India Pathology Lab Services Market Size, Share, Trends and Forecast by Type, Testing Services, End Use, and Region, 2026-2034

India Pathology Lab Services Market Size and Share:

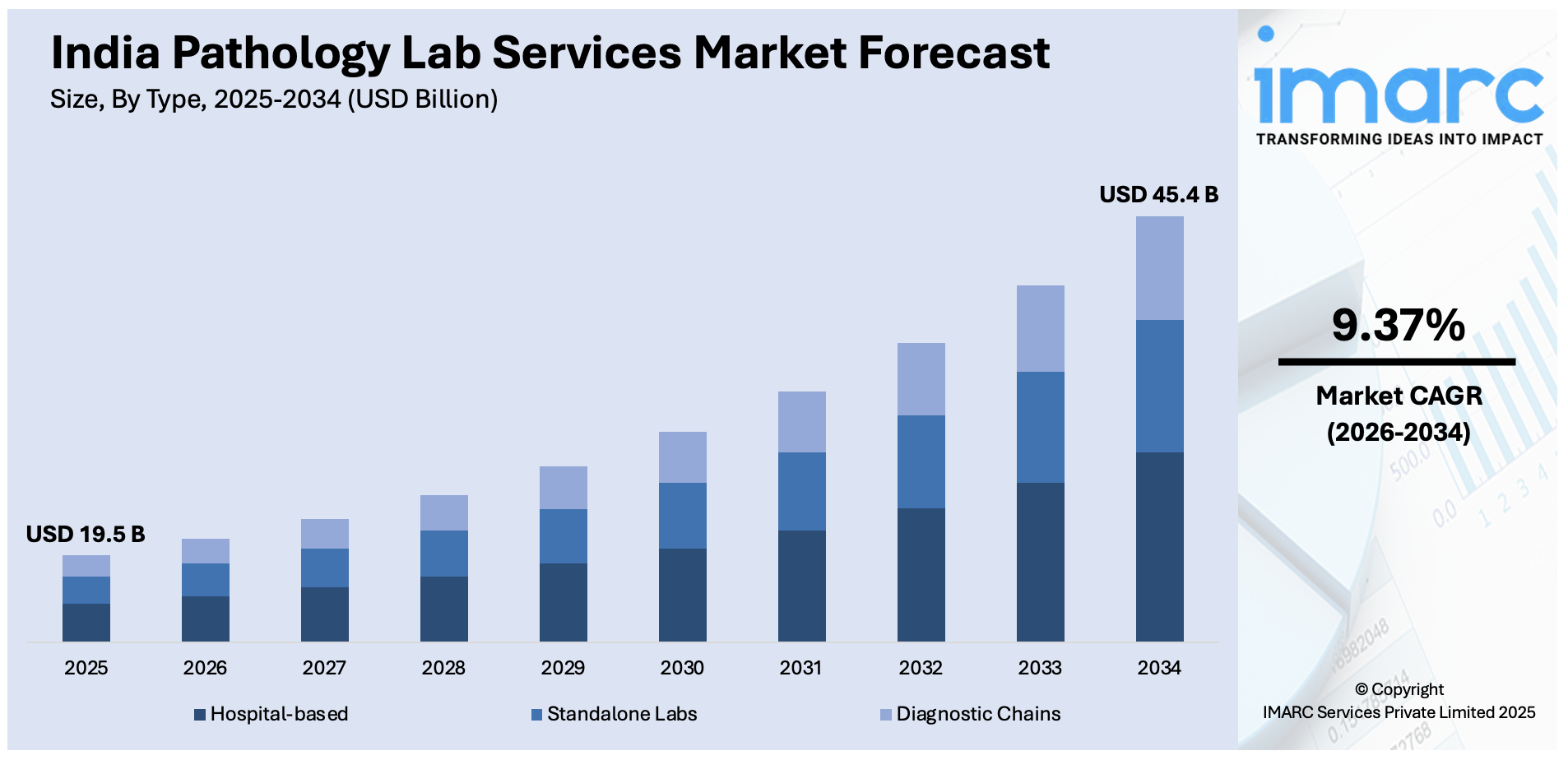

The India pathology lab services market size reached USD 19.5 Billion in 2025. Looking forward, IMARC Group expects the market to reach USD 45.4 Billion by 2034, exhibiting a growth rate (CAGR) of 9.37% during 2026-2034. The rising healthcare awareness, growing prevalence of chronic diseases, increasing demand for preventive diagnostics, expanding health insurance coverage, government health initiatives, rising disposable incomes, improved access to diagnostic centers, growing medical tourism, continual technological advancements in diagnostic tools, and increasing investments in healthcare infrastructure are some of the major factors expanding the India pathology lab services market share.

|

Report Attribute

|

Key Statistics

|

|---|---|

|

Base Year

|

2025

|

|

Forecast Years

|

2026-2034

|

|

Historical Years

|

2020-2025

|

| Market Size in 2025 | USD 19.5 Billion |

| Market Forecast in 2034 | USD 45.4 Billion |

| Market Growth Rate 2026-2034 | 9.37% |

India Pathology Lab Services Market Trends:

Growth in Home Sample Collection and Digital Integration

The demand for home sample collection is increasing, accelerated by the COVID-19 pandemic, and now embedded as a consumer expectation. Additionally, urban consumers, especially working professionals and the elderly, prefer the convenience of at-home testing. Therefore, labs are expanding phlebotomist networks and investing in home sample collection, mobile apps, call centers, and digital platforms that allow for test booking, sample tracking, and online report delivery. For instance, on January 17, 2025, Curelo, a rapidly growing healthcare platform in India, launched CURELO FLASH, a pioneering 10-minute doorstep blood sample collection service, following a successful pilot in Gurugram. This kind of rapid, tech-enabled service sets a new benchmark for responsiveness in diagnostics and reflects growing competition among pathology providers to offer faster, more user-friendly experiences. Furthermore, integration with wearable health data and teleconsultation platforms is beginning to take shape, thereby offering a more