India Paints and Coatings Market Size, Share, Trends and Forecast by Product, Material, Application, and Region, 2025-2033

India Paints and Coatings Market Size and Share:

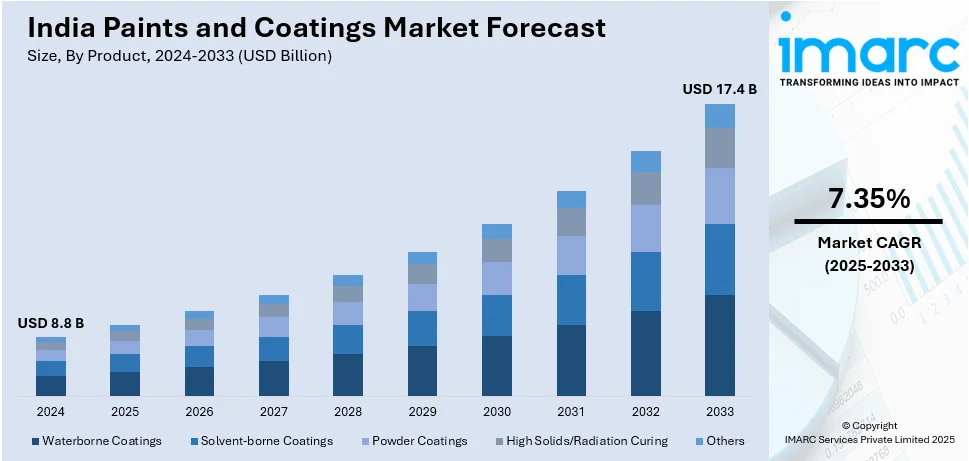

The India paints and coatings market size is estimated at USD 8.8 Billion in 2024, and is expected to reach USD 17.4 Billion by 2033, at a CAGR of 7.35% during the forecast period 2025-2033. The market growth is attributed to rapid urbanization, growing infrastructure development, increasing demand for decorative coatings, rising automotive production, expanding construction activities, shift towards eco-friendly and sustainable products, and technological advancements in formulations.

Market Insights:

- Based on region, the market is divided into North India, West and Central India, South India, and East and Northeast India.

- On the basis of product, the market is categorized as waterborne coatings, solvent-borne coatings, powder coatings, high solids/radiation curing, and others.

- Based on material, the market is segmented into acrylic, alkyd, polyurethane, epoxy, polyester, and others.

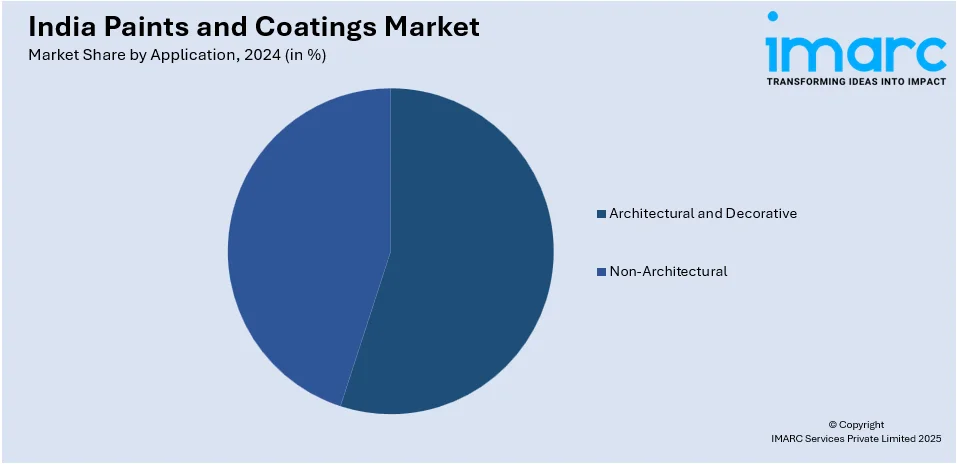

- On the basis of application, the market is categorized as architectural and decorative and non-architectural (automotive and transportation, wood, general industrial, marine, protective, and others).

