India Paper Packaging Market Size, Share, Trends and Forecast by Product Type, Grade, Packaging Level, End Use Industry, and Region, 2026-2034

India Paper Packaging Market Summary:

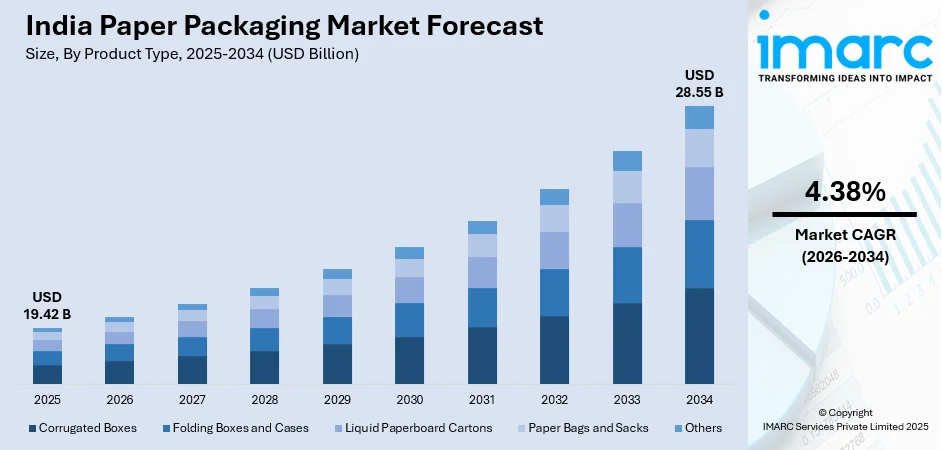

The India paper packaging market size was valued at USD 19.42 Billion in 2025 and is projected to reach USD 28.55 Billion by 2034, growing at a compound annual growth rate of 4.38% from 2026-2034.

The India paper packaging market is experiencing robust expansion driven by rising environmental awareness, government regulations banning single-use plastics, and growing demand for sustainable alternatives across industries. The rapid growth of e-commerce, food delivery services, and organized retail sectors is fueling the need for efficient and eco-friendly packaging solutions. Consumers are showing a growing preference for recyclable and biodegradable products, prompting companies to develop innovative paper-based materials. Technological advancements in durability, printability, and moisture resistance are enhancing the appeal and functionality of paper packaging, contributing to sustained India paper packaging market share.

Key Takeaways and Insights:

-

By Product Type: Corrugated boxes dominate the market with a share of 40.08% in 2025, driven by strong demand from e-commerce fulfillment centres and industrial logistics applications requiring durability and cushioning performance.

-

By Grade: Solid bleached leads the market with a share of 35.07% in 2025, supported by premium FMCG and pharmaceutical applications requiring superior printability and food-contact compliance.

-

By Packaging Level: Primary packaging dominates the market with a share of 50.05% in 2025, owing to extensive use in direct food-contact cartons and consumer-facing applications across retail channels.

-

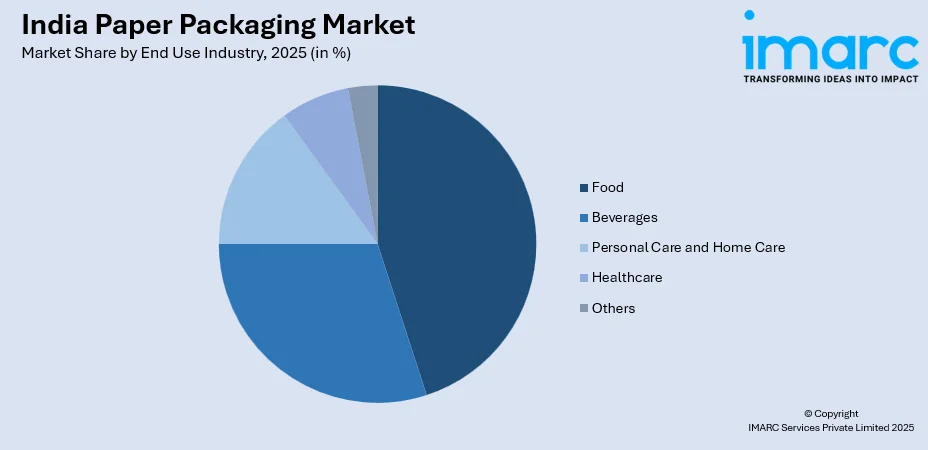

By End Use Industry: Food leads the market with a share of 45.1% in 2025, reflecting the expanding food processing sector and rising consumer preference for hygienic packaged food products.

