India Phthalic Anhydride Market Size, Share, Trends and Forecast by Type, Sales Channel, End User, and Region, 2025-2033

India Phthalic Anhydride Market Size and Share:

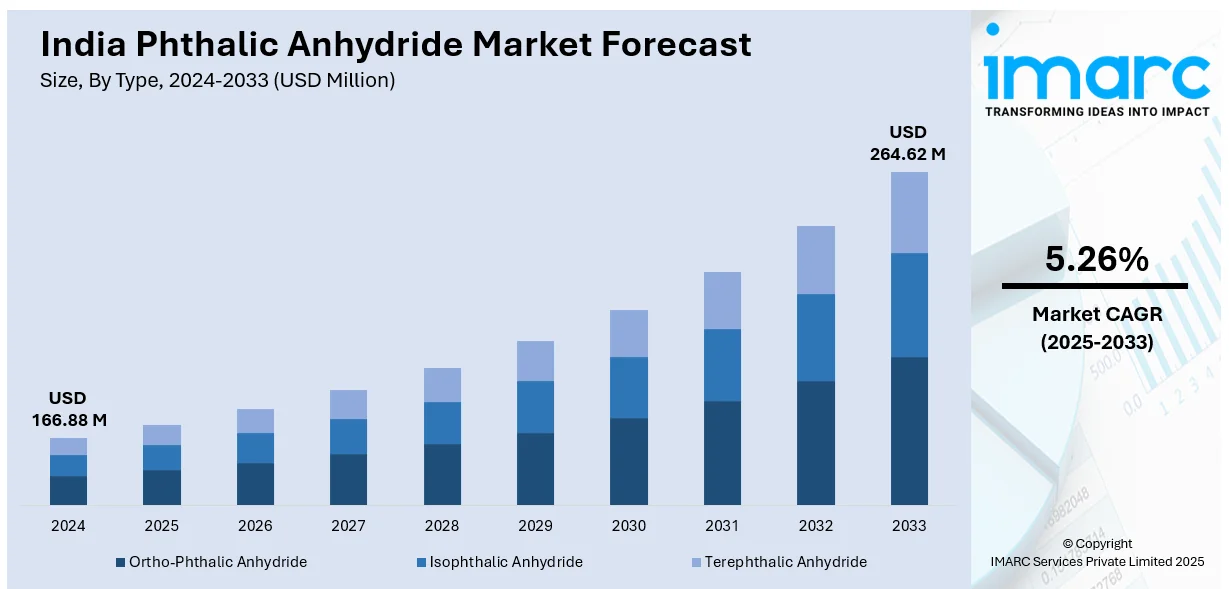

The India phthalic anhydride market size reached USD 166.88 Million in 2024. Looking forward, IMARC Group expects the market to reach USD 264.62 Million by 2033, exhibiting a growth rate (CAGR) of 5.26% during 2025-2033. The India phthalic anhydride market is expanding due to rising investments in chemical and petrochemical infrastructure and increasing demand from the construction sector for coatings, resins, and plasticizers used in renovation and large-scale infrastructure development projects.

|

Report Attribute

|

Key Statistics

|

|---|---|

|

Base Year

|

2024

|

|

Forecast Years

|

2025-2033

|

|

Historical Years

|

2019-2024

|

| Market Size in 2024 | USD 166.88 Million |

| Market Forecast in 2033 | USD 264.62 Million |

| Market Growth Rate 2025-2033 | 5.26% |

India Phthalic Anhydride Market Trends:

