India Pain Management Drugs Market Size, Share, Trends and Forecast by Drug Class, Indication, Distribution Channel, and Region, 2025-2033

India Pain Management Drugs Market Size and Share:

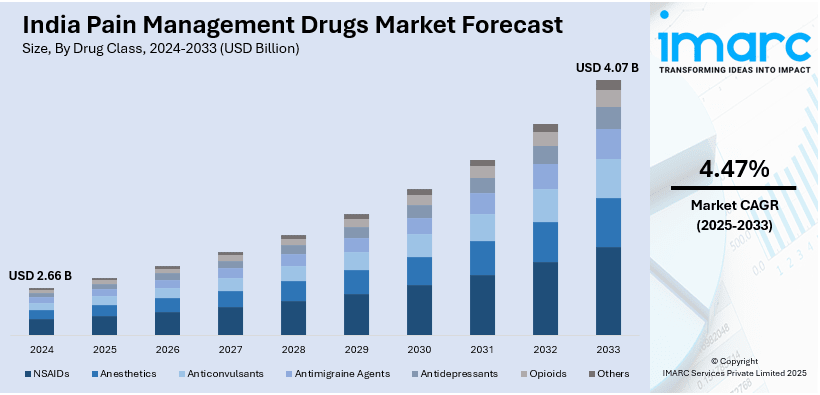

The India pain management drugs market size reached USD 2.66 Billion in 2024. Looking forward, IMARC Group expects the market to reach USD 4.07 Billion by 2033 exhibiting a growth rate (CAGR) of 4.47% during 2025-2033. India’s pain management drugs market is expanding due to regulatory advancements, increasing biosimilar adoption, and rising demand for cost-effective treatments. Moreover, streamlined opioid regulations, growing availability of biosimilars for chronic pain conditions, and improved access to essential medications are propelling market growth and enhancing patient care and treatment affordability.

|

Report Attribute

|

Key Statistics

|

|---|---|

|

Base Year

|

2024

|

|

Forecast Years

|

2025-2033

|

|

Historical Years

|

2019-2024

|

| Market Size in 2024 | USD 2.66 Billion |

| Market Forecast in 2033 | USD 4.07 Billion |

| Market Growth Rate (2025-2033) | 4.47% |

India Pain Management Drugs Market Trends:

Regulatory Advancements Enhancing Drug Accessibility

India’s pain management drug industry is evolving with regulatory reforms aimed at improving access to essential medications. Opioid-based pain relief remains crucial for managing severe and chronic pain conditions, yet regulatory restrictions and logistical challenges often limit availability. In addition, efforts to simplify narcotic drug regulations and streamline approval processes are driving market efficiency, ensuring patients receive timely and effective treatment. Furthermore, government agencies are working to address concerns related to storage, distribution, and prescription regulations, promoting responsible usage while enhancing accessibility. In September 2024, FDA Maharashtra collaborated with Pallium India to streamline Essential Narcotic Drug (END) regulations and raise awareness among stakeholders. A virtual session engaged 76 participants, including regulatory officials and healthcare professionals, facilitating discussions on improving opioid accessibility while ensuring compliance. This initiative is a step toward eliminating unnecessary barriers in pain management, making essential drugs more accessible to patients in need. As the demand for effective pain management solutions grows, regulatory reforms play a pivotal role in expanding the market. Along with this, policymakers are ensuring that essential pain relief medications, by simplifying compliance requirements and improving distribution networks, particularly those classified as controlled substances. Consequently, these advancements are strengthening India’s pharmaceutical landscape, making pain management drugs more widely available and enhancing overall patient care.

To get more information on this market, Request Sample

Growing Demand for Affordable Biosimilars

The rising prevalence of chronic pain conditions in India has created a strong demand for cost-effective treatment solutions. Biosimilars are emerging as a critical component in pain management, particularly for patients with autoimmune disorders, arthritis, and musculoskeletal conditions. These drugs offer the same therapeutic benefits as biologics but at significantly lower costs, making them more accessible to a larger population. The increasing approval and adoption of biosimilars for pain-related diseases are driving market growth, allowing patients to receive high-quality, affordable treatments without financial strain. In July 2024, Dr. Reddy’s Laboratories received a positive CHMP opinion from EMA for its Rituximab biosimilar (ITUXREDI), marking a key milestone in expanding access to biosimilar pain treatments. The drug is intended for rheumatoid arthritis and autoimmune conditions, providing a more affordable alternative to reference biologics. This approval strengthens India’s role in the global biosimilar market, supporting greater affordability and accessibility for patients suffering from chronic pain-related diseases. As healthcare costs continue to rise, the demand for biosimilars in pain management is expected to accelerate. Pharmaceutical companies are investing in research and development to create effective, low-cost alternatives for patients in India and international markets. India’s pain management drug sector is poised for expansion with regulatory bodies approving more biosimilars, thereby ensuring wider treatment availability and improved healthcare outcomes for millions affected by chronic pain.

India Pain Management Drugs Market Segmentation:

IMARC Group provides an analysis of the key trends in each segment of the market, along with forecasts at the region/country level for 2025-2033. Our report has categorized the market based on drug class, indication, and distribution channel.