Market Size and Forecast:

- 2024 Market Size: USD 8.8 Billion

- 2033 Projected Market Size: USD 17.4 Billion

- CAGR (2025-2033): 7.35%

Paints are liquids containing pigments applied to enhance substrate aesthetics, while coatings serve to improve surface properties and prevent substrate deterioration. Common product variations encompass waterborne, powder, high solids, radiation curing, and solvent-borne coatings. These substances are commonly employed for enhancing the appearance of industrial equipment, residential and non-residential structures, and buildings. Paints and coatings showcase properties such as anti-fouling, flame retardancy, and anti-microbial characteristics. They play a crucial role in safeguarding surfaces from adverse environmental conditions, weathering, rust, and chemical exposure. Consequently, their applications span various industries including marine, construction, automobile, and transportation.

To get more information on this market, Request Sample

The paints and coatings market in India is experiencing dynamic growth, propelled by a burgeoning construction sector, increased urbanization, and a growing focus on infrastructure development. This market encompasses a diverse range of products, including waterborne, powder, high solids, radiation curing, and solvent-borne coatings, as well as various types of paints. One of the key drivers for the expansion of the paints and coatings industry size in India is the construction boom. Moreover, with rapid urbanization and a surge in real estate development, there is a heightened demand for decorative and protective coatings to enhance the durability and visual appeal of buildings. Additionally, infrastructure projects, including bridges, highways, and airports, contribute to the escalating need for coatings that provide resistance against environmental factors, such as corrosion, weathering, and chemical exposure. The automotive industry is another significant contributor to the demand for paints and coatings. Furthermore, the industry in India is witnessing a shift toward environmentally friendly and sustainable solutions. According to the India paints and coatings market analysis, the number of vehicles on Indian roads continues to rise, there is a parallel increase in the need for coatings that offer corrosion protection and aesthetic enhancements. Besides this, with applications spanning construction, automotive, and industrial sectors, the market across the country is poised for continued growth in the coming years.

India Paints and Coatings Market Trends:

Growth of Eco-Friendly and Sustainable Products

As environmental consciousness grows, the demand for eco-friendly and sustainable paints and coatings is increasing in India. With rising concerns over air quality and the harmful effects of conventional paints, consumers are becoming more inclined toward products with low or no VOCs (volatile organic compounds). These eco-friendly paints not only minimize health risks but also reduce the environmental impact associated with traditional formulations. Additionally, the government's push for sustainable construction and the growing preference for green buildings are accelerating the adoption of low-emission coatings in residential and commercial spaces. Moreover, manufacturers are investing in developing water-based, non-toxic coatings that meet international standards, ensuring both environmental and functional benefits. This shift toward sustainable products is driven by both consumer awareness and regulatory pressure, with increasing emphasis on reducing the carbon footprint of buildings and industrial spaces. As a result, the eco-friendly paints segment is expanding rapidly, with a clear preference for long-lasting, safe, and environment-conscious solutions.

Expansion of the Construction Sector

The country's rapidly growing construction sector is one of the most influential factors driving the India paints and coatings market growth. Furthermore, the expanding need for residential, commercial, and infrastructural development due to urbanization and population growth is significantly expanding the demand for paints and coatings. Apart from this, government initiatives have catalyzed large-scale urban development projects. For instance, in August 2024, the Union Cabinet approved the Pradhan Mantri Awas Yojana–Urban (PMAY‑U) 2.0, under which the government will support the construction, purchase, or rental of homes for INR 1 Crore urban poor and middle-income households over five years, backed by an INR 2.30 Lakh Crore subsidy commitment. The scheme introduces multiple verticals, including beneficiary‑led construction. Additional provisions include an INR 3,000 Crore Credit Risk Guarantee Fund expansion, a National Credit Guarantee Company takeover for risk management, and mandatory adoption of innovative, disaster‑resilient construction technologies. This is increasing the consumption of coatings in various sectors. Besides, infrastructure projects such as roads, bridges, and airports require specialized coatings for durability, resistance to weathering, and prevention of corrosion. These developments also create a demand for coatings that provide enhanced performance, such as heat resistance, UV protection, and waterproofing, especially in harsh climates. As the construction activity is set to continue its upward trajectory, it will significantly augment the India paints and coatings market share.

India Paints and Coatings Market Segmentation:

IMARC Group provides an analysis of the key trends in each segment of the market, along with forecasts at the country level for 2025-2033. Our report has categorized the market based on product, material, and application.

Product Insights:

- Waterborne Coatings

- Solvent-borne Coatings

- Powder Coatings

- High Solids/Radiation Curing

- Others

The report has provided a detailed breakup and analysis of the market based on the product. This includes waterborne coatings, solvent-borne coatings, powder coatings, high solids/radiation curing, and others.

