India Perfume Market Size, Share, Trends and Forecast by Perfume Type, End User, and Region, 2026-2034

India Perfume Market Summary:

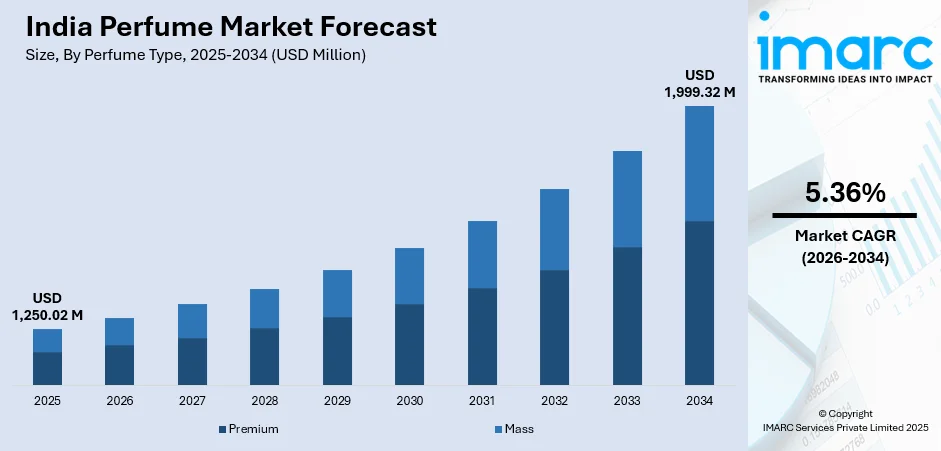

The India perfume market size was valued at USD 1,250.02 Million in 2025 and is projected to reach USD 1,999.32 Million by 2034, growing at a compound annual growth rate of 5.36% from 2026-2034.

The market is driven by rising disposable incomes, increasing urbanization, and growing consumer awareness about personal grooming and luxury fragrances. Expanding retail infrastructure, including organized retail outlets and e-commerce platforms, is enhancing product accessibility. The influence of social media and celebrity endorsements is shaping consumer preferences toward premium and niche fragrance offerings. Additionally, the growing middle-class population and evolving lifestyle aspirations are contributing to the expanding India perfume market share.

Key Takeaways and Insights:

- By Perfume Type: Premium dominates the market with a share of 58% in 2025, driven by rising aspirational consumer demand, increasing brand consciousness, and growing gifting culture during festivals and occasions.

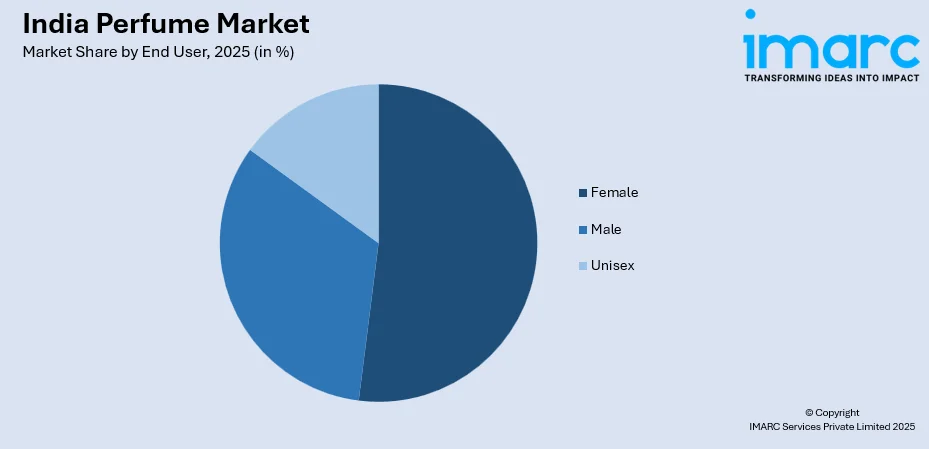

- By End User: Female leads the market with a share of 52% in 2025, owing to higher spending propensity on grooming products, extensive product variety, and strong influence of fashion trends.

- By Region: North India represents the market with a share of 31% in 2025, driven by concentration of metropolitan cities including Delhi-NCR, greater purchasing power, and premium retail infrastructure presence.

- Key Players: The India perfume market exhibits a fragmented competitive landscape, with international luxury brands competing alongside domestic manufacturers. Participants differentiate through product innovation, celebrity collaborations, and digital marketing strategies.

