India Physical Security Market Size, Share, Trends and Forecast by Component, Enterprise Size, Industry Vertical, and Region, 2025-2033

Market Overview:

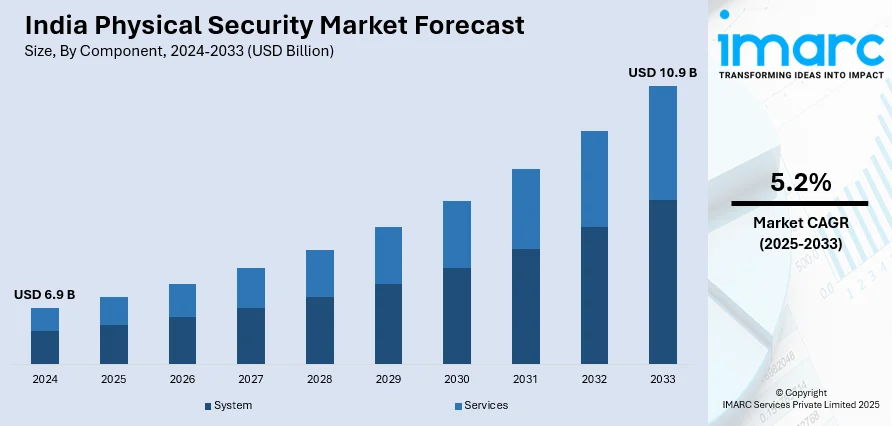

The India physical security market size reached USD 6.9 Billion in 2024. The market is expected to reach USD 10.9 Billion by 2033, exhibiting a growth rate (CAGR) of 5.2% during 2025-2033. The market growth is attributed to increasing advancements in video analytics, high-resolution cameras, and edge computing, which contribute to the growth of the video surveillance segment within physical security, increasing regional awareness and concerns regarding security threats, integration of cutting-edge technologies such as artificial intelligence, video analytics, and IoT (Internet of Things), and evolving regulatory landscape with emphasis on stringent security standards and compliance requirements.

Market Insights:

- On the basis of region, the market has been divided into North India, West and Central India, South India, and East and Northeast India.

- On the basis of component, the market has been divided into system (physical access system, video surveillance system, perimeter intrusion and detection, physical security information management, and others) and services (system integration, remote monitoring, and others).

- On the basis of enterprise size, the market has been divided into large enterprises and small and medium-sized enterprises.

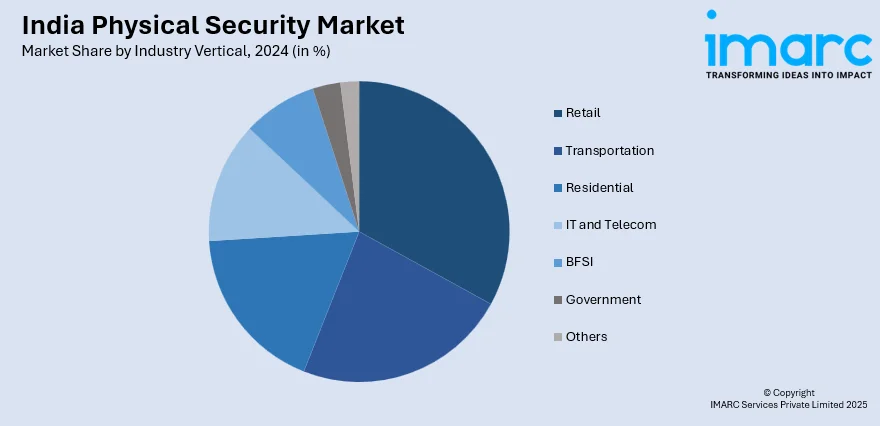

- On the basis of industry vertical, the market has been divided into retail, transportation, residential, IT and telecom, BFSI, government, and others.

Market Size and Forecast:

- 2024 Market Size: USD 6.9 Billion

- 2033 Projected Market Size: USD 10.9 Billion

- CAGR (2025-2033): 5.2%

Physical security is a critical aspect of safeguarding assets, people, and information within a physical space. It encompasses measures designed to prevent unauthorized access, protect against potential threats, and mitigate risks to physical infrastructure. This multifaceted approach involves the implementation of various security measures such as access control systems, surveillance cameras, perimeter barriers, and intrusion detection systems. These components work together to create a secure environment, deterring potential intruders and providing a rapid response to any security breaches. Physical security is not limited to traditional brick-and-mortar facilities; it extends to data centers, transportation hubs, and critical infrastructure. The goal is to create a robust defense system that ensures the safety of individuals, secures sensitive information, and safeguards valuable assets. As technology evolves, physical security measures continue to adapt, incorporating advanced technologies to address emerging threats and challenges.

