India Petrochemicals Market Size, Share, Trends and Forecast by Type, Application, End Use Industry, and Region, 2026-2034

India Petrochemicals Market Overview:

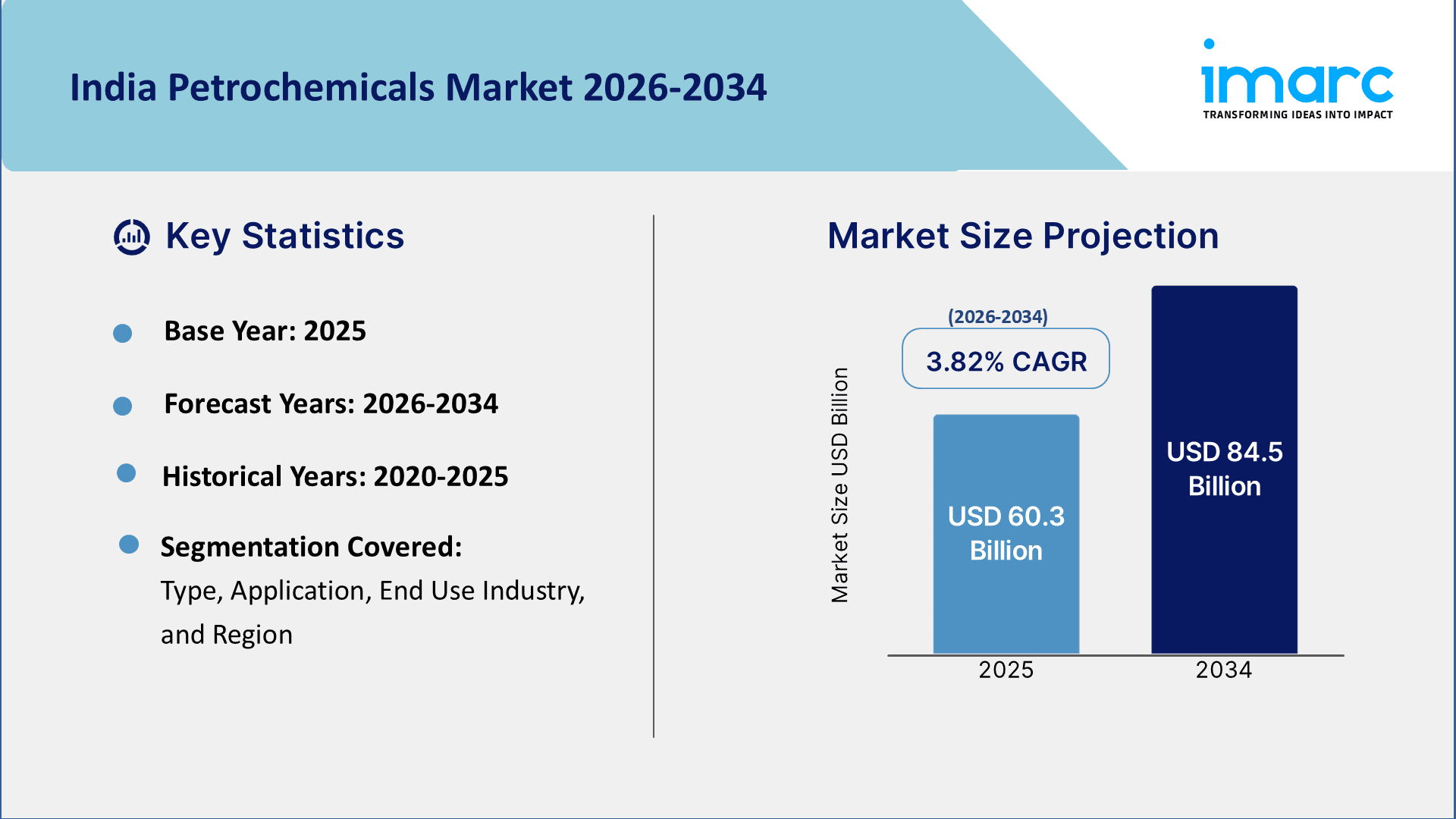

The India petrochemicals market size reached USD 60.3 Billion in 2025. Looking forward, IMARC Group expects the market to reach USD 84.5 Billion by 2034, exhibiting a growth rate (CAGR) of 3.82% during 2026-2034. The market is driven by rising demand for plastics and polymers in packaging, automotive, and construction sectors, alongside government initiatives including the PLI scheme. Growing urbanization, increasing disposable income, and a shift toward sustainable bio-based chemicals further expands the India petrochemicals market share. Export opportunities and refinery expansions also contribute to industry expansion.

