India Pet Funeral Services Market Size, Share, Trends and Forecast by Pet Type, Service Type, and Region, 2025-2033

India Pet Funeral Services Market Overview:

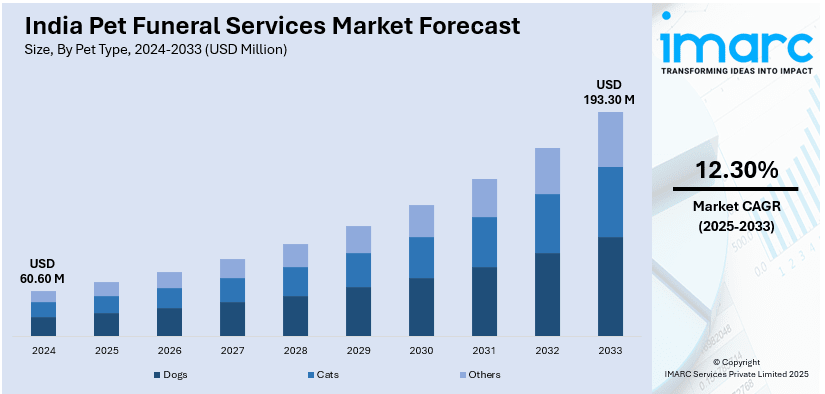

The India pet funeral services market size reached USD 60.60 Million in 2024. Looking forward, IMARC Group expects the market to reach USD 193.30 Million by 2033, exhibiting a growth rate (CAGR) of 12.30% during 2025-2033. The India pet funeral services market share is influenced by rising pet crematoriums, increased awareness about ethical aftercare, and expanding veterinary care. Moreover, urbanization is reducing burial space, driving cremation adoption across the region.

|

Report Attribute

|

Key Statistics

|

|---|---|

|

Base Year

|

2024

|

|

Forecast Years

|

2025-2033

|

|

Historical Years

|

2019-2024

|

| Market Size in 2024 | USD 60.60 Million |

| Market Forecast in 2033 | USD 193.30 Million |

| Market Growth Rate (2025-2033) | 12.30% |

India Pet Funeral Services Market Trends:

Rising Awareness About Ethical Pet Aftercare

Rising awareness about ethical pet aftercare is significantly influencing the India pet funeral services market outlook. More pet parents are recognizing the importance of respectful and environmentally responsible end-of-life arrangements for their pets. Increasing media coverage is highlighting improper pet disposal's environmental impact, encouraging ethical cremation and burial services. Government regulations on animal waste disposal are promoting structured and legal funeral solutions for deceased pets. Growing pet humanization is making pet parents prioritize dignified aftercare, similar to traditional human funeral practices. Awareness campaigns by animal welfare organizations are educating pet parents about sustainable and compassionate aftercare options. Expanding veterinary networks are informing pet parents about ethical cremation and burial services during end-of-life discussions. Businesses and governments are offering specialized pet memorial services, encouraging emotional closure and respectful pet remembrance. For instance, in December 2024, Hyderabad inaugurated its pet crematorium, Paws to Heaven, in Gopanapalli, offering a dignified and eco-friendly cremation option. This facility highlighted the rising demand for structured pet aftercare services, particularly in urban areas. The growing trend of responsible pet ownership is making ethical end-of-life care a priority for pet parents, further strengthening the market growth.

To get more information on this market, Request Sample

Increasing Availability of Pet Crematoriums

Rising availability of crematoriums are ensuring pet parents can access dignified and professional end-of-life services. Rising urbanization is reducing available land for traditional pet burials, increasing crematorium demand. Government regulations on pet disposal are encouraging pet parents to choose ethical cremation services. Expanding veterinary care is prolonging pet lifespans, eventually increasing the need for professional funeral solutions. Pet parents are opting for cremation due to environmental concerns and space limitations in cities. To cater the growing demand, in March 2025, Jamshedpur opened its first pet crematorium in Jubilee Park, offering an eco-friendly option for pet parents. The gas-wired facility accommodates pets up to 50 kg, with a cremation fee of ₹3,000. Located near Marine Drive, it provides a dignified alternative to burials, addressing challenges faced by apartment residents, as highlighted by Jamshedpur Kennel Club. More crematoriums are offering specialized services like biodegradable urns and digital memorials for grieving pet parents. Technological advancements are improving accessibility through online booking platforms and doorstep pet body pickups. Rising disposable incomes are enabling pet parents to afford premium and customized cremation services, thereby strengthening the India pet funeral services market growth. Increased pet humanization is making pet parents more willing to invest in compassionate funeral arrangements. As a result, more companies are entering the market, further expanding pet cremation services across urban and semi-urban regions.