-

By Region: North India dominates the market with a share of 29% in 2025, driven by strong industrial infrastructure and concentration of FMCG manufacturing facilities in the region.

-

Key Players: The India paper packaging market exhibits a fragmented competitive structure with domestic manufacturers competing alongside international players across various product segments. Leading companies are focusing on capacity expansion, technological upgrades, and sustainability initiatives to strengthen market positions.

To get more information on this market Request Sample

The India paper packaging market represents a vital segment of the country's manufacturing ecosystem, serving diverse industries including food and beverages, personal care, healthcare, and consumer electronics. Paper packaging offers cost-effective solutions for transporting, preserving, and protecting various items using products such as corrugated boxes, paper bags, folding cartons, and liquid paperboard cartons. The industry benefits from India's position as one of the world's largest paper producers with extensive recycled fiber utilization. Government initiatives promoting sustainable packaging and the Make in India campaign have created favorable conditions for industry growth. In July 2024, the Council of Scientific and Industrial Research (CSIR) launched the National Mission on Sustainable Packaging Solutions, driving research in sustainable materials and recycling technologies to address environmental challenges.

India Paper Packaging Market Trends:

Rapid Growth of E-commerce and Quick Commerce Driving Packaging Demand

The rapid expansion of e‑commerce and quick commerce in India is driving strong demand for functional, sustainable packaging solutions. Online platforms increasingly rely on secondary and tertiary packaging like carton boards and paperboards, which offer stiffness and protection during transit. For example, Amazon India, have replaced single-use plastics with paper-based alternatives such as packing paper and cushions. Frequent food and grocery deliveries further amplify the demand, making this segment a key volume driver for paper packaging solutions across the country.

Government Regulations Accelerating Shift from Plastic to Paper Packaging

Regulatory bans on certain single‑use plastics across Indian states are accelerating the shift toward paper-based packaging. Since the nationwide ban took effect on July 1, 2022, authorities have conducted over 861,740 inspections and seized nearly 1,985 tonnes of banned plastics, while the government promoted eco-alternatives through a “Compendium of Manufacturers/Sellers of Eco‑alternatives” on World Environment Day 2025. Initiatives like Extended Producer Responsibility and procurement policies favoring recyclable materials are encouraging businesses to adopt sustainable, paper-based packaging solutions, boosting market demand.

Innovation in Barrier Coatings and Sustainable Materials

Technological advances in barrier coatings are enabling paper packaging to challenge plastics in moisture- and grease-sensitive applications. At Fachpack 2025, Heidelberg and Solenis showcased an inline barrier coating process that embeds high-performance, eco-friendly coatings into flexible paper packaging, reducing material use while enhancing protection against liquids and fats. Manufacturers are also developing water-based barrier coatings compliant with mono-material guidelines, innovating compostable flexible packaging for FMCG, and using advanced multiwall kraft designs that lower industrial sack weight without compromising strength, gaining share from woven polypropylene alternatives.

Market Outlook 2026-2034:

The India paper packaging market is set for steady growth over the forecast period, driven by the expansion of e-commerce, restrictions on single-use plastics, and increasing FMCG volumes boosting demand for lightweight, recyclable materials. Advances in sustainable substrates and digital printing technologies are expected to improve product variety and efficiency across the supply chain, supporting innovation while meeting evolving environmental and consumer requirements in packaging. The market generated a revenue of USD 19.42 Billion in 2025 and is projected to reach a revenue of USD 28.55 Billion by 2034, growing at a compound annual growth rate of 4.38% from 2026-2034.

