India Palletized Cargo Market Size, Share, Trends and Forecast by Pallet Type, Cargo Type, Mode of Transportation, End User Industry, and Region, 2025-2033

India Palletized Cargo Market Size and Share:

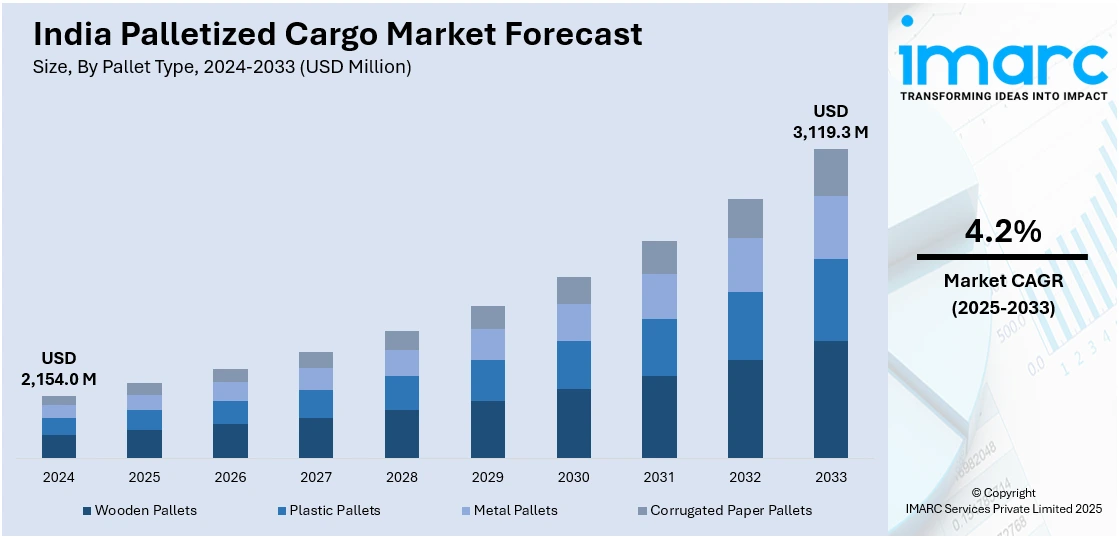

The India palletized cargo market size reached USD 2,154.0 Million in 2024. Looking forward, IMARC Group expects the market to reach USD 3,119.3 Million by 2033, exhibiting a growth rate (CAGR) of 4.2% during 2025-2033. The rising demand for efficient logistics, growth in organized retail, expansion of e-commerce, government push for infrastructure development, increasing export activities, shift toward safe and damage-free goods transport, warehouse automation, GST implementation, demand for cold chain solutions, and the need for faster turnaround in supply chains are some of the major factors augmenting the India palletized cargo market share.

|

Report Attribute

|

Key Statistics

|

|---|---|

|

Base Year

|

2024

|

|

Forecast Years

|

2025-2033

|

|

Historical Years

|

2019-2024

|

| Market Size in 2024 | USD 2,154.0 Million |

| Market Forecast in 2033 | USD 3,119.3 Million |

| Market Growth Rate 2025-2033 | 4.2% |

India Palletized Cargo Market Trends:

Shift Toward Organized Warehousing and 3PL Services

The transition from fragmented, unorganized storage spaces to Grade A warehousing and demand from third-party logistics (3PL) providers is positively impacting India palletized cargo market outlook. In addition to this, organized warehouses offer better infrastructure for pallet handling, including racking systems, forklifts, and automated storage and retrieval systems. According to an industry report, the warehousing sector is seeing strong demand from Third-Party Logistics (3PL) and the automobile industries, which together account for nearly 53% of total leased space. This rise directly supports the growth of the palletized cargo market, as both sectors require efficient, stackable, and standardized handling systems to manage high cargo volumes. As e-commerce players, FMCG companies, and retail chains push for faster deliveries and better inventory management, they are increasingly relying on 3PL providers with large, pallet-friendly warehouses near consumption hubs. The introduction of GST removed interstate checkpoints and lead to the centralization of warehouses, favoring larger facilities where palletized systems are more viable. Furthermore, developers are also building logistics parks with a focus on pallet-compatible layouts, high ceilings, and mechanized operations. This is leading to a higher adoption of standardized pallet sizes and improved stacking efficiency. As brands aim for scalability, outsourcing logistics to pallet-ready 3PLs has become a preferred route.

