India PET Resin Market Size, Share, Trends and Forecast by Type, Application, and Region, 2025-2033

India PET Resin Market Overview:

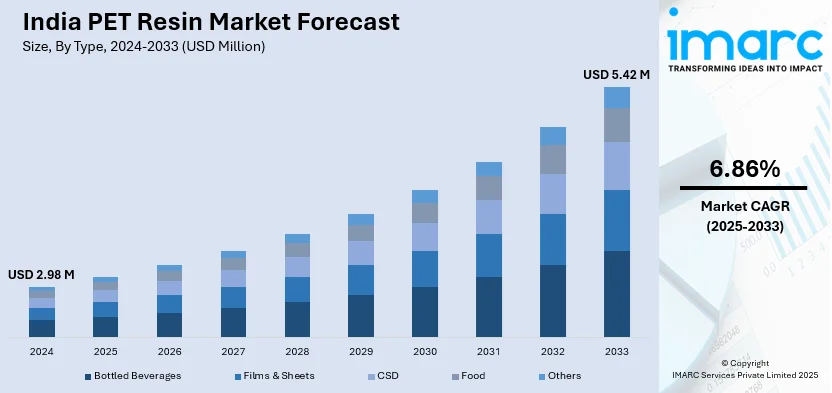

The India PET resin market size reached USD 2.98 Million in 2024. Looking forward, IMARC Group expects the market to reach USD 5.42 Million by 2033, exhibiting a growth rate (CAGR) of 6.86% during 2025-2033. The market is driven by rising demand for sustainable and lightweight packaging in the food, beverage, and pharmaceutical sectors, the expansion of the e-commerce industry, and government initiatives promoting plastic recycling and sustainability.

|

Report Attribute

|

Key Statistics

|

|---|---|

|

Base Year

|

2024 |

|

Forecast Years

|

2025-2033

|

|

Historical Years

|

2019-2024

|

| Market Size in 2024 | USD 2.98 Million |

| Market Forecast in 2033 | USD 5.42 Million |

| Market Growth Rate (2025-2033) | 6.86% |

India PET Resin Market Trends:

Surging Demand from Packaging Sectors

The India PET Resin market is witnessing robust growth due to an escalating demand from the packaging sectors, particularly food, beverage, and pharmaceuticals. Rapid urbanization and rising disposable incomes have led to a dramatic expansion of packaged consumer goods. The beverage industry, a major consumer of PET resin, is growing steadily, thus creating a positive outlook for the beverage packaging segment. In addition, the food processing sector is modernizing quickly with increasing investments in e-commerce and organized retail, further boosting demand for lightweight and durable packaging solutions made from PET resin. According to industry insights, in FY 2022, India's total PET production capacity surpassed 3,400 kilotons, with Reliance Industries Limited as the leading producer at over 1,000 kilotons, followed by IVL Dhunseri as the second-largest at 720 kilotons. This growth is fueled by a need for cost-effective and environmentally friendly packaging materials that meet stringent safety standards. Manufacturers are expanding production capacities and investing in advanced technologies to cater to this growing demand.

To get more information on this market, Request Sample

Sustainability and Circular Economy Initiatives

Sustainability has emerged as a key driver in the India PET Resin market, as both regulators and consumers push for environmentally responsible solutions. One major aspect is the increased use of recycled PET (rPET) in packaging applications. With environmental regulations tightening, the recycling rate for PET in India is expected to rise from around 60% in 2023 to approximately 70% by 2025, reflecting a strong shift towards circular economy practices. Investments in recycling infrastructure have surged, with capital expenditures in green technology and sustainable manufacturing growing by nearly 15% between 2023 and 2025. Furthermore, many global brands are demanding more sustainable packaging to reduce their carbon footprints, prompting manufacturers to innovate by incorporating bio-based additives and advanced recycling technologies. These initiatives not only contribute to environmental conservation but also help companies comply with new government regulations that encourage sustainable practices.

India PET Resin Market Segmentation:

IMARC Group provides an analysis of the key trends in each segment of the market, along with forecasts at the region/country level for 2025-2033. Our report has categorized the market based on type and application.

