India Pharmaceutical Packaging Market Size, Share, Trends and Forecast by Material Type, Product Type, End User, and Region, 2025-2033

India Pharmaceutical Packaging Market Size and Share:

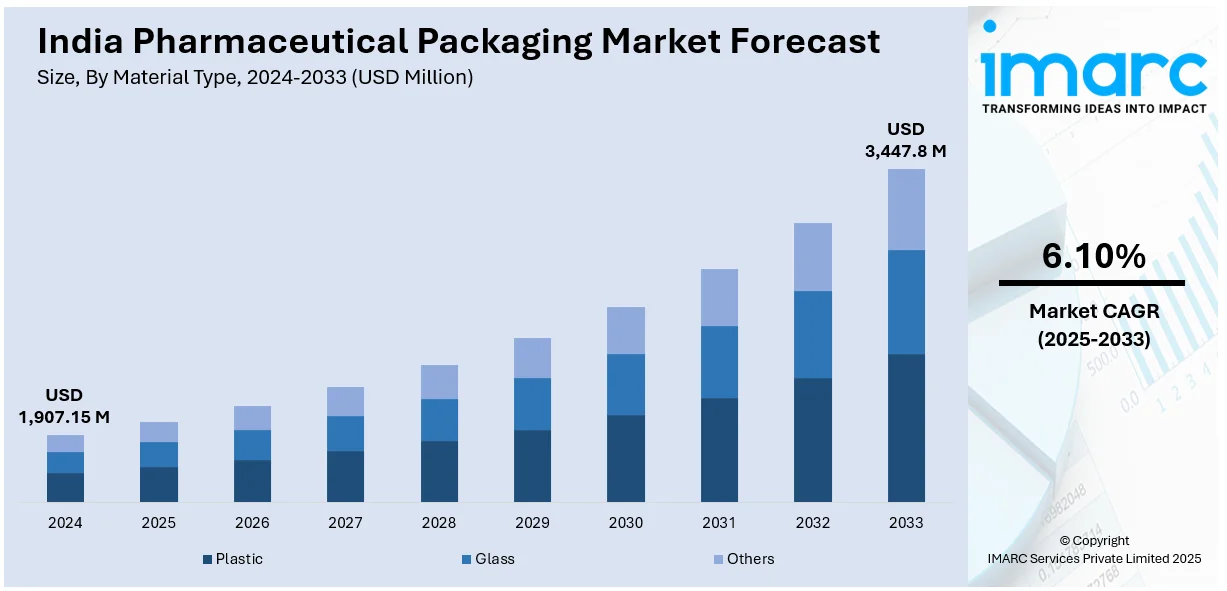

The India pharmaceutical packaging market size was valued at USD 1,907.15 Million in 2024. Looking forward, IMARC Group estimates the market to reach USD 3,447.8 Million by 2033, exhibiting a CAGR of 6.10% during 2025-2033. West and Central India currently dominates the market in 2024. The market is witnessing significant growth, driven by rising demand for sustainable packaging, child-resistant features, and tamper-proof solutions. As regulatory pressures and consumer preferences evolve, India pharmaceutical packaging market share is expanding, with companies focusing on innovative, eco-friendly, and secure packaging technologies.

|

Report Attribute

|

Key Statistics

|

|---|---|

|

Base Year

|

2024

|

|

Forecast Years

|

2025-2033

|

|

Historical Years

|

2019-2024

|

|

Market Size in 2024

|

USD 1,907.15 Million |

|

Market Forecast in 2033

|

USD 3,447.8 Million |

| Market Growth Rate 2025-2033 | 6.10% |

The Indian pharma packaging industry is also changing with a strong movement towards tamper-evident and child-resistant packaging solutions. As the awareness of the safety of drugs grows, especially among children, packaging solutions with restricted access are gaining prominence. With the growth in healthcare awareness and education among the population, there has been an emphasis on safeguarding consumers, especially vulnerable groups like children, from accidental drug intake. Consequently, the market for child-resistant packaging, including special closures or designs that take more than a single step to open, has grown exponentially. Pharmaceutical firms are now using more and more tamper-proof packaging, particularly for over-the-counter medications and high-risk products, to guarantee product integrity and protect consumer confidence.

