affluence, exposure to global culinary standards, and the desire for differentiated products during festive gifting occasions.

Digital Commerce and Direct-to-Consumer Expansion

E-commerce is transforming distribution dynamics in the India packaged sweets market as both established brands and new entrants leverage online platforms to reach consumers directly. Quick‑commerce and e‑commerce platforms are increasingly becoming avenues for purchasing mithai and festive essentials, with services such as Blinkit, Zepto and Swiggy Instamart adding dedicated sections for traditional Indian sweets during festival seasons like Diwali and Navratri, reflecting how consumer buying habits are shifting online. The proliferation of quick-commerce services and improved last-mile delivery infrastructure has enabled fresh sweet deliveries across metropolitan areas. Direct-to-consumer brands are utilizing social media marketing and digital storefronts to build customer relationships and gather valuable consumer insights. This digital transformation is enabling smaller regional brands to compete with established players by accessing wider markets without substantial physical retail investments.

Market Outlook 2026-2034:

The market outlook in the packaged sweets industry in India is highly positive, given the transition from the unorganized sector to the organized sector. The rise in preferences for branded products, with guaranteed quality and hygiene, is also set to contribute positively to the growing demand in the market. The market is set to derive long-term benefits from product innovations such as increasing shelf life, including single-serve packaging. The rise in the adoption of modern retail stores and online purchase options is set to increase accessibility. The market generated a revenue of INR 8,431 Crore in 2025 and is projected to reach a revenue of INR 30,505.74 Crore by 2034, growing at a compound annual growth rate of 15.36% from 2026-2034.

India Packaged Sweets Market Report Segmentation:

| Segment Category | Leading Segment | Market Share |

|---|---|---|

| Product Type | Rasgulla and Gulab Jamun | 28% |

| Ingredient Type | Milk and Milk Derivatives | 40% |

| Packaging Type | Boxes | 49% |

| Distribution Channel | Supermarkets and Hypermarkets | 30% |

| Region | North India | 30% |

Product Type Insights:

- Rasgulla and Gulab Jamun

- Barfi

- Soan Papdi

- Peda

- Laddoo

- Others

The rasgulla and gulab jamun dominates with a market share of 28% of the total India packaged sweets market in 2025.

Rasgulla and gulab jamun continue to lead the India packaged sweets market owing to their universal appeal and deep-rooted presence in Indian culinary traditions. These syrup-based confections are integral to religious offerings, festive celebrations, and everyday indulgence across all demographic segments. Reflecting their continued popularity and evolving formats, brands and dessert innovators are introducing modern single‑serve and fusion interpretations, such as Baked Rasgulla and Jamun Jubilee, that blend traditional flavours with contemporary presentation to attract younger consumers and premium dessert seekers. The extended shelf life achievable through modern packaging technologies has enhanced their commercial viability, enabling nationwide distribution without compromising taste or texture. Manufacturers are introducing convenient ready-to-serve formats and portion-controlled packaging to cater to evolving consumer preferences.

The dominance in rasgulla and gulab jamun is further supported by their flexibility in being used in various functions starting from mere snacking to being used as a gift item. The category enjoys benefits in terms of brand recognition and trust established over the years by established brands in this sector. The sector also enjoys innovative offerings in the range, including sugar-free rasgulla, luxury or artisanal forms, and fusion flavors that attract the health- and innovation-conscious buyer respectively.

Ingredient Type Insights:

- Milk and Milk Derivatives

- Cereal and Pulses

- Dry Fruits

- Fruits and Vegetables

- Others

The milk and milk derivatives leads with a share of 40% of the total India packaged sweets market in 2025.

Milk and milk derivatives dominate the ingredient segment, reflecting India’s strong preference for dairy-based sweets known for their rich, creamy textures and authentic flavors. Ingredients such as khoya, paneer, and condensed milk underpin popular sweets including barfi, peda, and kalakand. The perception of dairy as a nutritious and wholesome ingredient further reinforces demand for milk-based confections, while India’s extensive dairy infrastructure and cooperative network ensure a reliable supply of quality milk products to sweet manufacturers nationwide.