connected diagnostic experience. Labs are also developing loyalty programs, test packages, and subscription models through these apps to retain users, which is contributing to the India pathology lab services market growth. Data privacy and cybersecurity have become critical focus areas, given the volume of personal health data being collected and shared. This digital layer is not just about convenience, as it is reshaping customer engagement, backend operations, and how labs differentiate themselves in a crowded market.

To get more information on this market Request Sample

Rising Burden of Chronic Diseases Driving Preventive Diagnostics

India is facing a steady increase in lifestyle-related chronic diseases such as diabetes, hypertension, cardiovascular conditions, obesity, and certain types of cancer. These ailments are no longer limited to older population as the younger demographic is also being affected due to sedentary lifestyles, poor diet, stress, and lack of physical activity. According to a survey, 52% of Indian women and 48% of Indian males are at risk of developing health issues related to lifestyle choices. And, a growing number of people are suffering from conditions including diabetes, thyroid problems, lipid imbalances, kidney problems, fatty liver disease, arthritis, cardiovascular illnesses, and cancer. According to industry reports, non-communicable illnesses and injuries are responsible for 52% of fatalities in India. This is shifting consumer behavior toward preventive healthcare, with a sharp rise in demand for early detection and regular health monitoring, which is positively impacting pathology lab services market outlook. In addition to this, pathology labs are capitalizing on this by offering bundled preventive packages that include blood glucose, lipid profiles, liver, and kidney function tests, thyroid panels, and vitamin assessments. Besides this, preventive diagnostics offer a recurring business for labs and encourage higher consumer engagement throughout the year, not just during illness. The focus is further extending to disease risk assessments, enabling people to monitor hereditary and lifestyle-related risks before symptoms appear. This shift is pushing pathology players to develop more comprehensive, yet affordable diagnostic packages suited for periodic screening.

