India Photopolymers Market Size, Share, Trends and Forecast by Performance, Technology, Application, and Region, 2025-2033

India Photopolymers Market Overview:

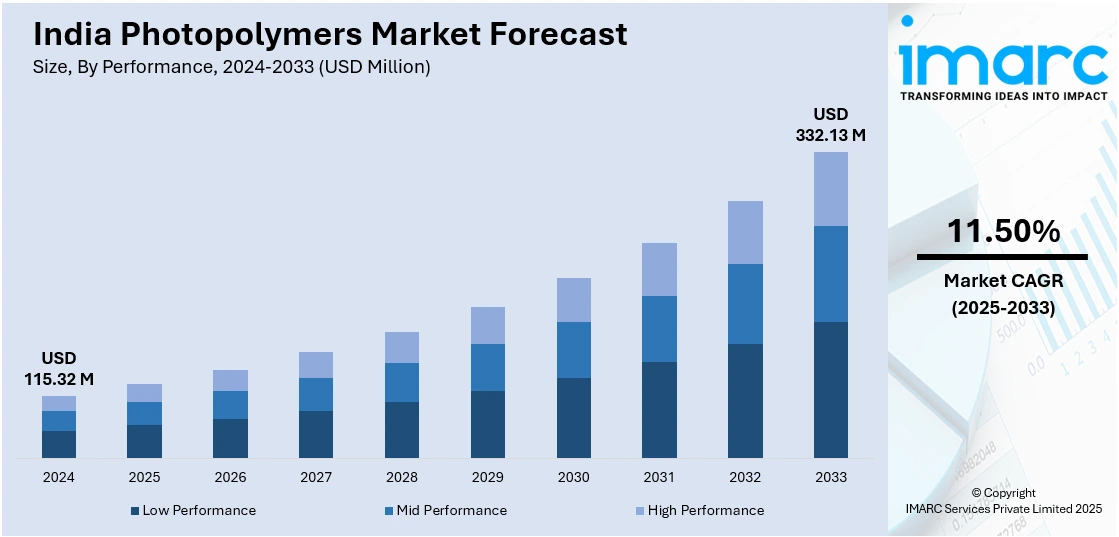

The India photopolymers market size reached USD 115.32 Million in 2024. Looking forward, IMARC Group expects the market to reach USD 332.13 Million by 2033, exhibiting a growth rate (CAGR) of 11.50% during 2025-2033. The increasing adoption of 3D printing technologies across industries such as automotive, aerospace, and healthcare, government initiatives like 'Make in India' promoting advanced manufacturing, and the rising need for rapid prototyping and customized products are among the primary factors bolstering the market growth.

|

Report Attribute

|

Key Statistics

|

|---|---|

|

Base Year

|

2024

|

|

Forecast Years

|

2025-2033

|

|

Historical Years

|

2019-2024

|

| Market Size in 2024 | USD 115.32 Million |

| Market Forecast in 2033 | USD 332.13 Million |

| Market Growth Rate 2025-2033 | 11.50% |

India Photopolymers Market Trends:

Rapid Growth of 3D Printing Across Industrial Sectors

India's accelerating adoption of 3D printing technology is fueling a substantial rise in demand for photopolymers, particularly across high-performance sectors such as automotive, aerospace, dental, and healthcare. Photopolymers, essential in resin-based additive manufacturing techniques like stereolithography (SLA) and digital light processing (DLP), are gaining prominence as the country pushes forward with its 'Make in India' initiative. This national focus on boosting domestic manufacturing has positioned 3D printing as a vital enabler of rapid prototyping, customization, and lightweight part production—capabilities critical to defense and automotive innovation. In 2024, India's 3D printing market was estimated at USD 707 million and is anticipated to grow significantly, reaching USD 4,330 million by 2033. This growth reflects a strong compound annual growth rate (CAGR) of 21.70%. Industrial applications currently account for a high proportion of photopolymer resin usage, highlighting the material's importance in manufacturing workflows. Moreover, a growing ecosystem of 3D printing startups in India is driving domestic innovation in photopolymer development. As technology matures, the demand for high-strength, durable, and biocompatible photopolymers is expected to surge.

To get more information on this market, Request Sample

Increasing Adoption in Dentistry and Custom Healthcare Solutions

An emerging trend in India’s healthcare sector is the growing use of photopolymers in dental and medical applications, driven by the rapid digitization of clinical workflows. Dental clinics and laboratories, particularly in tier-1 cities, are increasingly adopting 3D printing technologies that utilize photopolymer resins to produce crowns, bridges, dentures, surgical guides, and orthodontic devices with high precision and biocompatibility. A growing number of private dental labs in major Indian cities are integrating photopolymer-based 3D printing into their operations. These materials significantly reduce turnaround time, making them ideal for delivering personalized, patient-specific solutions. Beyond dentistry, photopolymers are being employed in creating anatomical models, medical device prototypes, and hearing aids, further accelerating the shift toward customized healthcare. The demand for biocompatible photopolymer resins is anticipated to grow at a robust pace, fueled by rising regulatory approvals and the increasing need for rapid, patient-centered care solutions across India’s evolving medical landscape.

India Photopolymers Market Segmentation:

IMARC Group provides an analysis of the key trends in each segment of the market, along with forecasts at the region/country level for 2025-2033. Our report has categorized the market based on performance, technology, and application.

Performance Insights:

- Low Performance

- Mid Performance

- High Performance

The report has provided a detailed breakup and analysis of the market based on the performance. This includes low performance, mid performance, and high performance.