To get more information on this market, Request Sample

Growth in Cold Chain and Temperature-Controlled Logistics

The rising demand for pharmaceuticals, dairy, frozen foods, and perishable commodities is accelerating the need for temperature-controlled logistics, where palletization plays a crucial role in maintaining cargo integrity. In cold chain operations, palletized cargo helps reduce handling time, minimizes exposure during transfers, and supports space-efficient storage in reefer containers or cold storage facilities. According to an industry report, the food processing industry in India is expected to reach USD 735.5 Billion, at a CAGR of 8.8% during 2023-2032. The rapid growth of both the food processing and pharmaceutical sectors, along with tighter regulations on hygiene and traceability, is prompting logistics providers to align with global standards. This includes adopting standardized pallets and specialized material handling systems suited for temperature-controlled environments. Moreover, urban centers and export hubs are seeing a wave of investment in multi-temperature warehouses with integrated pallet systems, which is providing an impetus to India palletized cargo market growth. Besides this, in sectors like vaccine distribution, where time and temperature control are critical, palletized systems help streamline outbound and inbound operations. With the growing focus on reducing spoilage and ensuring quality across the supply chain, pallet-based handling is increasingly considered essential in cold chain logistics.

India Palletized Cargo Market Segmentation:

IMARC Group provides an analysis of the key trends in each segment of the market, along with forecasts at the country level for 2025-2033. Our report has categorized the market based on pallet type, cargo type, mode of transportation, and end user industry.

Pallet Type Insights:

- Wooden Pallets

- Plastic Pallets

- Metal Pallets

- Corrugated Paper Pallets

The report has provided a detailed breakup and analysis of the market based on the pallet type. This includes wooden pallets, plastic pallets, metal pallets, and corrugated paper pallets.

Cargo Type Insights:

- Dry Cargo

- Perishable Cargo

- Hazardous Cargo

- Heavy Equipment and Machinery

A detailed breakup and analysis of the market based on the cargo type have also been provided in the report. This includes dry cargo, perishable cargo, hazardous cargo, and heavy equipment and machinery.

Mode of Transportation Insights:

- Road Transport

- Rail Transport

- Air Transport

- Sea Transport

The report has provided a detailed breakup and analysis of the market based on the mode of transportation. This includes road transport, rail transport, air transport, and sea transport.

