India Petroleum Resins Market Size, Share, Trends and Forecast by Product Type, End User Industry, and Region, 2025-2033

India Petroleum Resins Market Overview:

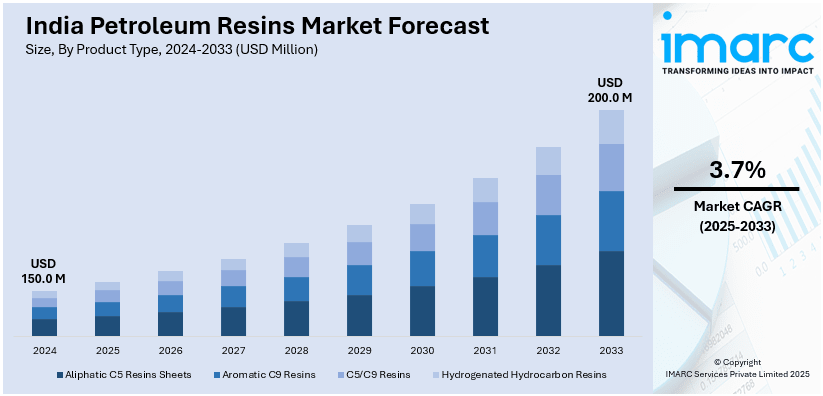

The India petroleum resins market size reached USD 150.0 Million in 2024. Looking forward, IMARC Group expects the market to reach USD 200.0 Million by 2033, exhibiting a growth rate (CAGR) of 3.7% during 2025-2033. The rising demand for adhesives, coatings, and rubber industries, expanding infrastructure projects, increasing automotive production, and growth in packaging are some of the factors propelling the growth of the market. Advancements in resin formulations, import dependency reduction, and regulatory support for domestic manufacturing further boost market expansion.

|

Report Attribute

|

Key Statistics

|

|---|---|

|

Base Year

|

2024 |

|

Forecast Years

|

2025-2033

|

|

Historical Years

|

2019-2024

|

| Market Size in 2024 | USD 150.0 Million |

| Market Forecast in 2033 | USD 200.0 Million |

| Market Growth Rate 2025-2033 | 3.7% |

India Petroleum Resins Market Trends:

Rising Domestic Demand Driving Production Growth

The petroleum resins market in India is expanding as domestic production rises to meet increasing consumption. Industrial applications in adhesives, coatings, and rubber compounding are driving this shift, alongside infrastructure development and manufacturing sector growth. Companies are investing in capacity expansion and efficiency improvements to align with evolving market needs. The focus on self-sufficiency is strengthening supply chains, reducing dependency on imports, and ensuring stable availability for downstream industries. Increased production is also supporting emerging applications in the construction and automotive sectors. With rising end-user demand, manufacturers are adopting advanced refining processes and sustainable sourcing strategies. This ongoing shift highlights the industry's commitment to balancing supply with demand while reinforcing India's role in petroleum-based specialty chemicals. According to industry reports, in the fiscal year 2022, India's production volume of petroleum products reached over 254 Million Metric Tons, marking an increase from approximately 233.5 Million Metric Tons in the fiscal year 2021. Additionally, the consumption volume of these products was around 205 million metric tons in the same period.

To get more information on this market, Request Sample

Strengthening Regional Connectivity for Expansion

Growing cross-border energy cooperation is driving positive developments in the petroleum resins market in India, enhancing supply chain efficiency and export potential. Infrastructure expansion, including pipeline extensions and new storage facilities, is optimizing fuel transportation and reducing costs. These developments are improving logistics for resin production, ensuring a stable raw material supply for downstream industries. Strengthened trade relations are also driving market expansion, positioning India as a key supplier in South Asia’s resin and petrochemical sectors. With improved connectivity, manufacturers are gaining better access to neighboring markets, encouraging investment in production capabilities. The shift towards secure, cost-effective distribution is reinforcing the market’s competitiveness, supporting industries reliant on petroleum resins such as adhesives, coatings, and rubber compounding. For instance, in October 2024, IndianOil and Nepal Oil Corporation signed a framework agreement to expand petroleum infrastructure. Key projects include extending the Motihari-Amlekhgunj Pipeline, building storage terminals in Chitwan, and developing a new Siliguri-Jhapa pipeline. These initiatives will enhance fuel supply efficiency, reduce transportation costs, and minimize environmental risks. For India, the projects will strengthen trade ties, boost petroleum exports, and enhance regional energy cooperation, reinforcing its influence in South Asia’s fuel supply chain.

