India Pin and Sleeve Devices Market Size, Share, Trends and Forecast by Product, Material, End Use, and Region, 2025-2033

India Pin and Sleeve Devices Market Overview:

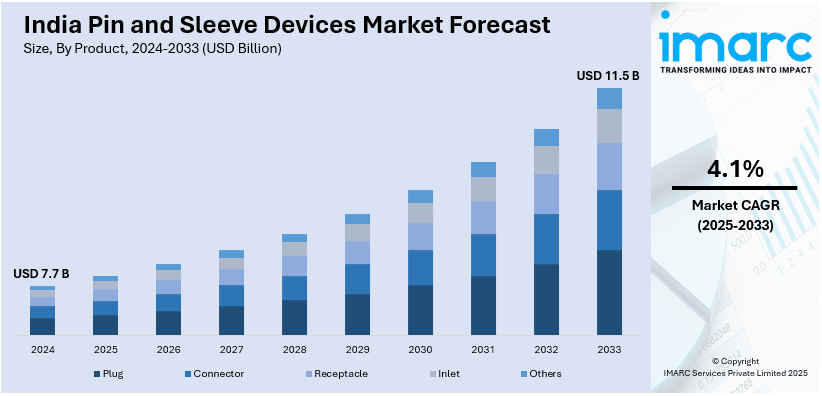

The India pin and sleeve devices market size reached USD 7.7 Billion in 2024. Looking forward, IMARC Group expects the market to reach USD 11.5 Billion by 2033, exhibiting a growth rate (CAGR) of 4.1% during 2025-2033. Industrial expansion, increasing demand for secure electrical connections, rising infrastructure projects, government initiatives for electrification, growth in data centers, and stringent safety regulations driving the adoption of durable and high-performance industrial plugs and connectors are some of the factors propelling the growth of the market.

|

Report Attribute

|

Key Statistics

|

|---|---|

|

Base Year

|

2024 |

|

Forecast Years

|

2025-2033

|

|

Historical Years

|

2019-2024

|

| Market Size in 2024 | USD 7.7 Billion |

| Market Forecast in 2033 | USD 11.5 Billion |

| Market Growth Rate 2025-2033 | 4.1% |

India Pin and Sleeve Devices Market Trends:

Advancing EV Connectivity

India’s electric vehicle infrastructure is witnessing a significant boost with the introduction of advanced connectors and charging solutions tailored for two- and three-wheelers. These innovations focus on improving durability, efficiency, and ease of use in charging systems, addressing the growing demand for robust pin and sleeve devices. By enhancing connectivity and safety in EV charging, such developments contribute to the broader goal of accelerating EV adoption across the country. The emphasis on local manufacturing aligns with India’s push for self-reliance in critical EV components. As adoption increases, these solutions are expected to improve charging efficiency, reduce downtime, and support a seamless transition to electrified mobility, reinforcing India’s position as a key player in the evolving EV ecosystem. For example, in January 2025, Amphenol unveiled two innovations, i.e., DuraSwap Concentric Connectors and the Type 6 Charging Gun at the Bharat Mobility Global Expo 2025, both designed and manufactured in India. These products aim to enhance the country's electric vehicle infrastructure, focusing on two- and three-wheeler applications, thereby supporting the growth of India's pin and sleeve devices market.

To get more information on this market, Request Sample

Rising Demand for Advanced Electrical Connectivity Solutions

The increasing focus on efficient and secure electrical infrastructure is driving the adoption of innovative wiring devices. With rapid urbanization and industrial growth, businesses are seeking integrated solutions that enhance safety, durability, and ease of installation. This shift is influencing product development in the pin and sleeve devices segment, leading to more compact, high-performance components designed for various applications. The market is witnessing a shift toward user-friendly, modular designs that streamline electrical connections while ensuring compliance with stringent safety regulations. Additionally, advancements in automation and smart technology integration are pushing manufacturers to develop products that support seamless connectivity in commercial and industrial environments. The growing need for reliable power distribution solutions is reshaping electrical component offerings. For instance, in August 2019, Legrand India introduced a new range of wiring devices, enhancing its portfolio in the electrical components market. This expansion underscores Legrand's commitment to providing comprehensive electrical solutions, potentially influencing the pin and sleeve devices segment by offering integrated connectivity options.