India Paper Packaging Market Report Segmentation:

| Segment Category | Leading Segment | Market Share |

|---|---|---|

| Product Type | Corrugated Boxes | 40.08% |

| Grade | Solid Bleached | 35.07% |

| Packaging Level | Primary Packaging | 50.05% |

| End Use Industry | Food | 45.1% |

| Region | North India | 29% |

Product Type Insights:

- Corrugated Boxes

- Folding Boxes and Cases

- Liquid Paperboard Cartons

- Paper Bags and Sacks

- Others

The corrugated boxes dominate with a market share of 40.08% of the total India paper packaging market in 2025.

Corrugated boxes maintain their dominant position in the India paper packaging market driven by robust demand from e-commerce fulfillment centers that prioritize cushioning performance and pallet efficiency. In March 2025, Oji India Packaging opened its largest corrugated facility in Sri City, Andhra Pradesh, covering 43,000 m² with 100 million m² annual capacity. The segment benefits from increasing online shipment volumes as major platforms standardize packaging dimensions and reduce empty space through automated packing lines. Quick-commerce operators favor compact corrugated formats designed for micro-fulfillment centers serving rapid delivery requirements across urban areas.

The corrugated packaging segment continues to evolve with investments in inline print-and-die-cut technology that reduces changeover costs and enables greater customization. Manufacturers are engineering reinforced flute combinations to balance strength and grammage requirements for last-mile delivery efficiency. Local converters positioned close to tier-two urban clusters are capturing significant business due to tight service-level agreements, reinforcing regionalization patterns within the corrugated segment across India, while also supporting sustainable and cost-effective packaging solutions.

Grade Insights:

- Solid Bleached

- Coated Recycled

- Uncoated Recycled

- Others

The solid bleached leads with a share of 35.07% of the total India paper packaging market in 2025.

Solid bleached paperboard maintains its leadership position owing to superior surface smoothness, excellent printability, and compliance with food-contact migration requirements essential for premium FMCG and pharmaceutical applications. In September 2025, Stora Enso unveiled Ensovelvet, an uncoated solid bleached sulphate board designed specifically for luxury packaging in cosmetics and fragrances, offering a “velvet‑like” smooth surface that enhances brand presentation in competitive retail environments. The segment serves brand owners seeking high-quality tactile appeal for beauty and premium product categories where visual presentation drives consumer purchase decisions and brand differentiation in competitive retail environments.

In addition to luxury packaging, solid bleached paperboard is increasingly used in sustainable packaging solutions due to its recyclability and lower environmental footprint compared with plastics. Manufacturers are exploring lightweight variants that reduce material consumption without compromising strength. Innovations in barrier coatings now allow this paperboard to safely package moisture-sensitive products, including gourmet foods and beverages. Rising demand from e-commerce and premium gift segments is expected to drive further adoption across India’s evolving packaging landscape.

Packaging Level Insights:

- Primary Packaging

- Secondary Packaging

- Tertiary Packaging

The primary packaging dominates with a market share of 50.05% of the total India paper packaging market in 2025.

Primary packaging dominates the market through extensive use in food-contact cartons, direct-meal service clamshells, and consumer-facing retail applications that require direct product protection and visual appeal. The segment benefits from government directives encouraging plastic replacement in public-sector tenders that favor paper-based primary packaging solutions meeting food safety standards and recyclability requirements.

The primary packaging segment continues to expand with innovations in sustainable materials such as coated paperboard, molded fiber, and recyclable films. Growing demand from ready-to-eat meals, dairy, and beverage sectors drives adoption, as brands prioritize hygiene, convenience, and shelf appeal. Technological advancements like barrier coatings and easy-open features enhance functionality, while government policies promoting eco-friendly alternatives further incentivize manufacturers to replace plastics with certified paper-based primary packaging solutions that comply with food-contact safety standards.

