India Pet Sitting Market Size, Share, Trends and Forecast by Pet Type, Service Type, and Region, 2025-2033

India Pet Sitting Market Overview:

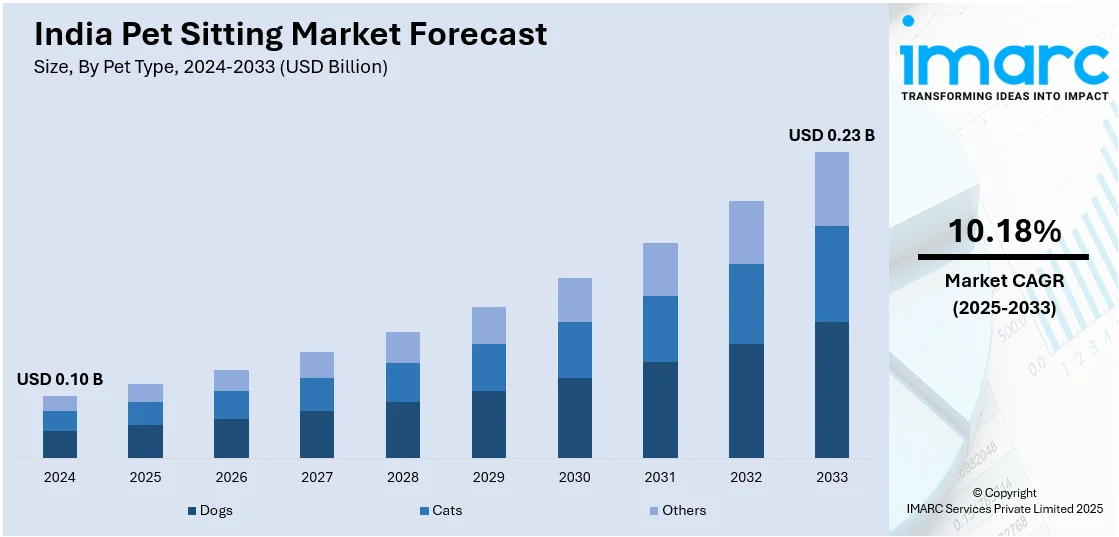

The India pet sitting market size reached USD 0.10 Billion in 2024. Looking forward, IMARC Group expects the market to reach USD 0.23 Billion by 2033, exhibiting a growth rate (CAGR) of 10.18% during 2025-2033. The market is being driven by rising pet ownership, heightening disposable income levels, greater awareness of pet welfare, urban nuclear family lifestyles, and the rising demand for convenient, home-based pet care solutions as pet parents seek reliable, stress-free alternatives to boarding while balancing work, travel, and personal commitments.

|

Report Attribute

|

Key Statistics

|

|---|---|

|

Base Year

|

2024 |

|

Forecast Years

|

2025-2033

|

|

Historical Years

|

2019-2024

|

| Market Size in 2024 | USD 0.10 Billion |

| Market Forecast in 2033 | USD 0.23 Billion |

| Market Growth Rate 2025-2033 | 10.18% |

India Pet Sitting Market Trends:

Urbanization and Changing Lifestyles

India's rapid urbanization is acting as a catalyst for the development of the pet sitting business. According to reports, 40% of the population is projected to reside in urban areas by 2030. With people moving away from rural regions to cities for schooling and work, nuclear families have now become the norm. Unlike traditional joint families where pets could be cared for by multiple family members, urban dwellers often live alone or with just a partner, making it difficult to manage pet care, especially during work hours or travel. This has generated a tangible demand for professional pet sitting services. Also, the growing corporate working culture in cities, such as Bengaluru, Mumbai, and Delhi, comes with long work hours, variable shifts, or regular business travel. These working patterns call for reliable pet care services that can offer companionship, feeding, exercise, and even medical care while the owner is away. Pet sitting is no longer a luxury but a part of good pet keeping. Additionally, the emergence of technology-enabled platforms for pet sitter booking has made the service more convenient and trustworthy. Apps and websites now provide vetted experts, real-time information, and ratings increasing customer trust.

To get more information on this market, Request Sample

Humanization of Pets and Emotional Attachment

Another driver of India's pet sitting market is the expanding humanization of pets and resultant emotional bonding among pet owners with their pets. Over the last few years, pets are gradually considered not as animals but members of the family. This psychological alteration has deeply changed the way human beings engage with pet care such that there has been more expenditure on ensuring pet well-being in their absence through services. The Indian pet owners of today, especially the millennials and Gen Z, are more emotionally attached to their pets than generations before them. They seek caretakers who do not provide merely essential services but also affection and companionship. Therefore, pet sitters are likely to need to grasp pet behavior, provide personal attention, and even replicate the pet owner's lifestyle habits from time to time to avoid causing stress or separation anxiety among pets. This emotional consideration has generated a preference for in-home pet sitting or customized care over conventional kennel care. Owners prefer their pets to stay in their familiar surroundings, eschewing the trauma of moving. In addition, individuals are prepared to pay extra for pet sitters with formal training in animal behavior or veterinary fundamentals, highlighting how emotional attachments are driving spending habits.