To get more information on this market, Request Sample

To counter this, packaging technology has also changed, with newer alternatives like secure closure blister packs, shrink seals, and breakable seals becoming popular. These not only ensure safety but also assist in maintaining the quality and efficacy of the pharmaceutical drugs. The use of child-resistant and tamper-evident packaging ensures that drug products are not only safe for intake but also preserved from damage or contamination, which raises consumer confidence. The Indian pharmaceutical packaging industry is seeing an increasing trend towards eco-friendly and green packaging solutions. With growing consciousness about eco-friendliness and the requirement to minimize plastic waste, manufacturers, as well as customers, are demanding packaging that is recyclable, biodegradable, or made from renewable resources. Government regulations and efforts towards adopting eco-friendly practices only increase the movement further. For example, the Indian government has issued guidelines for minimizing the use of plastic and is promoting the use of recyclable packaging.

India Pharmaceutical Packaging Market Trends:

Sustainable Packaging Innovations in Pharma

The growing demand for sustainable packaging solutions is reshaping the Indian pharmaceutical packaging market, driven by environmental concerns and regulatory pressures. As industries look to reduce their carbon footprints, innovative packaging alternatives are becoming more mainstream. For instance, in November 2024, UPM Biochemicals, Selenis, and Bormioli Pharma introduced the world's first pharmaceutical bottles partially made from wood-based plastics. This breakthrough used BioPET with UPM's BioMEG, significantly reducing fossil resource dependency. This shift towards more sustainable materials offers the industry a viable option to meet eco-friendly packaging demands while maintaining high standards for product safety and quality. Such innovations, with lower carbon footprints, are setting the stage for future advancements in the market. The trend of eco-friendly solutions aligns with India's increasing focus on sustainability in packaging. Pharmaceutical companies are increasingly adopting materials and technologies that minimize environmental impact. These developments help meet consumer and regulatory demands for greener products, prompting shifts towards packaging solutions that contribute to a circular economy. The use of wood-based plastics and other bio-based materials is not just about reducing dependency on fossil fuels but also about reducing the waste generated by traditional plastic packaging. As consumer awareness of environmental issues rises, there will be more pressure on pharmaceutical companies to adopt these advanced, sustainable solutions.

Regulatory Push for Eco-Friendly Packaging Solutions

Government initiatives in India are also supporting a strong push towards sustainable packaging, driving further innovation in the pharmaceutical packaging sector. Aligned with this trend, in July 2024, the Council of Scientific and Industrial Research (CSIR) launched a National Mission on Sustainable Packaging focused on developing advanced, indigenous solutions to achieve net-zero emissions. This initiative prioritizes biodegradable alternatives, smart recycling, and the development of innovative materials to reduce the environmental impact of packaging. As part of this mission, there is a strong emphasis on creating bio-based packaging materials that are not only eco-friendly but also cost-effective for the pharmaceutical industry. These efforts align with the Indian government's vision to reduce plastic waste and enhance recycling capabilities. The mission also focuses on developing biodegradable alternatives to multi-layer packaging and PET bottles, which are commonly used in pharmaceutical packaging. This development marks a crucial step in India's progress towards sustainable and responsible packaging solutions, encouraging pharmaceutical companies to adopt materials that align with the country's growing environmental goals. Additionally, the focus on reducing microplastics and addressing packaging waste through blockchain-based traceability is gaining momentum. By promoting smarter, more sustainable packaging solutions, the mission aims to revolutionize the pharmaceutical packaging industry, helping it align with both environmental and regulatory standards and paving the way for a greener future in pharmaceutical packaging market in India.

