India Pigments Market Report by Product Type (Organic Pigments, Inorganic Pigments, Specialty Pigments), Color Index (Red, Orange, Yellow, Blue, Green, Brown, and Others), Application (Paints and Coatings, Plastics, Printing Inks, Construction Materials, and Others), and Region 2025-2033

Market Overview:

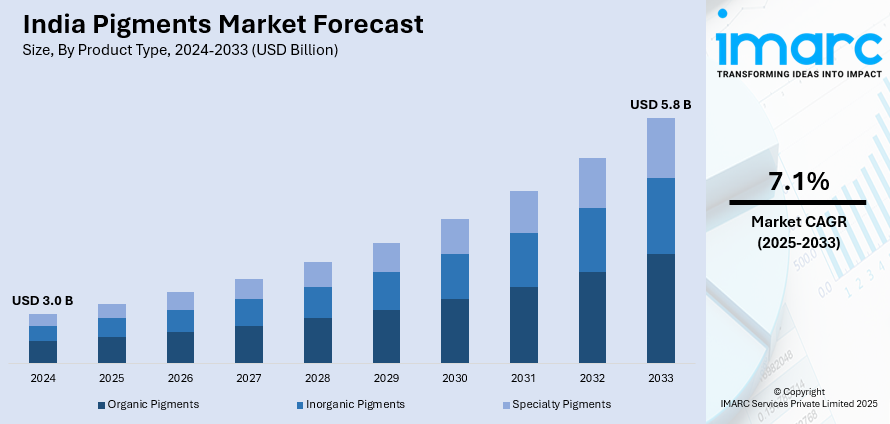

India pigments market size reached USD 3.0 Billion in 2024. Looking forward, IMARC Group expects the market to reach USD 5.8 Billion by 2033, exhibiting a growth rate (CAGR) of 7.1% during 2025-2033. The rising number of construction activities and the widespread adoption of digital inks are primarily driving the market growth.

|

Report Attribute

|

Key Statistics

|

|---|---|

|

Base Year

|

2024

|

|

Forecast Years

|

2025-2033

|

|

Historical Years

|

2019-2024

|

|

Market Size in 2024

|

USD 3.0 Billion |

|

Market Forecast in 2033

|

USD 5.8 Billion |

| Market Growth Rate 2025-2033 | 7.1% |

Pigments encompass a group of colored chemical compounds that are insoluble and physically blended into a medium. They play a crucial role in selectively absorbing light at specific wavelengths, resulting in the emission of colors through transmission, concealing the substrate, and enhancing the material's surface properties. Due to these versatile applications, pigments serve as a fundamental component in various industries, including paints, coatings, plastics, printing inks, and light-emitting sources. Presently, pigments are broadly classified into two main forms: organic and inorganic. Organic pigments are sourced from natural origins, while inorganic or synthetic pigments are either derived from petrochemicals or produced through calcination processes.

To get more information on this market, Request Sample

India Pigments Market Trends:

The India pigments market occupies a pivotal position within the nation's industrial landscape, serving as a crucial component in diverse sectors. Pigments are integral to various industries in India, prominently featuring in the formulation of paints, coatings, plastics, printing inks, and light-emitting sources. Additionally, the dynamic applications of pigments contribute significantly to the aesthetic and functional properties of end products in these sectors. Besides this, the current categorization of pigments in India encompasses two primary forms: organic and inorganic. Organic pigments are derived from natural sources, while inorganic or synthetic pigments are either sourced from petrochemicals or synthesized through calcination processes. Moreover, as India undergoes industrial growth and urbanization, the demand for pigments is on the rise. Apart from this, the country's construction, automotive, and packaging sectors, among others, are key contributors to the expanding pigments market. The versatility of pigments in providing a spectrum of colors and functionalities makes them indispensable in diverse applications. In addition to meeting domestic demand, the India pigments market is also positioned as a significant player in the global market. Furthermore, as industries continue to evolve and innovate, pigments play a pivotal role in shaping the visual and material aspects of various products. With ongoing advancements in manufacturing processes and increased emphasis on sustainable and eco-friendly options, the pigments market in India is poised for continued growth and adaptation to emerging trends.

India Pigments Market Segmentation:

IMARC Group provides an analysis of the key trends in each segment of the market, along with forecasts at the country level for 2025-2033. Our report has categorized the market based on product type, color index, and application.