Increased Investment in Chemical and Petrochemical Industries

The rising investment in chemical and petrochemical sectors is a key element propelling the phthalic anhydride market growth. The governing body along with private sector entities is making significant investments to expand and modernize chemical manufacturing facilities, aiming to boost production capacity and enhance the overall competitiveness of the sector. These investments are resulting in greater production of vital chemical intermediates, such as phthalic anhydride, utilized across numerous industries. The creation of modern, sophisticated petrochemical facilities and refineries guarantees that phthalic anhydride can be manufactured in significant quantities, satisfying both local needs and export requirements. By focusing on the integration of cutting-edge technologies, these facilities enhance operational efficiency, lower expenses, and lead to improved product quality. As investments in the sector continue to rise, the market for phthalic anhydride is expected to grow further, driven by enhanced infrastructure, innovation, and technological advancements. In line with this trend, in 2024, I G Petrochemicals declared the start of production at its new PA-5 phthalic anhydride facility in Taloja, Maharashtra, with a capacity of 53,000 MTPA. The facility was created to facilitate the company's expansion in manufacturing vital chemicals utilized in plastics, resins, and coatings. This signified an important growth for I G Petrochemicals in the chemical production industry.

To get more information on this market, Request Sample

Growing Focus on Renovation and Construction Projects

With the ongoing growth and development of urban regions, the need for renovation and construction projects is increasing, thereby heightening the demand for phthalic anhydride. The rising emphasis on enhancing current infrastructure and building new structures, especially residential and commercial properties, is greatly boosting the need for coatings, adhesives, and sealants, which depend on phthalic anhydride as a crucial raw material. Additionally, extensive infrastructure initiatives, such as building roads, bridges, and public facilities, necessitate high-quality materials like resins and plasticizers sourced from phthalic anhydride. The swift urban development in India, combined with a shift towards upgrading infrastructure, is catalyzing the demand for these premium materials, rendering phthalic anhydride an essential element in this expanding industry. For instance, in 2024, the Prime Minister of India launched railway and national highway initiatives in Odisha valued at Rs 3,800 crore. He established the groundwork for railway initiatives worth more than Rs 2,800 crore in Bhubaneswar and national highway projects exceeding Rs 1,000 crore. These efforts sought to enhance infrastructure and connectivity in the area, highlighting the necessity for strong building materials that utilize phthalic anhydride. Furthermore, ongoing infrastructure advancements are driving the need for phthalic anhydride, confirming its vital importance in India's construction industry.

India Phthalic Anhydride Market Segmentation:

IMARC Group provides an analysis of the key trends in each segment of the market, along with forecasts at the regional level for 2025-2033. Our report has categorized the market based on type, sales channel, and end user.

Type Insights:

- Ortho-Phthalic Anhydride

- Isophthalic Anhydride

- Terephthalic Anhydride

The report has provided a detailed breakup and analysis of the market based on the type. This includes ortho-phthalic anhydride, isophthalic anhydride, and terephthalic anhydride.

