India Payroll Outsourcing Market Size, Share, Trends and Forecast by Type, Application, End Use Industry, and Region, 2026-2034

India Payroll Outsourcing Market Size and Share:

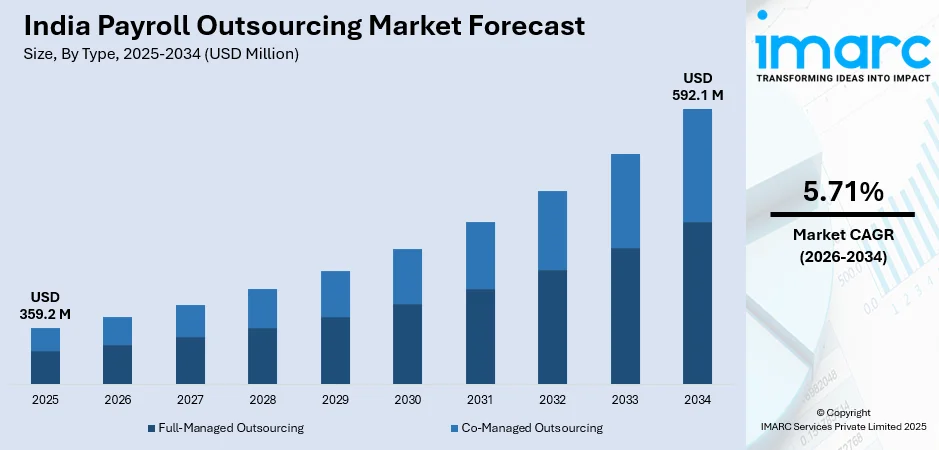

The India payroll outsourcing market size reached USD 359.2 Million in 2025. Looking forward, IMARC Group expects the market to reach USD 592.1 Million by 2034, exhibiting a growth rate (CAGR) of 5.71% during 2026-2034. The market is driven by the need for cost efficiency, compliance with complex labor laws, and the adoption of advanced technologies such as cloud-based solutions. Businesses, especially SMEs and MNCs, are outsourcing to streamline operations, reduce errors, and focus on core activities which is favoring the India payroll outsourcing market share.

|

Report Attribute

|

Key Statistics

|

|---|---|

|

Base Year

|

2025

|

|

Forecast Years

|

2026-2034

|

|

Historical Years

|

2020-2025

|

| Market Size in 2025 | USD 359.2 Million |

| Market Forecast in 2034 | USD 592.1 Million |

| Market Growth Rate (2026-2034) | 5.71% |

India Payroll Outsourcing Market Trends:

Increasing Adoption of Cloud-Based Payroll Solutions

The escalating shift towards cloud-based payroll solutions is significantly supporting the India payroll outsourcing market growth. Businesses are increasingly adopting these platforms due to their scalability, cost-effectiveness, and ease of access. Cloud-based systems allow companies to manage payroll processes remotely, which is particularly beneficial in the post-pandemic era, where hybrid work models are prevalent. These solutions also offer real-time data processing, automated compliance updates, and seamless integration with other HR and accounting systems. According to a recent survey, 97% of employees and 98% of employers in India are satisfied with their hybrid work arrangement, more than the global averages of 87% and 95%, respectively. And while Indian employees are logging fewer hours sitting at their office desks, they are still putting a premium on flexibility, with 31% willing to take a salary drop for the ability to work remotely, almost double the worldwide figure. The most significant change to account for in this dynamic is the constant evolution of hybrid work around the world and how payroll outsourcing in India is adapting to cater to the changing expectations of employees and the demands of employers. Consequently, the solution of cloud-based payroll outsourcing is fast becoming popular amongst small and medium enterprises SMEs to reduce operational expenses and focus on their core business functions. Moreover, the increased emphasis on data security and compliance with Indian labor laws is driving the need for advanced, secure, and compliant cloud payroll solutions. This trend is anticipated to persist as a greater number of organizations acknowledge the advantages of digitizing their payroll operations.

To get more information on this market, Request Sample

Rising Demand for Compliance Management Services

The increasing demand for compliance management services is creating a positive India payroll outsourcing market outlook. With frequent changes in labor laws, tax regulations, and statutory requirements, businesses are finding it challenging to stay updated and ensure adherence. For instance, remote workers in India have complex tax obligations, which include compliance with FEMA, advance tax, and the benefit of a double taxation avoidance agreement (DTAA) if they work for a domestic or foreign company. The tax structure for the financial year (FY) 2024-25 has a choice between deductibles in the old system and lower rates in the new system with tax slabs of 5%-30%. In order to remain compliant, employers must match their payroll practices to the Indian labor law, manage Tax Deducted at Source (TDS), and mitigate permanent establishment risk. Payroll outsourcing providers are also providing specialized compliance management services to help companies stay compliant with ever-changing regulatory requirements. The services they offer include timely updates with respect of changing regulations, accurate tax filling and compliance with statutory requirements such as provident fund (PF) and employee state insurance (ESI). This is especially true for MNCs and large corporations doing business in India, where non-compliance can have serious consequences and impact their reputation. Outsourcing compliance activities enables organizations to mitigate risks, maintain accuracy, and focus on their strategic growth plans. This trend is expected to grow as regulatory frameworks become more sophisticated, and businesses prioritize risk management.