End Use Industry Insights:

Access the comprehensive market breakdown Request Sample

- Food

- Beverages

- Personal Care and Home Care

- Healthcare

- Others

The food leads with a share of 45.1% of the total India paper packaging market in 2025.

The food segment dominates paper packaging demand driven by India's rapidly expanding food processing sector and increasing consumer preference for hygienic packaged food products. In April 2025, FSSAI mandated that all food-contact packaging must be certified and compliant under updated inspection checklists, emphasizing food-grade materials as a critical food safety parameter. The Food Safety and Standards Authority of India has implemented guidelines requiring food and beverage companies to follow specific packaging standards, driving adoption of compliant paper-based solutions. Rising awareness about packaged food safety, particularly for food deliveries, continues to support market growth.

Bakery and confectionery products are also driving demand for paper packaging, as manufacturers seek hygienic, visually appealing, and transport-safe solutions. Specialty papers with grease-resistant coatings and windowed cartons allow products like cakes, pastries, chocolates, and snacks to remain fresh while showcasing their quality to consumers. Growing urbanization, increasing gifting occasions, and the rise of online food delivery are further boosting the adoption of paper-based packaging in this segment, reinforcing its importance in India’s expanding food packaging market.

Regional Insights:

- North India

- West and Central India

- South India

- East India

North India exhibits a clear dominance with a 29% share of the total India paper packaging market in 2025.

North India maintains its leadership in the paper packaging market supported by strong industrial infrastructure and concentration of FMCG manufacturing facilities across major states including Uttar Pradesh, Punjab, and Haryana. The region benefits from proximity to large consumer markets in the National Capital Region and established logistics networks connecting production centers with distribution hubs serving northern markets.

North India’s paper packaging market is further supported by the region’s growing e-commerce and organized retail sectors, which demand reliable, high-quality packaging for timely delivery. States like Delhi, Uttar Pradesh, and Haryana are witnessing increased investment in modern food processing units and cold-chain infrastructure, boosting demand for paper cartons, trays, and clamshells. Additionally, government initiatives promoting sustainable and recyclable packaging encourage manufacturers in the region to adopt eco-friendly paper-based solutions, reinforcing North India’s leadership in the market.

Market Dynamics:

Growth Drivers:

Why is the India Paper Packaging Market Growing?

Explosive Growth of E-commerce and Online Retail Channels

The rapid growth of e-commerce and quick commerce in India is driving unprecedented demand for paper packaging solutions. The India e-commerce market was valued at USD 129.72 Billion in 2025 and is projected to reach USD 651.10 Billion by 2034, growing at a CAGR of 19.63% from 2026–2034. Online platforms require durable secondary and tertiary packaging to protect goods during complex logistics operations. Sustainability commitments by major players, including eliminating plastic cushioning, are shifting substantial parcel volumes to paper-based formats. Quick commerce’s fast delivery models are further boosting demand for compact, sturdy corrugated solutions for micro-fulfillment centers in urban areas.

Government Regulations Promoting Sustainable Packaging Solutions

The Government of India is promoting sustainable packaging through initiatives to reduce single‑use plastics and encourage eco‑friendly alternatives. Regulatory bans on selected plastics across all states are driving adoption of recyclable paper-based solutions. In February 2025, the Ministry of Environment, Forest and Climate Change updated Extended Producer Responsibility (EPR) guidelines to explicitly include paper and other sustainable materials, reinforcing mandates for producers to manage packaging lifecycle impacts and enhance circularity. Coupled with EPR frameworks and government procurement policies favoring recyclable substrates, these measures are boosting demand for sustainable packaging solutions across both public and private sectors.

Expanding Food Processing Sector and Rising Consumer Demand

India’s rapidly growing food processing industry is driving demand for paper packaging across folding cartons, corrugated boxes, and liquid paperboard containers. In April 2025, Tetra Pak became the first company in India’s food and beverage sector to introduce packaging with certified recycled polymers, supporting sustainability and advanced paper-based solutions. Rising consumer awareness of food safety and hygiene is increasing preference for packaged products that provide reliable protection. The food and grocery segment contributes significantly to retail sales through organized retail and e-commerce channels. Growing health consciousness is also boosting demand for hygienic packaging in healthcare, personal care, and ready-to-eat foods.

