India PET and PBT Resins Market Size, Share, Trends and Forecast by PET Resins Application, PET Resins Application, and Region, 2025-2033

India PET and PBT Resins Market Overview:

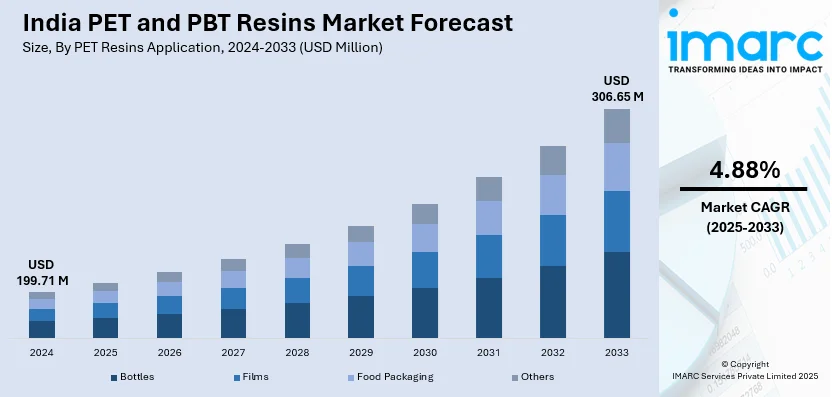

The India PET and PBT resins market size reached USD 199.71 Million in 2024. Looking forward, IMARC Group expects the market to reach USD 306.65 Million by 2033, exhibiting a growth rate (CAGR) of 4.88% during 2025-2033. The rising demand from the packaging, automotive, and electronics industries, growing adoption of sustainable and recyclable plastics, and increasing government regulations promoting eco-friendly materials are contributing to the market growth.

|

Report Attribute

|

Key Statistics

|

|---|---|

|

Base Year

|

2024 |

|

Forecast Years

|

2025-2033

|

|

Historical Years

|

2019-2024

|

| Market Size in 2024 | USD 199.71 Million |

| Market Forecast in 2033 | USD 306.65 Million |

| Market Growth Rate 2025-2033 | 4.88% |

India PET and PBT Resins Market Trends:

Rising Demand for Sustainable and Recyclable PET Resins

The growing environmental consciousness among Indian consumers and the implementation of stringent environmental regulations by government bodies are propelling the demand for sustainable PET resins, with industries like packaging, FMCG, and textiles increasingly adopting recycled PET (rPET) and biodegradable alternatives to curb plastic waste and lower carbon emissions. The Indian government aims to phase out single-use plastics and boost plastic recycling rates beyond 50% by 2025 under its Plastic Waste Management Rules. Additionally, the Extended Producer Responsibility (EPR) scheme mandates a minimum of 30% recycled plastic content in packaging by 2026, rising to 60% by 2029, driving rPET demand to surpass one million tons by 2031. Major companies, such as Reliance Industries and Indorama Ventures, are also investing in PET recycling infrastructures. By 2030, major beverage companies, such as PepsiCo and Coca-Cola, plan to use only recycled PET packaging, driving innovations in recycling technologies including bottle-to-bottle recycling and chemical depolymerization. In line with India's larger sustainability objectives, this transition to a circular economy is altering the PET resin industry and encouraging innovation in sustainable packaging solutions.

To get more information on this market, Request Sample

Growing Adoption of PBT Resins in Automotive and Electronics

India’s automotive and electronics industries are witnessing a surge in the adoption of Polybutylene Terephthalate (PBT) resins, driven by their superior heat resistance, electrical insulation, and lightweight properties. This trend is particularly pronounced in electric vehicles (EVs) and consumer electronics, where high-performance materials are crucial. India’s EV market, valued at USD 2,361 million in 2024, is projected to reach USD 164,420.4 million by 2033, growing at a CAGR of 57.23% (2025-2033). This rapid expansion is fueling demand for PBT-based components such as battery casings, connectors, and motor housings. The government’s FAME II policy, with an outlay of INR 10,000 crore (USD 1.43 billion), further incentivizes EV adoption and domestic manufacturing. Simultaneously, India's electronics sector is set to achieve USD 300 billion in production and USD 120 billion in exports by 2025-26, accelerating PBT usage in devices, such as laptops, smartphones, and circuit boards. Additionally, automakers are leveraging PBT to replace metal components, enhancing fuel efficiency, and complying with stringent BS-VI emission norms. Leading global players like BASF, SABIC, and Toray Industries, along with domestic manufacturers, are expanding their PBT production capabilities to cater to this rising demand, strengthening India's position in the global engineering plastics market.

