India Peritoneal Dialysis Market Size, Share, Trends and Forecast by Type, Product, and Region, 2025-2033

India Peritoneal Dialysis Market Overview:

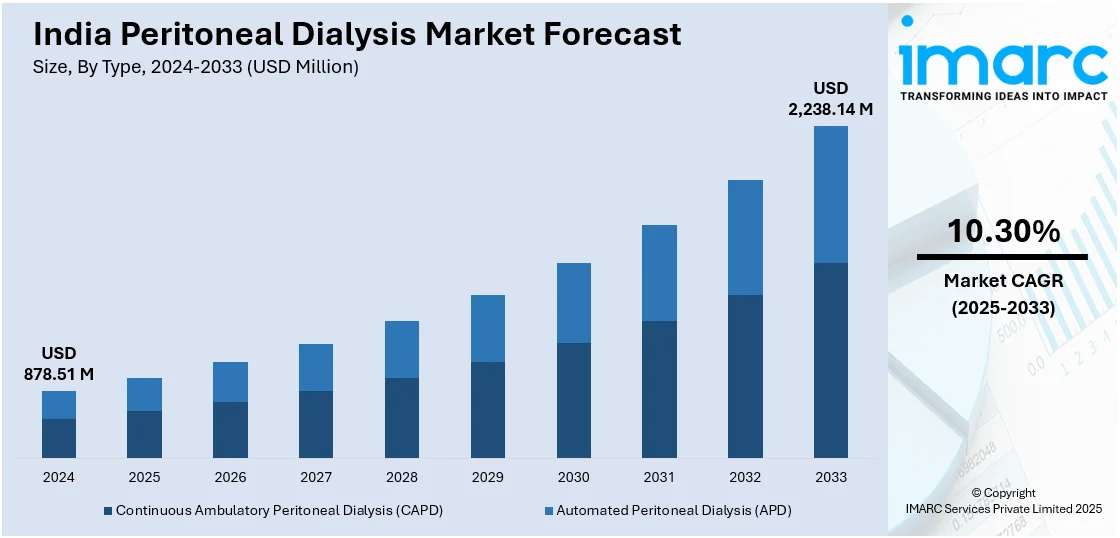

The India peritoneal dialysis market size reached USD 878.51 Million in 2024. Looking forward, IMARC Group expects the market to reach USD 2,238.14 Million by 2033, exhibiting a growth rate (CAGR) of 10.30% during 2025-2033. The market is being driven by rising chronic kidney disease prevalence, increasing diabetes and hypertension cases, government-led healthcare initiatives, growing adoption of home-based dialysis, technological advancements in dialysis solutions and equipment, and the push for cost-effective, locally manufactured alternatives to improve accessibility across urban and rural regions.

|

Report Attribute

|

Key Statistics

|

|---|---|

|

Base Year

|

2024 |

|

Forecast Years

|

2025-2033

|

|

Historical Years

|

2019-2024

|

| Market Size in 2024 | USD 878.51 Million |

| Market Forecast in 2033 | USD 2,238.14 Million |

| Market Growth Rate 2025-2033 | 10.30% |

India Peritoneal Dialysis Market Trends:

Growing Burden of Chronic Kidney Disease (CKD) and Diabetes

One of the prime market drivers is the increasing prevalence of Chronic Kidney Disease (CKD), which in turn is directly linked to the rise in diabetes and hypertension. India is now one of the leading countries in terms of prevalence of diabetes, with more than 100 million diabetics as of 2024. Diabetes is among the top causes of end-stage renal disease (ESRD), which tends to require dialysis. Since CKD develops silently and tends to be diagnosed at advanced stages, most patients are left with the sole alternative of renal replacement therapy. Peritoneal dialysis provides a less infrastructure-heavy alternative for such patients, especially those living in semi-urban and rural areas where hemodialysis centers are less accessible. The convenience and relatively low capital expenditure of home-based treatments have made peritoneal dialysis an attractive choice. In addition to this, the heavy burden of undiagnosed or untreated hypertension, another major cause of CKD, is also fueling early-stage interventions and awareness of dialysis options, driving demand as well as early take-up of peritoneal dialysis solutions in India.

To get more information on this market, Request Sample

Technological Advancements and Innovations in Dialysis Equipment and Solutions

Another key force driving the market is the fast pace of technology change in dialysis systems, which has improved to become safer, more effective, and more user-friendly, on account of medical device innovation, health digitization, and the growing influence of global and domestic dialysis technology vendors. Advances in automated peritoneal dialysis (APD) machines that enable overnight treatments during sleep have not only enhanced quality of life but also minimized the treatment burden. The machines are also associated with remote patient monitoring, cloud-based tracking of data, and real-time alert systems that allow nephrologists to step in promptly in case of any complications. Additionally, advancements in biocompatible dialysis fluids, including low-glucose degradation product (GDP) solutions, have resulted in enhanced patient outcomes and fewer side effects related to the long-term use of peritoneal dialysis.

India Peritoneal Dialysis Market Segmentation:

IMARC Group provides an analysis of the key trends in each segment of the market, along with forecasts at the region/country level for 2025-2033. Our report has categorized the market based on type and product.

Type Insights:

- Continuous Ambulatory Peritoneal Dialysis (CAPD)

- Automated Peritoneal Dialysis (APD)

The report has provided a detailed breakup and analysis of the market based on the type. This includes continuous ambulatory peritoneal dialysis (CAPD) and automated peritoneal dialysis (APD).