Market Restraints:

What Challenges the India Paper Packaging Market is Facing?

Volatility in Raw Material Prices and Supply Chain Disruptions

The India paper packaging industry faces challenges from fluctuating raw material prices, particularly for pulp and recovered fiber that represent significant input costs. Dependence on seaborne recovered fiber for recycled board furnish exposes manufacturers to freight disruptions and international bidding competition that impacts spot prices and squeezes margins. Currency fluctuations and shipping route disruptions maintain elevated volatility that dampens near-term growth momentum.

Competition from Alternative Packaging Materials

Paper packaging faces ongoing competition from flexible plastic packaging and other alternative materials that offer certain performance advantages in specific applications. Cost-competitive imports from countries with duty-free trade agreements pressure domestic manufacturers on pricing. The need for barrier coatings to match plastic performance in moisture and grease resistance adds complexity and cost to paper-based solutions serving demanding applications.

Rising Energy Costs and Operational Pressures

Electricity and fuel costs represent significant portions of mill cash costs, with tariff increases compressing margins across containerboard and paperboard operations. Grid reliability challenges in certain regions impact production consistency for manufacturers. Energy cost pressures require investments in efficiency improvements and alternative energy sources that add capital requirements for industry participants seeking to maintain competitive positioning.

Competitive Landscape:

The India paper packaging market exhibits a fragmented competitive structure characterized by a mix of domestic manufacturers and international players competing across various product segments and regional markets. Leading companies are pursuing consolidation strategies through acquisitions and capacity expansions to enlarge integrated footprints and achieve operational scale advantages. Competition is shaped by factors including production efficiency, distribution networks, product quality, and sustainability credentials that increasingly influence customer procurement decisions. Manufacturers are investing in modern equipment including digital printing technology and barrier coating lines to enhance product offerings and operational capabilities. The industry includes numerous small and medium enterprises serving regional markets alongside larger integrated players with national presence.

Recent Developments:

-

In October 2025, Goa’s Rhea Distilleries, in collaboration with UK-based Frugalpac and ITC Packaging, unveiled India’s first paper bottle for Fidalgo Premium Cashew Feni. This launch marks a significant sustainable packaging milestone, showcasing innovation in paper-based solutions and highlighting India’s move toward eco-friendly alternatives to glass and plastic during the UK–India trade visit.

India Paper Packaging Market Report Scope:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2025 |

| Historical Period | 2020-2025 |

| Forecast Period | 2026-2034 |

| Units | Billion USD |

| Scope of the Report |

Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Product Types Covered | Corrugated Boxes, Folding Boxes and Cases, Liquid Paperboard Cartons, Paper Bags and Sacks, Others |

| Grades Covered | Solid Bleached, Coated Recycled, Uncoated Recycled, Others |

| Packaging levels Covered | Primary Packaging, Secondary Packaging, Tertiary Packaging |

| End Use Industries Covered | Food, Beverages, Personal Care and Home Care, Healthcare, Others |

| Regions Covered | North India, West and Central India, South India, East India |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Questions Answered in This Report

The India paper packaging market size was valued at USD 19.42 Billion in 2025.

The India paper packaging market is expected to grow at a compound annual growth rate of 4.38% from 2026-2034 to reach USD 28.55 Billion by 2034.

Corrugated boxes dominated the India paper packaging market with 40.08% share, driven by strong demand from e-commerce fulfillment operations, industrial logistics applications, and the need for durable protective packaging across multiple end-use sectors.

Key factors driving the India paper packaging market include rapid e-commerce growth, government regulations banning single-use plastics, expanding food processing sector, rising consumer preference for sustainable packaging, and technological advancements in barrier coatings and printing technologies.

Major challenges include volatility in raw material prices particularly for pulp and recovered fiber, competition from alternative packaging materials, rising energy costs impacting manufacturing margins, and supply chain disruptions affecting imported raw material availability.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)