India Pizza Market Size, Share, Trends and Forecast by Type, Crust Type, Distribution Channel, and Region, 2026-2034

India Pizza Market Summary:

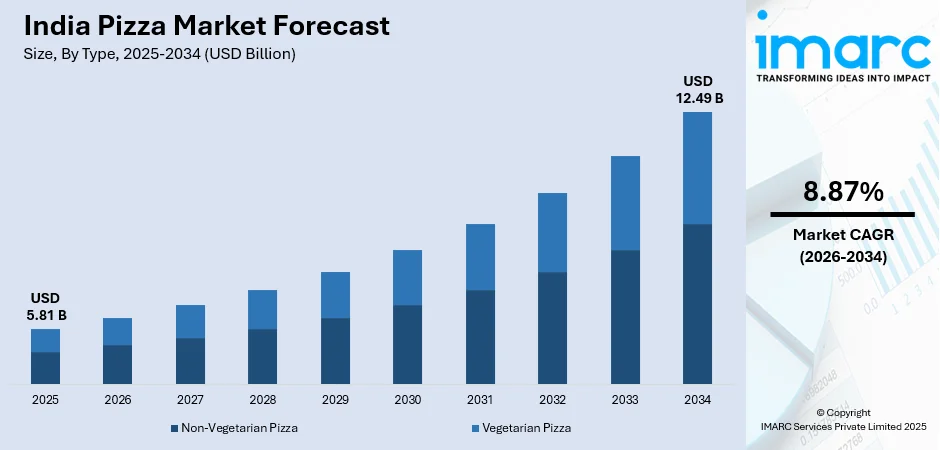

The India pizza market size was valued at USD 5.81 Billion in 2025 and is projected to reach USD 12.49 Billion by 2034, growing at a compound annual growth rate of 8.87% from 2026-2034.

The India pizza market is driven by rapid urbanization, rising disposable incomes among young working professionals, and increasing westernization of food preferences. The expansion of quick service restaurant networks across metropolitan and tier-two cities supports wider accessibility. Growing adoption of digital food ordering platforms, greater exposure to global cuisines through media and travel, and the convenience-oriented lifestyles of urban consumers are further accelerating demand, strengthening overall India pizza market share.

Key Takeaways and Insights:

-

By Type: Non-vegetarian pizza dominates the market with a share of 56% in 2025, driven by changing youth dietary habits, rising protein demand, innovative meat toppings, and growing urban acceptance of non-vegetarian choices.

-

By Crust Type: Thick crust leads the market with a share of 48% in 2025, owing to higher satiation levels, preference for hearty meals, superior topping retention, and wide availability across established national and international pizza chains.

-

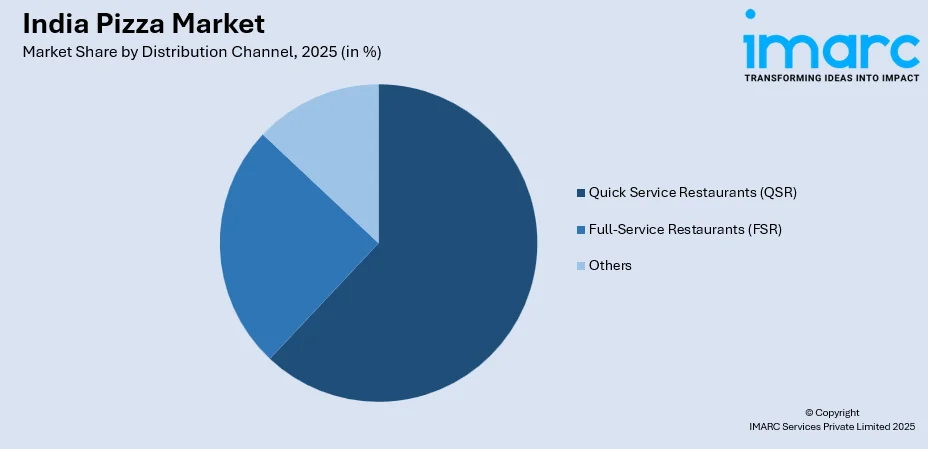

By Distribution Channel: Quick service restaurants (QSR) represent the largest segment with a market share of 62% in 2025, driven by dense outlet presence, strong promotions, efficient delivery systems, consistent quality standards, and high brand familiarity among consumers.

