India Personal Finance Software Market Size, Share, Trends and Forecast by Product Type, End User, and Region, 2025-2033

India Personal Finance Software Market Overview:

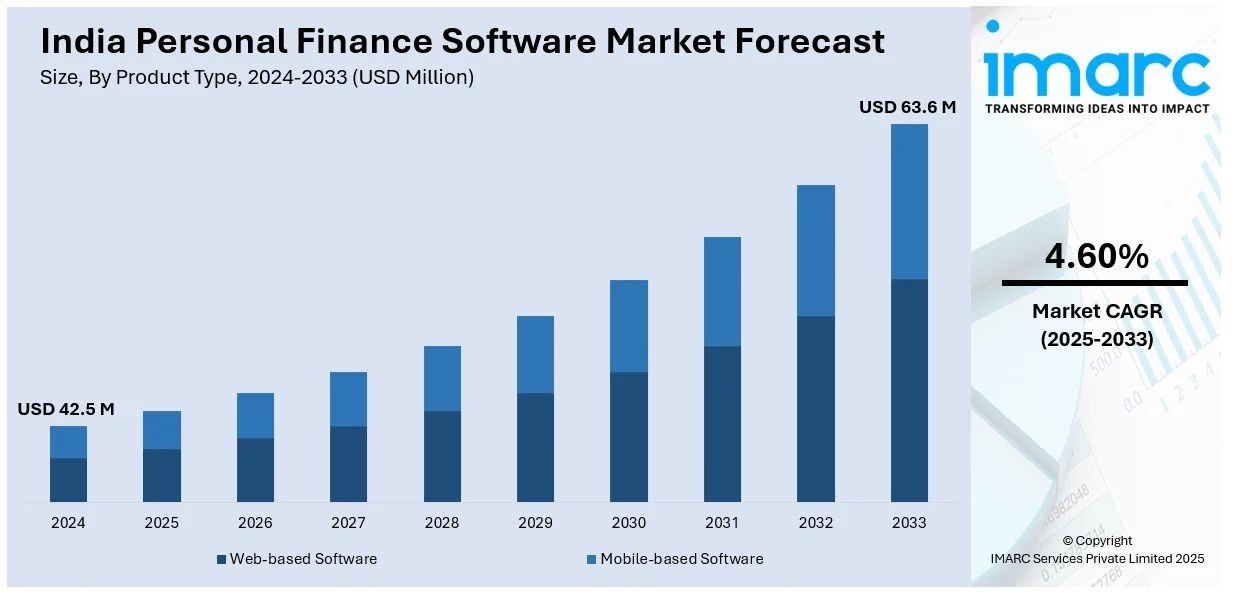

The India Personal Finance Software Market size reached USD 42.5 Million in 2024. Looking forward, IMARC Group expects the market to reach USD 63.6 Million by 2033, exhibiting a growth rate (CAGR) of 4.60% during 2025-2033. The market is advancing due to the expansion of digital payment infrastructure, rising financial literacy initiatives, escalating smartphone penetration, government-led fintech innovations, and growing awareness of financial management tools, enabling individuals to efficiently track expenses, budget effectively, and optimize investment decisions through user-friendly digital solutions.

|

Report Attribute

|

Key Statistics

|

|---|---|

|

Base Year

|

2024 |

|

Forecast Years

|

2025-2033

|

|

Historical Years

|

2019-2024

|

| Market Size in 2024 | USD 42.5 Million |

| Market Forecast in 2033 | USD 63.6 Million |

| Market Growth Rate 2025-2033 | 4.60% |

India Personal Finance Software Market Trends:

Proliferation of Digital Payments

India's economic landscape has seen a revolutionary change, with digital payments now being the preferred method of transactions. This rapid digitization has propelled the need for personal finance software as people look for smarter methods to monitor, manage, and optimize their finances. Since most transactions are now done online, users need solutions that are easy to integrate with digital payments in order to track spending, group expenses, and offer real-time insights. Personal finance software helps users achieve more financial control with features such as automated budgeting, expense monitoring, and setting financial goals. In addition, the incorporation of digital payment information into personal finance software enables users to make informed financial decisions, improving financial literacy and long-term money management. As India's digital payments ecosystem continues to grow, the market for personal finance software is expected to witness robust growth, meeting the escalating demand for financial awareness and planning.

To get more information on this market, Request Sample

Implementation of Financial Literacy Initiatives

The rising focus on financial literacy in India is having a profound influence on the market for personal finance software. The Government of India has initiated various programs to raise financial awareness, such as the New India Literacy Programme (NILP) (2022-2027), which supports the National Education Policy 2020. With a budget of INR 1,037.90 crore, NILP targets enhancing core financial knowledge, numeracy skills, and digital literacy. As financial literacy improves, more people are realizing the use of personal finance software that assists with budgeting, investing planning, and cost tracking. This change is causing demand for personal finance software solutions, as customers are looking for digital platforms to manage their finances effectively. The proliferation of online payments is developing a positive environment for the market to grow. With the Indian government continuing to drive digital financial inclusion and consumers becoming increasingly proactive in managing their finances, the India personal finance software market is on the cusp of immense development. Firms that have intuitive, AI-based, and mobile-supported personal finance apps stand to gain the most from this new environment.

