India PCB Components Market Size, Share, Trends and Forecast by Component Type, PCB Type, End Use Industry, and Region, 2025-2033

India PCB Components Market Overview:

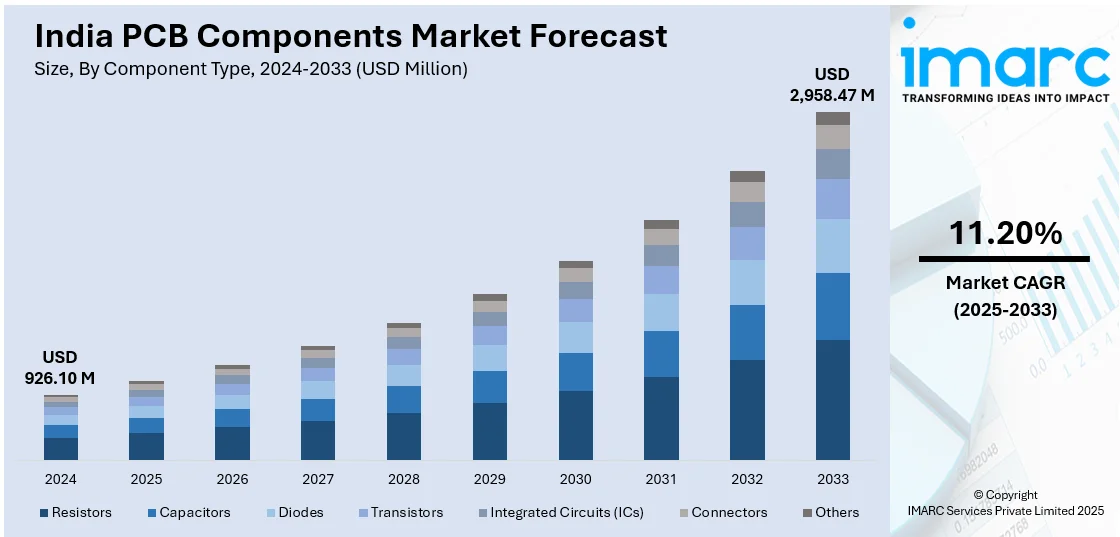

The India PCB components market size reached USD 926.10 Million in 2024. Looking forward, IMARC Group expects the market to reach USD 2,958.47 Million by 2033, exhibiting a growth rate (CAGR) of 11.20% during 2025-2033. The growing demand from the electronics industry, increased consumer electronics adoption, rising automotive electronics integration, implementation of government initiatives promoting local manufacturing, continual technological advancements, and the expansion of industries like telecommunications, healthcare, and industrial automation are some of the major factors augmenting India PCB components market share.

|

Report Attribute

|

Key Statistics

|

|---|---|

|

Base Year

|

2024

|

|

Forecast Years

|

2025-2033

|

|

Historical Years

|

2019-2024

|

| Market Size in 2024 | USD 926.10 Million |

| Market Forecast in 2033 | USD 2,958.47 Million |

| Market Growth Rate (2025-2033) | 11.20% |

India PCB Components Market Trends:

Growing Demand from the Consumer Electronics Industry

The thriving consumer electronics industry is one of the key contributors to the India PCB components market growth. According to an industry report, the consumer electronics market in India is expected to reach USD 152.59 Billion by 2033, exhibiting a growth rate (CAGR) of 6.90% during 2025-2033. Along with the increased use of smartphones, laptops, TVs, and wearables, the use of PCBs is growing. Smartphones still reign supreme in the industry, and their continuously developing features, like enhanced processing power, high-definition screens, and sophisticated cameras, necessitate highly advanced PCBs. As people demand more innovative and feature-laden electronic devices, the complexity of PCBs in the devices becomes higher. Moreover, the growth of smart homes and IoT devices also contributes to the demand for PCBs, as both technologies are based on printed circuit boards for connectivity and functionality. Moreover, the increasing middle-class population in the country is further contributing to this trend. Along with this, the rising disposable income levels of the consumer and an intense urge for high-tech products are driving the market growth. Additionally, manufacturers are putting money into new PCB technologies and designs to meet the various and growing demands of the consumer electronics industry, thus augmenting the market growth.

To get more information on this market, Request Sample

Expansion of Electric Vehicles (EV) and Automotive Electronics

The automotive industry in India is undergoing a significant transformation, with electric vehicles (EVs) emerging as a central focus. According to an industry report, the EV market in India saw its highest-ever yearly retail sales of 19,49,114 units in CY2024. As India works towards achieving environmental goals and cutting back on the use of fossil fuels, the adoption of EVs is increasing. With this change, the demand for PCBs is also on the rise as electric vehicles rely heavily on electronic systems for battery management, powertrain control, infotainment systems, and autonomous driving features. PCB components are the backbone of all these systems, and they facilitate the connectivity and control required for automotive applications. Along with this, demand for dependable, high-performance PCBs is increasingly growing as vehicle manufacturers seek to embed increasingly sophisticated technologies in their products, including sensors, communications equipment, and high-power electronics. Furthermore, the implementation of government initiatives, subsidies, and infrastructure development to promote EV adoption is positively impacting India PCB components market outlook. This market trend is expected to continue, with both domestic and international automotive manufacturers ramping up their production of electric and hybrid vehicles, thus driving PCB demand across the country.

India PCB Components Market Segmentation:

IMARC Group provides an analysis of the key trends in each segment of the market, along with forecasts at the country level for 2025-2033. Our report has categorized the market based on component type, PCB type, and end use industry.

