India Photonic Integrated Circuit Market Size, Share, Trends and Forecast by Component, Raw Material, Integration, Application, and Region, 2025-2033

India Photonic Integrated Circuit Market Overview:

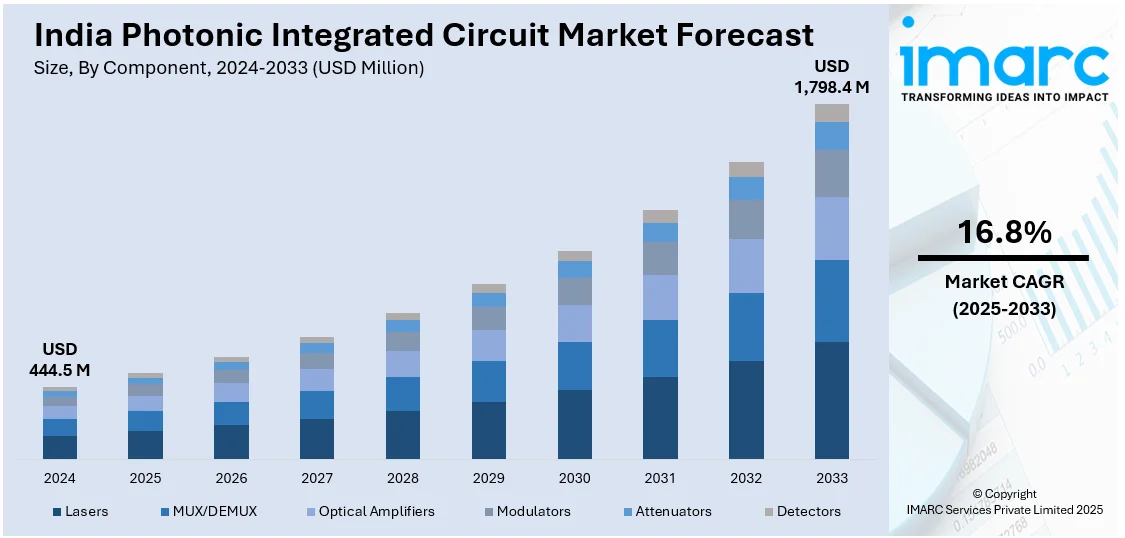

The India photonic integrated circuit market size reached USD 444.5 Million in 2024. Looking forward, IMARC Group expects the market to reach USD 1,798.4 Million by 2033, exhibiting a growth rate (CAGR) of 16.8% during 2025-2033. Government initiatives supporting semiconductor research, propelling demand for high-speed communication networks, advancements in silicon photonics by premier institutes like IITs, and collaborations with global technology leaders are key factors driving India's photonic integrated circuit market, fostering innovation, enhancing domestic manufacturing, and positioning India as a competitive player in photonics technology.

|

Report Attribute

|

Key Statistics

|

|---|---|

|

Base Year

|

2024 |

|

Forecast Years

|

2025-2033

|

|

Historical Years

|

2019-2024

|

| Market Size in 2024 | USD 444.5 Million |

| Market Forecast in 2033 | USD 1,798.4 Million |

| Market Growth Rate 2025-2033 | 16.8% |

India Photonic Integrated Circuit Market Trends:

Government Initiatives and Support

India's photonic integrated circuit (PIC) industry is experiencing strong growth with strategic government policies for the development of the semiconductor and photonics sector. Monetary assistance to indigenous semiconductor design companies, which also include the ones that have expertise in Integrated Circuits (ICs), chipsets, System on Chips (SoCs), and IP cores, directly promotes progress in PIC technology. With an aim to incubate at least 20 companies with a turnover of more than INR 1,500 crore each within five years, these policies are creating a healthy ecosystem for photonics innovation. By establishing a favorable research and development climate, such initiatives are not only boosting India's PIC manufacturing capacity but also making the nation a major world player in photonics. Government emphasis on semiconductor technology self-reliance will further boost investment and innovation within India's PIC market, bolstering applications for telecommunications, healthcare, and data centers.

To get more information on this market, Request Sample

Escalating Demand for Advanced Communication Technologies

India's photonic integrated circuit (PIC) industry is expanding at a fast pace, spurred by growing demand for cutting-edge communication technologies in India. As internet penetration has increased, with the proliferation of smartphones and the launch of 5G networks, there is a strong need for high-speed, high-efficiency data transmission technologies. PICs, through ultra-high speed optical processing of data, are becoming a key element in addressing these needs. The digitalization efforts and policies of the Indian government to encourage semiconductor and telecom infrastructure development are playing a key role in market development. Initiatives like the Make in India and Production-Linked Incentive (PLI) schemes are inducing domestic production of optical communication components, such as PICs, cutting down on import reliance and promoting domestic innovation. Also, India's thriving industrial base is further spurring the demand for state-of-the-art communications networks. The rise of smart cities, cloud computing, and the use of IoT applications are all the more promoting the demand for PIC technology amid this industrial progress.

India Photonic Integrated Circuit Market Segmentation:

IMARC Group provides an analysis of the key trends in each segment of the market, along with forecasts at the region/country level for 2025-2033. Our report has categorized the market based on component, raw material, integration, and application.

Component Insights:

- Lasers

- MUX/DEMUX

- Optical Amplifiers

- Modulators

- Attenuators

- Detectors

The report has provided a detailed breakup and analysis of the market based on the component. This includes lasers, MUX/DEMUX, optical amplifiers, modulators, attenuators, and detectors.