To get more information on this market Request Sample

The India perfume market is experiencing robust growth driven by fundamental shifts in consumer behaviour and economic development. Rising disposable incomes across urban and semi-urban regions are enabling consumers to allocate greater spending toward personal care and luxury products. The expanding middle-class population, coupled with increasing urbanization, is creating a substantial consumer base with aspirational purchasing patterns. Growing awareness about personal grooming and hygiene is establishing fragrance usage as an essential component of daily routines. As per sources, in 2025, Velvetor, a new luxury perfume brand, launched in India combining European craftsmanship with local scent preferences, signaling rising investor confidence in the premium fragrance space. Moreover, the influence of Western lifestyle trends, amplified through social media platforms and digital content, is reshaping consumer preferences toward branded and premium fragrance offerings. Additionally, the evolving gifting culture during festivals, weddings, and corporate occasions is contributing to sustained demand across various price segments. The proliferation of organized retail outlets and e-commerce platforms is further enhancing product accessibility and market penetration nationwide.

India Perfume Market Trends:

Premiumization and Niche Fragrance Adoption

The Indian fragrance industry is witnessing a significant shift toward premium and niche perfume segments as consumers increasingly prioritize quality over quantity. Discerning buyers are seeking unique scent profiles that reflect individual personality and style preferences. The growing appreciation for artisanal craftsmanship and exclusive ingredients is driving demand for luxury and boutique fragrance offerings. In December 2024, French luxury fragrance house Diptyque entered India by opening its first immersive retail store at Chanakya Mall, New Delhi, highlighting rising demand for premium and niche perfumes among Indian consumers. Furthermore, consumers are demonstrating willingness to invest in higher-priced products that offer long-lasting performance and distinctive olfactory experiences.

Digital Commerce and Omnichannel Retail Expansion

The fragrance retail landscape is undergoing transformation through the rapid expansion of e-commerce platforms and omnichannel distribution strategies. Online shopping has emerged as a preferred channel, offering consumers convenience, extensive product variety, and access to international brands previously unavailable in physical stores. In 2025, prestige fragrance brand Creed partnered with LUXASIA to deepen its presence in India through both luxury e-commerce platforms like Tata Cliq and physical boutiques, illustrating omnichannel growth in premium perfume retail. Moreover, virtual try-on technologies and personalized recommendation algorithms are enhancing the digital shopping experience for fragrance products. Brands are investing in immersive online experiences, including detailed scent descriptions and curated discovery sets, to overcome traditional barriers to online perfume purchasing.

Indigenous and Sustainable Fragrance Preferences

Growing consumer consciousness about sustainability and cultural heritage is driving interest in indigenous fragrance ingredients and eco-friendly formulations. Traditional Indian attars and natural botanical extracts are gaining renewed appreciation among consumers seeking authentic and culturally rooted scent experiences. In February 2025, Indian attars made from natural botanicals gained renewed popularity among eco conscious consumers, highlighting growing preference for sustainable, heritage-based fragrance formulations in India. Furthermore, the demand for clean, cruelty-free, and environmentally responsible fragrance products is increasing among environmentally conscious consumers. Brands incorporating sustainable packaging solutions and transparent sourcing practices are resonating with value-driven buyers.

Market Outlook 2026-2034:

The India perfume market is projected to witness substantial revenue growth during the forecast period, driven by continued economic development and evolving consumer preferences. Rising urbanization rates and expanding middle-class population will create sustained demand across mass and premium segments. The proliferation of organized retail infrastructure and e-commerce penetration will enhance product accessibility in tier-two and tier-three cities. Increasing brand awareness through digital marketing initiatives and celebrity endorsements will strengthen consumer engagement. The market generated a revenue of USD 1,250.02 Million in 2025 and is projected to reach a revenue of USD 1,999.32 Million by 2034, growing at a compound annual growth rate of 5.36% from 2026-2034.

India Perfume Market Report Segmentation:

|

Segment Category |

Leading Segment |

Market Share |

|

Perfume Type |

Premium |

58% |

|

End User |

Female |

52% |

|

Region |

North India |

31% |

Perfume Type Insights:

- Premium

- Mass

Premium dominates with a market share of 58% of the total India perfume market in 2025.