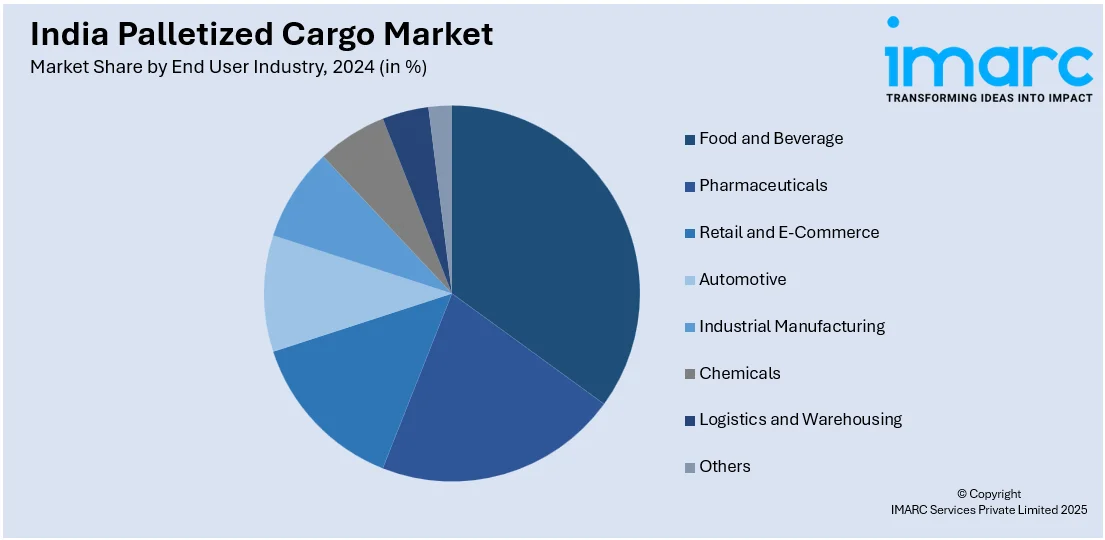

End User Industry Insights:

- Food and Beverage

- Pharmaceuticals

- Retail and E-Commerce

- Automotive

- Industrial Manufacturing

- Chemicals

- Logistics and Warehousing

- Others

A detailed breakup and analysis of the market based on the end user industry have also been provided in the report. This includes food and beverage, pharmaceuticals, retail and e-commerce, automotive, industrial manufacturing, chemicals, logistics and warehousing, and others.

Regional Insights:

- North India

- South India

- East India

- West India

The report has also provided a comprehensive analysis of all the major regional markets, which include North India, South India, East India, and West India.

Competitive Landscape:

The market research report has also provided a comprehensive analysis of the competitive landscape. Competitive analysis such as market structure, key player positioning, top winning strategies, competitive dashboard, and company evaluation quadrant has been covered in the report. Also, detailed profiles of all major companies have been provided.

India Palletized Cargo Market News:

- Jan 15, 2025: Haveus Aerotech Ltd, an aircraft maintenance, repair and overhaul (MRO) services provider, has received approval from the Directorate General of Civil Aviation (DGCA) to offer maintenance services for Unit Load Devices (ULD) and pallets at its recently expanded Delhi facility, making it the first MRO in India to receive such approval. ULDs are removable aircraft parts that hold cargo, baggage, or mail, and are crucial for flight safety. The company's CEO, Anshul Bhargava, stated that they will soon seek DGCA approval for their Mumbai, Bengaluru, and Kolkata facilities as well.

India Palletized Cargo Market Report Coverage:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2024 |

| Historical Period | 2019-2024 |

| Forecast Period | 2025-2033 |

| Units | Million USD |

| Scope of the Report |

Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Pallet Types Covered | Wooden Pallets, Plastic Pallets, Metal Pallets, Corrugated Paper Pallets |

| Cargo Types Covered | Dry Cargo, Perishable Cargo, Hazardous Cargo, Heavy Equipment and Machinery |

| Mode of Transportations Covered | Road Transport, Rail Transport, Air Transport, Sea Transport |

| End User Industries Covered | Food and Beverages, Pharmaceuticals, Retail and E-Commerce, Automotive, Industrial Manufacturing, Chemicals, Logistics and Warehousing, Others |

| Regions Covered | North India, South India, East India, West India |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Benefits for Stakeholders:

- IMARC’s industry report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, market forecasts, and dynamics of the India palletized cargo market from 2019-2033.

- The research report provides the latest information on the market drivers, challenges, and opportunities in the India palletized cargo market.

- Porter's five forces analysis assist stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyze the level of competition within the India palletized cargo industry and its attractiveness.

- Competitive landscape allows stakeholders to understand their competitive environment and provides an insight into the current positions of key players in the market.

Key Questions Answered in This Report

The palletized cargo market in India was valued at USD 2,154.0 Million in 2024.

The India palletized cargo market is projected to exhibit a CAGR of 4.2% during 2025-2033, reaching a value of USD 3,119.3 Million by 2033.

The India palletized cargo market is driven by the growth of e-commerce and organized retail, increasing air and sea freight activities, rising demand for efficient logistics and supply chain management, adoption of standardized pallets, and government initiatives supporting infrastructure and modern warehousing solutions.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)