India Phosphatic Fertilizer Market Size, Share, Trends and Forecast by Type, Solubility, Form, Source, Application, and Region, 2025-2033

India Phosphatic Fertilizer Market Overview:

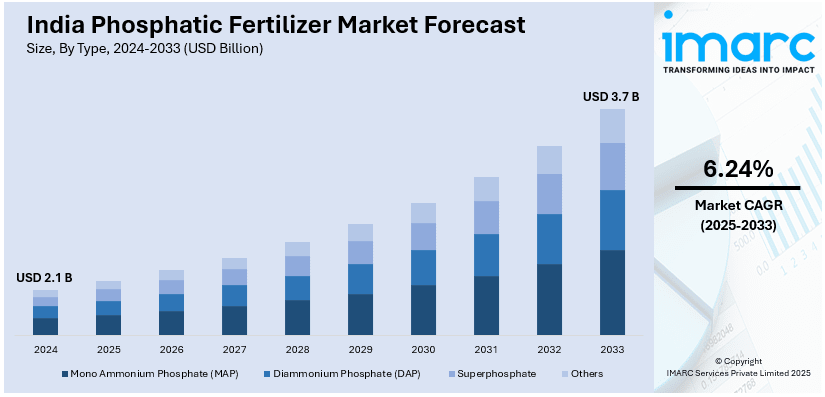

The India phosphatic fertilizer market size reached USD 2.1 Billion in 2024. Looking forward, IMARC Group expects the market to reach USD 3.7 Billion by 2033, exhibiting a growth rate (CAGR) of 6.24% during 2025-2033. The market is driven by increasing agricultural demand, government subsidies, rising population, and shrinking arable land. Technological advancements, soil nutrient management, and the promotion of sustainable farming practices further contribute to market growth. Additionally, import dependency and fluctuating raw material prices also influence market dynamics.

|

Report Attribute

|

Key Statistics

|

|---|---|

|

Base Year

|

2024 |

|

Forecast Years

|

2025-2033

|

|

Historical Years

|

2019-2024

|

| Market Size in 2024 | USD 2.1 Billion |

| Market Forecast in 2033 | USD 3.7 Billion |

| Market Growth Rate 2025-2033 | 6.24% |

India Phosphatic Fertilizer Market Trends:

Government Policy Support and Subsidy Programs

Government policies significantly shape the Indian phosphatic fertilizer market. Subsidy programs under schemes like the Nutrient-Based Subsidy (NBS) ensure affordable fertilizer prices for farmers. For instance, in March 2025, the Union Cabinet approved a ₹37,216 crore subsidy for phosphatic and potassic (P&K) fertilizers for the Kharif 2025 season (April to September). This decision ensures affordable fertilizer prices for farmers under the Nutrient-Based Subsidy (NBS) scheme. The subsidy is ₹13,000 crore higher than the previous Rabi season. The government aims to maintain stable prices for Di-ammonium Phosphate (DAP) and reduce the impact of fluctuating international fertilizer prices. Additionally, 28 grades of P&K fertilizers will be available at subsidized rates. Additionally, policy reforms promoting balanced nutrient application and soil health management have further enhanced the consumption of phosphatic fertilizers. Additionally, the government's emphasis on reducing import dependency by encouraging domestic production has spurred investments in fertilizer manufacturing plants. Recent initiatives to develop integrated nutrient management systems have also contributed to market expansion. Strengthening public-private partnerships and increased financial assistance to manufacturers ensure market stability. Through these policies, the government aims to achieve food security and improve agricultural productivity, driving steady growth in the phosphatic fertilizer sector.

To get more information on this market, Request Sample

Rising Demand for Specialty and Customized Fertilizers

The demand for specialty and customized fertilizers, including water-soluble and slow-release phosphatic fertilizers, is rapidly growing in India. These fertilizers are designed to meet the distinct needs of various crops and regional soil conditions, enhancing nutrient absorption and boosting productivity. Agribusiness companies are increasingly investing in research and development to create innovative formulations tailored to diverse farming landscapes. The rise of horticulture and floriculture industries has further fueled the need for premium fertilizers. Additionally, India is securing raw materials through long-term agreements, such as the recent deal with Mauritania for importing rock phosphate, which are essential components of specialty and customized blends tailored for different crop needs. With a fertilizer demand of 43.5 million tonnes annually, the government has committed ₹1.64 trillion in subsidies to ensure price stability, support innovation, and maintain agricultural productivity.

India Phosphatic Fertilizer Market Segmentation:

IMARC Group provides an analysis of the key trends in each segment of the market, along with forecasts at the region/country level for 2025-2033. Our report has categorized the market based on type, solubility, form, source, and application.

Type Insights:

- Mono Ammonium Phosphate (MAP)

- Diammonium Phosphate (DAP)

- Superphosphate

- Others

The report has provided a detailed breakup and analysis of the market based on the type. This includes mono ammonium phosphate (MAP), diammonium phosphate (DAP), superphosphate, and others.

Solubility Insights:

- Water-Soluble

- Citric Acid Soluble

- Water and Citric Acid Insoluble

- Others

A detailed breakup and analysis of the market based on the solubility have also been provided in the report. This includes water-soluble, citric acid soluble, water and citric acid insoluble, and others.