India Payroll Outsourcing Market Segmentation:

IMARC Group provides an analysis of the key trends in each segment of the market, along with forecasts at the country level for 2026-2034. Our report has categorized the market based on type, application, and end use industry.

Type Insights:

- Full-Managed Outsourcing

- Co-Managed Outsourcing

The report has provided a detailed breakup and analysis of the market based on the type. This includes full-managed outsourcing and co-managed outsourcing.

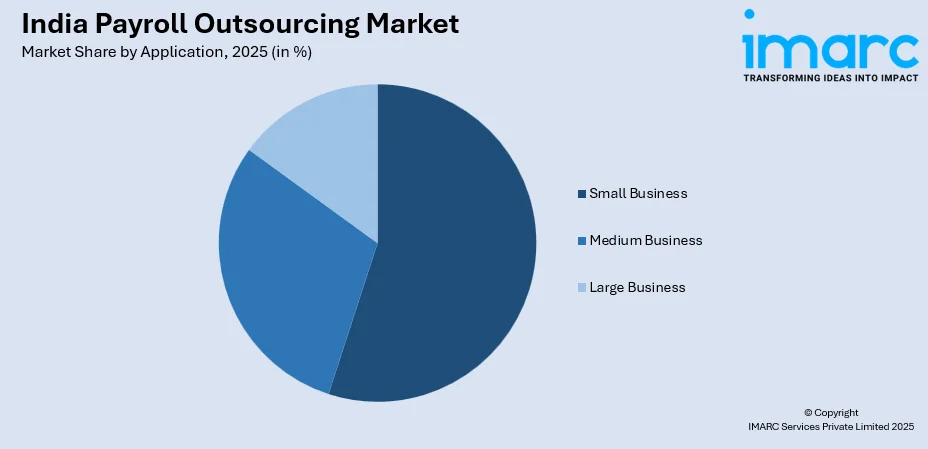

Application Insights:

- Small Business

- Medium Business

- Large Business

A detailed breakup and analysis of the market based on the application have also been provided in the report. This includes small business, medium business, and large business.

End Use Industry Insights:

- BFSI

- Consumer and Industrial Products

- IT and Telecommunication

- Public Sector

- Healthcare

- Others

The report has provided a detailed breakup and analysis of the market based on the end use industry. This includes BFSI, consumer and industrial products, IT and telecommunication, public sector, healthcare, and others.

Regional Insights:

- North India

- South India

- East India

- West India

The report has also provided a comprehensive analysis of all the major regional markets, which include North India, South India, East India, and West India.

Competitive Landscape:

The market research report has also provided a comprehensive analysis of the competitive landscape. Competitive analysis such as market structure, key player positioning, top winning strategies, competitive dashboard, and company evaluation quadrant has been covered in the report. Also, detailed profiles of all major companies have been provided.

India Payroll Outsourcing Market News:

- April 03, 2024: Rippling introduced global payroll outsourcing and compliance to Indian enterprises, making them accessible to enterprises in India for the first time, backed by illustrious investors, including Y Combinator. The firm, which has been in business since 2017, has 500+ employees in its Bangalore office and offers services such as EOR (Employer of Record), global HRIS, IT, and payroll to help businesses hire and pay employees around the world. With India at the forefront of remote hiring, boasting a 70% EOR adoption rate, Rippling’s comprehensive platform enhances workforce management by minimizing compliance risks and streamlining manual procedures.

India Payroll Outsourcing Market Report Coverage:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2025 |

| Historical Period | 2020-2025 |

| Forecast Period | 2026-2034 |

| Units | Million USD |

| Scope of the Report |

Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Types Covered | Full-Managed Outsourcing, Co-Managed Outsourcing |

| Applications Covered | Small Business, Medium Business, Large Business |

| End Use Industries Covered | BFSI, Consumer and Industrial Products, IT and Telecommunication, Public Sector, Healthcare, Others |

| Regions Covered | North India, South India, East India, West India |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Benefits for Stakeholders:

- IMARC’s industry report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, market forecasts, and dynamics of the India payroll outsourcing market from 2020-2034.

- The research report provides the latest information on the market drivers, challenges, and opportunities in the India payroll outsourcing market.

- Porter's five forces analysis assist stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyze the level of competition within the India payroll outsourcing industry and its attractiveness.

- Competitive landscape allows stakeholders to understand their competitive environment and provides an insight into the current positions of key players in the market.

Key Questions Answered in This Report

The payroll outsourcing market in India was valued at USD 359.2 Million in 2025.

The India payroll outsourcing market is projected to exhibit a CAGR of 5.71% during 2026-2034, reaching a value of USD 592.1 Million by 2034.

The payroll outsourcing market in India is growing as companies aim to cut costs, reduce compliance risks, and focus on core activities. Complex tax structures and frequent regulatory updates push firms to rely on specialized providers. Small and medium enterprises adopt outsourcing to access professional expertise without large in-house teams, driving steady demand for reliable payroll management solutions.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)