-

By Region: South India dominates the market with a share of 34% in 2025, driven by high urbanization rates in cities like Bangalore, Chennai, and Hyderabad, significant IT sector workforce concentration, cosmopolitan food culture, and strong quick service restaurant penetration.

-

Key Players: The India pizza market shows a concentrated competitive landscape, led by international chains with strong brand presence, while domestic and regional players compete through value pricing, localized flavors, and targeted offerings across diverse consumer segments.

To get more information on this market Request Sample

The India pizza market is witnessing robust expansion fueled by transformative socioeconomic and lifestyle shifts across the country. Rapid urbanization and the emergence of a young, aspirational middle class with increasing disposable incomes have fundamentally altered food consumption patterns, with pizza becoming a preferred choice for casual dining and convenience meals. The proliferation of quick service restaurant chains across metropolitan cities and their strategic expansion into tier-two and tier-three markets has significantly improved product accessibility. As per sources, in 2025, Pizza Hut India expanded its network from 567 to 630 stores in FY25, while Domino’s India added 184 outlets, highlighting aggressive expansion by leading pizza chains nationwide. Moreover, digital transformation through food aggregator platforms and brand-owned delivery applications has revolutionized ordering convenience, enabling seamless access to pizza offerings. Westernization of taste preferences, exposure to global food cultures, and the social dining appeal of pizza as a shareable food item continue to drive consumption among families and peer groups, establishing pizza as a mainstream food category in India's evolving culinary landscape.

India Pizza Market Trends:

Premiumization and Gourmet Pizza Offerings

The India pizza market is witnessing a distinct premiumization wave as consumers increasingly seek elevated dining experiences beyond conventional offerings. Gourmet pizza variants featuring artisanal ingredients, specialty cheeses, exotic toppings, and innovative flavor combinations are gaining traction among urban consumers willing to pay premium prices for differentiated experiences. In July 2025, Si Nonna’s opened its first Gurugram outlet, marking its 29th store nationwide and expansion into its ninth Indian city, reflecting rising consumer demand for premium, artisanal pizza experiences. Further, his trend reflects broader culinary sophistication among Indian consumers who seek restaurant-quality experiences. Operators are responding by introducing chef-curated menus, wood-fired cooking techniques, and farm-to-table ingredient sourcing narratives. The premium segment particularly resonates with millennials and affluent consumers seeking Instagram-worthy food experiences that combine taste with visual appeal and storytelling elements.

Expansion of Cloud Kitchen and Delivery-First Models

Cloud kitchen infrastructure is rapidly reshaping India's pizza delivery landscape, enabling brands to expand geographic reach without traditional brick-and-mortar investments. These delivery-only kitchen facilities optimize operational efficiency by eliminating dining space costs while maximizing order fulfilment capacity. The model enables rapid market penetration into residential neighbourhoods previously underserved by conventional outlets. Technology integration through food aggregator partnerships and proprietary ordering applications enhances customer acquisition and order management capabilities. This asset-light expansion strategy particularly benefits emerging pizza brands seeking nationwide presence while established players leverage cloud kitchens to complement existing restaurant networks and capture incremental delivery demand. As per sources, in July 2025, EatClub raised ₹185 Crore in a Tiger Global–led funding round, with A91 Partners and 360 ONE participating, reinforcing strong investor confidence in India’s cloud kitchen and delivery-first food brands.

Indianization and Regional Flavor Innovations

Menu localization strategies incorporating Indian flavors and regional taste preferences are emerging as significant market differentiators. Operators are introducing fusion variants featuring local spices, paneer toppings, tandoori preparations, and regional cuisine-inspired combinations that resonate with Indian palates while maintaining pizza's fundamental appeal. In April 2025, Pizza Hut India launched its Juicylicious Pizza range featuring marinated paneer and chicken with Kadhai, Royal Spice, and Southern Chilli sauces, reinforcing menu localization through bold Indian flavour innovations. Further, this trend extends beyond vegetarian adaptations to include regional meat preparations and indigenous ingredient incorporations. Seasonal and festival-themed limited-time offerings leverage cultural relevance to drive consumer engagement and repeat purchases. The Indianization approach enables brands to address taste preferences across diverse regional markets while differentiating from competitors relying solely on international menu standards.