Form Insights:

- Granular

- Powder

- Solution

A detailed breakup and analysis of the market based on the form have also been provided in the report. This includes granular, powder, and solution.

Source Insights:

- Domestic

- Import

A detailed breakup and analysis of the market based on the source have also been provided in the report. This includes domestic and import.

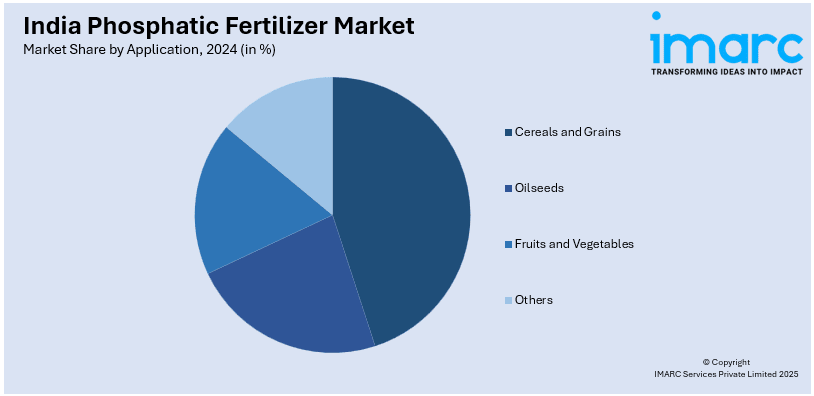

Application Insights:

- Cereals and Grains

- Oilseeds

- Fruits and Vegetables

- Others

A detailed breakup and analysis of the market based on the application have also been provided in the report. This includes cereals and grains, oilseeds, fruits and vegetables, and others.

Regional Insights:

- North India

- South India

- East India

- West India

The report has also provided a comprehensive analysis of all the major regional markets, which include North, South, East, and West India.

Competitive Landscape:

The market research report has also provided a comprehensive analysis of the competitive landscape. Competitive analysis such as market structure, key player positioning, top winning strategies, competitive dashboard, and company evaluation quadrant has been covered in the report. Also, detailed profiles of all major companies have been provided.

India Phosphatic Fertilizer Market News:

- In April 2024, Coromandel International Limited established a phosphatic fertilizer facility in Kakinada, Andhra Pradesh, with an investment of ₹1,000 crore. The project includes 650 TPD phosphoric acid and 1,800 TPD sulphuric acid plants, aiming to supply 15% of India's NPK fertilizer output. This initiative will reduce import dependence and integrate with existing plants in Visakhapatnam and Ennore.

- In March 2025, India's Fertilisers and Chemicals Travancore (FACT) negotiated a three-year agreement to procure 250,000 metric tons of rock phosphate annually from Togo's Societe Nouvelle des Phosphates du Togo (SNPT). This initiative marks the first long-term fertilizer deal between an Indian company and Togo, aiming to secure stable supplies amid rising demand and price volatility in India's agriculture sector. In the fiscal year ending March 31, 2024, India's rock phosphate imports from Togo totaled 1.1 Million tons, reflecting a 30% increase from the previous year.

India Phosphatic Fertilizer Market Report Coverage:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2024 |

| Historical Period | 2019-2024 |

| Forecast Period | 2025-2033 |

| Units | Billion USD |

| Scope of the Report |

Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Types Covered | Mono Ammonium Phosphate (MAP), Diammonium Phosphate (DAP), Superphosphate, Others |

| Solubilities Covered | Water-Soluble, Citric Acid Soluble, Water, Citric Acid Insoluble, Others |

| Forms Covered | Granular, Powder, Solution |

| Sources Covered | Domestic, Import |

| Applications Covered | Cereals, Grains, Oilseeds, Fruits, Vegetables, Others |

| Regions Covered | North India, South India, East India, West India |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Questions Answered in This Report:

- How has the India phosphatic fertilizer market performed so far and how will it perform in the coming years?

- What is the breakup of the India phosphatic fertilizer market on the basis of type?

- What is the breakup of the India phosphatic fertilizer market on the basis of solubility?

- What is the breakup of the India phosphatic fertilizer market on the basis of form?

- What is the breakup of the India phosphatic fertilizer market on the basis of source?

- What is the breakup of the India phosphatic fertilizer market on the basis of application?

- What are the various stages in the value chain of the India phosphatic fertilizer market?

- What are the key driving factors and challenges in the India phosphatic fertilizer market?

- What is the structure of the India phosphatic fertilizer market and who are the key players?

- What is the degree of competition in the India phosphatic fertilizer market?

Key Benefits for Stakeholders:

- IMARC’s industry report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, market forecasts, and dynamics of the India phosphatic fertilizer market from 2019-2033.

- The research report provides the latest information on the market drivers, challenges, and opportunities in the India phosphatic fertilizer market.

- Porter's Five Forces analysis assist stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyze the level of competition within the India phosphatic fertilizer industry and its attractiveness.

- Competitive landscape allows stakeholders to understand their competitive environment and provides an insight into the current positions of key players in the market.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)