India Personal Finance Software Market Segmentation:

IMARC Group provides an analysis of the key trends in each segment of the market, along with forecasts at the region/country level for 2025-2033. Our report has categorized the market based on product type and end user.

Product Type Insights:

- Web-based Software

- Mobile-based Software

The report has provided a detailed breakup and analysis of the market based on the product type. This includes web-based software and mobile-based software.

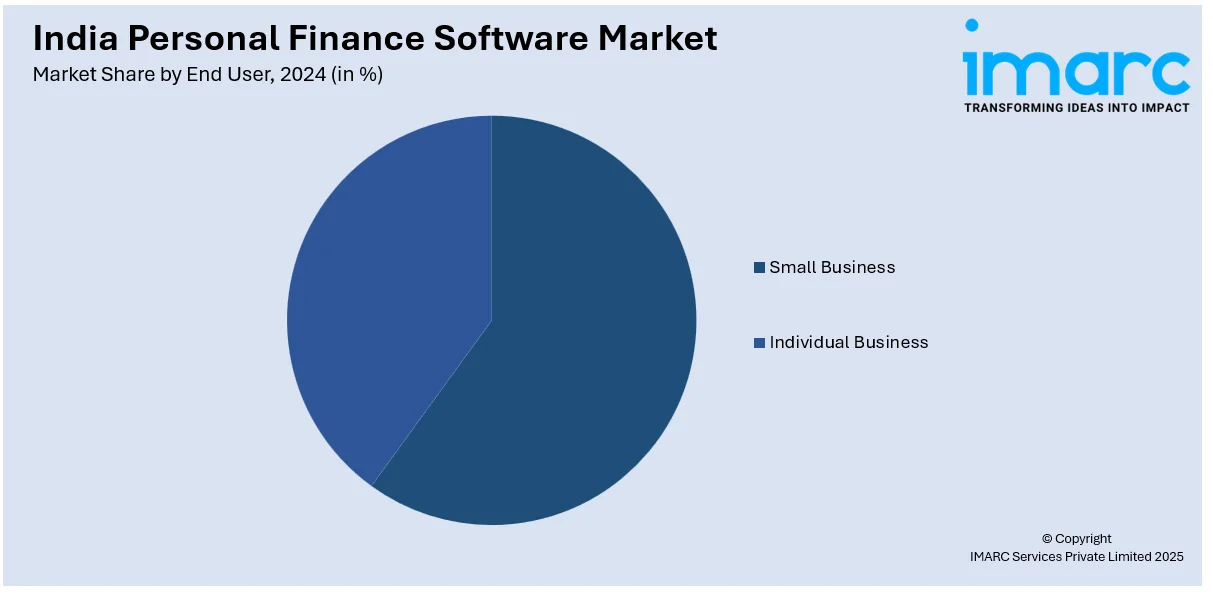

End User Insights:

- Small Business

- Individual Business

A detailed breakup and analysis of the market based on the end user have also been provided in the report. This includes small business and individual business.

Regional Insights:

- North India

- South India

- East India

- West India

The report has also provided a comprehensive analysis of all the major regional markets, which include North India, South India, East India, and West India.

Competitive Landscape:

The market research report has also provided a comprehensive analysis of the competitive landscape. Competitive analysis such as market structure, key player positioning, top winning strategies, competitive dashboard, and company evaluation quadrant has been covered in the report. Also, detailed profiles of all major companies have been provided.

India Personal Finance Software Market News:

- January 2025: The Employees' Provident Fund Organisation (EPFO) is expected to roll out EPFO 3.0 by June 2025, allowing for direct provident fund withdrawal using ATM cards. This move improves financial access and promotes the use of digital financial instruments. Therefore, it leads to the development of India's personal finance software sector by incorporating such features.

- October 2024: Motilal Oswal Mutual Fund launched the Digital India scheme, an NFO for investments in businesses that are gaining from India's digital growth. This effort enhances the adoption of financial technology, which translates into greater awareness and availability of digital financial instruments. With more people using digital investment platforms, the need for personal finance software solutions increases.

India Personal Finance Software Market Report Coverage:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2024 |

| Historical Period | 2019-2024 |

| Forecast Period | 2025-2033 |

| Units | Million USD |

| Scope of the Report |

Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Product Types Covered | Web-based Software, Mobile-based Software |

| End Users Covered | Small Business, Individual Business |

| Regions Covered | North India, South India, East India, West India |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Benefits for Stakeholders:

- IMARC’s industry report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, market forecasts, and dynamics of the India personal finance software market from 2019-2033.

- The research report provides the latest information on the market drivers, challenges, and opportunities in the India personal finance software market.

- Porter's five forces analysis assist stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyze the level of competition within the India personal finance software industry and its attractiveness.

- Competitive landscape allows stakeholders to understand their competitive environment and provides an insight into the current positions of key players in the market.

Key Questions Answered in This Report

The India personal finance software market was valued at USD 42.5 Million in 2024.

The India personal finance software market is projected to exhibit a CAGR of 4.60% during 2025-2033, reaching a value of USD 63.6 Million by 2033.

The India personal finance software market is driven by rising digital literacy, increasing smartphone penetration, and growing awareness about financial planning. The shift toward cashless transactions, demand for expense tracking, and interest in investment management tools are encouraging consumers to adopt personal finance software for better control over their financial health.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)