Growth Driven by Chronic Disease and Regulatory Support

The rising incidence of chronic diseases such as diabetes, cancer, and cardiovascular and respiratory conditions is a key driver for India pharmaceutical packaging market growth. For example, the International Diabetes Federation reports that in 2024, approximately 89.8 million individuals aged 20-79 years in India were living with diabetes, a number expected to rise to 156.7 million by 2050. Additionally, the Government of India has implemented the Production Linked Incentive (PLI) scheme to promote domestic manufacturing of essential key starting materials (KSMs), drug intermediates (DIs), and active pharmaceutical ingredients (APIs), aiming to reduce reliance on imports. The government is also enhancing primary healthcare access by establishing health and wellness centers (HWCs) that offer comprehensive primary health care (CPHC), including services for non-communicable diseases, maternal and child health, and providing free essential drugs and diagnostic services. Furthermore, India's pharmaceutical exports are on the rise, with the India Brand Equity Foundation (IBEF) reporting that pharmaceutical exports reached USD 27.8 billion in FY24, up from USD 25.4 billion in FY23. The increasing adoption of new regulatory standards for packaging recycling also contributes positively to market expansion. Additionally, the development of child-resistant packaging (CRP) is anticipated to further stimulate growth by reducing the risk of poisoning from prescription drugs and over-the-counter (OTC) medications among children.

India Pharmaceutical Packaging Industry Segmentation:

IMARC Group provides an analysis of the key trends in each segment of the India pharmaceutical packaging market, along with forecasts at the country and regional levels from 2025-2033. The market has been categorized based on material type, product type, and end user.

Analysis by Material Type:

- Plastic

- Glass

- Others

As per the India pharmaceutical packaging market outlook, in 2024, the plastic segment led the market its versatility, durability, and cost-effectiveness. Plastic packaging materials, such as polyethylene, polypropylene, and PET, are widely used for bottles, blisters, and containers due to their lightweight nature, resistance to moisture, and ability to preserve the integrity of pharmaceutical products. The rising demand for safe and secure drug storage, along with the growing production of generics and over-the-counter medications, contributes to the increasing preference for plastic packaging. Additionally, advancements in plastic manufacturing technologies have allowed for innovations like tamper-evident packaging, further boosting its adoption in the pharmaceutical industry.

Analysis by Product Type:

- Bottles

- Vials and Ampoules

- Syringes

- Tubes

- Caps and Closures

- Pouches

- Labels

- Others

As per the India pharmaceutical packaging market analysis, in 2024 the vials and ampoules segment led the Indian pharmaceutical packaging market, driven by the increasing demand for injectable drugs and biologics. Vials and ampoules are crucial for storing and delivering injectable medications safely, particularly in liquid form, as they provide airtight, sterile conditions that preserve the drug's efficacy. The rise in chronic diseases, along with the expansion of biologics, vaccines, and COVID-19-related therapies, has significantly fueled the demand for this packaging type. Furthermore, growing advancements in sterilization methods and the shift towards smaller, user-friendly packaging solutions for better dosage control have further supported the popularity of vials and ampoules.

