India Patient Handling Equipment Market Size, Share, Trends and Forecast by Product, Type of Care, End User, and Region, 2025-2033

Market Overview:

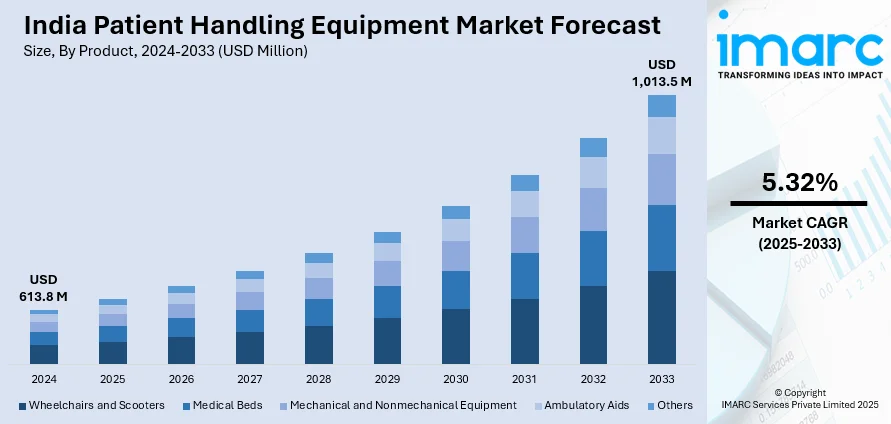

India patient handling equipment market size reached USD 613.8 Million in 2024. Looking forward, IMARC Group expects the market to reach USD 1,013.5 Million by 2033, exhibiting a growth rate (CAGR) of 5.32% during 2025-2033. The growing adoption of these tools that are instrumental in optimizing healthcare processes, reflecting a commitment to providing safer and more effective patient care across the country, is primarily driving the market growth.

|

Report Attribute

|

Key Statistics

|

|---|---|

|

Base Year

|

2024

|

|

Forecast Years

|

2025-2033

|

|

Historical Years

|

2019-2024

|

|

Market Size in 2024

|

USD 613.8 Million |

|

Market Forecast in 2033

|

USD 1,013.5 Million |

| Market Growth Rate 2025-2033 | 5.32% |

Patient handling equipment encompasses specialized devices utilized in healthcare settings to safely reposition, transfer, or move patients. These tools are specifically crafted to aid healthcare personnel in the safe lifting and relocation of patients who may have limited mobility or require additional assistance. The spectrum of equipment varies from fundamental items like wheelchairs and stretchers to more sophisticated apparatus such as mechanical lifts, transfer chairs, and slide sheets. Their purpose is crucial in mitigating physical strain on healthcare staff, thereby minimizing the potential for injuries to both healthcare workers and patients. By facilitating smoother and safer patient movements, this equipment significantly contributes to enhanced patient comfort, expedited recovery, and the overall efficiency of healthcare services. Consequently, patient handling equipment are gaining widespread recognition, due to their pivotal role in augmenting the quality and safety of healthcare delivery.

To get more information on this market, Request Sample

India Patient Handling Equipment Market Trends:

The India patient handling equipment market has become integral to the healthcare landscape, providing essential tools designed to move safely and efficiently, transfer, or position patients. One of the primary objectives of patient handling equipment in India is to alleviate the physical strain on healthcare personnel, reducing the risk of injuries for both caregivers and patients. These devices play a pivotal role in enhancing the overall quality and safety of healthcare delivery. By facilitating safer patient movements, the equipment contributes to improved patient comfort, faster recovery times, and more efficient healthcare services. Moreover, the demand for patient handling equipment in India is on the rise, driven by factors such as an aging population, increased prevalence of chronic diseases, and a growing awareness of the importance of patient safety. Apart from this, government initiatives promoting healthcare infrastructure development further contribute to the market's expansion. Additionally, as healthcare facilities in India strive to enhance their standards of care and ensure the well-being of both patients and healthcare professionals, the patient handling equipment market is poised for sustained growth in the coming years.

India Patient Handling Equipment Market Segmentation:

IMARC Group provides an analysis of the key trends in each segment of the market, along with forecasts at the country level for 2025-2033. Our report has categorized the market based on product, type of care, and end user.

