India Pepperoni Market Size, Share, Trends and Forecast by Product Type, Distribution Channel, and Region, 2025-2033

India Pepperoni Market Size and Share:

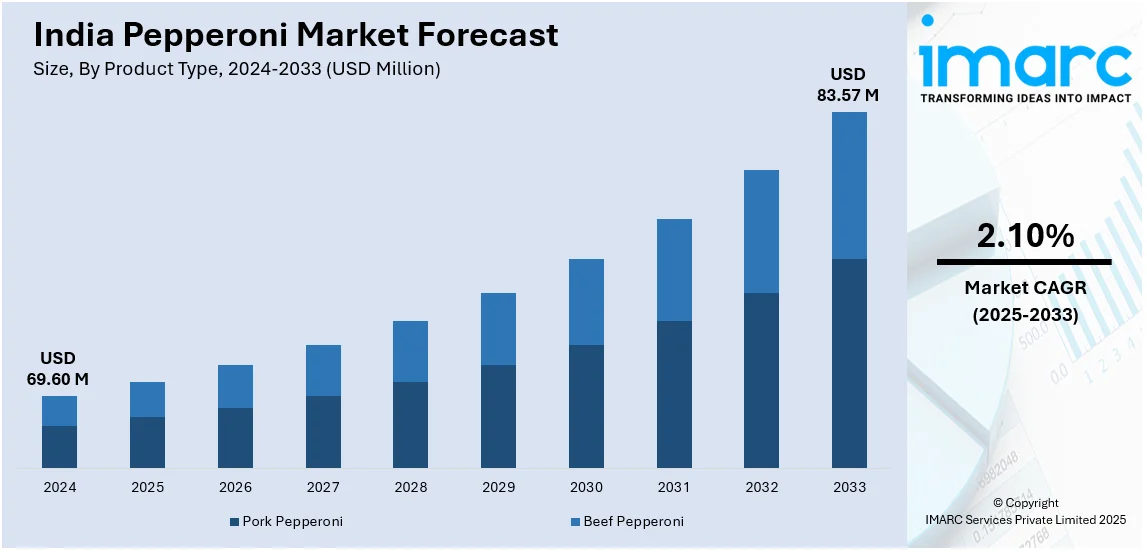

The India pepperoni market size reached USD 69.60 Million in 2024 Looking forward, IMARC Group expects the market to reach USD 83.57 Million by 2033, exhibiting a growth rate (CAGR) of 2.10% during 2025-2033. The market is driven by the rising western-style food adoption, increasing fast-food consumption, rapid urbanization, growing disposable incomes, expanding cold chain infrastructure, ongoing innovations in chicken and plant-based alternatives, and evolving regulatory support.

|

Report Attribute

|

Key Statistics

|

|---|---|

|

Base Year

|

2024

|

|

Forecast Years

|

2025-2033

|

|

Historical Years

|

2019-2024

|

| Market Size in 2024 | USD 69.60 Million |

| Market Forecast in 2033 | USD 83.57 Million |

| Market Growth Rate (2025-2033) | 2.10% |

India Pepperoni Market Trends:

Growing Demand for Chicken and Plant-Based Alternatives

The pepperoni market in India experiences a growing demand for chicken-based and plant-based options because customers follow dietary norms and religious mandates alongside rising health awareness. In line with this, the traditional pork or beef composition of pepperoni faces increased competition because India has many Hindu and Muslim followers who want non-pork and halal-certified options. Moreover, the food industry and quick-service restaurants (QSRs) as well as frozen food segments have embraced chicken pepperoni as a popular market choice. The increasing popularity of vegetarianism and flexitarian diets promotes the development of plant-based pepperoni as a suitable replacement. For instance, in July 2024, Plantaway, an award-winning Indian brand, introduced plant-based pepperoni and sausages. Made from premium pea protein and free from preservatives, these products cater to consumers seeking healthier, environmentally conscious alternatives. Besides this, manufacturers use soy and pea proteins together with jackfruit-based ingredients to develop food products that duplicate the appearance and flavor of regular pepperoni. Furthermore, the world is moving towards sustainable and ethical meat alternatives which matches this market trend. As a result, the increased funding for plant-based protein startups and improved distribution networks enhance accessibility to alternative meat products, driving greater consumer adoption and expanding the India pepperoni market share.

To get more information on this market, Request Sample

Expansion of Cold Chain and Processed Meat Infrastructure

The development of India's cold chain logistics infrastructure and processed meat facilities are significantly driving the India pepperoni market growth. In line with this, the increasing market demand for frozen and ready-to-eat (RTE) food requires efficient refrigeration systems to support growth. For example, the Department for Promotion of Industry and Internal Trade (DPIIT) reported that India's cold chain sector, valued at approximately ₹2 lakh crore, is projected to reach ₹5 lakh crore by 2030, driven by innovations and infrastructure development. Concurrently, the Indian government along with the private sector operates significant investments into cold chain networks which lead to reduced post-production losses and maintain steady processed meat product quality including pepperoni. Additionally, large-scale food retailers together with QSR chains and online food delivery platforms gain market expansion for their pepperoni-based products through this market development. In confluence with this, the enhancement of packaging technology through vacuum-sealing and modified atmosphere packaging (MAP) boosts pepperoni storage duration which attracts both retailers and consumers to buy this product. Furthermore, the processed meat market of India is experiencing expanding availability and product variety for pepperoni which satisfies traditional and emerging consumer tastes, thereby enhancing the India pepperoni market outlook.

