India Party Supplies Market Size, Share, Trends, and Forecast by Product Type, Application, Distribution Channel, and Region, 2025-2033

India Party Supplies Market Overview:

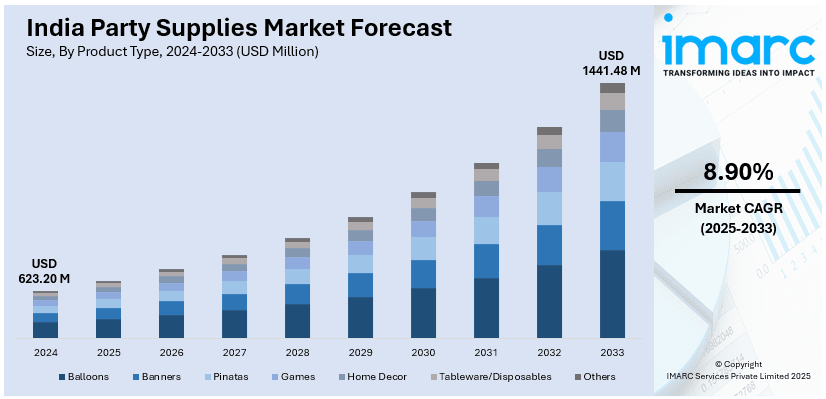

The India party supplies market size reached USD 623.20 Million in 2024. Looking forward, IMARC Group expects the market to reach USD 1,441.48 Million by 2033, exhibiting a growth rate (CAGR) of 8.90% during 2025-2033. The market is witnessing significant growth, driven by the rising demand for eco-friendly and sustainable party suppliers and growth of e-commerce and customization in party suppliers.

|

Report Attribute

|

Key Statistics

|

|---|---|

|

Base Year

|

2024 |

|

Forecast Years

|

2025-2033

|

|

Historical Years

|

2019-2024

|

| Market Size in 2024 | USD 623.20 Million |

| Market Forecast in 2033 | USD 1,441.48 Million |

| Market Growth Rate 2025-2033 | 8.90% |

India Party Supplies Market Trends:

Rising Demand for Eco-Friendly and Sustainable Party Supplies

The party supply market in India is experiencing a marked shift toward eco-friendly and sustainable products increasingly. Consumers are becoming more aware of the ill effects of disposable plastic decorations, tableware, and packaging on the environment, thereby driving demand for biodegradable, compostable, and reusable alternatives. This trend is most vividly observed in the urban area, where government regulations and sustainability initiatives encourage corporate adoption of greener practices. Exploiting and promoting the use of bamboo, recycled paper, palm leaves, and plant-based plastics in their products are the reactions that manufacturers will take in this concern. Furthermore, major online and offline retailers have embarked on expanding offerings that address the demand for such sustainable party accessories as compostable cutlery, eco-friendly balloons, and reusable decorations. E-commerce could be an important avenue for promoting these products, allowing customization as well as bulk purchase for events. Corporate event planners and premium party organizers are already integrating sustainability into their products and appeal to consumers who prefer environmentally sound celebrations. For instance, in December 2024, WedMeGood reported over 50% of respondents choosing eco-conscious wedding planning. Vendors support sustainability with organic, local materials, sustainable decor, and eco-friendly packaging. Government policies banning single-use plastics in several states are further accelerating this transition. As sustainability becomes a core purchasing criterion, businesses in the Indian party supplies market are expected to invest in R&D to develop innovative, eco-conscious solutions that align with evolving consumer preferences.

To get more information on this market, Request Sample

Growth of E-Commerce and Customization in Party Supplies

The increasing penetration of e-commerce platforms is transforming the Indian party supplies market, providing consumers with greater convenience, variety, and customization options. Online marketplaces, social media-driven sales, and direct-to-consumer (DTC) brands are driving the accessibility of party essentials, allowing customers to browse, personalize, and purchase supplies from anywhere. Customization has become a key differentiator, with consumers seeking personalized decorations, themed party kits, and bespoke event accessories. This demand is particularly strong for children’s birthday parties, weddings, and corporate events, where unique themes and branding elements are essential. Vendors are leveraging digital tools to offer customized banners, printed balloons, themed tableware, and personalized invitations. E-commerce platforms such as Amazon, Flipkart, and niche party supply websites are capitalizing on this trend by integrating AI-driven recommendations, virtual previews, and bulk ordering options for event planners. For instance, as per industry reports, in October 2024, Indian quick commerce sales will surpass $6 billion this year, with Blinkit holding nearly 40% market share, while Swiggy and Zepto each capture around 30%. The rise of social media influencers and digital marketing campaigns is further fueling growth, as businesses collaborate with content creators to showcase innovative party setups and exclusive product offerings. With the increasing adoption of digital payments and last-mile delivery improvements, online sales of party supplies are expected to surge, making e-commerce a dominant distribution channel in the Indian party supplies market.

