India Paracetamol Market Size, Share, Trends and Forecast by Form, Application, and Region, 2025-2033

India Paracetamol Market Overview:

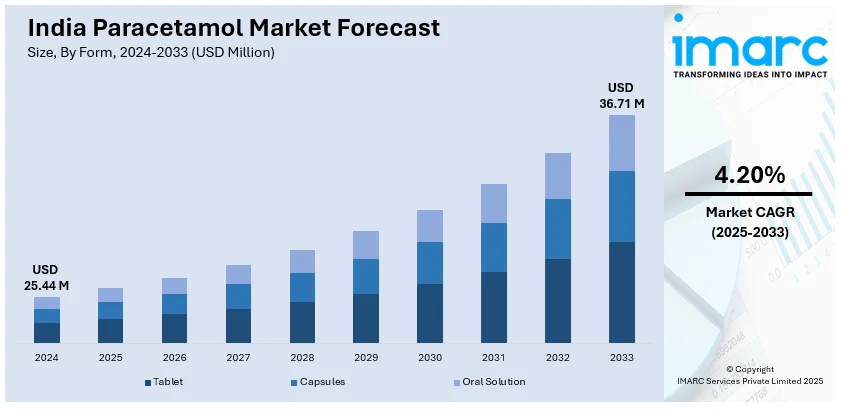

The India paracetamol market size reached USD 25.44 Million in 2024. Looking forward, IMARC Group expects the market to reach USD 36.71 Million by 2033, exhibiting a growth rate (CAGR) of 4.20% during 2025-2033. The market is experiencing significant growth due to rising demand for pain and fever relief medications, increasing healthcare awareness, and growing pharmaceutical production. Government initiatives like the Production Linked Incentive (PLI) scheme, increasing exports and innovations in formulation are also creating a positive India paracetamol market outlook.

|

Report Attribute

|

Key Statistics

|

|---|---|

|

Base Year

|

2024 |

|

Forecast Years

|

2025-2033

|

|

Historical Years

|

2019-2024

|

| Market Size in 2024 | USD 25.44 Million |

| Market Forecast in 2033 | USD 36.71 Million |

| Market Growth Rate (2025-2033) | 4.20% |

India Paracetamol Market Trends:

Expansion of E-Pharmacies Driving Paracetamol Accessibility

The rise of e-pharmacies in India is transforming the accessibility and distribution of paracetamol. With increasing internet penetration and smartphone usage consumers are shifting towards online medicine purchases benefiting from doorstep delivery, discounts, and easy access to prescriptions. The rapid expansion of e-pharmacies is supported by strong market growth projections and increasing investments in the sector. According to the report published by IBEF, India's e-pharmacy market is projected to surge from $0.5 billion in 2019 to $4.5 billion by 2025, growing at a 44% CAGR. Currently, 50 e-pharmacies operate capturing 2-3% of total pharmacy sales. Investment in the sector reached $700 million in 2020 fueled by rising internet access and e-commerce adoption. Major players like 1mg, Netmeds and PharmEasy are expanding their reach, ensuring availability across both urban and rural areas. Government initiatives such as the National Digital Health Mission (NDHM) and regulations for online pharmacy operations are further supporting this sector. The convenience of digital prescriptions and online consultations has increased consumer trust in purchasing paracetamol through e-pharmacies. As digital healthcare adoption rises, online pharmaceutical platforms are expected to capture a larger share of medicine sales, contributing significantly to India paracetamol market growth by enhancing availability and affordability across diverse demographics.

To get more information on this market, Request Sample

Growth in Pharmaceutical Manufacturing

India's pharmaceutical manufacturing sector is expanding rapidly due to government initiatives, increasing demand for essential medicines, and rising healthcare needs. Policies like the Production Linked Incentive (PLI) scheme is encouraging domestic production of active pharmaceutical ingredients (APIs) and finished formulations, reducing dependence on imports. The expansion of manufacturing capacities by key players ensures a stable supply of paracetamol for both domestic and export markets. With growing investments in automation and quality compliance, Indian pharmaceutical companies are improving production efficiency and meeting international regulatory standards. The push for self-reliance in API manufacturing, particularly for paracetamol, is further strengthening India's position in the global pharmaceutical industry. According to the data published by IBEF, India's pharmaceuticals market is projected to reach $65 billion by 2024, $130 billion by 2030, and $450 billion by 2047. In FY23, the sector was valued at $49.78 billion, with exports at $27.82 billion. The biosimilars market is set to grow to $12 billion by 2025, while domestic sales are expected to increase by 8-10% in FY24. As pharmaceutical production scales up to meet increasing demand, it is expected to contribute significantly to India paracetamol market share

India Paracetamol Market Segmentation:

IMARC Group provides an analysis of the key trends in each segment of the market, along with forecasts at the regional level for 2025-2033. Our report has categorized the market based on form and application.

