India Paint Protection Film Market Size, Share, Trends and Forecast by Material, Formulation Type, End Use Industry, and Region, 2025-2033

India Paint Protection Film Market Overview:

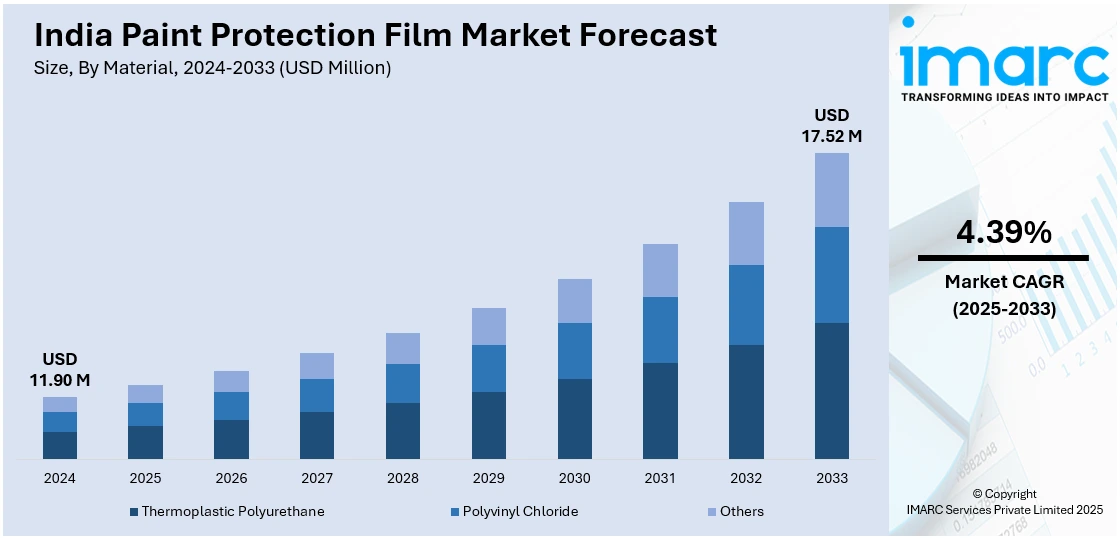

The India paint protection film market size reached USD 11.90 Million in 2024. Looking forward, IMARC Group expects the market to reach USD 17.52 Million by 2033, exhibiting a growth rate (CAGR) of 4.39% during 2025-2033. The India paint protection film (PPF) market is being driven by rising luxury vehicle ownership rates, growing automotive customization trends, increasing digital penetration enabling online access to PPF solutions, heightened consumer awareness about vehicle maintenance, and domestic manufacturing initiatives offering advanced and cost-effective films with features like self-healing, UV resistance, and hydrophobic protection.

|

Report Attribute

|

Key Statistics

|

|---|---|

|

Base Year

|

2024 |

|

Forecast Years

|

2025-2033

|

|

Historical Years

|

2019-2024

|

| Market Size in 2024 | USD 11.90 Million |

| Market Forecast in 2033 | USD 17.52 Million |

| Market Growth Rate 2025-2033 | 4.39% |

India Paint Protection Film Market Trends:

Rising Luxury and Premium Vehicle Ownership in Urban India

One of the key drivers of India's paint protection film market is the growing ownership of luxury and premium cars, particularly in tier-1 and metro cities. In the past decade, India has seen a rise in disposable incomes, aspirational consumption behavior, and urban lifestyle upgrades, which have boosted demand for premium vehicles like those from Mercedes-Benz, BMW, Audi, Lexus, etc. These cars are accompanied by a high price, and owners tend to see them as not only means of transportation but also long-term investments or status symbols. Since such cars have costly and visually stunning exterior finishes, maintaining the original paint is an important consideration. Even small scratches, UV rays, or environmental degradation can significantly lower the value and appearance of a luxury vehicle. PPFs provide a proactive measure through the creation of a nearly invisible, long-lasting layer protecting the car from abrasions, bird droppings, stone chips, and weathering. With luxury car penetration intensifying beyond conventional urban strongholds to smaller wealthy pockets, the need for aesthetic and functional protection products such as PPF is likely to increase in parallel. In addition to this, certified dealerships and high-end car service companies extensively package PPF solutions with car sales, which is also catalyzing the market growth.

To get more information on this market, Request Sample

Expansion of E-commerce and Digital Auto Services Driving Accessibility and Awareness

Another factor driving the PPF market is the development of e-commerce portals and digitalized auto service networks. India e-commerce market is expected to reach USD 650.4 billion by 2023, exhibiting a growth rate (CAGR) of 19.70% during 2025-2033. This growth is fueled by technology enablement, convenience, and pan-Indian reach, particularly in tier-2 and tier-3 cities. With rising penetration of smartphones and internet usage, Indian consumers are becoming digital-savvy and venturing into online forums for vehicle accessories-related recommendations, including for PPF. Online stores of e-commerce players like Amazon, Flipkart, and dedicated motor vehicle marketplaces now stock up paint protection films, equipment, and installation kits for sale online. Moreover, online auto service aggregators, such as GoMechanic, CarDekho, and Pitstop, offer expert PPF installation services via online appointments, frequently bundled with other car care offerings. This has made paint protection accessible to even budget car owners in semi-urban or rural locations to explore and embrace PPF without relying solely on conventional auto body shops.

