India Pharmaceutical Labeling Market Size, Share, Trends and Forecast by Label Type, Material, Application, End Use, and Region, 2025-2033

India Pharmaceutical Labeling Market Overview:

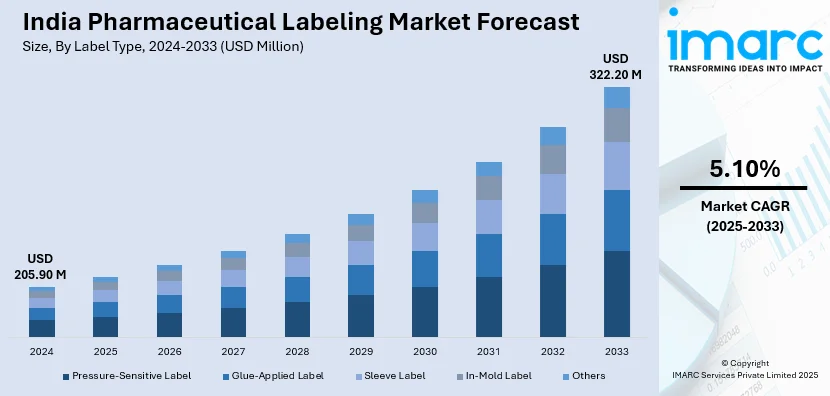

The India pharmaceutical labeling market size reached USD 205.90 Million in 2024. Looking forward, IMARC Group expects the market to reach USD 322.20 Million by 2033, exhibiting a growth rate (CAGR) of 5.10% during 2025-2033. The market is driven by stringent regulatory compliance, increasing demand for patient safety, and the rise of e-pharmacies. Additionally, the adoption of digital labeling technologies including QR codes and RFID for traceability, along with a growing emphasis on sustainable and eco-friendly labeling solutions, further expands the India pharmaceutical labeling market share.

|

Report Attribute

|

Key Statistics

|

|---|---|

|

Base Year

|

2024 |

|

Forecast Years

|

2025-2033

|

|

Historical Years

|

2019-2024

|

| Market Size in 2024 | USD 205.90 Million |

| Market Forecast in 2033 | USD 322.20 Million |

| Market Growth Rate 2025-2033 | 5.10% |

India Pharmaceutical Labeling Market Trends:

Increasing Adoption of Digital Labeling Solutions

The significant shift towards digital labeling solutions is majorly driving the India pharmaceutical labeling market growth. With the growing emphasis on regulatory compliance and patient safety, pharmaceutical companies are increasingly adopting technologies such as QR codes, barcodes, and RFID (Radio-Frequency Identification) tags. These digital tools enable real-time tracking, authentication, and traceability of pharmaceutical products, reducing the risk of counterfeiting and ensuring compliance with stringent regulations such as the Drugs and Cosmetics Act. On 9th October 2024, the Central Drugs Standard Control Organization (CDSCO) announced plans to implement QR codes on the packaging of medicines sold in India. After launching this technology on 300 leading brands, including Allegra and Calpol, the initiative aims to enhance drug authenticity by providing key information such as manufacturer details and expiration dates. This action is part of a continuous effort to combat fraudulent drugs and enhance quality assurance within the industry. Digital labels also offer improved accessibility of vital product details, including dosage, expiration, and manufacturing information, contributing to patient engagement and better safety. The availability of e-pharmaceutics and online drug delivery platforms has helped to enhance such trends as well, with digital labels optimizing inventory management and supply chains, leading to more efficient use. This movement aligns with global sustainability objectives and consumer demand for environmentally conscious products.

To get more information on this market, Request Sample

Growing Demand for Sustainable and Eco-Friendly Labeling

Sustainability is becoming a major trend in the marketplace, and businesses are increasingly opting for sustainable labeling materials and practices. As awareness of environmental issues continues to increase, pharmaceutical manufacturers are also reacting by replacing traditional plastic labels with biodegradable, recyclable, and compostable alternatives. Paper made from recycled materials, as well as plant-based films and water-based adhesives, are becoming more popular. This aligns with global sustainability goals and the desire for sustainable products from consumers. On 11th November 2024, researchers at IISc-Bengaluru created a biodegradable foam utilizing non-edible oils and tea leaf extracts, presenting a sustainable substitute for plastic packaging that can decompose within hours. This innovation, which greatly diminishes greenhouse gas emissions, seeks to revolutionize the USD 7.9 Billion foam market by providing environmentally friendly options for packaging. Moreover, regulatory bodies and industry associations are encouraging the adoption of green labeling practices to reduce carbon footprints and waste generation which is creating a positive India pharmaceutical labeling market outlook. Corporate social responsibility (CSR), business strategies to improve brand image and attract consumers with an interest in sustainability, plays an integral role in moving towards sustainability. This has triggered a growing market for sustainable solutions, driving innovation and collaboration among manufacturers, suppliers, and regulatory bodies.

India Pharmaceutical Labeling Market Segmentation:

IMARC Group provides an analysis of the key trends in each segment of the market, along with forecasts at the country level for 2025-2033. Our report has categorized the market based on label type, material, application, and end use.

Label Type Insights:

- Pressure-Sensitive Label

- Glue-Applied Label

- Sleeve Label

- In-Mold Label

- Others

The report has provided a detailed breakup and analysis of the market based on the label type. This includes pressure-sensitive label, glue-applied label, sleeve label, in-mold label, and others.