To get more information on the market, Request Sample

Key Takeaways:

- The petrochemicals market in India reached USD 60.3 billion in 2025.

- By 2034, the market value is anticipated to reach USD 84.5 billion, with a CAGR of nearly 3.82% from 2026-2034.

- Major growth drivers include increasing demand from end-use industries such as packaging, automotive, and construction, expanding refining and chemical production capacities, supportive government initiatives for self-reliance in petrochemical manufacturing, and rising investments in downstream infrastructure across India.

- Segmentation Highlights:

- Type: Ethylene, Propylene, Butadiene, Benzene, Toluene, Xylene, Methanol, Others.

- Application: Polymers, Paints and Coatings, Solvents, Rubber, Adhesives and Sealants, Surfactants and Dyes, Others.

- End Use Industry: Packaging, Automotive and Transportation, Construction, Electrical and Electronics, Healthcare, Others.

- Regional Insights: North, South, East, and West India are analyzed, with the report highlighting growth drivers and opportunities in each region.

India Petrochemicals Market Trends:

Rising Demand for Sustainable and Bio-based Petrochemicals

The shift toward sustainable and bio-based petrochemical products, driven by increasing environmental awareness and stringent government regulations is majorly driving the India petrochemicals market growth. Companies are investing in bio-based alternatives to conventional plastics, such as biodegradable polymers and bio-polyethylene, to reduce carbon footprints. The government’s push for initiatives such as the Plastic Waste Management Rules and the Extended Producer Responsibility (EPR) framework is accelerating this trend. More than 2 billion tons of municipal waste are generated globally every year, and projections indicate a 70% increase by the year 2050, predominantly in developing countries. With waste management methods such as recycling and energy recovery, helping to control pollution, methane emissions, and climate change, the smart waste management industry is well-positioned to solve some of the biggest problems facing the planet. Implementing circular economy frameworks, such as extended producer responsibility, is essential for minimizing waste, fostering economic development, and confronting global environmental issues. Additionally, consumer preference for eco-friendly packaging in industries such as FMCG, healthcare, and automotive are enhancing demand for green petrochemical solutions. Major players including Reliance Industries and Indian Oil Corporation are expanding their bio-based product portfolios, aligning with global sustainability goals. This trend is expected to grow as India moves toward a circular economy, with innovations in recycling and bio-refineries gaining traction in the petrochemical sector.

Expansion of Petrochemical Capacity to Meet Domestic and Export Demand

India’s petrochemical market is experiencing significant capacity expansion to cater to rising domestic consumption and increasing export opportunities. With a refining representation of approximately 256.816 MMTPA among 23 refineries and a solid petrochemical landscape, India ranks 4th globally (after the USA, China, and Japan) in refining capacity. In order to expand its reserves to 651.8 million metric tonnes (MMT) of crude oil and 1,138.6 billion cubic meters (BCM) of natural gas, India's initiative enhanced planning policy with the Oilfields Amendment Bill 2025 and Hydrocarbon Exploration and Licensing Policy (HELP) aims to increase exploration area to 1 million square kilometers by 2030. With a GVA of INR 2.12 lakh crore (approximately USD 25,542 Million) in 2022-23 and with sizable investments in green fuels, bio-refineries, and hydrogen, India’s petrochemical sector is poised for significant growth and greater global competitiveness. With rapid urbanization, the demand for plastics, polymers, and specialty chemicals is increasing across the packaging, construction, and automotive sectors. To capitalize on this, companies and private players are investing in new production facilities and refinery-integrated petrochemical complexes. The government’s Production-Linked Incentive (PLI) scheme for the chemical sector further supports this expansion. Additionally, India is emerging as a key exporter of petrochemical products to regions such as Southeast Asia and Africa due to competitive pricing and improving production capabilities. This trend is expected to strengthen India’s position as a global petrochemical hub, driven by infrastructure development, foreign investments, and technological advancements in refining processes. Therefore, this is also creating a positive India petrochemicals market outlook.