The segment benefits from strong cultural associations between milk-based sweets and auspicious occasions in Indian tradition. Manufacturers are investing in advanced processing technologies to extend product shelf life while maintaining the freshness and taste of dairy-based sweets. The emergence of premium variants using A2 milk and organic dairy sources is creating new market opportunities in the health-conscious consumer segment. Regional specialties featuring unique milk-based preparations continue to attract consumers seeking authentic traditional experiences.

Packaging Type Insights:

- Boxes

- Tin Cans

- Plastic Containers

The boxes dominates with a market share of 49% of the total India packaged sweets market in 2025.

Box packaging commands the largest market share driven by its suitability for gifting purposes, which represents a substantial portion of packaged sweet consumption in India. Decorative boxes with elegant designs and premium finishes enhance product appeal during festive seasons when sweet gifting is customary. The structural integrity of boxes provides superior protection for delicate sweets during transportation and storage. Manufacturers are increasingly adopting sustainable materials and innovative designs to differentiate their products in the competitive market.

The boxes segment is increasingly shifting toward eco-friendly materials, driven by rising consumer environmental awareness and stricter regulations on single-use plastics. Premium brands are adopting luxury box packaging with features such as magnetic closures, fabric linings, and artistic illustrations to support higher price positioning. The ability of box packaging to accommodate diverse sweet assortments makes it a preferred option for both manufacturers and consumers. Additionally, customization options, including personalized messages and corporate branding, are enhancing the segment’s attractiveness in the institutional gifting market.

Distribution Channel Insights:

Access the comprehensive market breakdown Request Sample

- Own Brand Stores

- Convenience Stores

- Supermarkets and Hypermarkets

- E-Commerce

- Milk Outlets

The supermarkets and hypermarkets leads with a share of 30% of the total India packaged sweets market in 2025.

Supermarkets and hypermarkets have become the dominant distribution channel for packaged sweets, fueled by the growing footprint of organized retail across urban and semi-urban India. These modern trade formats provide consumers with seamless shopping experiences, offering diverse product selections from various brands under one roof. For example, Reliance Retail has partnered with more than 50 traditional Indian sweet makers to mass‑produce, hygienically package and stock a wide variety of regional sweets such as laddoos, barfis and pedas in its grocery and modern trade formats, bringing artisanal mithai into the organized retail ecosystem. Climate-controlled environments within these stores help preserve product integrity, ensuring sweets retain their quality and freshness. Strategic in-store promotions, eye-catching festive displays, and sampling initiatives effectively stimulate impulse buying and enhance brand recognition.

The popularity of this channel is further supported by consumer demand for standardized pricing, ease of product comparison, and the reliability associated with established retail chains. For manufacturers, supermarkets and hypermarkets serve as critical platforms to introduce new products and highlight premium assortments to a broad customer base. The adoption of membership rewards, cashback schemes, and seamless digital transactions continues to foster customer loyalty and encourage higher spending. As organized retail expands into smaller cities and emerging markets, this distribution channel is poised to consolidate its leading position in the coming years.

Regional Insights:

- North India

- West and Central India

- South India

- East India

North India exhibits a clear dominance with a 30% share of the total India packaged sweets market in 2025.

North India continues to lead the packaged sweets market, driven by the region's deeply ingrained sweet consumption culture and the presence of well-established production centers across key states. The legacy of renowned sweet-making traditions provides a solid foundation for consumer trust and widespread acceptance of packaged offerings. Dense population clusters combined with rapid urbanization contribute to significant consumption volumes spanning various income and demographic groups. Year-round demand is sustained by the region's vibrant festival calendar and customary practices that emphasize sweet distribution during religious and social gatherings.

The region enjoys strategic advantages including mature logistics networks and close proximity to prominent dairy-producing zones, ensuring consistent access to essential raw materials. A thriving manufacturing ecosystem encompassing ingredient suppliers, packaging solution providers, and extensive distribution channels reinforces North India's competitive edge in the sector. Increasing household incomes in metropolitan and emerging urban areas, coupled with the expanding presence of organized retail outlets, are driving consumers toward branded and hygienically packaged alternatives. The region's celebrated sweet-crafting heritage from iconic confectionery destinations continues to influence premium product positioning and brand credibility across national markets.

Market Dynamics:

Growth Drivers:

Why is the India Packaged Sweets Market Growing?