Material Insights:

- Paper

- Polymer Film

- Others

A detailed breakup and analysis of the market based on the material have also been provided in the report. This includes paper, polymer film, and others.

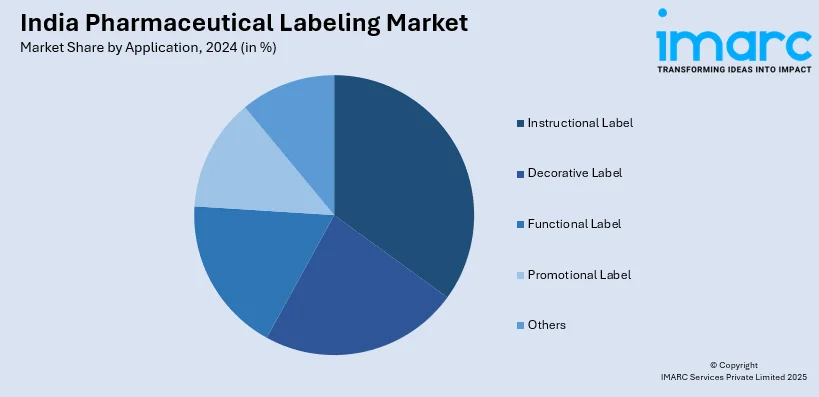

Application Insights:

- Instructional Label

- Decorative Label

- Functional Label

- Promotional Label

- Others

The report has provided a detailed breakup and analysis of the market based on the application. This includes instructional label, decorative label, functional label, promotional label, and others.

End Use Insights:

- Bottles

- Blister Packs

- Parenteral Containers

- Pre-Fillable Syringes

- Pre-Fillable Inhalers

- Pouches

- Others

A detailed breakup and analysis of the market based on the end use have also been provided in the report. This includes bottles, blister packs, parenteral containers, pre-fillable syringes, pre-fillable inhalers, pouches, and others.

Regional Insights:

- North India

- South India

- East India

- West India

The report has also provided a comprehensive analysis of all the major regional markets, which include North India, South India, East India, and West India.

Competitive Landscape:

The market research report has also provided a comprehensive analysis of the competitive landscape. Competitive analysis such as market structure, key player positioning, top winning strategies, competitive dashboard, and company evaluation quadrant has been covered in the report. Also, detailed profiles of all major companies have been provided.

India Pharmaceutical Labeling Market News:

- December 03, 2024: ACG Engineering launched the ADAPT X feeder, a fully customizable solution designed specifically for the packaging of tablets with different tablet shapes and sizes at CPhI & PMEC India 2024. The innovative feeder achieves speeds of up to 13.2 m/min on rotary sealing and 60 cycles per minute on intermittent machines, allowing for quick, tool-free changeovers in 15 to 20 minutes. Produced in India with international design proficiency, the ADAPT X significantly improves efficiency and flexibility in pharmaceutical labeling and packaging processes.

- October 09, 2024: BizDate secured USD 1 Million in pre-IPO funding for a pharmaceutical packaging firm, Sorich Foils, to establish its business in India. By utilizing these funds, it will help to optimize production processes, improve working capital and continue the building of patented products such as Heat Transfer Labels (HTL). Sorich specializes in offering distinctive packaging solutions such as Child resistant foils and Pharma Lidding foil and aspires to emerge as a leader in the growing pharmaceutical labeling industry.

India Pharmaceutical Labeling Market Report Coverage:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2024 |

| Historical Period | 2019-2024 |

| Forecast Period | 2025-2033 |

| Units | Million USD |

| Scope of the Report |

Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Label Types Covered | Pressure-Sensitive Label, Glue-Applied Label, Sleeve Label, In-Mold Label, Others |

| Materials Covered | Paper, Polymer Film, Others |

| Applications Covered | Label, Decorative Label, Functional Label, Promotional Label, Others |

| End Uses Covered | Bottles, Blister Packs, Parenteral Containers, Pre-Fillable Syringes, Pre-Fillable Inhalers, Pouches, Others |

| Regions Covered | North India, South India, East India, West India |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Questions Answered in This Report:

- How has the India pharmaceutical labeling market performed so far and how will it perform in the coming years?

- What is the breakup of the India pharmaceutical labeling market on the basis of label type?

- What is the breakup of the India pharmaceutical labeling market on the basis of material?

- What is the breakup of the India pharmaceutical labeling market on the basis of application?

- What is the breakup of the India pharmaceutical labeling market on the basis of end use?

- What is the breakup of the India pharmaceutical labeling market on the basis of region?

- What are the various stages in the value chain of the India pharmaceutical labeling market?

- What are the key driving factors and challenges in the India pharmaceutical labeling market?

- What is the structure of the India pharmaceutical labeling market and who are the key players?

- What is the degree of competition in the India pharmaceutical labeling market?

Key Benefits for Stakeholders:

- IMARC’s industry report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, market forecasts, and dynamics of the India pharmaceutical labeling market from 2019-2033.

- The research report provides the latest information on the market drivers, challenges, and opportunities in the India pharmaceutical labeling market.

- Porter's five forces analysis assist stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyze the level of competition within the India pharmaceutical labeling industry and its attractiveness.

- Competitive landscape allows stakeholders to understand their competitive environment and provides an insight into the current positions of key players in the market.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)