India Pharmaceutical Filtration Market Size, Share, Trends and Forecast by Product, Technique, Application, Scale of Operation, and Region, 2025-2033

Market Overview:

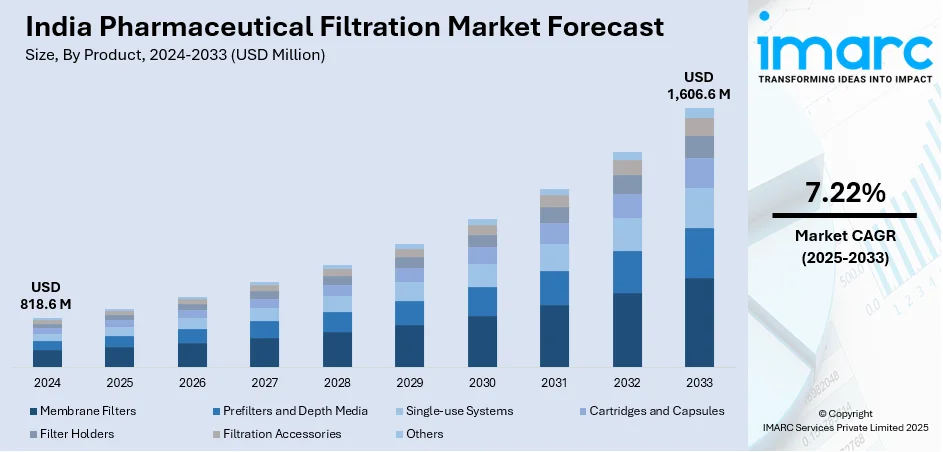

India pharmaceutical filtration market size reached USD 818.6 Million in 2024. Looking forward, IMARC Group expects the market to reach USD 1,606.6 Million by 2033, exhibiting a growth rate (CAGR) of 7.22% during 2025-2033. The increasing cases of chronic diseases, such as cancer, diabetes, and cardiovascular disorders, which contributes to the growing demand for pharmaceuticals, are driving the market.

|

Report Attribute

|

Key Statistics

|

|---|---|

|

Base Year

|

2024 |

|

Forecast Years

|

2025-2033 |

|

Historical Years

|

2019-2024

|

| Market Size in 2024 | USD 818.6 Million |

| Market Forecast in 2033 | USD 1,606.6 Million |

| Market Growth Rate (2025-2033) | 7.22% |

Pharmaceutical filtration is a critical process in the pharmaceutical industry that involves the separation of impurities and particles from liquids or gases to ensure the production of high-quality and safe pharmaceutical products. This technique plays a crucial role in various stages of drug manufacturing, including raw material purification, final product clarification, and sterile filtration. Different filtration methods, such as membrane filtration, depth filtration, and sterile filtration, are employed to remove contaminants like bacteria, viruses, and particulate matter. The goal is to meet stringent regulatory requirements and maintain product integrity by achieving the desired level of purity and sterility. Effective pharmaceutical filtration safeguards patient safety, enhances product efficacy, and complies with rigorous quality standards set by regulatory authorities.

To get more information on this market, Request Sample

India Pharmaceutical Filtration Market Trends:

The pharmaceutical filtration market in India is experiencing robust growth, driven by several key factors. Firstly, the increasing prevalence of chronic diseases necessitates stringent quality control in pharmaceutical manufacturing processes, elevating the demand for advanced filtration technologies. Moreover, the growing emphasis on drug safety and efficacy pushes pharmaceutical companies to adopt high-performance filtration solutions to ensure the removal of contaminants and impurities. In addition, stringent regulatory requirements imposed by health authorities regionally act as a major driver for the adoption of advanced filtration technologies in pharmaceutical manufacturing. The need for compliance with Good Manufacturing Practices (GMP) and other regulatory standards propels pharmaceutical companies to invest in state-of-the-art filtration systems. Furthermore, the escalating production of biopharmaceuticals, including vaccines and monoclonal antibodies, fuels the demand for specialized filtration methods tailored to the unique characteristics of these complex products. Additionally, the continuous evolution of pharmaceutical R&D, with a focus on precision medicine and personalized therapies, underscores the importance of precise and efficient filtration processes. This dynamic landscape encourages innovation in filtration technologies to meet the evolving needs of the pharmaceutical industry. In summary, a confluence of factors, including disease burden, regulatory requirements, biopharmaceutical advancements, and R&D trends, collectively propels the growth of the pharmaceutical filtration market in India.

India Pharmaceutical Filtration Market Segmentation:

IMARC Group provides an analysis of the key trends in each segment of the market, along with forecasts at the country level for 2025-2033. Our report has categorized the market based on product, technique, application, and scale of operation.