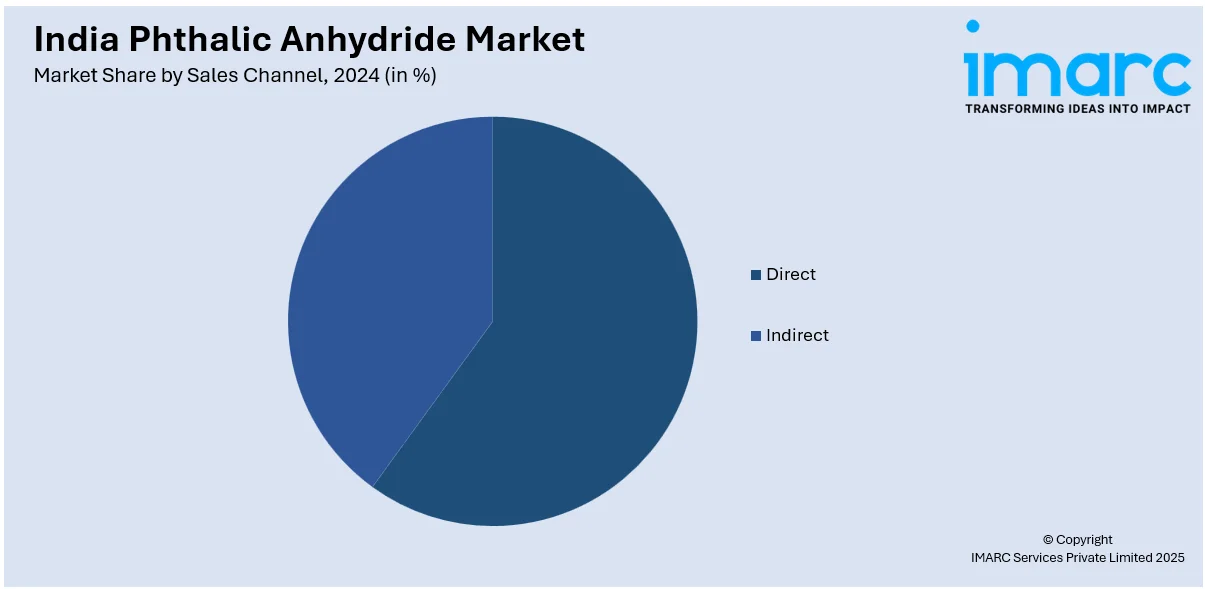

Sales Channel Insights:

- Direct

- Indirect

A detailed breakup and analysis of the market based on the sales channel have also been provided in the report. This includes direct and indirect.

End User Insights:

- Automotive

- Construction

- Textiles

- Electrical and Electronics

- Pharmaceuticals

- Paints and Coatings

The report has provided a detailed breakup and analysis of the market based on the end user. This includes automotive, construction, textiles, electrical and electronics, pharmaceuticals, and paints, and coatings.

Regional Insights:

- North India

- South India

- East India

- West India

The report has also provided a comprehensive analysis of all the major regional markets, which include North India, South India, East India, and West India.

Competitive Landscape:

The market research report has also provided a comprehensive analysis of the competitive landscape. Competitive analysis such as market structure, key player positioning, top winning strategies, competitive dashboard, and company evaluation quadrant has been covered in the report. Also, detailed profiles of all major companies have been provided.

India Phthalic Anhydride Market News:

- In January 2024, Thirumalai Chemicals resumed operations at its phthalic anhydride plant located at GIDC Estate, Dahej, Gujarat. The plant had been shut down for maintenance, and production was restarted after the necessary repairs and upgrades had been completed.

- In June 2023, KLJ Group announced the commissioning of its Rs. 1,200 crore plasticizers & phthalic anhydride production facility at GIDC Jhagadia, Gujarat. The facility had a capacity of 300,000 MT of phthalate plasticizers and 100,000 MT of phthalic anhydride annually. This strategic investment supported KLJ Group's growth and expansion in the chemicals and plastics industry.

India Phthalic Anhydride Market Report Coverage:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2024 |

| Historical Period | 2019-2024 |

| Forecast Period | 2025-2033 |

| Units | Million USD |

| Scope of the Report |

Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Types Covered | Ortho-Phthalic Anhydride, Isophthalic Anhydride, Terephthalic Anhydride |

| Sales Channels Covered | Direct, Indirect |

| End Users Covered | Automotive, Construction, Textiles, Electrical and Electronics, Pharmaceuticals, Paints and Coatings |

| Regions Covered | North India, South India, East India, West India |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Questions Answered in This Report:

- How has the India phthalic anhydride market performed so far and how will it perform in the coming years?

- What is the breakup of the India phthalic anhydride market on the basis of type?

- What is the breakup of the India phthalic anhydride market on the basis of sales channel?

- What is the breakup of the India phthalic anhydride market on the basis of end user?

- What is the breakup of the India phthalic anhydride market on the basis of region?

- What are the various stages in the value chain of the India phthalic anhydride market?

- What are the key driving factors and challenges in the India phthalic anhydride market?

- What is the structure of the India phthalic anhydride market and who are the key players?

- What is the degree of competition in the India phthalic anhydride market?

Key Benefits for Stakeholders:

- IMARC’s industry report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, market forecasts, and dynamics of the India phthalic anhydride market from 2019-2033.

- The research report provides the latest information on the market drivers, challenges, and opportunities in the India phthalic anhydride market.

- Porter's five forces analysis assist stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyze the level of competition within the India phthalic anhydride industry and its attractiveness.

- Competitive landscape allows stakeholders to understand their competitive environment and provides an insight into the current positions of key players in the market.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)