The premium commands the leading position in the India perfume market, driven by the growing aspirational consumer base seeking luxury fragrance experiences. Rising disposable incomes and increasing exposure to international brands through travel and digital media are fueling demand for high-end offerings. Consumers in metropolitan cities demonstrate strong preference for premium products that offer superior longevity, sophisticated scent compositions, and prestigious brand associations. According to reports, Titan’s Fragrances Division reported that online perfume sales in India surged 25–30%, reflecting rising consumer adoption of e-commerce channels for premium and luxury fragrances.

The segment benefits from expanding organized retail infrastructure including exclusive brand boutiques, department stores, and premium shopping destinations across major cities. E-commerce platforms have further democratized access to luxury fragrances, enabling consumers beyond metropolitan markets to purchase premium offerings. Brand marketing initiatives featuring celebrity endorsements and influencer collaborations strengthen consumer engagement and aspirational appeal. The growing emphasis on personal expression and self-care among younger demographics continues driving sustained demand for premium fragrance products nationwide.

End User Insights:

Access the comprehensive market breakdown Request Sample

- Female

- Male

- Unisex

Female leads with a share of 52% of the total India perfume market in 2025.

The female dominates the market, reflecting higher engagement with personal care and grooming products among women consumers. The extensive variety of fragrance options catering to diverse preferences, occasions, and moods drives sustained purchasing behaviour. Increasing workforce participation among women and growing financial independence are enabling greater spending on premium personal care products. The influence of fashion trends, celebrity endorsements, and social media content shapes fragrance preferences and purchasing decisions among female consumers.

Women consumers demonstrate sophisticated understanding of fragrance categories, actively seeking products aligned with seasonal preferences, professional requirements, and social occasions. The segment benefits from continuous product innovation with brands launching diverse scent profiles ranging from floral and fruity compositions to oriental and woody offerings. Marketing campaigns specifically targeting female audiences through lifestyle content and beauty influencers strengthen brand connections. The growing culture of self-gifting and personal indulgence further supports sustained purchasing patterns within this segment.

Regional Insights:

- North India

- West and Central India

- South India

- East and Northeast India

North India dominates with a market share of 31% of the total India perfume market in 2025.

North India holds the dominant regional position in the perfume market, driven by the concentration of major metropolitan centers including Delhi-NCR and surrounding urban areas. High population density, superior purchasing power, and well-developed retail infrastructure support robust demand across product categories. The region benefits from strong fashion and lifestyle influences, with consumers demonstrating early adoption of premium and trending fragrance offerings. As per sources, in October 2024, Indian fragrance brand Nisara opened its first dedicated perfume store in Pacific Mall, Delhi, reflecting rising regional demand for premium and lifestyle fragrance shopping experiences in North India.

The region serves as a trendsetting market influencing fragrance preferences across other parts of the country through cultural and media influence. Seasonal variations create diverse demand patterns with consumers seeking lighter fragrances during summers and intense compositions during winters. The presence of international airports and business hubs exposes consumers to global fragrance trends, driving demand for imported and luxury offerings. Growing penetration of e-commerce platforms in tier-two cities within the region further expands market reach and consumer accessibility.

Market Dynamics:

Growth Drivers:

Why is the India Perfume Market Growing?

Rising Disposable Incomes and Middle-Class Expansion

The sustained growth in disposable incomes across Indian households is fundamentally transforming consumer spending patterns toward lifestyle and personal care products. The expanding middle-class population, particularly in urban and semi-urban regions, is demonstrating increased willingness to allocate budgets toward non-essential products including fragrances. According to reports, India’s private consumption nearly doubled to USD 2.1 Trillion in 2024, reflecting rising consumer spending on discretionary categories such as beauty, personal care, and fragrances. Moreover, economic development and employment growth are creating consumer segments with discretionary spending capacity previously unavailable. The aspiration to adopt premium lifestyle products as markers of social status and personal success is driving fragrance adoption across income segments.

Urbanization and Evolving Lifestyle Patterns

Rapid urbanization across India is creating concentrated consumer markets with access to organized retail infrastructure and diverse product offerings. Urban consumers demonstrate higher awareness about personal grooming standards and international fragrance trends through digital media exposure. As per sources, 55% of prestige beauty brands’ sales in India came from non-metro cities, highlighting rising consumer aspiration, discretionary spending, and growth opportunities outside major metropolitan regions. Furthermore, the lifestyle transformation accompanying urban migration includes adoption of daily fragrance usage as an essential grooming routine. Metropolitan environments with professional work settings create demand for personal presentation products including quality fragrances. Additionally, increasing social interactions and entertainment activities in urban settings drive occasion-based fragrance purchasing patterns.