To get more information on this market, Request Sample

The physical security market in India is experiencing robust growth, primarily propelled by the increasing regional awareness and concerns regarding security threats. In recent years, organizations across various sectors have recognized the imperative need to safeguard their physical assets, personnel, and information from potential risks. Consequently, this growing awareness has led to a surge in the India physical security market demand. Moreover, the rising incidents of unauthorized access, thefts, and acts of terrorism have underscored the necessity for robust security measures. In addition to this, advancements in technology play a pivotal role in driving the physical security market forward. The integration of cutting-edge technologies such as artificial intelligence, video analytics, and IoT (Internet of Things) into physical security solutions has enhanced their effectiveness and efficiency. Furthermore, the evolving regulatory landscape, with an emphasis on stringent security standards and compliance requirements, has become a significant driver for the market. As organizations strive to meet and exceed these standards, there is a corresponding increase in the adoption of comprehensive physical security solutions that address compliance needs. In summary, the confluence of heightened security awareness, technological innovations, and evolving regulatory frameworks collectively propels the growth of the physical security market in India.

India Physical Security Market Trends:

Growing Use of AI and Automation in Security Solutions

The industry is experiencing an upsurge in the adoption of artificial intelligence (AI) and automation. Facial recognition and anomaly detection are among the AI technologies being deployed to enhance surveillance capacity. The trend enables more streamlined monitoring and quicker response times. Automated systems, like access control and alarm management, are minimizing the risk of human error and maximizing security operations in business and residential areas. These innovations not only enhance physical security systems but also optimize security processes, lowering operational expenses. With increasing security threats, demand for AI-based solutions is likely to increase, facilitating proactive risk management and offering more surveillance at the critical infrastructure. This trend is significantly augmenting the India physical security market share.

Growth in demand for video surveillance

Video surveillance systems continue to be among the most important elements in the India physical security market. High-definition cameras and video analytics are in increasing demand as companies and government agencies try to upgrade security levels. With growing urbanization and public safety worries, video surveillance solutions have emerged as an important factor in public area monitoring, commercial properties, and government facilities. The movement towards IP-based cameras, providing more scalability and compatibility with other security technologies, is visible. Cloud storage for video data is also gaining popularity because of its affordability and convenience. With an increase in security concerns, video surveillance remains at the core of the overall physical security plan, thereby supports India physical security market growth.

Expansion of Smart Access Control Systems

The growth of smart access control systems is revolutionizing the physical security scenario in India. Such systems utilize technologies such as biometrics, smart cards, and mobile access to add security and convenience. As compared to conventional lock-and-key practices, smart access control provides fine-grained control, enabling organizations to monitor and manage entry in real time. This is especially true within corporate offices, high-rise residential apartments, and government buildings where security is paramount. Additionally, these systems are now cheaper and more scalable to be made available to smaller companies as well. The growing demand for contactless access solutions, post-COVID-19 pandemic, further propels the adoption of smart access control systems in India.

Some of the market trends are,

- Growing Security Needs Owing to Increasing Crime Rates: Growing crime rates in urban as well as rural India have increased the demand for extensive physical security solutions in different sectors. Organizations are spending more on sophisticated surveillance systems and access control technologies to safeguard their assets and people from potential dangers.

- Government Policies and Programs Encouraging Safety: Smart city development and infrastructure protection government programs are stimulating demand for comprehensive physical security solutions. Public safety and critical infrastructure protection-focused policy frameworks are stimulating private investment in security technology.

- Growing Use of Technology in Security Solutions: Artificial intelligence and machine learning technologies are transforming physical security systems with predictive analytics. Cloud-based security solutions are increasingly being used because of their scalability, affordability, and remote monitoring.

- India Physical Security Industry Trends: The industry is observing heightened consolidation with large players making acquisitions of smaller firms to extend their service offerings. There is a heightened emphasis on the integration of cybersecurity with physical security systems to offer end-to-end protection against hybrid threats.

Growth Drivers of the India Physical Security Market:

The market is experiencing robust growth driven by increasing security awareness across various industry verticals. Rising incidents of unauthorized access, thefts, and terrorism have created an urgent need for comprehensive security solutions. Technological advancements in artificial intelligence, video analytics, and IoT integration are enhancing the effectiveness of physical security systems. Government initiatives promoting smart city development and infrastructure security are providing additional growth momentum. The evolving regulatory landscape with stringent compliance requirements is driving organizations to upgrade their security infrastructure. Additionally, the increasing adoption of cloud-based security solutions is making advanced security technologies more accessible to businesses of all sizes.

Opportunities in the India Physical Security Market:

The market presents significant opportunities in the integration of physical and cybersecurity solutions to address hybrid threats. Growing demand for remote monitoring and management services opens new revenue streams for security service providers. The expansion of e-commerce and retail sectors creates substantial opportunities for physical security solutions in warehouses and distribution centers. Smart city initiatives across Indian metropolitan areas offer large-scale deployment opportunities for integrated security systems. The increasing focus on critical infrastructure protection presents opportunities for specialized security solutions in sectors like energy, transportation, and telecommunications. Furthermore, the development of indigenous security technologies presents opportunities for local manufacturers to capture market share.