Material Insights:

- Acrylic

- Alkyd

- Polyurethane

- Epoxy

- Polyester

- Others

A detailed breakup and analysis of the market based on the material have also been provided in the report. This includes acrylic, alkyd, polyurethane, epoxy, polyester, and others.

Application Insights:

- Architectural and Decorative

- Non-Architectural

- Automotive and Transportation

- Wood

- General Industrial

- Marine

- Protective

- Others

The report has provided a detailed breakup and analysis of the market based on the application. This includes architectural and decorative and non-architectural (automotive and transportation, wood, general industrial, marine, protective, and others).

Regional Insights:

- North India

- West and Central India

- South India

- East and Northeast India

The report has also provided a comprehensive analysis of all the major regional markets, which include the North India, West and Central India, South India, and East and Northeast India.

Competitive Landscape:

The market research report has also provided a comprehensive analysis of the competitive landscape in the market. Competitive analysis such as market structure, key player positioning, top winning strategies, competitive dashboard, and company evaluation quadrant has been covered in the report. Also, detailed profiles of all major companies have been provided.

Latest News and Developments:

- July 2025: Nippon Paint launched its n-SHIELD Paint Protection Film (PPF) range in India to address the country’s fragmented automotive surface protection market. The product line includes gloss, matte, and colored films designed to protect vehicle exteriors from UV exposure, road debris, and minor abrasions, and is supported by ceramic coatings, detailing solutions, and a global e-warranty system. As part of the launch, Nippon Paint partnered with the India Champions cricket team and announced plans to expand its presence to over 100 cities through distributors, dealerships, and n-SHIELD Studios, with future localization aligned to the “Make in India” initiative.

- July 2025: JSW Paints revealed its purchase of a 74.76% shareholding in Akzo Nobel India Limited for approximately INR 8,986 Crore, with an open offer planned for the remaining public shares. This strategic move positions JSW Paints as the fourth-largest player in India’s paint industry, enhancing its portfolio with premium brands such as Dulux, International, and Sikkens, while Akzo Nobel retains its powder coatings business and R&D center. The transaction, expected to close in Q4 2025, marks the largest consolidation in the Indian paint sector to date, with Akzo Nobel India’s shares surging over 11% following the announcement.

- May 2025: AkzoNobel India formally launched Dulux Maestro, its first dedicated ecosystem tailored exclusively for architects and interior designers, aimed at empowering India’s growing design professional community. The program integrates comprehensive business support—including on‑site sampling, expert color consultancy, advanced digital visualisation via the Dulux Color Plug‑in spanning over 2,000 shades, technical training, trend‑forecasting workshops, and preferential access to innovations and rewards.

- September 2024: Kamdhenu Paints announced the upcoming launch of its new wood coatings product range. The product is designed to meet international quality standards and strengthen the company’s premium coatings portfolio, particularly in the high-end wood application segment. To support this launch, Kamdhenu has expanded its production capacity from 36,000 to 49,000 kiloliters per year and is enhancing its dealer network by installing additional tinting machines to improve market reach and service efficiency.

India Paints and Coatings Market Report Coverage:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2024 |

| Historical Period | 2019-2024 |

| Forecast Period | 2025-2033 |

| Units | Billion USD |

| Scope of the Report | Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Products Covered | Waterborne Coatings, Solvent-borne Coatings, Powder Coatings, High Solids/Radiation Curing, Others |

| Materials Covered | Acrylic, Alkyd, Polyurethane, Epoxy, Polyester, Others |

| Applications Covered |

|

| Regions Covered | North India, West and Central India, South India, East and Northeast India |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Benefits for Stakeholders:

- IMARC’s industry report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, market forecasts, and dynamics of the India paints and coatings market from 2019-2033.

- The research report provides the latest information on the market drivers, challenges, and opportunities in the India paints and coatings market.

- Porter's five forces analysis assist stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyze the level of competition within the India paints and coatings industry and its attractiveness.

- Competitive landscape allows stakeholders to understand their competitive environment and provides an insight into the current positions of key players in the market.

Key Questions Answered in This Report

The paints and coatings market in India was valued at USD 8.8 Billion in 2024.

The India paints and coatings market is projected to exhibit a CAGR of 7.35% during 2025-2033, reaching a value of USD 17.4 Billion by 2033.

The growth of India’s paints and coatings market is fueled by expanding urban areas, increased construction projects, and a rising need for both decorative and protective finishes. Moreover, greater focus on environmentally safe, low-VOC products and advancements in technology are improving product quality and usage.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)