Product Insights:

- Membrane Filters

- MCE Membrane Filters

- Coated Cellulose Acetate Membrane Filters

- PTFE Membrane Filters

- Nylon Membrane Filters

- PVDF Membrane Filters

- Others

- Prefilters and Depth Media

- Glass Fiber Filters

- PTFE Fiber Filters

- Single-use Systems

- Cartridges and Capsules

- Filter Holders

- Filtration Accessories

- Others

The report has provided a detailed breakup and analysis of the market based on the product. This includes membrane filters (MCE membrane filters, coated cellulose acetate membrane filters, PTFE membrane filters, nylon membrane filters, PVDF membrane filters, and others), prefilters and depth media (glass fiber filters and PTFE fiber filters), single-use systems, cartridges and capsules, filter holders, filtration accessories, and others.

Technique Insights:

- Microfiltration

- Ultrafiltration

- Crossflow Filtration

- Nanofiltration

- Others

A detailed breakup and analysis of the market based on the technique have also been provided in the report. This includes microfiltration, ultrafiltration, crossflow filtration, nanofiltration, and others.

Application Insights:

- Final Product Processing

- Active Pharmaceutical Ingredient Filtration

- Sterile Filtration

- Protein Purification

- Vaccines and Antibody Processing

- Formulation and Filling Solutions

- Viral Clearance

- Raw Material Filtration

- Media Buffer

- Pre-Filtration

- Bioburden Testing

- Cell Separation

- Water Purification

- Air Purification

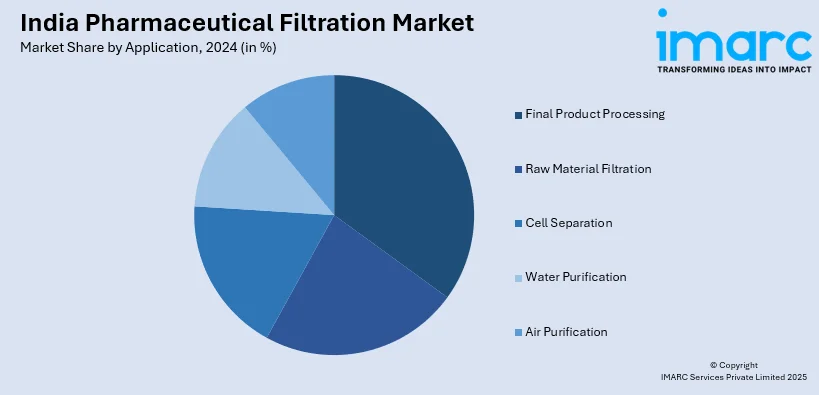

The report has provided a detailed breakup and analysis of the market based on the application. This includes final product processing (active pharmaceutical ingredient filtration, sterile filtration, protein purification, vaccines and antibody processing, formulation and filling solutions, and viral clearance), raw material filtration (media buffer, pre-filtration, and bioburden testing), cell separation, water purification, and air purification.

Scale of Operation Insights:

- Manufacturing Scale

- Pilot-scale

- Research and Development Scale

A detailed breakup and analysis of the market based on the scale of operation have also been provided in the report. This includes manufacturing scale, pilot-scale, and research and development scale.

Regional Insights:

- North India

- West and Central India

- South India

- East and Northeast India

The report has also provided a comprehensive analysis of all the major regional markets, which include North India, West and Central India, South India, and East and Northeast India.

Competitive Landscape:

The market research report has also provided a comprehensive analysis of the competitive landscape in the market. Competitive analysis such as market structure, key player positioning, top winning strategies, competitive dashboard, and company evaluation quadrant has been covered in the report. Also, detailed profiles of all major companies have been provided.

India Pharmaceutical Filtration Market Report Coverage:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2024 |

| Historical Period | 2019-2024 |

| Forecast Period | 2025-2033 |

| Units | Million USD |

| Scope of the Report | Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Products Covered |

|

| Techniques Covered | Microfiltration, Ultrafiltration, Crossflow Filtration, Nanofiltration, Others |

| Applications Covered |

|

| Scale of Operations Covered | Manufacturing Scale, Pilot-scale, Research and Development Scale |

| Regions Covered | North India, West and Central India, South India, East and Northeast India |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Questions Answered in This Report:

- How has the India pharmaceutical filtration market performed so far and how will it perform in the coming years?

- What has been the impact of COVID-19 on the India pharmaceutical filtration market?

- What is the breakup of the India pharmaceutical filtration market on the basis of product?

- What is the breakup of the India pharmaceutical filtration market on the basis of technique?

- What is the breakup of the India pharmaceutical filtration market on the basis of application?

- What is the breakup of the India pharmaceutical filtration market on the basis of scale of operation?

- What are the various stages in the value chain of the India pharmaceutical filtration market?

- What are the key driving factors and challenges in the India pharmaceutical filtration?

- What is the structure of the India pharmaceutical filtration market and who are the key players?

- What is the degree of competition in the India pharmaceutical filtration market?

Key Benefits for Stakeholders:

- IMARC’s industry report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, market forecasts, and dynamics of the India pharmaceutical filtration market from 2019-2033.

- The research report provides the latest information on the market drivers, challenges, and opportunities in the India pharmaceutical filtration market.

- Porter's five forces analysis assist stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyze the level of competition within the India pharmaceutical filtration industry and its attractiveness.

- Competitive landscape allows stakeholders to understand their competitive environment and provides an insight into the current positions of key players in the market.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)