Rising Urbanization and Changing Consumer Lifestyles

The rapid urbanization across India is fundamentally transforming consumer preferences towards convenient and ready-to-consume food products, including packaged sweets. Urban consumers with demanding work schedules increasingly prefer branded packaged alternatives over visiting traditional sweet shops for fresh purchases. According to reports, 51% of urban Indian households now consume traditional mithai three or more times a month, up significantly from the previous year, indicating that urban lifestyles are driving more frequent sweet consumption and creating opportunities for packaged options that fit busy routines and convenience needs. The nuclear family structure prevalent in cities reduces the tradition of homemade sweet preparation, creating substantial demand for commercially packaged options. Modern urban consumers prioritize hygiene, consistent quality, and convenience, attributes that packaged sweets readily deliver compared to unorganized alternatives. The expansion of residential areas and commercial districts in metropolitan regions has increased the distance between consumers and traditional sweet shops, making packaged variants more accessible.

Strong Festive and Gifting Culture

India's longstanding cultural tradition of exchanging sweets during festivals, religious observances, and social gatherings creates a robust and enduring demand base for the packaged sweets market. Key occasions such as Diwali, Raksha Bandhan, Eid, and various regional festivities generate substantial seasonal demand for elegantly packaged sweets ideal for gifting. During the 2025 festive season, packaged sweets and gourmet food gifting experienced a marked surge as brands capitalised on the demand for festive gifting packs, with organised players offering curated sweet hampers and premium festive assortments that attracted both individual buyers and corporate bulk orders. The corporate gifting sector has become an influential growth contributor, as organizations increasingly opt for premium packaged confections to express appreciation towards clients, partners, and employees. Life celebrations including weddings, childbirth ceremonies, and housewarmings customarily involve sweet sharing, ensuring steady consumption patterns throughout the year. Packaged sweets offer distinct advantages over loose alternatives, including enhanced visual appeal, extended freshness, and convenient portability, making them the preferred option for gifting purposes.

Expansion of Modern Retail and E-Commerce Channels

The proliferation of supermarkets, hypermarkets, and online retail platforms has significantly enhanced the accessibility and visibility of packaged sweets across Indian markets. Modern retail formats provide dedicated shelf space for packaged confectionery products, enabling consumers to discover and compare offerings from multiple brands. Quick‑commerce services are increasingly driving seasonal and impulse purchases of packaged treats: during Raksha Bandhan 2025, Zepto and other rapid delivery platforms saw sweets category orders increase roughly fourfold compared to regular days, as last‑minute shoppers turned to fast delivery for celebratory essentials. E-commerce platforms have democratized market access, allowing regional and artisanal sweet brands to reach consumers nationwide without substantial physical retail investments. Quick-commerce services offering rapid delivery have made packaged sweets accessible for immediate consumption and last-minute gifting requirements. The integration of digital payment options and loyalty programs in retail channels encourages consumer trial and repeat purchases of packaged sweet products. Improved cold chain logistics and delivery infrastructure ensure product quality maintenance during transportation, enabling broader geographic market penetration.

Market Restraints:

What Challenges the India Packaged Sweets Market is Facing?

Strong Competition from Unorganized Sector

The India packaged sweets market faces significant competition from the unorganized sector comprising traditional sweet shops and local manufacturers. Many consumers, particularly in smaller towns and rural areas, continue to prefer freshly prepared sweets from trusted local vendors over packaged alternatives. The price advantage enjoyed by unorganized players due to lower overhead costs and tax compliance challenges branded manufacturers. Consumer perception of freshness and authenticity often favors traditional sweet shops over mass-produced packaged products.

Perishability and Supply Chain Constraints

The inherent perishability of traditional Indian sweets poses significant challenges for manufacturers seeking to expand distribution reach. Maintaining product freshness and quality across extended supply chains requires substantial investments in cold chain infrastructure and specialized packaging technologies. Temperature fluctuations during transportation and storage can adversely affect product texture, taste, and shelf life. Seasonal demand variations create inventory management complexities and potential wastage concerns for manufacturers and retailers.

Rising Input Costs and Margin Pressures

Volatility in raw material prices, particularly dairy products, sugar, and dry fruits, creates margin pressures for packaged sweet manufacturers. Increasing packaging material costs and regulatory compliance requirements add to operational expenses without proportionate pricing flexibility. Labor costs and energy expenses continue to rise, challenging manufacturers to maintain profitability while offering competitive prices. Smaller brands often struggle to achieve economies of scale necessary to compete effectively with established players.