Raw Material Insights:

- Indium Phosphide (InP)

- Gallium Arsenide (GaAs)

- Lithium Niobate (LiNbO3)

- Silicon

- Silica-on-Silicon

A detailed breakup and analysis of the market based on the raw material have also been provided in the report. This includes indium phosphide (InP), gallium arsenide (GaAs), lithium niobate (LiNbO3), silicon, and silica-on-silicon.

Integration Insights:

- Monolithic Integration

- Hybrid Integration

- Module Integration

A detailed breakup and analysis of the market based on the integration have also been provided in the report. This includes monolithic integration, hybrid integration, and module integration.

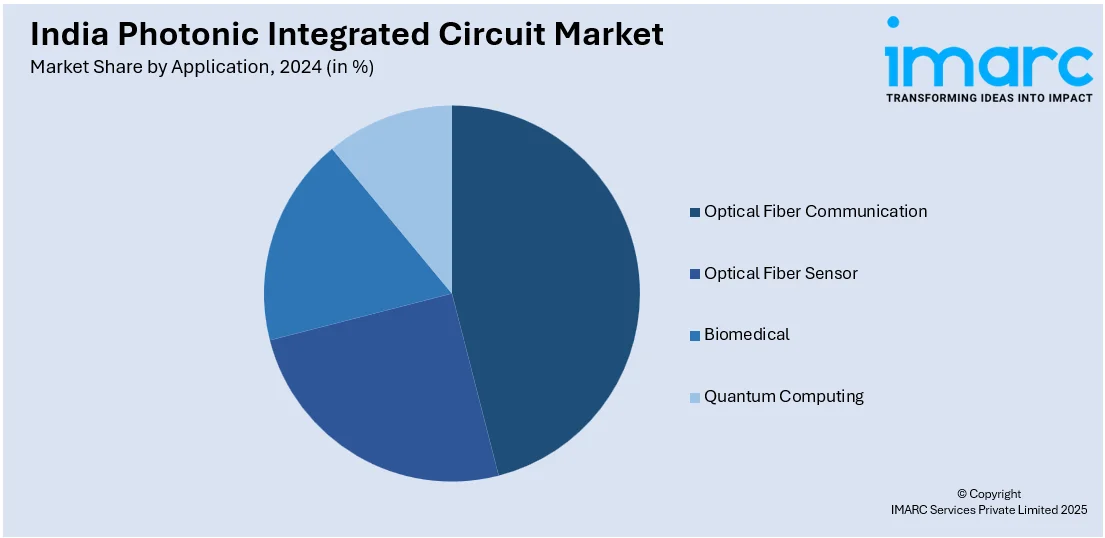

Application Insights:

- Optical Fiber Communication

- Optical Fiber Sensor

- Biomedical

- Quantum Computing

A detailed breakup and analysis of the market based on the application have also been provided in the report. This includes optical fiber communication, optical fiber sensor, biomedical, and quantum computing.

Regional Insights:

- North India

- South India

- East India

- West India

The report has also provided a comprehensive analysis of all the major regional markets, which include North India, South India, East India, and West India.

Competitive Landscape:

The market research report has also provided a comprehensive analysis of the competitive landscape. Competitive analysis such as market structure, key player positioning, top winning strategies, competitive dashboard, and company evaluation quadrant has been covered in the report. Also, detailed profiles of all major companies have been provided.

India Photonic Integrated Circuit Market News:

- July 2024: Scientists at IIT Bombay used silicon nitride to advance photonic technology for better efficiency and scalability. The development aids India's photonic integrated circuit industry by making it possible for cost-efficient, high-performance optical devices. Such technologies enhance local semiconductor capabilities and stimulate uptake in telecom and data communications industries.

- May 2024: IIT Madras' Silicon Photonics Centre of Excellence collaborated with SilTerra Malaysia to co-design programmable silicon photonic processor chips aimed at applications in quantum computing and quantum-proof communication systems. The partnership boosts India's strength in photonic integrated circuits, thereby driving innovation and enhancing India's position in the global photonics industry. Such efforts drive the expansion of India's semiconductor ecosystem, meeting national technology advancement objectives.

India Photonic Integrated Circuit Market Report Coverage:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2024 |

| Historical Period | 2019-2024 |

| Forecast Period | 2025-2033 |

| Units | Million USD |

| Scope of the Report | Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Components Covered | Lasers, MUX/DEMUX, Optical Amplifiers, Modulators, Attenuators, Detectors |

| Raw Materials Covered | Indium Phosphide (InP), Gallium Arsenide (GaAs), Lithium Niobate (LiNbO3), Silicon, Silica-on-Silicon |

| Integrations Covered | Monolithic Integration, Hybrid Integration, Module Integration |

| Applications Covered | Optical Fiber Communication, Optical Fiber Sensor, Biomedical, Quantum Computing |

| Regions Covered | North India, South India, East India, West India |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Benefits for Stakeholders:

- IMARC’s industry report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, market forecasts, and dynamics of the India photonic integrated circuit market from 2019-2033.

- The research report provides the latest information on the market drivers, challenges, and opportunities in the India photonic integrated circuit market.

- Porter's five forces analysis assist stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyze the level of competition within the India photonic integrated circuit industry and its attractiveness.

- Competitive landscape allows stakeholders to understand their competitive environment and provides an insight into the current positions of key players in the market.

Key Questions Answered in This Report

The photonic integrated circuit market in India was valued at USD 444.5 Million in 2024.

The India photonic integrated circuit market is projected to exhibit a CAGR of 16.8% during 2025-2033, reaching a value of USD 1,798.4 Million by 2033.

The photonic integrated circuit market in India is propelled by the rising need for high-speed data transfer, expanding rollout of 5G networks, and progress in optical computing. Additionally, the increasing application of photonics in data centers and telecommunications is contributing to market growth, along with favorable government support for semiconductor development.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)