India Phosphoric Acid Market Size, Share, Trends and Forecast by Grade, Application, and Region, 2025-2033

India Phosphoric Acid Market Overview:

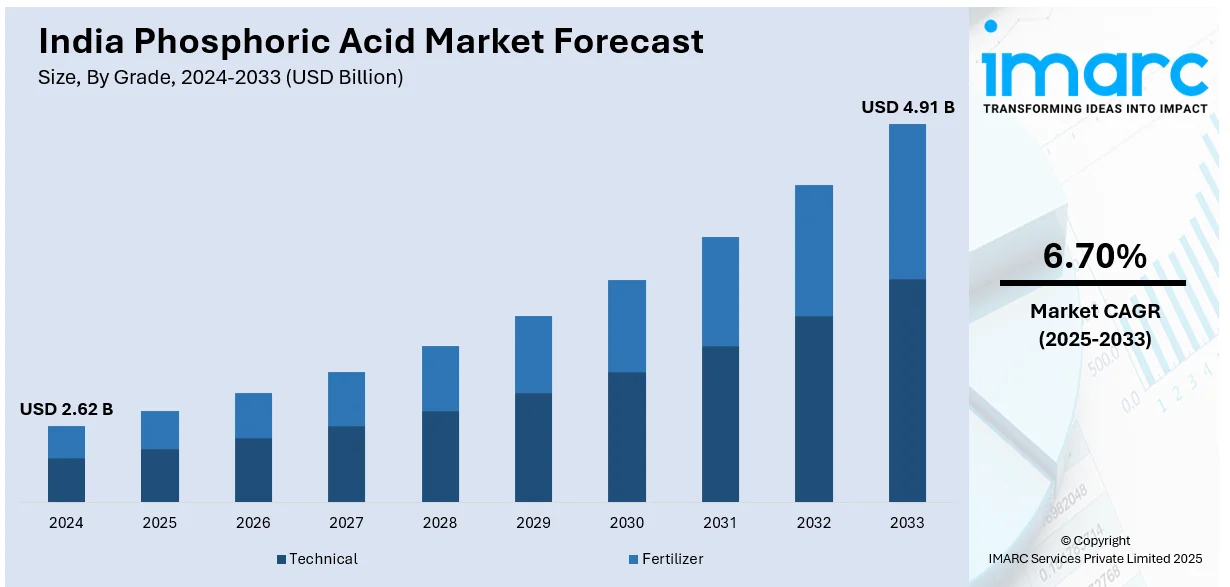

The India phosphoric acid market size reached USD 2.62 Billion in 2024. Looking forward, IMARC Group expects the market to reach USD 4.91 Billion by 2033, exhibiting a growth rate (CAGR) of 6.70% during 2025-2033. The market is driven by strong demand from the fertilizer sector, growing industrial use, and increased focus on domestic production. Import dependency, price volatility, and government-backed self-reliance efforts continue to shape market dynamics and future growth.

|

Report Attribute

|

Key Statistics

|

|---|---|

|

Base Year

|

2024 |

|

Forecast Years

|

2025-2033

|

|

Historical Years

|

2019-2024

|

| Market Size in 2024 | USD 2.62 Billion |

| Market Forecast in 2033 | USD 4.91 Billion |

| Market Growth Rate 2025-2033 | 6.70% |

India Phosphoric Acid Market Trends:

High Demand from Fertilizer Sector

The fertilizer industry remains the primary consumer of phosphoric acid in India, with Di-Ammonium Phosphate (DAP) production accounting for the largest share. India phosphoric acid market growth is closely tied to the agricultural sector, as DAP is a key nutrient source for improving crop yields. With India being one of the world’s largest producers and consumers of fertilizers, demand for phosphoric acid remains consistently high, especially during peak sowing seasons. According to the report published by IBEF, the Indian fertilizer industry is set to grow to US$ 16.58 billion (Rs. 1.38 lakh crore) by 2032, reflecting a CAGR of 4.2%. In FY24, production reached 45.2 million tonnes, supported by government initiatives and a focus on nano-liquid urea to boost agricultural productivity and efficiency. Government subsidies on fertilizers and support for food security programs have further strengthened domestic consumption. As agricultural output continues to be a national priority, fertilizer manufacturers are ramping up production, driving steady phosphoric acid requirements. Ongoing efforts to enhance farm productivity and expand irrigated land also contribute to this demand. The close linkage between agriculture and fertilizer production ensures a stable and essential role for phosphoric acid in India’s economy.

To get more information on this market, Request Sample

Rising Investments In Domestic Phosphoric Acid Production

Strategic investments in domestic phosphoric acid production are gaining momentum as India looks to reduce its dependence on imports. This shift is directly influencing the India phosphoric acid market share, with local producers ramping up capacity to meet the growing demand, especially from the fertilizer sector. Setting up integrated plants that produce both phosphoric and sulphuric acid is becoming a preferred approach, ensuring supply chain stability and cost efficiency. For instance, in April 2024, Coromandel International announced its plans to invest Rs 1,000 crore to establish a phosphoric and sulphuric acid plant in Kakinada, Andhra Pradesh. The facility aims to enhance backward integration and reduce reliance on imported acid, with a planned capacity of 650 TPD for phosphoric acid and 1,800 TPD for sulphuric acid, expected to be operational in two years. These projects are primarily located near ports or existing fertilizer hubs, allowing better access to raw materials and faster distribution. Supportive government policies and long-term demand forecasts are encouraging companies to commit large-scale capital expenditure in this space. The move toward self-reliance not only improves availability but also insulates the domestic market from global price volatility. This focus on building local capacity will continue to drive India phosphoric acid market growth.