Form Insights:

- Tablet

- Capsules

- Oral Solution

The report has provided a detailed breakup and analysis of the market based on the form. This includes tablet, capsules and oral solution.

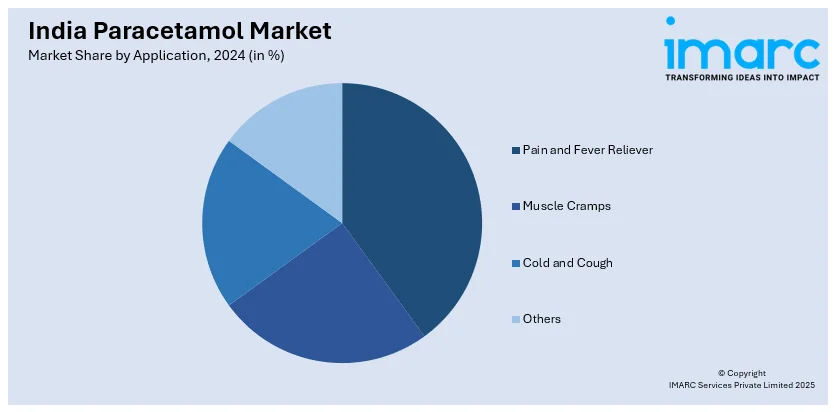

Application Insights:

- Pain and Fever Reliever

- Muscle Cramps

- Cold and Cough

- Others

A detailed breakup and analysis of the market based on the application have also been provided in the report. This includes pain and fever reliever, muscle cramps, cold and cough and others.

Regional Insights:

- North India

- South India

- East India

- West India

The report has also provided a comprehensive analysis of all the major regional markets, which include North India, South India, East India and West India.

Competitive Landscape:

The market research report has also provided a comprehensive analysis of the competitive landscape. Competitive analysis such as market structure, key player positioning, top winning strategies, competitive dashboard, and company evaluation quadrant has been covered in the report. Also, detailed profiles of all major companies have been provided.

India Paracetamol Market News:

- In January 2025, the Council of Scientific and Industrial Research (CSIR) developed indigenous technology for paracetamol production, announced by Dr. Jitendra Singh. This innovation aims to reduce India’s dependence on imports and supports the “Atmanirbhar Bharat” initiative. The 40th DSIR Foundation Day also highlighted 16 new technology transfers to MSMEs.

- In December 2024, the Council of Scientific and Industrial Research (CSIR) announced its plans to launch indigenous paracetamol manufacturing in India by year 2025, reducing dependency on imports.

India Paracetamol Market Report Coverage:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2024 |

| Historical Period | 2019-2024 |

| Forecast Period | 2025-2033 |

| Units | Million USD |

| Scope of the Report |

Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Forms Covered | Tablet, Capsules, Oral Solution |

| Applications Covered | Pain and Fever Reliever, Muscle Cramps, Cold and Cough, Others |

| Regions Covered | North India, South India, East India, West India |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Benefits for Stakeholders:

- IMARC’s industry report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, market forecasts, and dynamics of the India paracetamol market from 2019-2033.

- The research report provides the latest information on the market drivers, challenges, and opportunities in the India paracetamol market.

- Porter's five forces analysis assist stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyze the level of competition within the India paracetamol industry and its attractiveness.

- Competitive landscape allows stakeholders to understand their competitive environment and provides an insight into the current positions of key players in the market.

Key Questions Answered in This Report

The paracetamol market in India was valued at USD 25.44 Million in 2024.

The India paracetamol market is projected to exhibit a CAGR of 4.20% during 2025-2033, reaching a value of USD 36.71 Million by 2033.

Rising healthcare awareness, increasing prevalence of fever and flu-related conditions, and the widespread use of paracetamol as an over-the-counter pain and fever reliever are key drivers of the India paracetamol market. Additionally, affordable pricing and strong distribution networks support sustained demand across urban and rural areas.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)