Component Type Insights:

- Resistors

- Capacitors

- Diodes

- Transistors

- Integrated Circuits (ICs)

- Connectors

- Others

The report has provided a detailed breakup and analysis of the market based on the component type. This includes resistors, capacitors, diodes, transistors, integrated circuits (ICs), connectors, and others.

PCB Type Insights:

- Rigid PCBs

- Flexible PCBs

- Rigid-Flex PCBs

A detailed breakup and analysis of the market based on the PCB type have also been provided in the report. This includes rigid PCBs, flexible PCBs, and rigid-flex PCBs.

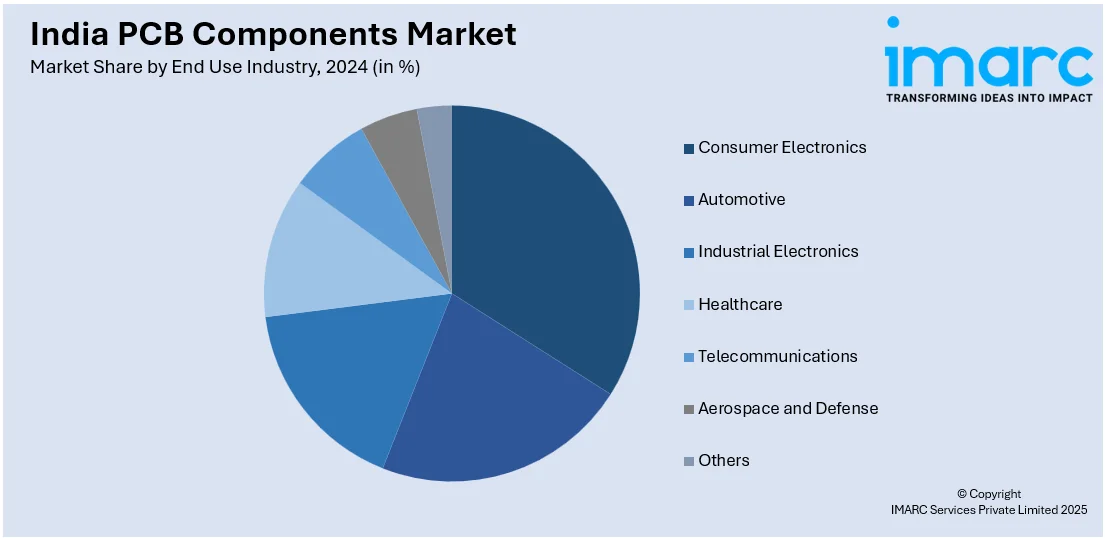

End Use Industry Insights:

- Consumer Electronics

- Automotive

- Industrial Electronics

- Healthcare

- Telecommunications

- Aerospace and Defense

- Others

The report has provided a detailed breakup and analysis of the market based on the end use industry. This includes consumer electronics, automotive, industrial electronics, healthcare, telecommunications, aerospace and defense, and others.

Regional Insights:

- North India

- South India

- East India

- West India

The report has also provided a comprehensive analysis of all the major regional markets, which include North India, South India, East India, and West India.

Competitive Landscape:

The market research report has also provided a comprehensive analysis of the competitive landscape. Competitive analysis such as market structure, key player positioning, top winning strategies, competitive dashboard, and company evaluation quadrant has been covered in the report. Also, detailed profiles of all major companies have been provided.

India PCB Components Market News:

- On October 10, 2024, Ascent Circuits announced an INR 650 Crore (about USD 78 Million) investment to establish a state-of-the-art printed circuit board (PCB) production facility in Hosur, Tamil Nadu. The factory seeks to manufacture a broad variety of PCBs, such as single-sided circuits, intricate multilayer circuits, and specialty circuits, employing advanced manufacturing technologies and creating over 1,000 direct and indirect employment opportunities. This initiative is set to enhance local manufacturing of critical components, supporting India's semiconductor and chip substrate industries.

India PCB Components Market Report Coverage:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2024 |

| Historical Period | 2019-2024 |

| Forecast Period | 2025-2033 |

| Units | Million USD |

| Scope of the Report |

Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Component Types Covered | Resistors, Capacitors, Diodes, Transistors, Integrated Circuits (ICs), Connectors, Others |

| PCB Types Covered | Rigid PCBs, Flexible PCBs, Rigid-Flex PCBs |

| End Use Industries Covered | Consumer Electronics, Automotive, Industrial Electronics, Healthcare, Telecommunications, Aerospace and Defense, Others |

| Regions Covered | North India, South India, East India, West India |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Questions Answered in This Report:

- How has the India PCB components market performed so far and how will it perform in the coming years?

- What is the breakup of the India PCB components market on the basis of component type?

- What is the breakup of the India PCB components market on the basis of PCB type?

- What is the breakup of the India PCB components market on the basis of end use industry?

- What is the breakup of the India PCB components market on the basis of region?

- What are the various stages in the value chain of the India PCB components market?

- What are the key driving factors and challenges in the India PCB components market?

- What is the structure of the India PCB components market and who are the key players?

- What is the degree of competition in the India PCB components market?

Key Benefits for Stakeholders:

- IMARC’s industry report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, market forecasts, and dynamics of the India PCB components market from 2019-2033.

- The research report provides the latest information on the market drivers, challenges, and opportunities in the India PCB components market.

- Porter's five forces analysis assist stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyze the level of competition within the India PCB components industry and its attractiveness.

- Competitive landscape allows stakeholders to understand their competitive environment and provides an insight into the current positions of key players in the market.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)