Digital Influence and E-Commerce Proliferation

The pervasive influence of social media platforms and digital content is reshaping consumer awareness and preferences regarding fragrance products. Celebrity endorsements, influencer marketing, and brand storytelling through digital channels are creating aspirational demand among younger demographics. According to sources in 2025, Rare Beauty engaged Indian influencer Ankush Bahuguna to promote its global fragrance launch, illustrating how brands leverage digital creators to drive aspirational awareness and engagement among young Indian consumers. Moreover, the expansion of e-commerce platforms has democratized access to international and premium fragrance brands previously limited to metropolitan markets. Online retail offers consumers extensive product variety, detailed information, and convenient purchasing experiences that overcome traditional retail limitations.

Market Restraints:

What Challenges the India Perfume Market is Facing?

High Price Sensitivity in Mass Market Segments

The significant price sensitivity among large consumer segments limits penetration of premium and international fragrance brands beyond metropolitan markets. Many consumers prioritize essential spending categories over discretionary personal care purchases, restricting market expansion potential. The substantial price differential between mass and premium offerings creates barriers for consumers seeking upgrades. Counterfeit products at lower price points further distort market dynamics.

Limited Fragrance Culture in Rural Markets

Traditional fragrance preferences in rural and semi-urban markets differ significantly from urban consumption patterns, limiting adoption of modern perfume products. Lower awareness about contemporary fragrance offerings and limited retail accessibility constrains market penetration in these regions. Cultural preferences for traditional scents and attars compete with modern perfume formulations. Infrastructure limitations in distribution create additional accessibility barriers.

Seasonal and Occasion-Dependent Demand Patterns

The fragrance market experiences significant demand fluctuations based on seasonal factors and festive occasions, creating planning challenges for manufacturers and retailers. Gift-driven purchasing concentrated around festivals creates uneven demand patterns throughout the year. Climate variations across regions influence fragrance preferences and usage patterns. These fluctuations impact inventory management and supply chain efficiency.

Competitive Landscape:

The India perfume market features a dynamic competitive environment characterized by the presence of established international luxury houses, domestic conglomerates, and emerging niche fragrance brands. Market participants employ diverse strategies including product innovation, distribution expansion, celebrity partnerships, and digital marketing initiatives to capture consumer attention. Competition occurs across multiple dimensions including price positioning, brand prestige, fragrance innovation, and retail presence. International brands leverage global heritage and premium positioning while domestic players capitalize on local market understanding and distribution reach. The growing direct-to-consumer channel is enabling emerging brands to establish market presence without traditional retail infrastructure.

Recent Developments:

- In May 2025, French luxury brand CHANEL Fragrance & Beauty expanded its footprint in India by launching products on Nykaa’s online and offline channels, including Mumbai, Bengaluru, and Chandigarh stores. The move improves access to premium perfumes nationwide, reaching over 40 Million customers through e-commerce and physical retail.

India Perfume Market Report Scope:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2025 |

| Historical Period | 2020-2025 |

| Forecast Period | 2026-2034 |

| Units | Million USD |

| Scope of the Report | Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Perfume Types Covered | Premium, Mass |

| End Users Covered | Female, Male, Unisex |

| Regions Covered | North India, West and Central India, South India, East and Northeast India |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Questions Answered in This Report

The India perfume market size was valued at USD 1,250.02 Million in 2025.

The India perfume market is expected to grow at a compound annual growth rate of 5.36% from 2026-2034 to reach USD 1,999.32 Million by 2034.

Premium held the largest market share, driven by rising aspirational consumer demand, increasing disposable incomes, growing brand consciousness among urban populations, and strong gifting culture during festivals and special occasions.

Key factors driving the India perfume market include rising disposable incomes across urban and semi-urban regions, expanding middle-class population, increasing urbanization, growing personal grooming awareness, and proliferation of e-commerce and organized retail channels.

Major challenges include high price sensitivity among mass market consumers, limited fragrance culture and retail infrastructure in rural regions, presence of counterfeit products, seasonal demand fluctuations, and traditional preference competition in certain segments.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)