India Petroleum Resins Market Segmentation:

IMARC Group provides an analysis of the key trends in each segment of the market, along with forecasts at the region/country level for 2025-2033. Our report has categorized the market based on product type and end user industry.

Product Type Insights:

- Aliphatic C5 Resins Sheets

- Aromatic C9 Resins

- C5/C9 Resins

- Hydrogenated Hydrocarbon Resins

The report has provided a detailed breakup and analysis of the market based on the product type. This includes aliphatic C5 resins sheets, aromatic C9 resins, C5/C9 resins, and hydrogenated hydrocarbon resins.

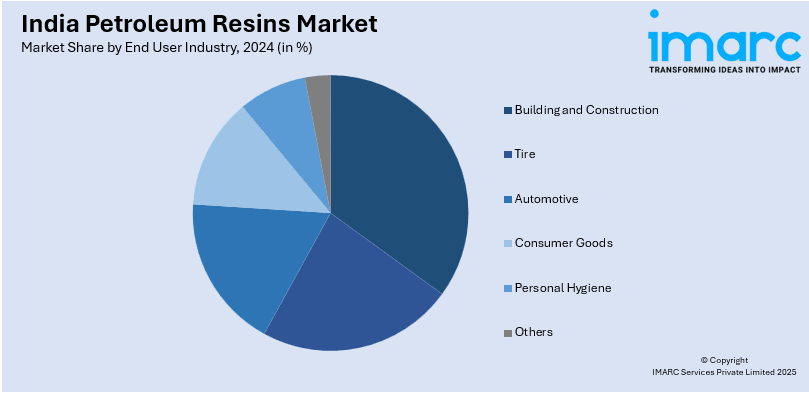

End User Industry Insights:

- Building and Construction

- Tire

- Automotive

- Consumer Goods

- Personal Hygiene

- Others

A detailed breakup and analysis of the market based on the end user industry have also been provided in the report. This includes building and construction, tire, automotive, consumer goods, personal hygiene, and others.

Regional Insights:

- North India

- South India

- East India

- West India

The report has also provided a comprehensive analysis of all the major regional markets, which include North India, South India, East India, and West India.

Competitive Landscape:

- The market research report has also provided a comprehensive analysis of the competitive landscape. Competitive analysis such as market structure, key player positioning, top winning strategies, competitive dashboard, and company evaluation quadrant has been covered in the report. Also, detailed profiles of all major companies have been provided.

India Petroleum Resins Market Report Coverage:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2024 |

| Historical Period | 2019-2024 |

| Forecast Period | 2025-2033 |

| Units | Million USD |

| Scope of the Report | Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Product Types Covered | Aliphatic C5 Resins Sheets, Aromatic C9 Resins, C5/C9 Resins, Hydrogenated Hydrocarbon Resins |

| End User Industries Covered | Building and Construction, Tire, Automotive, Consumer Goods, Personal Hygiene, Others |

| Regions Covered | North India, South India, East India, West India |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Questions Answered in This Report:

- How has the India petroleum resins market performed so far and how will it perform in the coming years?

- What is the breakup of the India petroleum resins market on the basis of product type?

- What is the breakup of the India petroleum resins market on the basis of end user industry?

- What are the various stages in the value chain of the India petroleum resins market?

- What are the key driving factors and challenges in the India petroleum resins market?

- What is the structure of the India petroleum resins market and who are the key players?

- What is the degree of competition in the India petroleum resins market?

Key Benefits for Stakeholders:

- IMARC’s industry report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, market forecasts, and dynamics of the India petroleum resins market from 2019-2033.

- The research report provides the latest information on the market drivers, challenges, and opportunities in the India petroleum resins market.

- Porter's five forces analysis assist stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyze the level of competition within the India petroleum resins industry and its attractiveness.

- Competitive landscape allows stakeholders to understand their competitive environment and provides an insight into the current positions of key players in the market.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)