India Petrochemicals Market Segmentation:

IMARC Group provides an analysis of the key trends in each segment of the market, along with forecasts at the country level for 2026-2034. Our report has categorized the market based on type, application, and end use industry.

Type Insights:

- Ethylene

- Propylene

- Butadiene

- Benzene

- Toluene

- Xylene

- Methanol

- Others

The report has provided a detailed breakup and analysis of the market based on the type. This includes ethylene, propylene, butadiene, benzene, toluene, xylene, methanol, and others.

Application Insights:

- Polymers

- Paints and Coatings

- Solvents

- Rubber

- Adhesives and Sealants

- Surfactants and Dyes

- Others

A detailed breakup and analysis of the market based on the application have also been provided in the report. This includes polymers, paints and coatings, solvents, rubber, adhesives and sealants, surfactants and dyes, and others.

End Use Industry Insights:

- Packaging

- Automotive and Transportation

- Construction

- Electrical and Electronics

- Healthcare

- Others

The report has provided a detailed breakup and analysis of the market based on the end use industry. This includes packaging, automotive and transportation, construction, electrical and electronics, healthcare, and others.

Regional Insights:

- North India

- South India

- East India

- West India

The report has also provided a comprehensive analysis of all the major regional markets, which include North India, South India, East India, and West India.

Competitive Landscape:

The market research report has also provided a comprehensive analysis of the competitive landscape. Competitive analysis such as market structure, key player positioning, top winning strategies, competitive dashboard, and company evaluation quadrant has been covered in the report. Also, detailed profiles of all major companies have been provided.

India Petrochemicals Market News:

- January 07, 2025: Adani Petrochemicals Ltd entered India's petrochemical industry in a tie-up with Thailand's Indorama Resources with the launch of a new company, Valor Petrochemicals Ltd. This will also set up a 2 million-tonne PVC plant in Gujarat by 2027. The initial phase, which is slated to be completed by 2026, has an overall investment of INR 35,000 Crore (around USD 4,217 Million), making it India's largest PVC manufacturing project. This complex use of renewable energy is part of the Adani group’s larger strategy to build an integrated petrochemical hub in India’s growing industrial landscape.

- April 02, 2025: Haldia Petrochemicals Ltd (HPL) announced initiating its USD 10 Billion oil-to-chemical project in Cuddalore district in Tamil Nadu to generate ethylene and propylene, 3.5 million metric tonnes annually, by 2028–2029.

India Petrochemicals Market Report Coverage:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2025 |

| Historical Period | 2020-2025 |

| Forecast Period | 2026-2034 |

| Units | Billion USD |

| Scope of the Report |

Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Types Covered | Ethylene, Propylene, Butadiene, Benzene, Toluene, Xylene, Methanol, Others |

| Applications Covered | Polymers, Paints and Coatings, Solvents, Rubber, Adhesives and Sealants, Surfactants and Dyes, Others |

| End Use Industries Covered | Packaging, Automotive and Transportation, Construction, Electrical and Electronics, Healthcare, Others |

| Regions Covered | North India, South India, East India, West India |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Benefits for Stakeholders:

- IMARC’s industry report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, market forecasts, and dynamics of the India petrochemicals market from 2020-2034.

- The research report provides the latest information on the market drivers, challenges, and opportunities in the India petrochemicals market.

- Porter's five forces analysis assist stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyze the level of competition within the India petrochemicals industry and its attractiveness.

- Competitive landscape allows stakeholders to understand their competitive environment and provides an insight into the current positions of key players in the market.

Key Questions Answered in This Report

The India petrochemicals market was valued at USD 60.3 Billion in 2025.

The India petrochemicals market is expected to exhibit a CAGR of 3.82% during 2025-2033, reaching a value of USD 84.5 Billion by 2034.

The market growth is driven by increasing demand for petrochemical products across various industries such as packaging, automotive, construction, and textiles, coupled with expanding manufacturing activities and infrastructure development.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)