India PET and PBT Resins Market Segmentation:

IMARC Group provides an analysis of the key trends in each segment of the market, along with forecasts at the region/country level for 2025-2033. Our report has categorized the market based on PET resins application and PBT resins application.

PET Resins Application Insights:

- Bottles

- Films

- Food Packaging

- Others

The report has provided a detailed breakup and analysis of the market based on the PET resins application. This includes bottles, films, food packaging, and others.

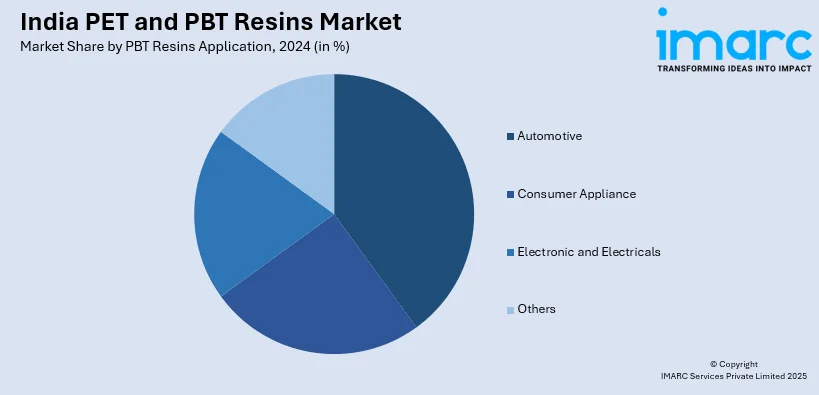

PBT Resins Application Insights:

- Automotive

- Consumer Appliance

- Electronic and Electricals

- Others

A detailed breakup and analysis of the market based on the PBT resins application have also been provided in the report. This includes automotive, consumer appliance, electronic and electricals, and others.

Regional Insights:

- North India

- South India

- East India

- West India

The report has also provided a comprehensive analysis of all the major regional markets, which include North India, South India, East India, and West India.

Competitive Landscape:

The market research report has also provided a comprehensive analysis of the competitive landscape. Competitive analysis such as market structure, key player positioning, top winning strategies, competitive dashboard, and company evaluation quadrant has been covered in the report. Also, detailed profiles of all major companies have been provided.

India PET and PBT Resins Market News:

- March 2025: Bhilwara Energy announced the launch of India’s largest single-site bottle-to-bottle (B2B) recycled PET resin production facility in Rajasthan, with an investment of INR 750 crore. Spanning 95 acres, the plant will recycle 20 million PET bottles daily, producing 100 kilotons of food-grade B2B rPET resin annually.

- March 2025: Bhilwara Energy introduced LNJ GREENPET, a state-of-the-art B2B food-grade PET resin manufacturing facility in Rajasthan’s Tonk district. This facility, the largest of its kind in India, will process 20 million PET bottles per day to produce 100 kilotons of food-grade rPET resin annually.

- May 2024: BASF India Limited expanded the production capacity of its Ultramid® polyamide (PA) and Ultradur® polybutylene terephthalate (PBT) compounding plants in Panoli and Thane, Gujarat, to meet growing domestic demand. The increased capacity is expected to be operational by the second half of 2025. The facility features advanced application equipment and enhanced customer support services.

India PET and PBT Resins Market Report Coverage:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2024 |

| Historical Period | 2019-2024 |

| Forecast Period | 2025-2033 |

| Units | Million USD |

| Scope of the Report |

Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| PET Resins Applications Covered | Bottles, Films, Food Packaging, Others |

| PBT Resins Applications Covered | Automotive, Consumer Appliance, Electronic and Electricals, Others |

| Regions Covered | North India, South India, East India, West India |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Benefits for Stakeholders:

- IMARC’s industry report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, market forecasts, and dynamics of the India PET and PBT resins market from 2019-2033.

- The research report provides the latest information on the market drivers, challenges, and opportunities in the India PET and PBT resins market.

- Porter's five forces analysis assist stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyze the level of competition within the India PET and PBT resins industry and its attractiveness.

- Competitive landscape allows stakeholders to understand their competitive environment and provides an insight into the current positions of key players in the market.

Key Questions Answered in This Report

The PET and PBT resins market in India was valued at USD 199.71 Million in 2024.

The India PET and PBT resins market is projected to exhibit a CAGR of 4.88% during 2025-2033, reaching a value of USD 306.65 Million by 2033.

The India PET and PBT resins market is driven by growing demand in the packaging, automotive, and electronics sectors; rising adoption of sustainable and recyclable plastics; supportive government initiatives like “Make in India”; and expanding R&D for advanced resin applications.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)