India Pin and Sleeve Devices Market Segmentation:

IMARC Group provides an analysis of the key trends in each segment of the market, along with forecasts at the region/country level for 2025-2033. Our report has categorized the market based on product, material, and end use.

Product Insights:

- Plug

- Connector

- Receptacle

- Inlet

- Others

The report has provided a detailed breakup and analysis of the market based on the product. This includes plug, connector, receptacle, inlet, and others.

Material Insights:

- Metallic

- Non-Metallic

A detailed breakup and analysis of the market based on the material have also been provided in the report. This includes metallic and non-metallic.

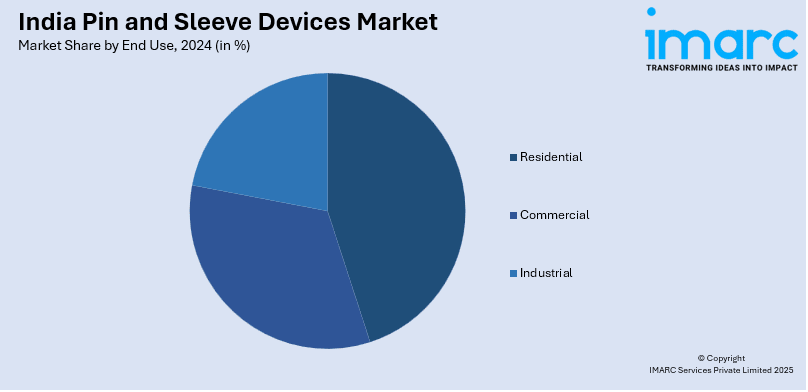

End Use Insights:

- Residential

- Commercial

- Industrial

- Automotive

- Manufacturing

- Oil and Gas

- Energy and Power

A detailed breakup and analysis of the market based on the end use have also been provided in the report. This includes residential, commercial, and industrial (automotive, manufacturing, oil and gas, and energy and power).

Regional Insights:

- North India

- South India

- East India

- West India

The report has also provided a comprehensive analysis of all the major regional markets, which include North India, South India, East India, and West India.

Competitive Landscape:

The market research report has also provided a comprehensive analysis of the competitive landscape. Competitive analysis such as market structure, key player positioning, top winning strategies, competitive dashboard, and company evaluation quadrant has been covered in the report. Also, detailed profiles of all major companies have been provided.

India Pin and Sleeve Devices Market Report Coverage:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2024 |

| Historical Period | 2019-2024 |

| Forecast Period | 2025-2033 |

| Units | Billion USD |

| Scope of the Report |

Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Products Covered | Plug, Connector, Receptacle, Inlet, Others |

| Materials Covered | Metallic, Non-Metallic |

| End Uses Covered |

|

| Regions Covered | North India, South India, East India, West India |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Questions Answered in This Report:

- How has the India pin and sleeve devices market performed so far and how will it perform in the coming years?

- What is the breakup of the India pin and sleeve devices market on the basis of product?

- What is the breakup of the India pin and sleeve devices market on the basis of material?

- What is the breakup of the India pin and sleeve devices market on the basis of end use?

- What are the various stages in the value chain of the India pin and sleeve devices market?

- What are the key driving factors and challenges in the India pin and sleeve devices market?

- What is the structure of the India pin and sleeve devices market and who are the key players?

- What is the degree of competition in the India pin and sleeve devices market?

Key Benefits for Stakeholders:

- IMARC’s industry report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, market forecasts, and dynamics of the India pin and sleeve devices market from 2019-2033.

- The research report provides the latest information on the market drivers, challenges, and opportunities in the India pin and sleeve devices market.

- Porter's five forces analysis assist stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyze the level of competition within the India pin and sleeve devices industry and its attractiveness.

- Competitive landscape allows stakeholders to understand their competitive environment and provides an insight into the current positions of key players in the market.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)