Challenges in the India Physical Security Market:

According to the India physical security market analysis, the market faces challenges related to high initial investment costs, particularly for small and medium-sized enterprises. Lack of skilled professionals for installation, maintenance, and operation of advanced security systems poses a significant constraint. Integration complexities between different security technologies and existing infrastructure create implementation challenges. Privacy concerns and data protection regulations may limit the adoption of certain surveillance technologies. Economic uncertainties and budget constraints in some sectors can impact investment decisions in security infrastructure. Additionally, the need for continuous technology upgrades to address evolving threats requires ongoing investment commitments from organizations.

India Physical Security Market Segmentation:

IMARC Group provides an analysis of the key trends in each segment of the market, along with forecasts at the country level for 2025-2033. Our report has categorized the market based on component, enterprise size, and industry vertical.

Component Insights:

- System

- Physical Access System

- Video Surveillance System

- Perimeter Intrusion and Detection

- Physical Security Information Management

- Others

- Services

- System Integration

- Remote Monitoring

- Others

The report has provided a detailed breakup and analysis of the market based on the component. This includes system (physical access system, video surveillance system, perimeter intrusion and detection, physical security information management, and others) and services (system integration, remote monitoring, and others).

Enterprise Size Insights:

- Large Enterprises

- Small and Medium-sized Enterprises

A detailed breakup and analysis of the market based on the enterprise size have also been provided in the report. This includes large enterprises and small and medium-sized enterprises.

Industry Vertical Insights:

- Retail

- Transportation

- Residential

- IT and Telecom

- BFSI

- Government

- Others

The report has provided a detailed breakup and analysis of the market based on the industry vertical. This includes retail, transportation, residential, IT and telecom, BFSI, government, and others.

Regional Insights:

- North India

- West and Central India

- South India

- East and Northeast India

The report has also provided a comprehensive analysis of all the major regional markets, which include North India, West and Central India, South India, and East and Northeast India.

Competitive Landscape:

The market research report has also provided a comprehensive analysis of the competitive landscape. Competitive analysis such as market structure, key player positioning, top winning strategies, competitive dashboard, and company evaluation quadrant has been covered in the report. Also, detailed profiles of all major companies have been provided.

Latest News and Developments:

- In September 2025, Precision Biometric India Pvt. Ltd. launched the country’s first “Make in India” Digital Signature Certificate (DSC) tokens incorporating FIPS 140-3 certified secure elements. The new products – the InnaITKey PK32XX USB DSC Token and PK33XX NFC Tap-and-Sign Smart Card – comply with Controller of Certifying Authorities (CCA) specifications and are built with EAL 6+ assurance. Designed and manufactured entirely in India, without components from India’s border-sharing countries, the tokens support secure digital transactions in government, banking, healthcare, and enterprise sectors.

- In June 2025, Honeywell announced the launch of its first-ever CCTV camera portfolio fully designed and manufactured in India, called the 50 Series. The Class 1 certified range, developed under the Make in India initiative, features advanced cybersecurity measures, intelligent video analytics, gyro-sensor stabilization, and enhanced imaging, available in both 3MP and 5MP dome and bullet formats.

- In October 2024, CN Labs (Criterion Network Labs) became India’s first Bureau of Indian Standards (BIS)-approved laboratory authorized to conduct security testing of CCTV cameras under the new regulation. The certification process covers essential security requirements, including physical safeguards, network encryption, secure software updates, and penetration testing. This development supports India’s Compulsory Registration Scheme (CRS), which mandates that all CCTV cameras comply with the updated security standards by the prescribed enforcement timeline.

India Physical Security Market Report Coverage:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2024 |

| Historical Period | 2019-2024 |

| Forecast Period | 2025-2033 |

| Units | Billion USD |

| Scope of the Report | Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Components Covered |

|

| Enterprise Sizes Covered | Large Enterprises, Small and Medium-sized Enterprises |

| Industry Verticals Covered | Retail, Transportation, Residential, IT and Telecom, BFSI, Government, Others |

| Regions Covered | North India, West and Central India, South India, East and Northeast India |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Questions Answered in This Report:

- How has the India physical security market performed so far and how will it perform in the coming years?

- What has been the impact of COVID-19 on the India physical security market?

- What is the breakup of the India physical security market on the basis of component?

- What is the breakup of the India physical security market on the basis of enterprise size?

- What is the breakup of the India physical security market on the basis of industry vertical?

- What are the various stages in the value chain of the India physical security market?

- What are the key driving factors and challenges in the India physical security?

- What is the structure of the India physical security market and who are the key players?

- What is the degree of competition in the India physical security market?

Key Benefits for Stakeholders:

- IMARC’s industry report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, market forecasts, and dynamics of the India physical security market from 2019-2033.

- The research report provides the latest information on the market drivers, challenges, and opportunities in the India physical security market.

- Porter's five forces analysis assist stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyze the level of competition within the India physical security industry and its attractiveness.

- Competitive landscape allows stakeholders to understand their competitive environment and provides an insight into the current positions of key players in the market.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)