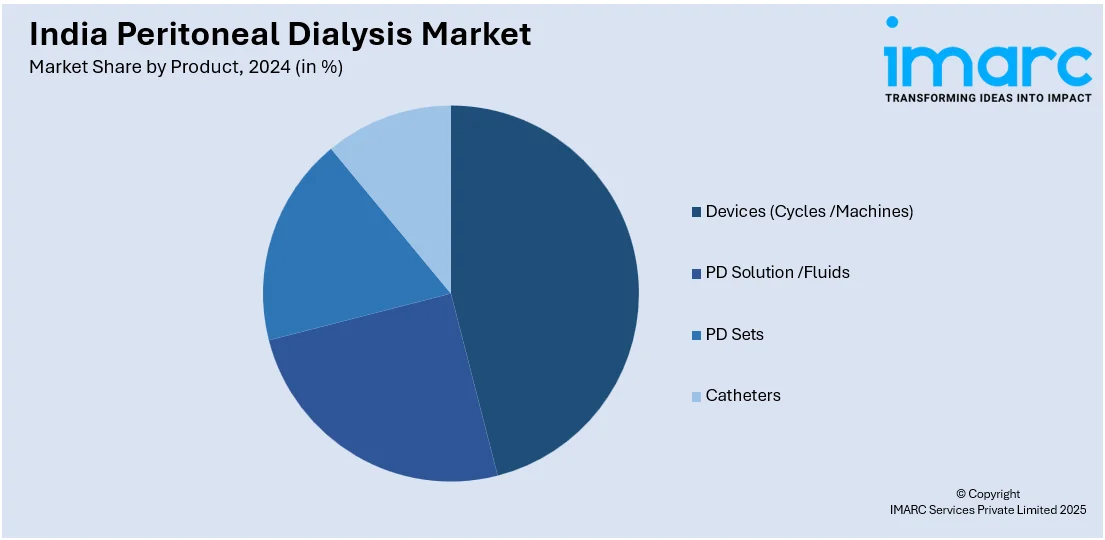

Product Insights:

- Devices (Cycles /Machines)

- PD Solution /Fluids

- PD Sets

- Catheters

A detailed breakup and analysis of the market based on the product have also been provided in the report. This includes devices (cycles /machines), PD solutions/fluids, PD sets, and catheters.

Regional Insights:

- North India

- South India

- East Indi

- West India

The report has also provided a comprehensive analysis of all the major regional markets, which include North India, South India, East India, and West India.

Competitive Landscape:

The market research report has also provided a comprehensive analysis of the competitive landscape. Competitive analysis such as market structure, key player positioning, top winning strategies, competitive dashboard, and company evaluation quadrant has been covered in the report. Also, detailed profiles of all major companies have been provided.

India Peritoneal Dialysis Market News:

- March 2024: Mitra Industries, based in Faridabad, introduced an innovative triple-chambered peritoneal dialysis (PD) bag designed to enhance patient care for those undergoing peritoneal dialysis. This new PD solution features a near-neutral pH and low glucose degradation products (GDPs), addressing concerns associated with traditional acidic PD solutions that can adversely affect the peritoneal membrane's functionality. The introduction of this advanced PD bag aims to improve treatment efficacy and patient outcomes for individuals with chronic kidney disease (CKD).

- April 2023: The Government of Kerala introduced a free peritoneal dialysis scheme to benefit end-stage kidney disease patients. This initiative allows patients to perform dialysis at home, reducing hospital visits and associated costs. The program aims to improve the quality of life for approximately 3,000 patients statewide, particularly those in remote areas.

India Peritoneal Dialysis Market Report Coverage:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2024 |

| Historical Period | 2019-2024 |

| Forecast Period | 2025-2033 |

| Units | Million USD |

| Scope of the Report | Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Types Covered | Continuous Ambulatory Peritoneal Dialysis (CAPD), Automated Peritoneal Dialysis (APD) |

| Products Covered | Devices (Cycles /Machines), PD Solution /Fluids, PD Sets, Catheters |

| Regions Covered | North India, South India, East India, West India |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Benefits for Stakeholders:

- IMARC’s industry report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, market forecasts, and dynamics of the India peritoneal dialysis market from 2019-2033.

- The research report provides the latest information on the market drivers, challenges, and opportunities in the India peritoneal dialysis market.

- Porter's five forces analysis assist stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyze the level of competition within the India peritoneal dialysis industry and its attractiveness.

- Competitive landscape allows stakeholders to understand their competitive environment and provides an insight into the current positions of key players in the market.

Key Questions Answered in This Report

The peritoneal dialysis market in India was valued at USD 878.51 Million in 2024.

The India peritoneal dialysis market is projected to exhibit a CAGR of 10.30% during 2025-2033, reaching a value of USD 2,238.14 Million by 2033.

The growth of the India peritoneal dialysis market is driven by rising cases of chronic kidney disease (CKD), increasing geriatric population, and growing awareness of home-based dialysis solutions. Additionally, favorable government initiatives, improved healthcare infrastructure, and the cost-effectiveness of peritoneal dialysis over hemodialysis are boosting adoption. Technological advancements and greater availability of automated systems also support market expansion.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)