India Paper Cups and Paper Plates Market Size, Share, Trends and Forecast by Product Type, Wall Type, and Region, 2025-2033

India Paper Cups and Paper Plates Market Overview:

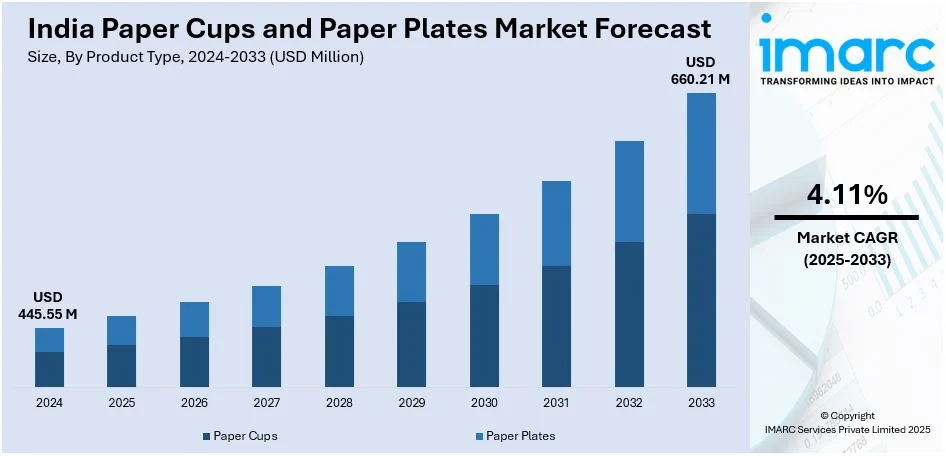

The India paper cups and paper plates market size reached USD 445.55 Million in 2024. Looking forward, IMARC Group expects the market to reach USD 660.21 Million by 2033, exhibiting a growth rate (CAGR) of 4.11% during 2025-2033. India paper cups and paper plates market share is being fueled by the growing demand for disposable and environment-friendly products, increasing awareness regarding hygiene, and a move towards sustainable alternatives to plastic. Expansion in the retail and foodservice segments, along with government policies against single-use plastics, also fuels India paper cups and paper plates market growth.

|

Report Attribute

|

Key Statistics

|

|---|---|

|

Base Year

|

2024 |

|

Forecast Years

|

2025-2033

|

|

Historical Years

|

2019-2024

|

| Market Size in 2024 | USD 445.55 Million |

| Market Forecast in 2033 | USD 660.21 Million |

| Market Growth Rate (2025-2033) | 4.11% |

India Paper Cups and Paper Plates Market Trends:

Rising Demand for Eco-friendly and Sustainable Products

One of the major trends in India paper cups and paper plates market outlook is the increasing move towards green, biodegradable, and sustainable options. As per the IMARC Group, the size of the India paper cups market was 23.2 Billion Units in 2024 and is expected to further grow to 29.0 Billion Units by 2033 at a growth rate (CAGR) of 2.38% during 2025-2033. As concern for plastic waste in the environment grows, consumers and companies alike are turning to paper-based products. This trend is most notably seen in the foodservice sector, where paper plates and cups are the choice because they are disposable and have less environmental impact than plastic or Styrofoam options. Paper products derived from recycled paper or wood pulp sourced sustainably are also on the rise because of their lower carbon footprint. Also, the government policies prohibiting single-use plastics are further propelling the use of paper cups and plates since they provide a safer and environmentally friendly solution for food packaging. In response to increased consumer sensitivity to environmental sustainability, there is a growing need for compostable, recyclable, or natural fiber-based paper cups and plates, fueling market expansion.

To get more information on this market, Request Sample

Growth in Foodservice and Delivery Sectors

The expanding foodservice and delivery sectors in India are driving the growth of the paper cups and paper plates market. The India Food Services Report-2024, released by the National Restaurants Association of India (NRAI), indicates that the Indian food services industry accounts for 1.9 percent of India's GDP and is expected to increase to Rs 7.76 trillion by 2028 from the current Rs 5.69 trillion. The increasing popularity of quick-service restaurants (QSRs), food delivery services, and casual dining options has led to a higher demand for disposable packaging products, including paper cups and plates. Consumers seeking convenience and hygiene in their food consumption, particularly in urban areas, are opting for these products, which are perfect for takeout and delivery. The rise of online food ordering platforms and the busy lifestyle of the working population has accelerated the demand for disposable food containers. Additionally, the growing trend of outdoor dining and picnics also boosts the demand for portable, lightweight, and disposable paper products. As the foodservice industry continues to expand, the paper cups and paper plates market will likely see continued growth, driven by the convenience and hygiene these products offer.

India Paper Cups and Paper Plates Market Segmentation:

IMARC Group provides an analysis of the key trends in each segment of the market, along with forecasts at the regional level for 2025-2033. Our report has categorized the market based on product type and wall type.

Product Type Insights:

- Paper Cups

- Hot Paper Cups

- Cold Paper Cups

- Paper Plates

- Heavy-Duty Paper Plates

- Medium-Duty Paper Plates

The report has provided a detailed breakup and analysis of the market based on the product. This includes paper cups (hot paper cups, cold paper cups), and paper plates (heavy-duty paper plates, and medium-duty paper plates).

Wall Type Insights:

.webp)

- Single Wall

- Double Wall

The report has provided a detailed breakup and analysis of the market based on the wall type. This includes single wall, and double wall.

Regional Insights:

- North India

- South India

- East India

- West India

The report has also provided a comprehensive analysis of all the major regional markets, which include North India, South India, East India, and West India.

Competitive Landscape:

The market research report has also provided a comprehensive analysis of the competitive landscape. Competitive analysis such as market structure, key player positioning, top winning strategies, competitive dashboard, and company evaluation quadrant has been covered in the report. Also, detailed profiles of all major companies have been provided.

India Paper Cups and Paper Plates Market Report Coverage:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2024 |

| Historical Period | 2019-2024 |

| Forecast Period | 2025-2033 |

| Units | Million USD |

| Scope of the Report |

Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Product Types Covered |

|

| Wall Types Covered | Single Wall, Double Wall |

| Regions Covered | North India, South India, East India, West India |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Benefits for Stakeholders:

- IMARC’s industry report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, market forecasts, and dynamics of the India paper cups and paper plates market from 2019-2033.

- The research report provides the latest information on the market drivers, challenges, and opportunities in the India paper cups and paper plates market.

- Porter's five forces analysis assist stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyze the level of competition within the India paper cups and paper plates industry and its attractiveness.

- Competitive landscape allows stakeholders to understand their competitive environment and provides an insight into the current positions of key players in the market.

Key Questions Answered in This Report

The paper cups and paper plates market in India was valued at USD 445.55 Million in 2024.

The India paper cups and paper plates market is projected to exhibit a CAGR of 4.11% during 2025-2033, reaching a value of USD 660.21 Million by 2033.

The India paper cups and paper plates market is propelled by increasing environmental awareness, rising demand for eco-friendly disposable tableware, and government regulations limiting single-use plastics. Growth in quick-service restaurants, catering services, and on-the-go consumption, combined with urbanization and expanding food delivery platforms, further accelerates adoption of sustainable paper-based products.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)