India Pathology Lab Services Market Segmentation:

IMARC Group provides an analysis of the key trends in each segment of the market, along with forecasts at the country level for 2026-2034. Our report has categorized the market based on type, testing services, and end use.

Type Insights:

- Hospital-based

- Standalone Labs

- Diagnostic Chains

The report has provided a detailed breakup and analysis of the market based on the type. This includes hospital-based, standalone labs, and diagnostic chains.

Testing Services Insights:

- General Physiological and Clinical Tests

- Imaging and Radiology Tests

- Esoteric Tests

- COVID-19 Tests

A detailed breakup and analysis of the market based on the testing services have also been provided in the report. This includes general physiological and clinical tests, imaging and radiology tests, esoteric tests, and COVID-19 tests.

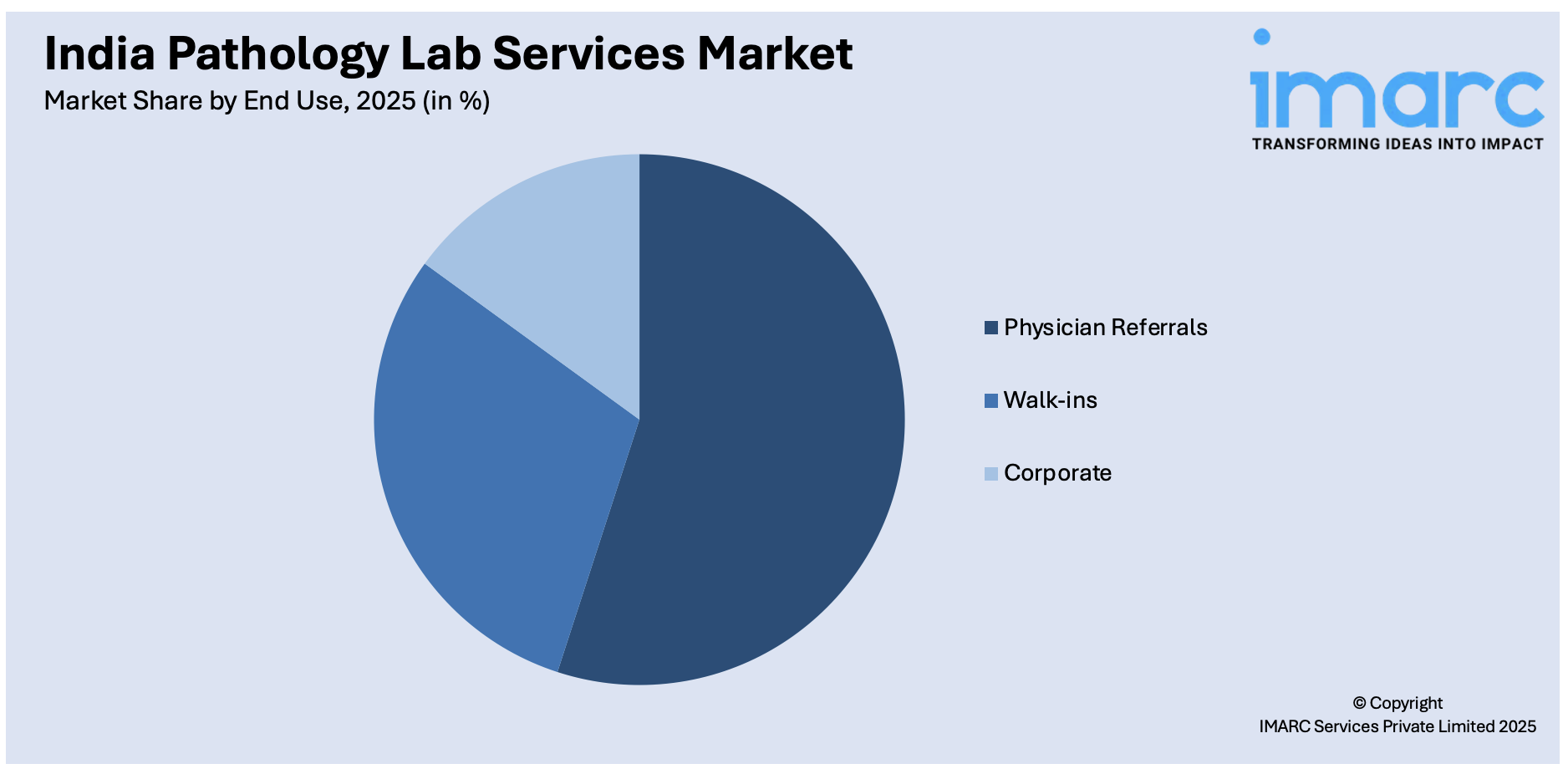

End Use Insights:

Access the comprehensive market breakdown Request Sample

- Physician Referrals

- Walk-ins

- Corporate

The report has provided a detailed breakup and analysis of the market based on the end use. This includes physician referrals, walk-ins, and corporate.

Regional Insights:

- North India

- South India

- East India

- West India

The report has also provided a comprehensive analysis of all the major regional markets, which include North India, South India, East India, and West India.

Competitive Landscape:

The market research report has also provided a comprehensive analysis of the competitive landscape. Competitive analysis such as market structure, key player positioning, top winning strategies, competitive dashboard, and company evaluation quadrant has been covered in the report. Also, detailed profiles of all major companies have been provided.

India Pathology Lab Services Market News:

- On April 27, 2024, Apollo Health & Lifestyle, a subsidiary of Apollo Hospitals Enterprise Limited, announced plans to expand its diagnostic services by adding approximately 70 new laboratories within the next 12 to 18 months, augmenting its existing network of over 100 labs. This initiative aims to cater to a broader clientele, including hospitals, nursing homes, and B2B clients, while also focusing on introducing over 500 new tests in the next one to two years, with an emphasis on genomics and preventive care.