Product Type Insights:

- Organic Pigments

- Azo Pigments

- Phthalocyanine Pigment

- Quinacridone Pigment

- Others

- Inorganic Pigments

- Titanium Dioxide Pigments

- Iron Oxide Pigments

- Cadmium Pigments

- Carbon Black Pigments

- Chromium Oxide Pigments

- Complex Inorganic Pigments

- Others

- Specialty Pigments

- Classic Organic Pigments

- Metallic Pigments

- High-Performance Pigments

- Light Interference Pigments

- Fluorescent Pigment

- Luminescent Pigments

- Thermo-Chromic Pigments

The report has provided a detailed breakup and analysis of the market based on the product type. This includes organic pigments (azo pigments, phthalocyanine pigment, quinacridone pigment, and others), inorganic pigments (titanium dioxide pigments, iron oxide pigments, cadmium pigments, carbon black pigments, chromium oxide pigments, complex inorganic pigments, and others), and specialty pigments (classic organic pigments, metallic pigments, high-performance pigments, light interference pigments, fluorescent pigment, luminescent pigments, and thermo-chromic pigments).

Color Index Insights:

- Red

- Orange

- Yellow

- Blue

- Green

- Brown

- Others

A detailed breakup and analysis of the market based on the color index have also been provided in the report. This includes red, orange, yellow, blue, green, brown, and others.

Application Insights:

- Paints and Coatings

- Plastics

- Printing Inks

- Construction Materials

- Others

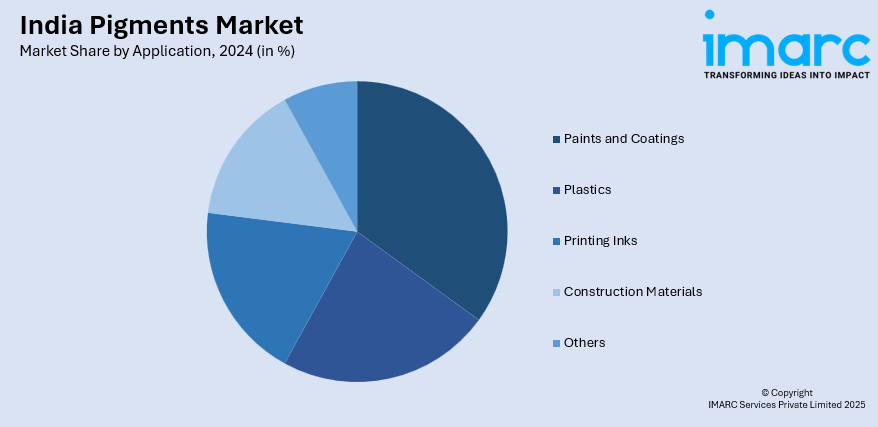

The report has provided a detailed breakup and analysis of the market based on the application. This includes paints and coatings, plastics, printing inks, construction materials, and others.

Regional Insights:

- North India

- West and Central India

- South India

- East and Northeast India

The report has also provided a comprehensive analysis of all the major regional markets, which include North India, West and Central India, South India, and East and Northeast India.

Competitive Landscape:

The market research report has also provided a comprehensive analysis of the competitive landscape. Competitive analysis such as market structure, key player positioning, top winning strategies, competitive dashboard, and company evaluation quadrant has been covered in the report. Also, detailed profiles of all major companies have been provided.

India Pigments Market Report Coverage:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2024 |

| Historical Period | 2019-2024 |

| Forecast Period | 2025-2033 |

| Units | Billion USD |

| Scope of the Report | Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Product Types Covered |

|

| Colors Index Covered | Red, Orange, Yellow, Blue, Green, Brown, Others |

| Applications Covered | Paints and Coatings, Plastics, Printing Inks, Construction Materials, Others |

| Regions Covered | North India, West and Central India, South India, East and Northeast India |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Benefits for Stakeholders:

- IMARC’s industry report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, market forecasts, and dynamics of the India pigments market from 2019-2033.

- The research report provides the latest information on the market drivers, challenges, and opportunities in the India pigments market.

- Porter's five forces analysis assist stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyze the level of competition within the India pigments industry and its attractiveness.

- Competitive landscape allows stakeholders to understand their competitive environment and provides an insight into the current positions of key players in the market.

Key Questions Answered in This Report

The pigments market in India was valued at USD 3.0 Billion in 2024.

The India pigments market is projected to exhibit a CAGR of 7.1% during 2025-2033, reaching a value of USD 5.8 Billion by 2033.

The India pigments market is driven by robust demand from paint and coatings sectors, fueled by infrastructure growth and rising residential and automotive projects. Increasing use in plastics, textiles, and inks, along with the shift toward eco-friendly and high-performance pigments, further stimulates industry expansion.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)