India Paint Roller Market Size, Share, Trends and Forecast by Product, Fabric, Pile Depth, End Use, and Region, 2025-2033

India Paint Roller Market Overview:

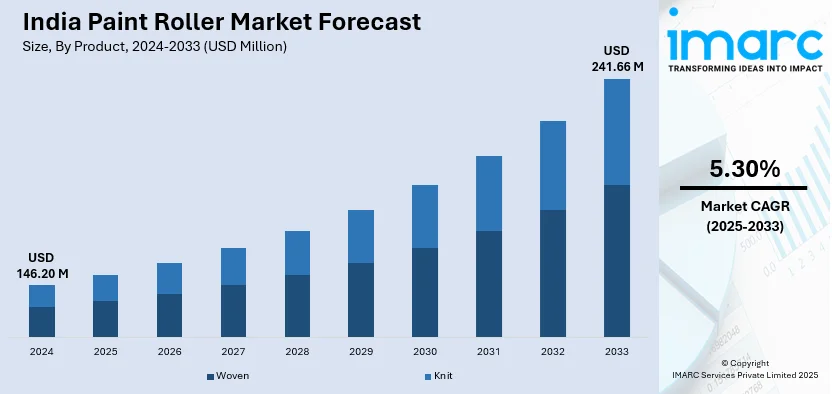

The India paint roller market size reached USD 146.20 Million in 2024. Looking forward, IMARC Group expects the market to reach USD 241.66 Million by 2033, exhibiting a growth rate (CAGR) of 5.30% during 2025-2033. The market is witnessing growth owing to growing construction activities, urbanization, and rising demand for cost-effective and efficient painting instruments. Furthermore, the trend for DIY home renovation projects and environmental-friendly products is also supporting market growth.

|

Report Attribute

|

Key Statistics

|

|---|---|

|

Base Year

|

2024

|

|

Forecast Years

|

2025-2033

|

|

Historical Years

|

2019-2024

|

| Market Size in 2024 | USD 146.20 Million |

| Market Forecast in 2033 | USD 241.66 Million |

| Market Growth Rate 2025-2033 | 5.30% |

India Paint Roller Market Trends:

Growth in Construction and Infrastructure

The Indian paint roller industry is observing impressive growth, courtesy of the speedy growth of the construction and infrastructure sectors. The constant initiatives by the government, such as Smart Cities and housing in urban areas, are heavily driving the demand for cost-effective and efficient painting solutions. Moreover, paint rollers are fast becoming popular because they leave a smoother finish than the conventional brushes yet save labor time and painting wastage. Also, their cost-effectiveness makes them appropriate for large-scale projects. Also, the increasing number of residential and commercial properties in urban and semi-urban locations is generating consistent demand. In the lower segments of the market, small-scale contractors and home improvement enthusiasts are using paint rollers for fast and even application. The growing consciousness of environmentally friendly practices has also prompted the production of low-VOC and green paints, further driving the use of advanced paint roller materials. This combination of drivers is making the paint roller market a sought-after option across industries.

To get more information on this market, Request Sample

DIY Culture and Consumer Preferences

The paint roller market in India is also benefiting from the increasing popularity of DIY (Do-It-Yourself) home improvement activities. Consumers are becoming more inclined to undertake minor renovations and decorative projects, driving the demand for user-friendly and time-saving painting tools. Online tutorials and social media content have further encouraged individuals to explore DIY options, contributing to market growth. Manufacturers are responding to this trend by offering ergonomic and easy-to-use rollers designed for smooth application across various surfaces. In addition, the availability of customizable roller designs catering to textured walls and decorative patterns is attracting consumers seeking creative expression. At the lower end of the market, affordable rollers and locally manufactured options are gaining traction, ensuring accessibility for price-sensitive buyers. This consumer-driven shift, combined with increased retail penetration through e-commerce platforms, is significantly influencing the Indian paint roller market landscape.

India Paint Roller Market Segmentation:

IMARC Group provides an analysis of the key trends in each segment of the market, along with forecasts at the region/country level for 2025-2033. Our report has categorized the market based on product, fabric, pile depth, and end use.