India Paint Protection Film Market Segmentation:

IMARC Group provides an analysis of the key trends in each segment of the market, along with forecasts at the region/country level for 2025-2033. Our report has categorized the market based on material, formulation type, and end use industry.

Material Insights:

- Thermoplastic Polyurethane

- Polyvinyl Chloride

- Others

The report has provided a detailed breakup and analysis of the market based on the material. This includes thermoplastic polyurethane, polyvinyl chloride, and others.

Formulation Type Insights:

- Water-Based

- Solvent-Based

A detailed breakup and analysis of the market based on the formulation type have also been provided in the report. This includes water-based and solvent-based.

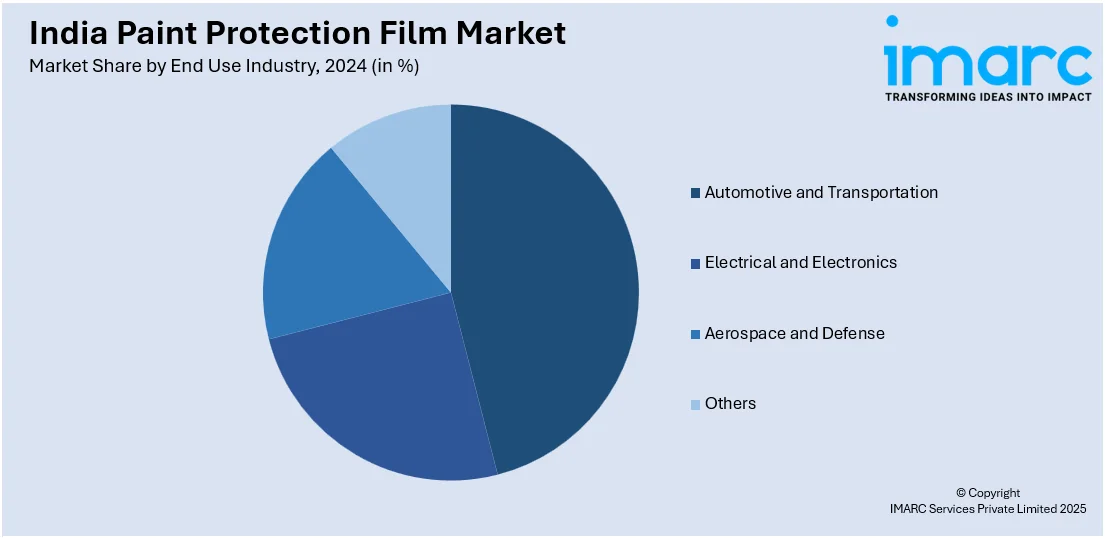

End Use Industry Insights:

- Automotive and Transportation

- Electrical and Electronics

- Aerospace and Defense

- Others

The report has provided a detailed breakup and analysis of the market based on the end use industry. This includes automotive and transportation, electrical and electronics, aerospace and defense, and others.

Regional Insights:

- North India

- South India

- East India

- West India

The report has also provided a comprehensive analysis of all the major regional markets, which include North India, South India, East India, and West India.

Competitive Landscape:

The market research report has also provided a comprehensive analysis of the competitive landscape. Competitive analysis such as market structure, key player positioning, top winning strategies, competitive dashboard, and company evaluation quadrant has been covered in the report. Also, detailed profiles of all major companies have been provided.

India Paint Protection Film Market News:

- January 2025: ALP Group unveiled its new PPF variants, Defender, Armor, and Ranger, at the Bharat Mobility Global Expo 2025. These films reportedly incorporate self-healing technology for minor scratches and offer UV protection to prevent discoloration, aiming to shield vehicles from environmental damage.

- December 2024: Cosmo First launched new PPFs for vehicles, featuring advanced scratch resistance, self-healing technology, hydrophobic properties, and comprehensive UV and chemical protection. The PPF line includes two variants: Cosmo PPF Platinum, featuring an 8-mil thickness and a lifetime warranty, and Cosmo PPF Gold, offering a 5-year warranty.

India Paint Protection Film Market Report Coverage:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2024 |

| Historical Period | 2019-2024 |

| Forecast Period | 2025-2033 |

| Units | Million USD |

| Scope of the Report | Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Materials Covered | Thermoplastic Polyurethane, Polyvinyl Chloride, Others |

| Formulation Types Covered | Water-Based, Solvent-Based |

| End Use Industries Covered | Automotive and Transportation, Electrical and Electronics, Aerospace and Defense, Others |

| Regions Covered | North India, South India, East India, West India |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Benefits for Stakeholders:

- IMARC’s industry report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, market forecasts, and dynamics of the India paint protection film market from 2019-2033.

- The research report provides the latest information on the market drivers, challenges, and opportunities in the India paint protection film market.

- Porter's five forces analysis assist stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyze the level of competition within the India paint protection film industry and its attractiveness.

- Competitive landscape allows stakeholders to understand their competitive environment and provides an insight into the current positions of key players in the market.

Key Questions Answered in This Report

The paint protection film market in India was valued at USD 11.90 Million in 2024.

The India paint protection film market is projected to exhibit a CAGR of 4.39% during 2025-2033, reaching a value of USD 17.52 Million by 2033.

The harsh weather conditions, pollution, and road debris in many parts of India are making vehicle surfaces more prone to damage, creating the need for paint protective films. Advancements in film technology, such as self-healing features, aid in enhancing the appeal of these products. The influence of car enthusiasts and social media trends around vehicle customization is also contributing to the market growth.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)