India Pet Funeral Services Market Segmentation:

IMARC Group provides an analysis of the key trends in each segment of the market, along with forecasts at the regional level for 2025-2033. Our report has categorized the market based on pet type and service type.

Pet Type Insights:

- Dogs

- Cats

- Others

The report has provided a detailed breakup and analysis of the market based on the pet type. This includes dogs, cats, and others.

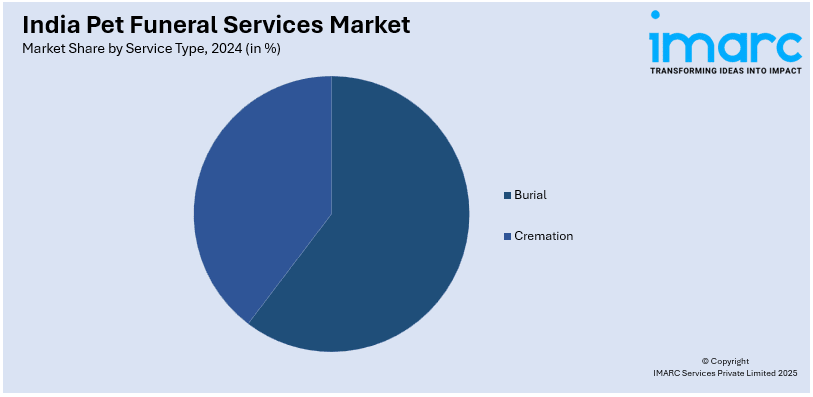

Service Type Insights:

- Burial

- Cremation

- Communal

- Partitioned

- Private

A detailed breakup and analysis of the market based on the service type have also been provided in the report. This includes burial and cremation (communal, partitioned, private).

Regional Insights:

- North India

- South India

- East India

- West India

The report has also provided a comprehensive analysis of all the major regional markets, which include North India, South India, East India, and West India.

Competitive Landscape:

The market research report has also provided a comprehensive analysis of the competitive landscape. Competitive analysis such as market structure, key player positioning, top winning strategies, competitive dashboard, and company evaluation quadrant has been covered in the report. Also, detailed profiles of all major companies have been provided.

India Pet Funeral Services Market News:

- In January 2025, Delhi’s first eco-friendly pet crematorium opened in Dwarka, featuring two CNG-operated furnaces handling up to 10 pets and 15 strays daily. Managed by the Municipal Corporation of Delhi (MCD), it offers cremation services at ₹2,000–₹3,000, ensuring dignified pet aftercare. A green memorial park is also being developed, allowing pet parents to plant trees in memory of their pets.

- In September 2023, Mumbai’s Brihanmumbai municipal corporation (BMC) inaugurated an eco-friendly pet crematorium in Malad (West), using piped natural gas (PNG) for a 50 kg capacity combustion system. Operated with support from Mahanagar Gas Limited, the facility runs daily from 10 AM to 6 PM and offered free cremation services to all Mumbai residents, promoting sustainable pet aftercare.

India Pet Funeral Services Market Report Coverage:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2024 |

| Historical Period | 2019-2024 |

| Forecast Period | 2025-2033 |

| Units | Million USD |

| Scope of the Report |

Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Pet Types Covered | Dogs, Cats, Others |

| Service Types Covered |

|

| Regions Covered | North India, South India, East India, West India |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Questions Answered in This Report:

- How has the India pet funeral services market performed so far and how will it perform in the coming years?

- What is the breakup of the India pet funeral services market on the basis of pet type?

- What is the breakup of the India pet funeral services market on the basis of service type?

- What is the breakup of the India pet funeral services market on the basis of region?

- What are the various stages in the value chain of the India pet funeral services market?

- What are the key driving factors and challenges in the India pet funeral services?

- What is the structure of the India pet funeral services market and who are the key players?

- What is the degree of competition in the India pet funeral services market?

Key Benefits for Stakeholders:

- IMARC’s industry report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, market forecasts, and dynamics of the India pet funeral services market from 2019-2033.

- The research report provides the latest information on the market drivers, challenges, and opportunities in the India pet funeral services market.

- Porter's five forces analysis assist stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyze the level of competition within the India pet funeral services industry and its attractiveness.

- Competitive landscape allows stakeholders to understand their competitive environment and provides an insight into the current positions of key players in the market.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)