India Phosphoric Acid Market Segmentation:

IMARC Group provides an analysis of the key trends in each segment of the market, along with forecasts at the regional level for 2025-2033. Our report has categorized the market based on grade and application.

Grade Insights:

- Technical

- Fertilizer

The report has provided a detailed breakup and analysis of the market based on the grade. This includes technical and fertilizer.

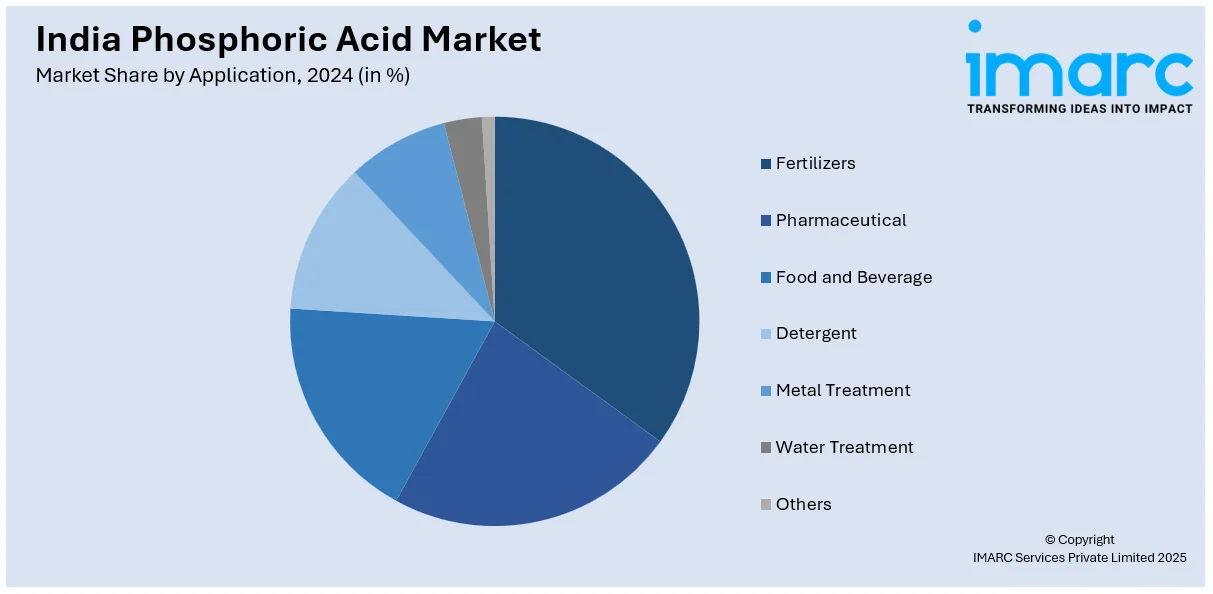

Application Insights:

- Fertilizers

- Pharmaceutical

- Food and Beverage

- Detergent

- Metal Treatment

- Water Treatment

- Others

A detailed breakup and analysis of the market based on the application have also been provided in the report. This includes fertilizers, pharmaceutical, food and beverage, detergent, metal treatment, water treatment and others.

Regional Insights:

- North India

- South India

- East India

- West India

The report has also provided a comprehensive analysis of all the major regional markets, which include North India, South India, East India and West India.

Competitive Landscape:

The market research report has also provided a comprehensive analysis of the competitive landscape. Competitive analysis such as market structure, key player positioning, top winning strategies, competitive dashboard, and company evaluation quadrant has been covered in the report. Also, detailed profiles of all major companies have been provided.

India Phosphoric Acid Market News:

- In January 2025, Paradeep Phosphates Ltd. (PPL) signed an MoU with the Government of Odisha to invest ₹4,000 crore over five years, boosting its phosphatic fertilizer manufacturing capacity. The initiative aims to enhance production, reduce environmental impact, and support agricultural growth, including developments in phosphoric acid production and infrastructure investments.

- In September 2024, Coromandel International announced its plans to acquire an additional 8.82% stake in Senegal's BMCC, increasing its ownership to 53.8%. The firm plans to invest $3.84 million and offer a $6.5 million loan for expansion, ensuring long-term supply security of rock phosphate for phosphoric acid production in India.

India Phosphoric Acid Market Report Coverage:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2024 |

| Historical Period | 2019-2024 |

| Forecast Period | 2025-2033 |

| Units | Billion USD |

| Scope of the Report |

Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Grades Covered | Technical, Fertilizer |

| Applications Covered | Fertilizers, Pharmaceutical, Food and Beverage, Detergent, Metal Treatment, Water Treatment, Others |

| Regions Covered | North India, South India, East India, West India |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Benefits for Stakeholders:

- IMARC’s industry report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, market forecasts, and dynamics of the India phosphoric acid market from 2019-2033.

- The research report provides the latest information on the market drivers, challenges, and opportunities in the India phosphoric acid market.

- Porter's five forces analysis assist stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyze the level of competition within the India phosphoric acid industry and its attractiveness.

- Competitive landscape allows stakeholders to understand their competitive environment and provides an insight into the current positions of key players in the market.

Key Questions Answered in This Report

The phosphoric acid market in India was valued at USD 2.62 Billion in 2024.

The India phosphoric acid market is projected to exhibit a CAGR of 6.70% during 2025-2033, reaching a value of USD 4.91 Billion by 2033.

The India phosphoric acid market is driven by rising fertilizer demand, growing population pressures on food production, increased use in animal feed, water treatment, and detergents, along with industrial applications in metal treatment and chemicals. Supportive government policies and expanding agricultural activities further accelerate market growth.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)