Market Outlook 2026-2034:

The India pizza market is positioned for sustained revenue expansion throughout the forecast period, supported by favorable demographic dynamics and evolving consumption patterns. Continued urbanization, rising household incomes, and growing youth population will underpin demand growth while enabling category premiumization. Market revenue trajectory will benefit from distribution network expansion into emerging cities, technological innovations enhancing ordering convenience, and menu diversification catering to evolving taste preferences. The organized segment is expected to capture increasing share as consumer preference shifts toward branded, quality-assured offerings. The market generated a revenue of USD 5.81 Billion in 2025 and is projected to reach a revenue of USD 12.49 Billion by 2034, growing at a compound annual growth rate of 8.87% from 2026-2034.

India Pizza Market Report Segmentation:

| Segment Category | Leading Segment | Market Share |

|---|---|---|

| Type | Non-Vegetarian Pizza | 56% |

| Crust Type | Thick Crust | 48% |

| Distribution Channel | Quick Service Restaurants (QSR) | 62% |

| Region | South India | 34% |

Type Insights:

- Non-Vegetarian Pizza

- Vegetarian Pizza

Non-vegetarian pizza dominates with a market share of 56% of the total India pizza market in 2025.

Non-vegetarian pizza variants have established clear market leadership, reflecting evolving dietary attitudes and protein consumption preferences among Indian consumers. The segment benefits from increasing acceptance of meat-based foods across urban demographics, particularly among younger consumers influenced by global food trends and cosmopolitan lifestyles. Diverse topping options spanning chicken, pepperoni, sausage, and seafood varieties enable extensive menu innovation and flavor experimentation that drives consumer engagement and repeat purchases. As per sources, in June 2025, Domino’s India launched the Double Chicken Burst Pizza, featuring chicken keema-stuffed crusts, multiple chicken toppings, and five flavour variants, expanding its non-vegetarian menu across dine-in and delivery.

The non-vegetarian commands premium pricing relative to vegetarian alternatives, enhancing revenue contribution and operator profitability. Marketing strategies emphasizing indulgence, protein content, and international authenticity resonate with target consumers seeking Western dining experiences. Regional variations in meat preferences enable localized menu customization, with tandoori chicken variants particularly popular across North Indian markets while coastal regions demonstrate stronger seafood pizza acceptance, collectively strengthening segment dominance.

Crust Type Insights:

- Thick Crust

- Thin Crust

- Stuffed Crust

Thick crust leads with a share of 48% of the total India pizza market in 2025.

Thick crust lead India's pizza market through their alignment with consumer expectations for substantial, filling meal experiences. Indian consumers traditionally prefer hearty, satisfying food portions, and thick crust pizzas deliver greater satiation value that justifies purchase occasions as complete meals rather than snacks. The substantial base provides superior structural support for generous topping applications, enabling the loaded pizza presentations that Indian consumers favor.

Thick crust dominance extends across both dine-in and delivery channels, with the format demonstrating better transport durability maintaining quality during last-mile delivery operations. According to sources, in November 2025, Pizza Hut India launched the Ultimate Cheese Crust with a molten Cheese Crown and 2X cheese, promoted through the innovative “Flip To The Cheese” campaign across dine-in, delivery, and takeaway. Further, major pizza chains have established thick crust as their standard offering, building consumer familiarity and preference through consistent availability. The format accommodates diverse cheese quantities and topping combinations without compromising structural integrity, enabling the cheese-heavy preparations particularly popular among Indian consumers while supporting value-focused promotional strategies emphasizing generous portions.

Distribution Channel Insights:

Access the comprehensive market breakdown Request Sample

- Quick Service Restaurants (QSR)

- Full-Service Restaurants (FSR)

- Others

Quick service restaurants (QSR) exhibit a clear dominance with a 62% share of the total India pizza market in 2025.

Quick service restaurants (QSR) dominate India's pizza distribution landscape through their comprehensive operational advantages and consumer accessibility. Established QSR chains have developed extensive outlet networks spanning metropolitan cities and emerging urban centers, ensuring widespread brand visibility and convenient consumer access. As per sources, in 2025, Little Caesars entered the Indian market by opening its first outlet in DelhiNCR, marking India as its 30th country and signaling plans for further expansion nationwide. Moreover, standardized operations, efficient kitchen processes, and robust supply chain infrastructure enable consistent quality delivery across locations while optimizing cost structures.