Competitive Landscape:

The packaged sweets market in India is moderately fragmented, consisting of established national players, regional manufacturers, and state-level dairy cooperatives. Strong brands leverage their wide distribution reach, consumer recall, and large-scale production facilities to maintain leadership positions. Regional players create differentiation through legacy recipes, locally relevant product variants, and tight relationships with neighborhood retail networks. Dairy cooperatives often hold significant positions in the market by offering value-for-money products backed by consumer trust and vertically integrated milk procurement systems. The competitive landscape is witnessing heightened activity in new product development, premiumization strategies, and brand-building initiatives as players attempt to carve distinctive identities for themselves and expand their consumer franchise. M&A and strategic partnerships are increasingly becoming popular routes to expansion, with private equity firms showing a keen interest in the promising growth outlook of the sector. Digitally native direct-to-consumer brands and entrepreneurial ventures are driving competitive intensity while encouraging innovation and further consumer engagement across the market.

Some of the key players include:

- Banchharam

- Bikanervala Foods Private Limited

- Bikaji Food International Limited

- Bihar State Co-operative Milk Producers Federation Limited (COMFED)

- Gujarat Co-operative Milk Marketing Federation Limited

- Haldiram's

- Karnataka Co-operative Milk Producers Federation Limited (KMF)

- KC Das Private Limited

- Lal Sweets Private Limited

- Orissa State Co-operative Milk Producers Federation Limited (OMFED)

- Parag Milk Foods Limited

- Tamil Nadu Co-operative Milk Producers Federation Limited (TCMF)

Recent Developments:

- In February 2025, India’s iconic snack and sweets maker Haldiram’s has launched premium gifting boxes in the UK, expanding its overseas footprint with curated selections that blend traditional Indian flavours and sophisticated packaging. The move targets corporate, personal and luxury gifting segments, underscoring the brand’s broader international growth ambitions.

India Packaged Sweets Market Report Coverage:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2025 |

| Historical Period | 2020-2025 |

| Forecast Period | 2026-2034 |

| Units | INR Crore |

| Scope of the Report | Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Product Types Covered | Rasgulla and Gulab Jamun, Barfi, Soan Papdi, Peda, Laddoo, Others |

| Ingredient Types Covered | Milk and Milk Derivatives, Cereal and Pulses, Dry Fruits, Fruits and Vegetables, Others |

| Packaging Types Covered | Boxes, Tin Cans, Plastic Containers |

| Distribution Channels Covered | Own Brand Stores, Convenience Stores, Supermarkets and Hypermarkets, E-Commerce, Milk Outlets |

| Regions Covered | North India, West and Central India, South India, East India |

| Companies Covered | Banchharam, Bikanervala Foods Private Limited, Bikaji Food International Limited, Bihar State Co-operative Milk Producers Federation Limited (COMFED), Gujarat Co-operative Milk Marketing Federation Limited, Haldiram's, Karnataka Co-operative Milk Producers Federation Limited (KMF), KC Das Private Limited, Lal Sweets Private Limited, Orissa State Co-operative Milk Producers Federation Limited (OMFED), Parag Milk Foods Limited, and Tamil Nadu Co-operative Milk Producers Federation Limited (TCMF) |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Questions Answered in This Report

The India packaged sweets market size was valued at INR 8,431 Crore in 2025.

The India packaged sweets market is expected to grow at a compound annual growth rate of 15.36% from 2026-2034 to reach INR 30,505.74 Crore by 2034.

Rasgulla and gulab jamun dominated the product type segment with a 28% market share, driven by their universal popularity across all regions and integral role in festive celebrations and religious offerings throughout India.

Key factors driving the India packaged sweets market include rising urbanization and changing consumer lifestyles favoring convenient food options, strong festive and gifting culture sustaining year-round demand, expansion of modern retail and e-commerce channels enhancing product accessibility, and growing consumer focus on hygiene and food safety standards.

Major challenges include strong competition from the unorganized sector comprising traditional sweet shops, perishability constraints requiring investment in cold chain infrastructure, rising input costs creating margin pressures, and the need for continuous product innovation to meet evolving consumer preferences.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)