Product Insights:

- Wheelchairs and Scooters

- Medical Beds

- Mechanical and Nonmechanical Equipment

- Ambulatory Aids

- Others

The report has provided a detailed breakup and analysis of the market based on the product. This includes wheelchairs and scooters, medical beds, mechanical and nonmechanical equipment, ambulatory aids, and others.

Type of Care Insights:

- Bariatric Care

- Fall Prevention

- Critical Care

- Wound Care

- Others

A detailed breakup and analysis of the market based on the type of care have also been provided in the report. This includes bariatric care, fall prevention, critical care, wound care, and others.

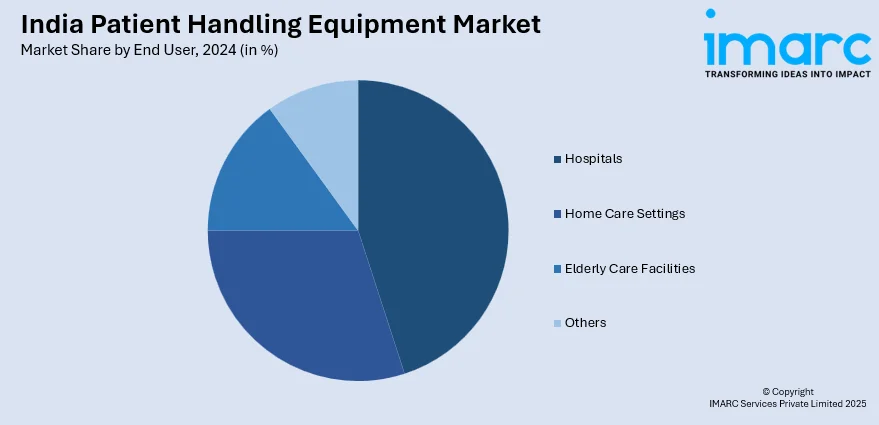

End User Insights:

- Hospitals

- Home Care Settings

- Elderly Care Facilities

- Others

The report has provided a detailed breakup and analysis of the market based on the end user. This includes hospitals, home care settings, elderly care facilities, and others.

Regional Insights:

- North India

- West and Central India

- South India

- East and Northeast India

The report has also provided a comprehensive analysis of all the major regional markets, which include North India, West and Central India, South India, and East and Northeast India.

Competitive Landscape:

The market research report has also provided a comprehensive analysis of the competitive landscape in the market. Competitive analysis such as market structure, key player positioning, top winning strategies, competitive dashboard, and company evaluation quadrant has been covered in the report. Also, detailed profiles of all major companies have been provided.

India Patient Handling Equipment Market Report Coverage:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2024 |

| Historical Period | 2019-2024 |

| Forecast Period | 2025-2033 |

| Units | Million USD |

| Scope of the Report | Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Products Covered | Wheelchairs and Scooters, Medical Beds, Mechanical and Nonmechanical Equipment, Ambulatory Aids, Others |

| Type of Cares Covered | Bariatric Care, Fall Prevention, Critical Care, Wound Care, Others |

| End Users Covered | Hospitals, Home Care Settings, Elderly Care Facilities, Others |

| Regions Covered | North India, West and Central India, South India, East and Northeast India |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Benefits for Stakeholders:

- IMARC’s industry report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, market forecasts, and dynamics of the India patient handling equipment market from 2019-2033.

- The research report provides the latest information on the market drivers, challenges, and opportunities in the India patient handling equipment market.

- Porter's five forces analysis assist stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyze the level of competition within the India patient handling equipment industry and its attractiveness.

- Competitive landscape allows stakeholders to understand their competitive environment and provides an insight into the current positions of key players in the market.

Key Questions Answered in This Report

The India patient handling equipment market was valued at USD 613.8 Million in 2024.

The India patient handling equipment market is projected to exhibit a CAGR of 5.32% during 2025-2033, reaching a value of USD 1,013.5 Million by 2033.

The India patient handling equipment market is propelled by the increasing geriatric population, rising chronic disease prevalence, and growing awareness about caregiver safety. Government initiatives to enhance healthcare infrastructure, particularly in rural areas, further boost demand. Technological advancements in equipment design and functionality also contribute to market growth.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)