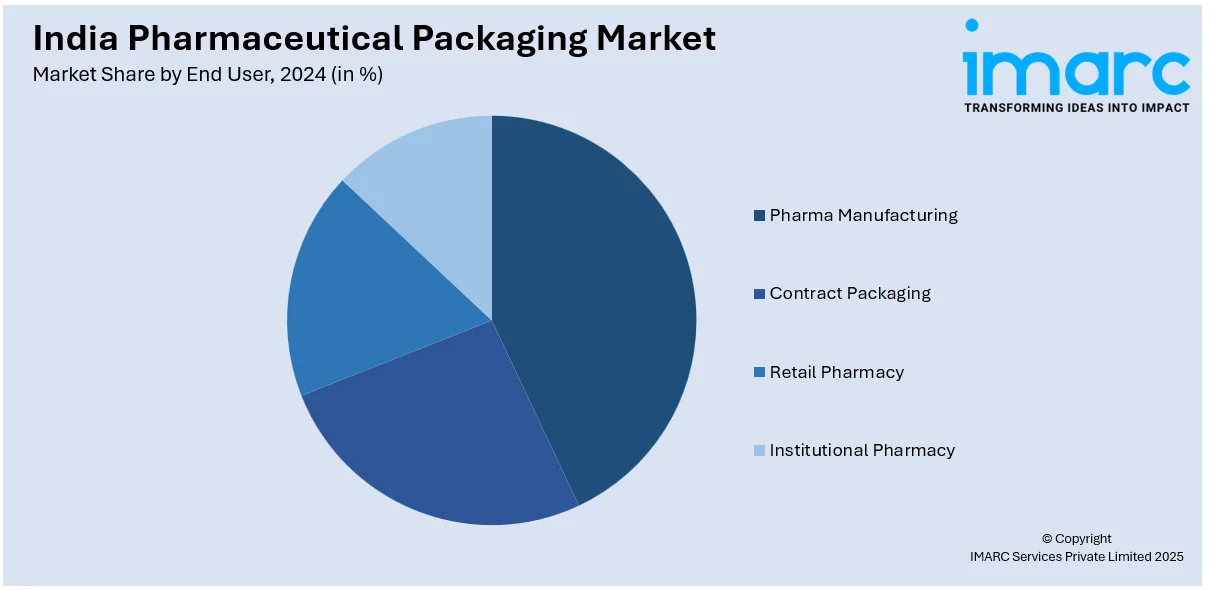

Analysis by End User:

- Pharma Manufacturing

- Contract Packaging

- Retail Pharmacy

- Institutional Pharmacy

In 2024, the pharma manufacturing segment led the Indian pharmaceutical packaging market, driven by the expansion of domestic pharmaceutical production. India’s robust pharmaceutical manufacturing industry, including contract manufacturing and the production of generic drugs, is a significant driver of demand for packaging solutions. Increased investments in pharmaceutical manufacturing plants and a focus on complying with stringent regulatory standards have spurred the need for high-quality, efficient, and secure packaging. Furthermore, the shift towards automation and sustainable practices in pharmaceutical production has prompted the adoption of innovative packaging materials and designs that enhance product safety, efficiency, and sustainability across the sector.

Regional Analysis:

- North India

- West and Central India

- South India

- East India

In 2024, the West and Central India led the Indian pharmaceutical packaging market, driven by the concentration of pharmaceutical manufacturing hubs in these regions. Maharashtra, Gujarat, and Madhya Pradesh are key centers for pharmaceutical production, with a high number of manufacturing units, packaging facilities, and distribution networks. The growing number of pharmaceutical companies and the establishment of research and development centers in these areas have boosted the demand for pharmaceutical packaging solutions. Additionally, these regions benefit from robust logistics infrastructure, access to raw materials, and a skilled workforce, further enhancing their dominance in the pharmaceutical packaging market. The increasing demand for both generic and branded drugs has contributed to the market growth in these areas.

Competitive Landscape:

Advancements in pharmaceutical packaging technologies, material innovations, and integration strategies are driving the growth of the India pharmaceutical packaging market. Companies are focusing on enhancing packaging material properties, scalability, and efficiency for applications in various sectors, including pharmaceuticals, biologics, and consumer health products. Market competition is intensifying with the development of high-performance, versatile packaging solutions, which are finding broader applications in drug delivery systems, biologics, and OTC medications. Strategic partnerships, regional market expansion, and continuous innovation are accelerating the adoption of advanced packaging materials. The India pharmaceutical packaging market forecast indicates rising demand as industries prioritize secure, sustainable packaging solutions, driving investments in innovative packaging technologies to ensure product safety and quality.

The report provides a comprehensive analysis of the competitive landscape in the India pharmaceutical packaging market with detailed profiles of all major companies, including:

- ACG World

- Amcor plc

- AptarGroup Inc.

- EPL Limited

- Huhtamaki India Ltd

- Nipro Medical India Pvt. Ltd.

- Parekhplast India Limited

- PGP Glass

- SCHOTT Poonawalla Private Limited

- SGD Pharma

- UFlex Limited

- West Pharmaceutical Services, Inc.

