India Paper Napkins Market Size, Share, Trends and Forecast by Product Type, Material Type, Application, Distribution Channel, and Region, 2025-2033

India Paper Napkins Market Overview:

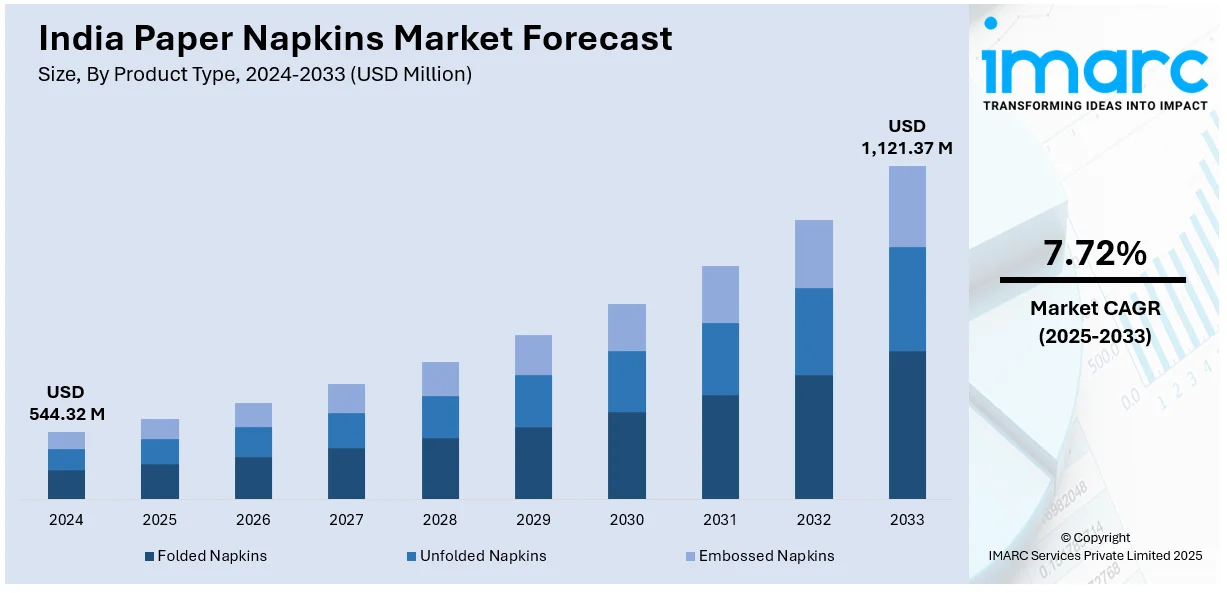

The India paper napkins market size reached USD 544.32 Million in 2024. Looking forward, IMARC Group expects the market to reach USD 1,121.37 Million by 2033, exhibiting a growth rate (CAGR) of 7.72% during 2025-2033. The market is driven by increasing hygiene awareness, rapid expansion of the hospitality and catering industry, and rising demand for eco-friendly products. Additionally, the growth of organized retail and e-commerce enhances accessibility, while urbanization, higher disposable incomes, and sustainability-focused branding boost premium product adoption.

|

Report Attribute

|

Key Statistics

|

|---|---|

|

Base Year

|

2024

|

|

Forecast Years

|

2025-2033

|

|

Historical Years

|

2019-2024

|

| Market Size in 2024 | USD 544.32 Million |

| Market Forecast in 2033 | USD 1,121.37 Million |

| Market Growth Rate 2025-2033 | 7.72% |

India Paper Napkins Market Trends:

Rising Demand for Premium and Eco-Friendly Paper Napkins

India paper napkins industry is experiencing a transition towards premium and green products as a result of growing environmental concerns and a desire for sustainable products. Customers are switching to paper napkins made of bamboo or other ecological materials that are biodegradable, recyclable, and unbleached. Foodservice and hospitality companies are also embracing environmentally friendly products in order to continue their positioning with sustainability initiatives and adhere to regulations. Also, increased disposable incomes and urbanization are fueling demand for soft, strong, and visually attractive napkins. This is further strengthened by the ongoing technological advancements in manufacturing processes that minimize water and chemical consumption, thus making paper napkins more eco-friendly. As consciousness increases, manufacturers are making investments in sustainable solutions to address changing consumer demands.