India Pet Sitting Market Segmentation:

IMARC Group provides an analysis of the key trends in each segment of the market, along with forecasts at the region/country level for 2025-2033. Our report has categorized the market based on pet type and service type.

Pet Type Insights:

- Dogs

- Cats

- Others

The report has provided a detailed breakup and analysis of the market based on the pet type. This includes dogs, cats, and others.

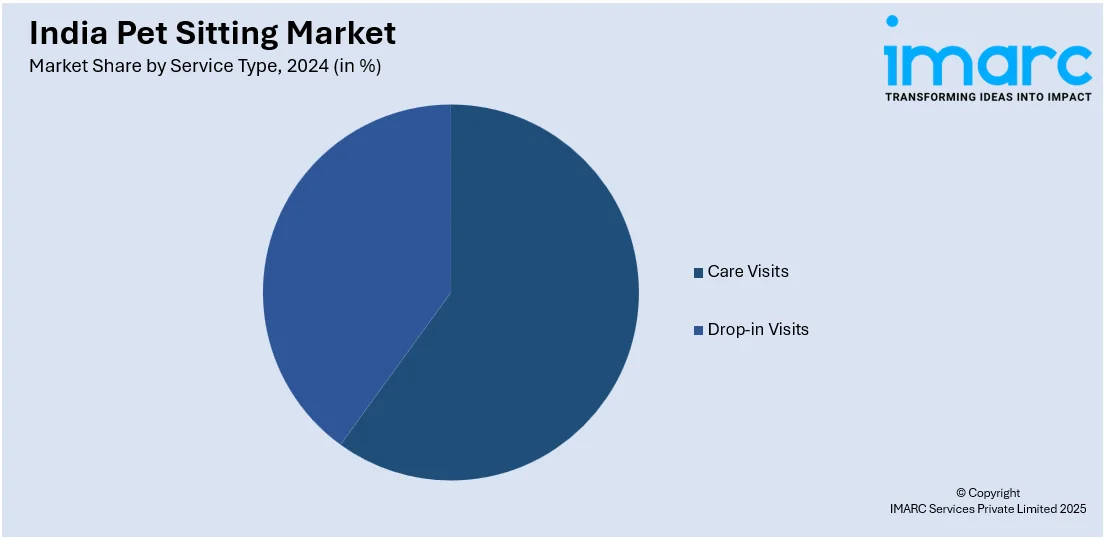

Service Type Insights:

- Care Visits

- Drop-in Visits

A detailed breakup and analysis of the market based on the service type have also been provided in the report. This includes care visits and drop-in visits.

Regional Insights:

- North India

- South India

- East India

- West India

The report has also provided a comprehensive analysis of all the major regional markets, which include North India, South India, East India, and West India.

Competitive Landscape:

The market research report has also provided a comprehensive analysis of the competitive landscape. Competitive analysis such as market structure, key player positioning, top winning strategies, competitive dashboard, and company evaluation quadrant has been covered in the report. Also, detailed profiles of all major companies have been provided.

India Pet Sitting Market News:

- September 2024: Zoivane Pets launched dedicated online communities for dog and cat owners, providing 24/7 access to veterinary advice, training tips, and peer support. By fostering informed and engaged pet owners, such platforms indirectly boost the pet sitting market, as better-informed pet parents are more likely to seek and trust professional pet-sitting services, recognizing their value in comprehensive pet care.

- April 2024: Swiggy introduced the 'Paw-ternity Policy' to support employees in caring for their pets. Key provisions include an additional paid day off for welcoming a new pet, with the option to work from home during the settling-in period. Employees can also utilize casual or sick leave for veterinary appointments and routine vaccinations. Additionally, bereavement leave is provided for grieving the loss of a pet. These measures bolster pet humanization trends, indirectly impacting the pet sitting market as well.

India Pet Sitting Market Report Coverage:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2024 |

| Historical Period | 2019-2024 |

| Forecast Period | 2025-2033 |

| Units | Billion USD |

| Scope of the Report | Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Pet Types Covered | Dogs, Cats, Others |

| Service Types Covered | Care Visits, Drop-in Visits |

| Regions Covered | North India, South India, East India, West India |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Questions Answered in This Report:

- How has the India pet sitting market performed so far and how will it perform in the coming years?

- What is the breakup of the India pet sitting market on the basis of pet type?

- What is the breakup of the India pet sitting market on the basis of service type?

- What are the various stages in the value chain of the India pet sitting market?

- What are the key driving factors and challenges in the India pet sitting market?

- What is the structure of the India pet sitting market and who are the key players?

- What is the degree of competition in the India pet sitting market?

Key Benefits for Stakeholders:

- IMARC’s industry report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, market forecasts, and dynamics of the India pet sitting market from 2019-2033.

- The research report provides the latest information on the market drivers, challenges, and opportunities in the India pet sitting market.

- Porter's five forces analysis assist stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyze the level of competition within the India pet sitting industry and its attractiveness.

- Competitive landscape allows stakeholders to understand their competitive environment and provides an insight into the current positions of key players in the market.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)