Drug Class Insights:

- NSAIDs

- Anesthetics

- Anticonvulsants

- Antimigraine Agents

- Antidepressants

- Opioids

- Others

The report has provided a detailed breakup and analysis of the market based on the drug class. This includes NSAIDs, anesthetics, anticonvulsants, antimigraine agents, antidepressants, opioids, and others.

Indication Insights:

- Musculoskeletal Pain

- Surgical and Trauma Pain

- Cancer Pain

- Neuropathic Pain

- Migraine Pain

- Obstetrical Pain

- Fibromyalgia Pain

- Burn Pain

- Dental/Facial Pain

- Pediatric Pain

- Others

The report has provided a detailed breakup and analysis of the market based on the indication. This includes musculoskeletal pain, surgical and trauma pain, cancer pain, neuropathic pain, migraine pain, obstetrical pain, fibromyalgia pain, burn pain, dental/facial pain, pediatric pain, and others.

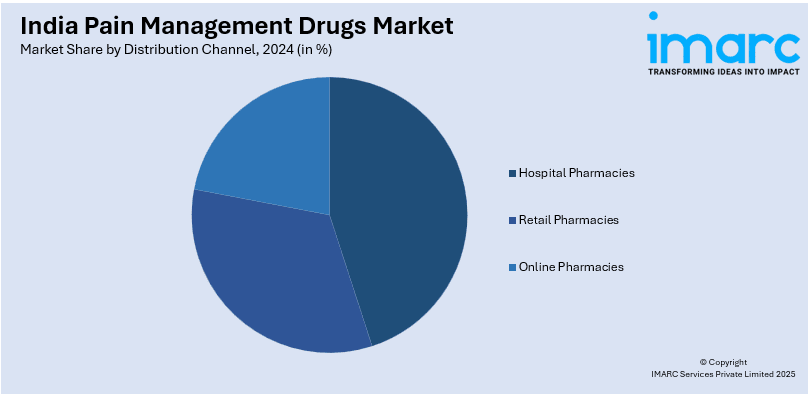

Distribution Channel Insights:

- Hospital Pharmacies

- Retail Pharmacies

- Online Pharmacies

A detailed breakup and analysis of the market based on the distribution channel have also been provided in the report. This includes hospital pharmacies, retail pharmacies, and online pharmacies.

Region Insights:

- North India

- South India

- East India

- West India

The report has also provided a comprehensive analysis of all the major regional markets, which include North India, South India, East India, and West India.

Competitive Landscape:

The market research report has also provided a comprehensive analysis of the competitive landscape. Competitive analysis such as market structure, key player positioning, top winning strategies, competitive dashboard, and company evaluation quadrant has been covered in the report. Also, detailed profiles of all major companies have been provided.

India Pain Management Drugs Market News:

- February 2025: Nivaan Care raised USD 4.25 Million to expand its multidisciplinary chronic pain management clinics across India. With evidence-based treatments, regenerative medicine, and holistic care, this development enhances India’s pain management drug market, improving accessibility and advancing comprehensive, long-term pain relief solutions.

- September 2024: Mankind Pharma entered the topical analgesic market with Nimulid Strong, featuring 2X diclofenac concentration for faster neck pain relief. Available in gel and spray forms, this launch strengthens India’s pain management drug segment, expanding consumer access to affordable and effective topical treatments.

India Pain Management Drugs Market Report Coverage:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2024 |

| Historical Period | 2019-2024 |

| Forecast Period | 2025-2033 |

| Units | Billion USD |

| Scope of the Report |

Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Drug Class Covered | NSAIDs, Anesthetics, Anticonvulsants, Antimigraine Agents, Antidepressants, Opioids, Others |

| Indication Covered | Musculoskeletal Pain, Surgical and Trauma Pain, Cancer Pain, Neuropathic Pain, Migraine Pain, Obstetrical Pain, Fibromyalgia Pain, Burn Pain, Dental/Facial Pain, Pediatric Pain, Others |

| Distribution Channel Covered | Hospital Pharmacies, Retail Pharmacies, Online Pharmacies |

| Regions Covered | North India, South India, East India, West India |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Benefits for Stakeholders:

- IMARC’s industry report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, market forecasts, and dynamics of the India pain management drugs market from 2019-2033

- The research report provides the latest information on the market drivers, challenges, and opportunities in the India pain management drugs market.

- Porter's five forces analysis assist stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyze the level of competition within the India pain management drugs industry and its attractiveness.

- Competitive landscape allows stakeholders to understand their competitive environment and provides an insight into the current positions of key players in the market.

Key Questions Answered in This Report

The pain management drugs market in the India was valued at USD 2.66 Billion in 2024.

The India pain management drugs market is projected to exhibit a CAGR of 4.47% during 2025-2033, reaching a value of USD 4.07 Billion by 2033.

The India pain management drugs market is growing owing to an increasing geriatric population base, increasing prevalence of chronic diseases such as cancer and arthritis, and increased awareness about efficient pain therapies. Increasing access to healthcare facilities, enhanced disposable income, and innovation in analgesic drug formulations such as opioids and non-steroidal anti-inflammatory drugs (NSAIDs) are boosting pharmaceutical demand considerably.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)