This segment benefits from significant marketing investments building strong brand equity and consumer recall among target demographics. Aggressive promotional strategies including value meals, combo offers, and discount campaigns drive customer acquisition and order frequency. Digital ordering integration through proprietary applications and aggregator partnerships has enhanced convenience while generating valuable consumer data enabling personalized marketing initiatives. Efficient delivery infrastructure with optimized dispatch systems ensures timely order fulfillment, reinforcing consumer preference for QSR channels over alternatives.

Regional Insights:

- South India

- North India

- West & Central India

- East India

South India dominates with a market share of 34% of the total India pizza market in 2025.

South India maintains regional market leadership driven by exceptional urbanization levels and demographic characteristics highly favorable for pizza consumption. Major metropolitan centers including Bangalore, Chennai, and Hyderabad concentrate substantial IT sector workforces comprising young professionals with disposable incomes and cosmopolitan food preferences conducive to Western cuisine adoption. These cities demonstrate mature quick service restaurant ecosystems with extensive outlet penetration and established delivery infrastructure.

The region's educated, globally exposed population exhibits higher receptivity to international food concepts while maintaining appreciation for quality and value propositions. Corporate office clusters and technology parks generate significant weekday delivery demand, while residential expansion in suburban areas creates family dining occasions. South India's relatively higher internet penetration and digital payment adoption facilitate seamless online ordering experiences, further supporting market development and channel modernization across the region.

Market Dynamics:

Growth Drivers:

Why is the India Pizza Market Growing?

Expanding Young Urban Population and Changing Lifestyles

India's demographic dividend featuring a substantial young population concentrated in urban centers represents the fundamental growth engine for the pizza market. Millennials and Generation Z consumers demonstrate strong affinity for Western food formats, convenience-oriented dining solutions, and social eating experiences that pizza inherently provides. According to sources, in 2024, Zomato reported that nearly two pizzas were ordered every second across India throughout the year, highlighting strong popularity among urban, young consumers. Furthermore, urbanization continues accelerating as employment opportunities draw migration toward metropolitan areas and emerging cities, expanding the addressable consumer base for organized food service offerings. Changing lifestyle patterns including longer working hours, dual-income households, and time constraints have elevated convenience as a primary food choice criterion, positioning pizza's delivery-friendly format favorably. The social media-savvy young demographic actively shares food experiences online, generating organic brand visibility and peer influence that amplifies consumption trends across networks.

Digital Transformation and Food Delivery Ecosystem Growth

India's rapidly maturing food delivery ecosystem has transformed pizza accessibility and consumption occasions, driving significant market expansion. Food aggregator platforms have simplified discovery, ordering, and payment processes while expanding delivery reach into previously underserved residential areas. Significant venture capital investments in delivery infrastructure have subsidized consumer acquisition through promotional offers, accelerating category trial and adoption rates. Brand-owned digital channels enable direct consumer relationships, loyalty program implementation, and first-party data collection enhancing marketing effectiveness. Real-time order tracking, multiple payment options, and streamlined refund processes have elevated consumer confidence in delivery channels. Cloud kitchen proliferation has enabled asset-light geographic expansion, allowing brands to serve demand concentrations without traditional outlet investments while optimizing delivery radii for faster fulfillment.

Rising Disposable Incomes and Premiumization Opportunities

India's sustained economic growth has elevated household incomes across socioeconomic segments, expanding the consumer base capable of regular pizza purchases while enabling trading-up behaviors toward premium offerings. The emerging affluent middle class demonstrates willingness to spend on quality food experiences, supporting average ticket value growth through premium variants, larger sizes, and add-on purchases. According to sources, Papa John’s reentered India with four new Bengaluru outlets, offering premium toppings and fresh dough, targeting urban consumers seeking elevated pizza experiences. Moreover, income growth in tier-two and tier-three cities creates new market frontiers as discretionary spending capacity reaches thresholds supporting organized food service adoption. Premiumization extends beyond product to encompass experience dimensions including upgraded packaging, faster delivery commitments, and exclusive menu access for loyal customers. This income-driven premiumization enables margin expansion opportunities complementing volume growth strategies.

Market Restraints:

What Challenges the India Pizza Market is Facing?