Technology Insights:

- Stereolithography (SLA)

- Digital Light Processing (DLP)

- Continuous Digital Light Processing (CDLP)

A detailed breakup and analysis of the market based on the technology have also been provided in the report. This includes stereolithography (SLA), digital light processing (DLP), and continuous digital light processing (CDLP).

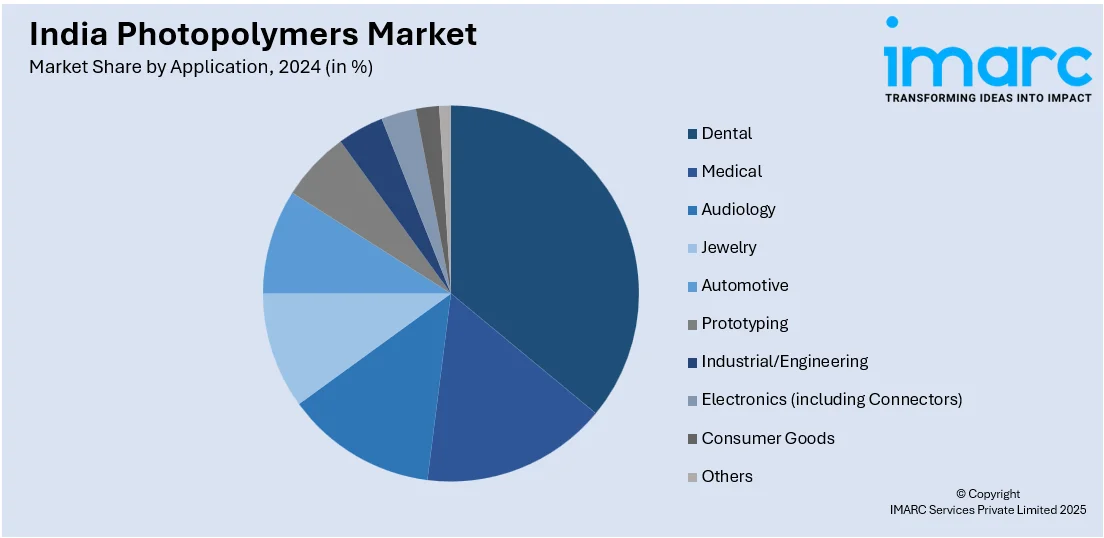

Application Insights:

- Dental

- Medical

- Audiology

- Jewelry

- Automotive

- Prototyping

- Industrial/Engineering

- Electronics (including Connectors)

- Consumer Goods

- Others

The report has provided a detailed breakup and analysis of the market based on the application. This includes dental, medical, audiology, jewelry, automotive, prototyping, industrial/engineering, electronics (including connectors), consumer goods, and others.

Regional Insights:

- North India

- South India

- East India

- West India

The report has also provided a comprehensive analysis of all the major regional markets, which include North India, South India, East India, and West India.

Competitive Landscape:

The market research report has also provided a comprehensive analysis of the competitive landscape. Competitive analysis such as market structure, key player positioning, top winning strategies, competitive dashboard, and company evaluation quadrant has been covered in the report. Also, detailed profiles of all major companies have been provided.

India Photopolymers Market News:

- November 2024: Supernova launched its Viscogels photopolymer materials alongside the Pulse Production Platform, both driven by its patented Viscous Lithography Manufacturing (VLM) technology.

- May 2024: XSYS introduced two new plates under the Nyloflex eco brand. The Nyloflex eco ACT and Nyloflex eco FAC are medium hard photopolymer plates designed for paper and board applications, offering optimal print quality and compatibility with tube and LED exposure systems.

- February 2024: Evonik introduced a new photopolymer resin called INFINAM FR 4100L. This resin was designed for utilization with DLP 3D printers and can be printed and further processed to achieve a desired surface feel.

India Photopolymers Market Report Coverage:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2024 |

| Historical Period | 2019-2024 |

| Forecast Period | 2025-2033 |

| Units | Million USD |

| Scope of the Report |

Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Performances Covered | Low Performance, Mid Performance, High Performance |

| Technologies Covered | Stereolithography (SLA), Digital Light Processing (DLP), Continuous Digital Light Processing (CDLP) |

| Applications Covered | Dental, Medical, Audiology, Jewelry, Automotive, Prototyping, Industrial/Engineering, Electronics (including Connectors), Consumer Goods, Others |

| Regions Covered | North India, South India, East India, West India |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Benefits for Stakeholders:

- IMARC’s industry report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, market forecasts, and dynamics of the India photopolymers market from 2019-2033.

- The research report provides the latest information on the market drivers, challenges, and opportunities in the India photopolymers market.

- Porter's five forces analysis assist stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyze the level of competition within the India photopolymers industry and its attractiveness.

- Competitive landscape allows stakeholders to understand their competitive environment and provides an insight into the current positions of key players in the market.

Key Questions Answered in This Report

The photopolymers market in India was valued at USD 115.32 Million in 2024.

The India photopolymers market is projected to exhibit a CAGR of 11.50% during 2025-2033, reaching a value of USD 332.13 Million by 2033.

The market is driven by expanding use in printing technologies, especially in packaging and imaging applications. Demand is also rising due to the material’s rapid curing properties and adaptability in light-based manufacturing processes. Growth in sectors requiring precision and customization, such as electronics and prototyping, is further encouraging the adoption of photopolymer solutions.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)