Latest News and Developments:

- May 2025: TPG announced that it would purchase a 35% share in SCHOTT Poonawalla, a joint venture between SCHOTT Pharma and the Serum Institute of India (SII) that aimed to provide premium, reasonably priced packaging solutions for pharmaceuticals and vaccines. Additionally, Denmark-based Novo Holdings would become a co-investor.

- May 2025: Nipro revealed that it will start producing high-quality glass cartridges for use in dental and pen applications at its production facility in India from July 2025. The goal of this calculated capacity increase is to meet the increasing requirement for glass cartridges in the Asian market.

- March 2025: Packaging manufacturer JPFL Films Private Limited, a division of Jindal Poly Films Ltd. (JPFL), introduced Biaxially Oriented Polyamide (BOPA) nylon films for use in pharmaceutical, medical, food, and fast-moving consumer goods packaging. The firm announced an investment of INR 120 crore for the production of these films at its plant in Nashik.

- October 2024: Uhlmann India inaugurated a new facility in Pune's Chakan MIDC Phase II, reinforcing its commitment to the Indian pharmaceutical packaging sector. The event also showcased innovations like the eBL350 blister packaging system and emphasized the company's 'Local for Local' strategy, focusing on localized production of format parts and digital support capabilities.

India Pharmaceutical Packaging Market Report Scope:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2024 |

| Historical Period | 2019-2024 |

| Forecast Period | 2025-2033 |

| Units | Million USD |

| Scope of the Report |

Exploration of Historical and Forecast Trends, Industry Catalysts and Challenges, Segment-Wise Historical and Predictive Market Assessment:

|

| Material Types Covered | Plastic, Glass, Others |

| Product Types Covered | Bottles, Vials and Ampoules, Syringes, Tubes, Caps and Closures, Pouches, Labels, Others |

| End Users Covered | Pharma Manufacturing, Contract Packaging, Retail Pharmacy, Institutional Pharmacy |

| Region Covered | North India, West and Central India, South India, East India |

| Companies Covered | ACG World, Amcor plc, AptarGroup Inc., EPL Limited, Huhtamaki India Ltd, Nipro Medical India Pvt. Ltd., Parekhplast India Limited, PGP Glass, SCHOTT Poonawalla Private Limited, SGD Pharma, UFlex Limited, West Pharmaceutical Services, Inc., etc. |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Benefits for Stakeholders:

- IMARC’s report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, market forecasts, and dynamics of the India pharmaceutical packaging market from 2019-2033.

- The India pharmaceutical packaging market research report provides the latest information on the market drivers, challenges, and opportunities in the regional market.

- The study maps the leading, as well as the fastest-growing, regional markets. It further enables stakeholders to identify the key markets within the region.

- Porter's five forces analysis assist stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyze the level of competition within the India pharmaceutical packaging industry and its attractiveness.

- Competitive landscape allows stakeholders to understand their competitive environment and provides an insight into the current positions of key players in the market.

Key Questions Answered in This Report

The pharmaceutical packaging market in India was valued at USD 1,907.15 Million in 2024.

The India pharmaceutical packaging market is projected to exhibit a CAGR of 6.10% during2025-2033, reaching a value of USD 3,447.8 Million by 2033.

Key factors driving the India pharmaceutical packaging market include increasing demand for injectable drugs, rising chronic diseases, growth in biologics and generics, advancements in packaging technologies, regulatory compliance, and the need for secure, durable, and sustainable packaging solutions to ensure product safety and efficacy.

In 2024, West and Central India dominated the India pharmaceutical packaging market driven by the region's strong pharmaceutical manufacturing presence, infrastructure, access to raw materials, skilled workforce, and high production of generics, biologics, and OTC drugs, boosting the demand for efficient packaging solutions.

Some of the major players in the India pharmaceutical packaging market include ACG World, Amcor plc, AptarGroup Inc., EPL Limited, Huhtamaki India Ltd, Nipro Medical India Pvt. Ltd., Parekhplast India Limited, PGP Glass, SCHOTT Poonawalla Private Limited, SGD Pharma, UFlex Limited, West Pharmaceutical Services, Inc., etc.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)