India Party Supplies Market Segmentation:

IMARC Group provides an analysis of the key trends in each segment of the market, along with forecasts at the region level for 2025-2033. Our report has categorized the market based on product type, application, and distribution channel.

Product Type Insights:

- Balloons

- Banners

- Pinatas

- Games

- Home Decor

- Tableware/Disposables

- Others

The report has provided a detailed breakup and analysis of the market based on the product type. This includes balloons, banners, pinatas, games, home décor, tableware/disposables, and others.

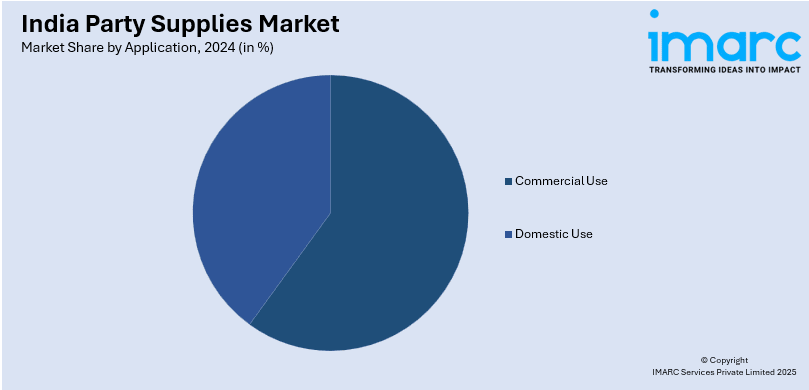

Application Insights:

- Commercial Use

- Domestic Use

A detailed breakup and analysis of the market based on the application have also been provided in the report. This includes commercial use and domestic use.

Distribution Channel Insights:

- Supermarkets and Hypermarkets

- Convenience Stores

- Specialized Stores

- Online Stores

- Others

A detailed breakup and analysis of the market based on the distribution channel have also been provided in the report. This includes supermarkets and hypermarkets, convenience stores, specialized stores, online stores, and others.

Regional Insights:

- North India

- South India

- East India

- West India

The report has also provided a comprehensive analysis of all the major regional markets, which include North India, South India, East India, and West India.

Competitive Landscape:

The market research report has also provided a comprehensive analysis of the competitive landscape. Competitive analysis such as market structure, key player positioning, top winning strategies, competitive dashboard, and company evaluation quadrant has been covered in the report. Also, detailed profiles of all major companies have been provided.

India Party Supplies Market News:

- In November 2024, Weddings by Betterhalf announced its rebranding as The Wedding Company, introducing a peacock-themed identity symbolizing prosperity. Expanding into India’s top 50 cities, it offers professional, cost-effective wedding services, including venue booking, decor, catering, and photography. The new website, TheWeddingCompany.com, ensures seamless planning with high-quality, reliable, and comprehensive wedding solutions.

India Party Supplies Market Report Coverage:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2024 |

| Historical Period | 2019-2024 |

| Forecast Period | 2025-2033 |

| Units | Million USD |

| Scope of the Report |

Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Product Types Covered | Balloons, Banners, Pinatas, Games, Home Décor, Tableware/Disposables, Others |

| Applications Covered | Commercial Use, Domestic Use |

| Distribution Channels Covered | Supermarkets and Hypermarkets, Convenience Stores, Specialized Stores, Online Stores, Others |

| Regions Covered | North India, South India, East India, West India |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Benefits for Stakeholders:

- IMARC’s industry report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, market forecasts, and dynamics of the India party supplies market from 2019-2033.

- The research report provides the latest information on the market drivers, challenges, and opportunities in the India party supplies market.

- Porter's five forces analysis assist stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyze the level of competition within the India party supplies industry and its attractiveness.

- Competitive landscape allows stakeholders to understand their competitive environment and provides an insight into the current positions of key players in the market.

Key Questions Answered in This Report

The party supplies market in India was valued at USD 623.20 Million in 2024.

The India party supplies market is projected to exhibit a CAGR of 8.90% during 2025-2033, reaching a value of USD 1,441.48 Million by 2033.

The India party supplies market is driven by rising disposable incomes, growing urbanization, and increasing popularity of themed celebrations. The influence of social media, expansion of event management services, and demand for personalized and decorative items also contribute significantly to the market’s growth across various consumer segments.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)