India PET Bottle Market Size, Share, Trends and Forecast by Capacity, Color, Technology, Distribution Channel, End Use, and Region, 2025-2033

Market Overview:

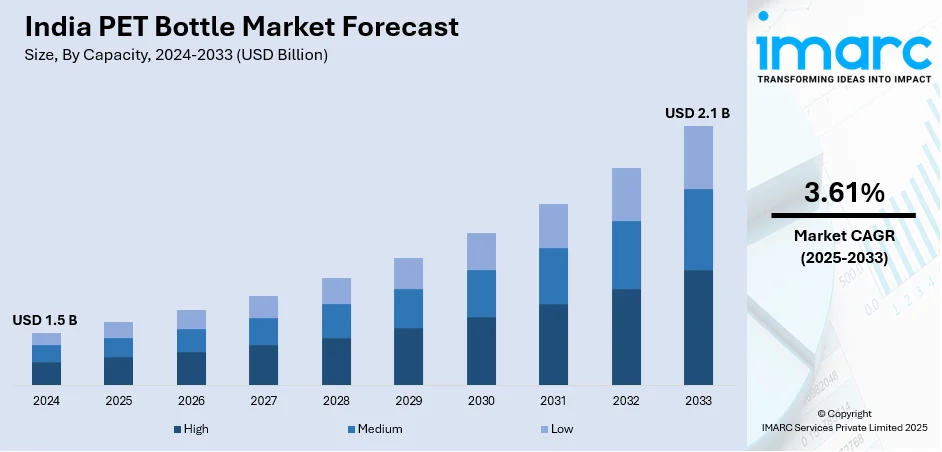

India PET bottle market size reached USD 1.5 Billion in 2024. Looking forward, IMARC Group expects the market to reach USD 2.1 Billion by 2033, exhibiting a growth rate (CAGR) of 3.61% during 2025-2033. Partnerships between packaging manufacturers, beverage producers, and recyclers are fostering a more integrated and sustainable approach, which is primarily augmenting the market growth across the country.

|

Report Attribute

|

Key Statistics

|

|---|---|

|

Base Year

|

2024 |

|

Forecast Years

|

2025-2033

|

|

Historical Years

|

2019-2024

|

| Market Size in 2024 | USD 1.5 Billion |

| Market Forecast in 2033 | USD 2.1 Billion |

| Market Growth Rate (2025-2033) | 3.61% |

A polyethylene terephthalate bottle, commonly referred to as a PET bottle, is a type of plastic container extensively employed for packaging beverages and other liquids. Constructed from a thermoplastic polymer resin resulting from the combination of terephthalic acid and ethylene glycol, this polymer exhibits robust, lightweight, and durable characteristics, making it an excellent choice for crafting easily transportable and storable bottles. Moreover, its widespread use is attributed to its cost-effectiveness and straightforward manufacturing process. Various techniques, including injection molding, stretch blow molding, and extrusion blow molding, are employed in its production, enabling the creation of bottles in diverse sizes, shapes, and colors. Furthermore, its recyclability is a notable feature, as PET bottles can be melted down and repurposed to manufacture new bottles, contributing to waste reduction and resource conservation.

To get more information on this market, Request Sample

India PET Bottle Market Trends:

The India PET bottle market is currently experiencing a transformative phase, driven by a convergence of factors that underscore the dynamic evolution of packaging and beverage industries. Firstly, technological advancements have emerged as a primary driver, reshaping the PET bottle landscape. Additionally, innovations in manufacturing processes, such as advanced injection molding and blow molding techniques, are enhancing production efficiency, allowing for a diverse range of bottle sizes, shapes, and designs. Besides this, with increasing environmental awareness, the industry is witnessing a shift towards eco-friendly practices. Moreover, manufacturers are exploring and implementing methods to reduce the environmental impact of PET bottles, including lightweighting designs to minimize material usage and promoting recycling initiatives. Additionally, the pandemic-induced preference for single-use, hygienic packaging has further accelerated this trend. Collaboration across the supply chain is emerging as a key trend in the India PET bottle market. Moreover, from technological advancements and sustainability initiatives to the growing beverage industry's impact and collaborative supply chain approaches, the PET bottle sector is adapting to meet the demands of a changing market landscape. This, in turn, is expected to fuel the market growth across the country in the coming years.

India PET Bottle Market Segmentation:

IMARC Group provides an analysis of the key trends in each segment of the market, along with forecasts at the country level for 2025-2033. Our report has categorized the market based on capacity, color, technology, distribution channel, and end use.