- On August 30, 2024, Thyrocare Technologies Limited announced the signing of a deal to pay INR 7 Crore (USD 0.8 million) in cash for Vimta Labs Limited's diagnostic and pathology services business. Thyrocare now has access to 11 facilities across Telangana, Andhra Pradesh, Uttar Pradesh, and Odisha as a result of this acquisition, including a central processing laboratory in Hyderabad that has earned NABL accreditation. The transaction aims to strengthen Thyrocare's presence in South India, leveraging Vimta Labs' established brand and customer loyalty to enhance its market share and operational scale.

India Pathology Lab Services Market Report Coverage:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2025 |

| Historical Period | 2020-2025 |

| Forecast Period | 2026-2034 |

| Units | Billion USD |

| Scope of the Report |

Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Types Covered | Hospital-based, Standalone Labs, Diagnostic Chains |

| Testing Services Covered | General Physiological and Clinical Tests, Imaging and Radiology Tests, Esoteric Tests, COVID-19 Tests |

| End Uses Covered | Physician Referrals, Walk-ins, Corporate |

| Regions Covered | North India, South India, East India, West India |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Questions Answered in This Report:

- How has the India pathology lab services market performed so far and how will it perform in the coming years?

- What is the breakup of the India pathology lab services market on the basis of type?

- What is the breakup of the India pathology lab services market on the basis of testing services?

- What is the breakup of the India pathology lab services market on the basis of end use?

- What is the breakup of the India pathology lab services market on the basis of region?

- What are the various stages in the value chain of the India pathology lab services market?

- What are the key driving factors and challenges in the India pathology lab services market?

- What is the structure of the India pathology lab services market and who are the key players?

- What is the degree of competition in the India pathology lab services market?

Key Benefits for Stakeholders:

- IMARC’s industry report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, market forecasts, and dynamics of the India pathology lab services market from 2020-2034.

- The research report provides the latest information on the market drivers, challenges, and opportunities in the India pathology lab services market.

- Porter's five forces analysis assist stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyze the level of competition within the India pathology lab services industry and its attractiveness.

- Competitive landscape allows stakeholders to understand their competitive environment and provides an insight into the current positions of key players in the market.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)