Product Insights:

- Woven

- Knit

The report has provided a detailed breakup and analysis of the market based on the product. This includes woven and knit.

Fabric Insights:

- Nylon

- Polyester

- Wool

The report has provided a detailed breakup and analysis of the market based on the fabric. This includes nylon, polyester, and wool.

Pile Depth Insights:

- Shorter Pile

- Medium Pile

- High Pile

The report has provided a detailed breakup and analysis of the market based on the pile depth. This includes shorter pile, medium pile, and high pile.

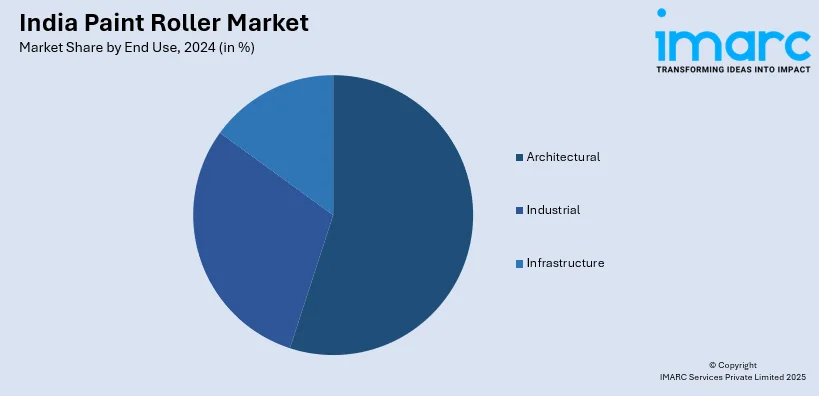

End Use Insights:

- Architectural

- Industrial

- Infrastructure

The report has provided a detailed breakup and analysis of the market based on the end use. This includes architectural, industrial, and infrastructure.

Regional Insights:

- North India

- South India

- East India

- West India

The report has also provided a comprehensive analysis of all the major regional markets, which include North India, South India, East India, and West India.

Competitive Landscape:

The market research report has also provided a comprehensive analysis of the competitive landscape. Competitive analysis such as market structure, key player positioning, top winning strategies, competitive dashboard, and company evaluation quadrant has been covered in the report. Also, detailed profiles of all major companies have been provided.

India Paint Roller Market News:

- February 2025: The Inbrush Expo 2025 was held at the Bombay Exhibition Centre, Mumbai, providing a significant platform for paint roller manufacturers to showcase innovations. The event boosted industry collaboration, expanded market presence, and encouraged domestic production, enhancing growth opportunities in India’s paint roller segment.

India Paint Roller Market Report Coverage:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2024 |

| Historical Period | 2019-2024 |

| Forecast Period | 2025-2033 |

| Units | Million USD |

| Scope of the Report |

Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Products Covered | Woven, Knit |

| Fabrics Covered | Nylon, Polyester,Wool |

| Pile Depths Covered | Shorter Pile, Medium Pile, High Pile |

| End Uses Covered | Architectural, Industrial, Infrastructure |

| Regions Covered | North India, South India, East India, West India |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Benefits for Stakeholders:

- IMARC’s industry report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, market forecasts, and dynamics of the India paint roller market from 2019-2033.

- The research report provides the latest information on the market drivers, challenges, and opportunities in the India paint roller market.

- Porter's five forces analysis assist stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyze the level of competition within the India paint roller industry and its attractiveness.

- Competitive landscape allows stakeholders to understand their competitive environment and provides an insight into the current positions of key players in the market.

Key Questions Answered in This Report

The paint roller market in India was valued at USD 146.20 Million in 2024.

The India paint roller market is projected to exhibit a CAGR of 5.30% during 2025-2033, reaching a value of USD 241.66 Million by 2033.

The India paint roller market is driven by growing demand for efficient and time-saving painting tools, rapid urbanization, and rising residential and commercial construction activities. Increasing DIY trends, along with the expansion of the organized retail sector, are further supporting the adoption of paint rollers across urban and semi-urban regions.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)