Intense Competition from Alternative Food Categories

The pizza market faces substantial competitive pressure from diverse food categories vying for consumer food service expenditure. Traditional Indian cuisine options, other Western formats like burgers and sandwiches, and emerging categories including Asian cuisines compete for share of stomach and wallet. Local street food alternatives offer compelling value propositions at significantly lower price points, constraining pizza's addressable market among price-sensitive consumers. The proliferation of food choices through aggregator platforms intensifies competition by enabling easy comparison and experimentation across categories.

Health Consciousness and Nutritional Concerns

Growing health awareness among Indian consumers presents headwinds for pizza consumption as nutritional scrutiny of fast food intensifies. Concerns regarding calorie density, processed ingredients, and sodium content influence consumption frequency decisions among health-conscious demographics. Fitness-focused millennials increasingly seek healthier alternatives, potentially constraining repeat purchase rates. While operators have introduced healthier variants with whole wheat crusts and vegetable-forward toppings, these modifications struggle to fully address fundamental category perceptions, limiting effectiveness in countering health-driven consumption moderation trends.

Operational Cost Pressures and Margin Constraints

Pizza operators face persistent cost pressures across multiple operational dimensions constraining profitability and expansion capacity. Real estate costs in prime urban locations challenge outlet economics, while rising ingredient costs including cheese and protein toppings compress margins. Labor cost inflation and delivery personnel expenses burden unit economics, particularly for delivery-intensive models. Intense promotional competition requires substantial marketing investments impacting profitability. These cost headwinds necessitate continuous operational optimization and pricing calibration to maintain sustainable business models.

Competitive Landscape:

The India pizza market exhibits a concentrated competitive structure dominated by established international quick service restaurant chains that have invested significantly in building nationwide distribution networks, brand equity, and operational capabilities. These market leaders compete intensively through promotional campaigns, menu innovation, and delivery infrastructure investments while pursuing geographic expansion into emerging urban centers. The competitive landscape includes domestic chains and regional players targeting value-conscious segments with localized offerings and competitive pricing strategies. Cloud kitchen operators and virtual brands have introduced new competitive dynamics, leveraging asset-light models for rapid market entry. Competition increasingly centers on delivery speed, digital experience quality, and menu differentiation, with loyalty programs and subscription models emerging as customer retention tools across major players.

Recent Developments:

-

In July 2025, Rapper and entrepreneur Badshah launched Badboy Pizza, marking his entry into India’s quick service restaurant (QSR) sector. The first outlet opened in Andheri, Mumbai, with plans to expand to 50 major city locations. The chain aims to compete with established players like Domino’s and Pizza Hut through dine-in and cloud kitchens.

-

In June 2025, The Real Pizza Company opened its first Indian outlet in Bangalore, introducing authentic UK wood-fired pizzas. Known for stone-baked, artisanal pizzas, the brand aims to expand across metro and Tier2 cities, offering young Indians and families a premium, handcrafted pizza experience in India’s growing QSR landscape.

Report Coverage:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2025 |

| Historical Period | 2020-2025 |

| Forecast Period | 2026-2034 |

| Units | Billion USD |

| Scope of the Report | Exploration of Historical and Forecast Trends, Industry Catalysts and Challenges, Segment-Wise Historical and Predictive Market Assessment:

|

| Types Covered | Non-Vegetarian Pizza, Vegetarian Pizza |

| Crust Types Covered | Thick Crust, Thin Crust, Stuffed Crust |

| Distribution Channels Covered | Quick Service Restaurants (QSR), Full-Service Restaurants (FSR), Others |

| Regions Covered | South India, North India, West & Central India, East India |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Questions Answered in This Report

The India pizza market size was valued at USD 5.81 Billion in 2025.

The India pizza market is expected to grow at a compound annual growth rate of 8.87% from 2026-2034 to reach USD 12.49 Billion by 2034.

Non-vegetarian pizza held the largest share of the India pizza market, driven by rising protein consumption, changing urban food habits, menu innovation, and strong demand among younger consumers across major metropolitan cities.

Key factors driving the India pizza market include expanding young urban population with changing lifestyles, digital transformation enabling food delivery ecosystem growth, rising disposable incomes supporting premiumization, proliferation of quick service restaurant networks, and increasing consumer preference for convenient meal solutions.

Major challenges include intense competition from alternative food categories and traditional cuisines, growing health consciousness affecting consumption frequency, operational cost pressures from real estate and ingredients, delivery infrastructure investments, and maintaining profitability amid promotional competition.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)