Capacity Insights:

- High

- Medium

- Low

The report has provided a detailed breakup and analysis of the market based on the capacity. This includes high, medium, and low.

Color Insights:

- Transparent

- Coloured

A detailed breakup and analysis of the market based on the color have also been provided in the report. This includes transparent and coloured.

Technology Insights:

- Stretch Blow Molding

- Injection Molding

- Extrusion Blow Molding

- Thermoforming

- Others

The report has provided a detailed breakup and analysis of the market based on the technology. This includes stretch blow molding, injection molding, extrusion blow molding, thermoforming, and others.

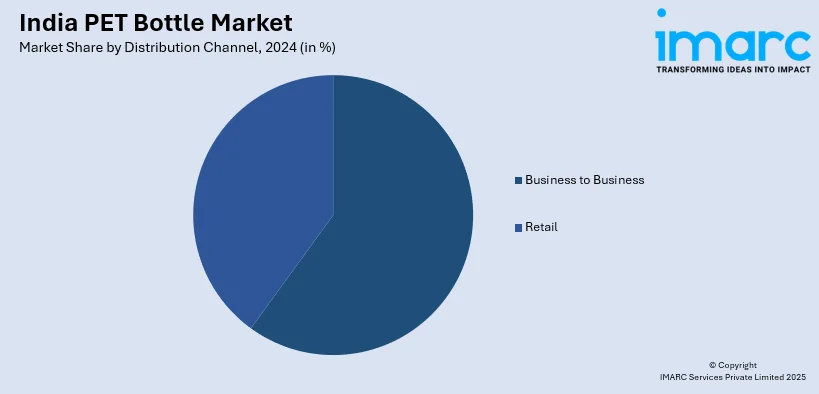

Distribution Channel Insights:

- Business to Business

- Retail

- Supermarkets and Hypermarkets

- Convenience Stores

- Online

- Others

A detailed breakup and analysis of the market based on the distribution channel have also been provided in the report. This includes business to business and retail (supermarkets and hypermarkets, convenience stores, online, and others).

End Use Insights:

- Packaged Water

- Carbonated Soft Drinks

- Food Bottles and Jars

- Non-Food Bottles and Jars

- Fruit Juice

- Beer

- Others

The report has provided a detailed breakup and analysis of the market based on end use. This includes packaged water, carbonated soft drinks, food bottles and jars, non-food bottles and jars, fruit juice, beer, and others.

Regional Insights:

- North India

- West and Central India

- South India

- East and Northeast India

The report has also provided a comprehensive analysis of all the major regional markets, which include North India, West and Central India, South India, and East and Northeast India.

Competitive Landscape:

The market research report has also provided a comprehensive analysis of the competitive landscape. Competitive analysis such as market structure, key player positioning, top winning strategies, competitive dashboard, and company evaluation quadrant has been covered in the report. Also, detailed profiles of all major companies have been provided.

India PET Bottle Market Report Coverage:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2024 |

| Historical Period | 2019-2024 |

| Forecast Period | 2025-2033 |

| Units | Billion USD |

| Scope of the Report | Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Capacities Covered | High, Medium, Low |

| Colors Covered | Transparent, Coloured |

| Technologies Covered | Stretch Blow Molding, Injection Molding, Extrusion Blow Molding, Thermoforming, Others |

| Distribution Channels Covered |

|

| End Uses Covered | Packaged Water, Carbonated Soft Drinks, Food Bottles and Jars, Non-Food Bottles and Jars, Fruit Juice, Beer, Others |

| Regions Covered | North India, West and Central India, South India, East and Northeast India |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Benefits for Stakeholders:

- IMARC’s industry report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, market forecasts, and dynamics of the India PET bottle market from 2019-2033.

- The research report provides the latest information on the market drivers, challenges, and opportunities in the India PET bottle market.

- Porter's five forces analysis assist stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyze the level of competition within the India PET bottle industry and its attractiveness.

- Competitive landscape allows stakeholders to understand their competitive environment and provides an insight into the current positions of key players in the market.

Key Questions Answered in This Report

The PET bottle market in India was valued at USD 1.5 Billion in 2024.

The PET bottle market in India is projected to grow at a CAGR of 3.61% during 2025-2033, reaching a value of USD 2.1 Billion by 2033.

The market growth is driven by technological advancements in molding processes, rising demand for lightweight and durable packaging, and increasing adoption of recyclable solutions. Additionally, sustainability initiatives, growing consumption of beverages, and collaborative efforts between manufacturers, beverage producers, and recyclers are further fueling demand for PET bottles across India.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)