India Pepperoni Market Segmentation:

IMARC Group provides an analysis of the key trends in each segment of the market, along with forecasts at the region level for 2025-2033. Our report has categorized the market based on product type and distribution channel.

Product Type Insights:

- Pork Pepperoni

- Beef Pepperoni

The report has provided a detailed breakup and analysis of the market based on the product type. This includes pork pepperoni and beef pepperoni.

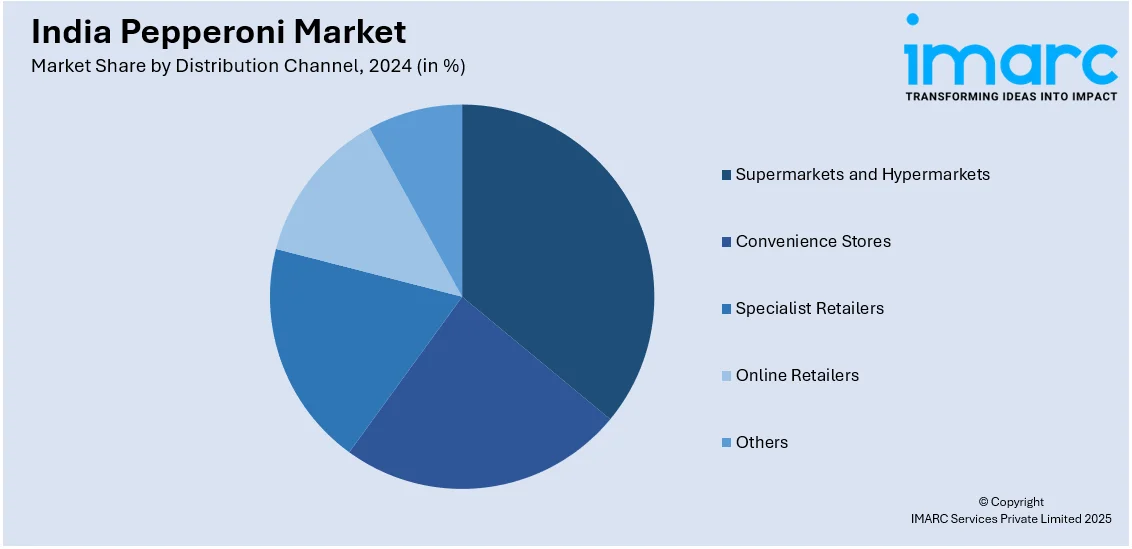

Distribution Channel Insights:

- Supermarkets and Hypermarkets

- Convenience Stores

- Specialist Retailers

- Online Retailers

- Others

A detailed breakup and analysis of the market based on the distribution channel have also been provided in the report. This includes supermarkets and hypermarkets, convenience stores, specialist retailers, online retailers, and others.

Regional Insights:

- North India

- South India

- East India

- West India

The report has also provided a comprehensive analysis of all the major regional markets, which include North, South, East and West India.

Competitive Landscape:

The market research report has also provided a comprehensive analysis of the competitive landscape. Competitive analysis such as market structure, key player positioning, top winning strategies, competitive dashboard, and company evaluation quadrant has been covered in the report. Also, detailed profiles of all major companies have been provided.

India Pepperoni Market News:

- In July 2024, Plantaway expanded its meat alternatives range by launching plant-based pepperoni and sausages. Made from premium pea protein and free from preservatives, the pepperoni offers 16 grams of protein per serving and is rich in dietary fiber. These products are available through Plantaway's website and food delivery platforms like Swiggy and Zomato in major cities, including Mumbai, Delhi NCR, Bangalore, Chennai, Pune, and Hyderabad.

- In December 2023, Pune-based startup The Daily Cut announced the plans to launch ‘Pepperoni but Desi’ in 2024, by blending four Indian chilies with classic pepperoni. This innovation caters to the growing demand for spice-infused cold cuts, expanding India's premium charcuterie market and appealing to fusion-flavor-seeking consumers.

India Pepperoni Market Report Coverage:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2024 |

| Historical Period | 2019-2024 |

| Forecast Period | 2025-2033 |

| Units | Million USD |

| Scope of the Report |

Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Product Types Covered | Pork Pepperoni, Beef Pepperoni |

| Distribution Channels Covered | Supermarkets and Hypermarkets, Convenience Stores, Specialist Retailers, Online Retailers, Others |

| Regions Covered | North India, South India, East India, West India |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Questions Answered in This Report:

- How has the India pepperoni market performed so far and how will it perform in the coming years?

- What is the breakup of the India pepperoni market on the basis of product type?

- What is the breakup of the India pepperoni market on the basis of distribution channel?

- What is the breakup of the India pepperoni market on the basis of region?

- What are the various stages in the value chain of the India pepperoni market?

- What are the key driving factors and challenges in the India pepperoni?

- What is the structure of the India pepperoni market and who are the key players?

- What is the degree of competition in the India pepperoni market?

Key Benefits for Stakeholders:

- IMARC’s industry report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, market forecasts, and dynamics of the India pepperoni market from 2019-2033.

- The research report provides the latest information on the market drivers, challenges, and opportunities in the India pepperoni market.

- Porter's five forces analysis assist stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyze the level of competition within the India pepperoni industry and its attractiveness.

- Competitive landscape allows stakeholders to understand their competitive environment and provides an insight into the current positions of key players in the market.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)