To get more information on this market, Request Sample

Growth of Organized Retail and E-Commerce Channels

The expansion of organized retail and e-commerce platforms is significantly driving the India paper napkins market. With India's retail market reaching ₹82 lakh crore in 2024 and growing at over 8.9% over the past decade, supermarkets, hypermarkets, and convenience stores are allocating more shelf space to branded paper napkins, offering diverse options to consumers. Additionally, online marketplaces and direct-to-consumer (D2C) brands are gaining momentum, enabling manufacturers to expand their reach. The growing popularity of digital shopping has simplified bulk purchasing for households and businesses, further boosting sales. Models based on subscriptions and volume discounts are fueling growth in online sales. Deepening digital penetration and changing consumption patterns to doorstep delivery are pushing producers to boost their web presence to sustain market expansion through diverse channels of distribution.

Expansion of the Foodservice and HoReCa Sectors

The burgeoning growth of HoReCa businesses is driving demand for paper napkins in India to a considerable extent. Following the proliferation of quick-service restaurants (QSR), cafes, and fine-dining restaurants, demand for high-quality napkins has been increased. Increased visits to restaurants, rising takeout and delivery preference, and an overall change in the trend towards hygienic dining experience are also driving the market forward. Also, large food chains and restaurant franchises are highlighting branding with customized napkins having printed logos and designs. Increasing the use of Western dining traditions, where the use of napkins is important in meal presentation and customer service, is another factor driving this trend. As the foodservices industry expands, the demand for paper napkins will continue to grow.

India Paper Napkins Market Segmentation:

IMARC Group provides an analysis of the key trends in each segment of the market, along with forecasts at the region level for 2025-2033. Our report has categorized the market based on product type material type, application and distribution channel.

Product Type Insights:

- Folded Napkins

- Unfolded Napkins

- Embossed Napkins

The report has provided a detailed breakup and analysis of the market based on the product type. This includes folded, unfolded, and embossed napkins.

Material Type Insights:

- Recycled Paper

- Virgin Paper

A detailed breakup and analysis of the market based on the material type have also been provided in the report. This includes recycled paper, and virgin paper.