Type Insights:

- Bottled Beverages

- Films & Sheets

- CSD

- Food

- Others

The report has provided a detailed breakup and analysis of the market based on the type. This includes bottled beverages, films & sheets, CSD, food, and others.

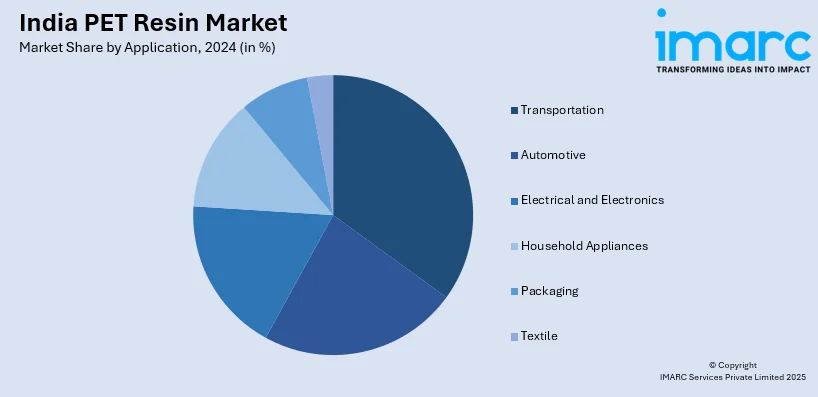

Application Insights:

- Transportation

- Automotive

- Electrical and Electronics

- Household Appliances

- Packaging

- Textile

A detailed breakup and analysis of the market based on the application have also been provided in the report. This includes transportation, automotive, electrical and electronics, household appliances, packaging, and textile.

Regional Insights:

- North India

- South India

- East India

- West India

The report has also provided a comprehensive analysis of all the major regional markets, which include North India, South India, East India, and West India.

Competitive Landscape:

The market research report has also provided a comprehensive analysis of the competitive landscape. Competitive analysis such as market structure, key player positioning, top winning strategies, competitive dashboard, and company evaluation quadrant has been covered in the report. Also, detailed profiles of all major companies have been provided.

India PET Resin Market News:

- October 2024: Magpet Polymers secured a strategic investment of ₹205 crore from British International Investment, the UK government’s development finance institution and impact investor. The funding will support the establishment of India’s largest integrated single-line bottle-to-bottle food-grade recycling facility in Kharagpur, West Bengal.

- January 2024: Shree Renga Polymers allocated ₹100 crore to develop a greenfield PET bottle recycling plant in Karur, Tamil Nadu. The facility will utilize advanced technology to transform used PET bottles into value-added products such as fibers, yarns, resins, and clothing. The initiative aims to expand rPSF production capacity to 130 tons per day, marking a sixfold increase.

India PET Resin Market Report Coverage:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2024 |

| Historical Period | 2019-2024 |

| Forecast Period | 2025-2033 |

| Units | Million USD |

| Scope of the Report |

Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Types Covered | Bottled Beverages, Films & Sheets, CSD, Food, Others |

| Applications Covered | Transportation, Automotive, Electrical and Electronics, Household Appliances, Packaging, Textile |

| Regions Covered | North India, South India, East India, West India |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Questions Answered in This Report:

- How has the India PET resin market performed so far and how will it perform in the coming years?

- What is the breakup of the India PET resin market on the basis of type?

- What is the breakup of the India PET resin market on the basis of application?

- What are the various stages in the value chain of the India PET resin market?

- What are the key driving factors and challenges in the India PET resin market?

- What is the structure of the India PET resin market and who are the key players?

- What is the degree of competition in the India PET resin market?

Key Benefits for Stakeholders:

- IMARC’s industry report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, market forecasts, and dynamics of the India PET resin market from 2019-2033.

- The research report provides the latest information on the market drivers, challenges, and opportunities in the India PET resin market.

- Porter's five forces analysis assist stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyze the level of competition within the India PET resin industry and its attractiveness.

- Competitive landscape allows stakeholders to understand their competitive environment and provides an insight into the current positions of key players in the market.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)