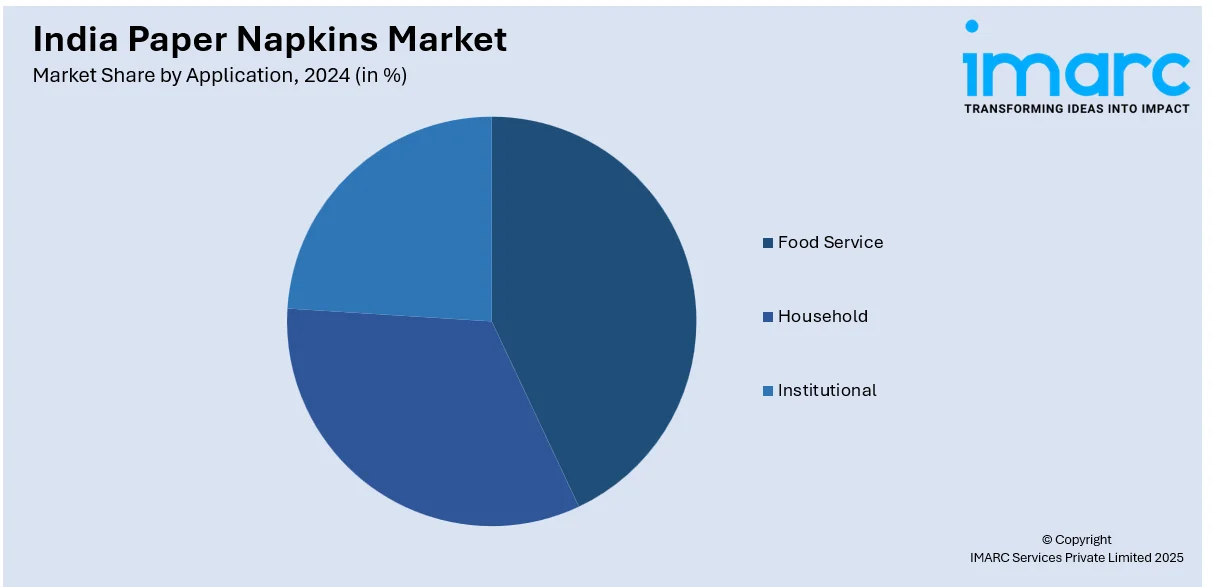

Application Insights:

- Food Service

- Household

- Institutional

The report has provided a detailed breakup and analysis of the market based on the application. This includes food service, household, and institutional.

Distribution Channel Insights:

- Online

- Offline

- Supermarkets and Hypermarkets

- Convenience Stores

- Specialty Stores

A detailed breakup and analysis of the market based on the distribution channel have also been provided in the report. This includes online, and offline (supermarkets and hypermarkets, convenience stores, and specialty stores)

Regional Insights:

- North India

- South India

- East India

- West India

The report has also provided a comprehensive analysis of all the major regional markets, which include North, South, East, and West India.

Competitive Landscape:

The market research report has also provided a comprehensive analysis of the competitive landscape. Competitive analysis such as market structure, key player positioning, top winning strategies, competitive dashboard, and company evaluation quadrant has been covered in the report. Also, detailed profiles of all major companies have been provided.

India Paper Napkins Market News:

- In May 2024, APRIL Group acquired a controlling stake in Origami, India’s leading consumer tissue company, marking its entry into the country’s growing hygiene market. Origami, known for its tissue paper, napkins, and wipes, will continue under founders Neelam and Manoj Pachisia, who retain a minority stake. The acquisition is in line with India's growing middle class and changing consumer preferences, which are driving up demand for high-end hygiene products.

India Paper Napkins Market Report Coverage:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2024 |

| Historical Period | 2019-2024 |

| Forecast Period | 2025-2033 |

| Units | Million USD |

| Scope of the Report |

Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Product Types Covered | Folded Napkins, Unfolded Napkins, Embossed Napkins |

| Material Types Covered | Recycled Paper, Virgin Paper |

| Applications Covered | Food Service, Household, Institutional |

| Distribution Channels Covered |

|

| Regions Covered | North India, South India, East India, West India |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Questions Answered in This Report:

- How has the India paper napkins market performed so far and how will it perform in the coming years?

- What is the breakup of the India paper napkins market on the basis of product type?

- What is the breakup of the India paper napkins market on the basis of material type?

- What is the breakup of the India paper napkins market on the basis of application?

- What is the breakup of the India paper napkins market on the basis of distribution channel?

- What is the breakup of the India paper napkins market on the basis of region?

- What are the various stages in the value chain of the India paper napkins market?

- What are the key driving factors and challenges in the India paper napkins?

- What is the structure of the India paper napkins market and who are the key players?

- What is the degree of competition in the India paper napkins market?

Key Benefits for Stakeholders:

- IMARC’s industry report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, market forecasts, and dynamics of the India paper napkins market from 2019-2033.

- The research report provides the latest information on the market drivers, challenges, and opportunities in the India paper napkins market.

- Porter's five forces analysis assist stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyze the level of competition within the India paper napkins industry and its attractiveness.

- Competitive landscape allows stakeholders to understand their competitive environment and provides an insight into the current positions of key players in the market.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)