India Plant-Based Meat Market Size, Share, Trends and Forecast by Product Type, Source, Meat Type, Distribution Channel, and Region, 2025-2033

Market Overview:

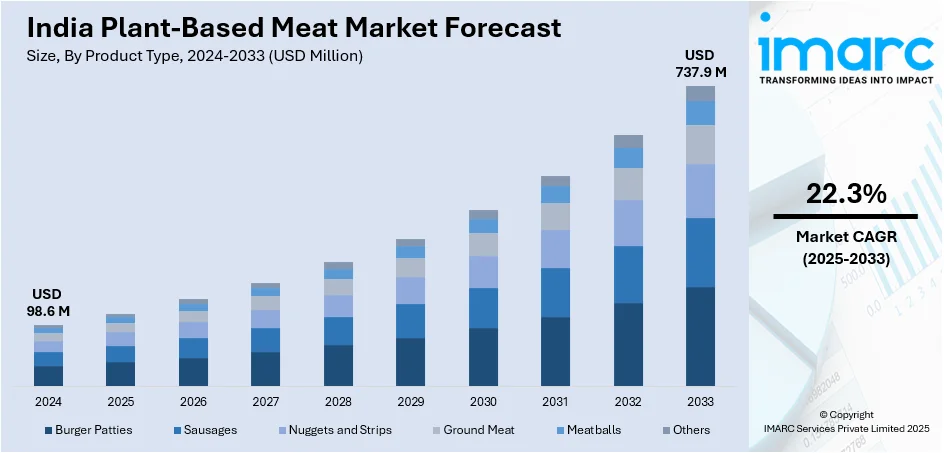

The India plant-based meat market size reached USD 98.6 Million in 2024. Looking forward, IMARC Group expects the market to reach USD 737.9 Million by 2033, exhibiting a growth rate (CAGR) of 22.3% during 2025-2033.

|

Report Attribute

|

Key Statistics

|

|---|---|

|

Base Year

|

2024

|

|

Forecast Years

|

2025-2033

|

|

Historical Years

|

2019-2024

|

|

Market Size in 2024

|

USD 98.6 Million |

|

Market Forecast in 2033

|

USD 737.9 Million |

| Market Growth Rate 2025-2033 | 22.3% |

Plant-based meats are manufactured using various ingredients, such as soy, green peas, jack fruit, wheat gluten, legumes, beans, coconut oil, beet juice, vegetable proteins, nuts, and seeds, to feel, taste, and appear like real meat. They are considered healthier as plant-based meats are lower in saturated fats and calories compared to regular meats. They are a rich source of antioxidants, vitamins, minerals, and fiber that assist in maintaining a healthy gut microbiome balance. In addition, they offer several advantages, such as weight management, preventing heart diseases, and reducing the risk of cancers. At present, there is a rise in the demand for plant-based meats in India due to their associated health benefits.

To get more information on this market, Request Sample

India Plant-Based Meat Market Trends:

Various non-governmental organizations (NGOs) operating in India are currently generating awareness about animal rights, which represents one of the key factors driving the market. Moreover, the rising consumer interest in plant-based diets for health and ethical reasons is propelling the growth of the market. In addition, the growing utilization of plant-based meats in making food products, such as burgers, sausages, ham, and meatballs, is positively influencing the market in the country. Besides this, the rising consumption of these meats to treat protein deficiency among the masses is contributing to the growth of the market. Apart from this, the escalating demand for plant-based meats in India to prevent non-communicable diseases, obesity, and digestive disorders is bolstering the growth of the market. Furthermore, their wide availability through online and offline distribution channels, coupled with the burgeoning e-commerce industry in the country, is expected to strengthen the growth of the market in the coming years.

Key Market Segmentation:

IMARC Group provides an analysis of the key trends in each sub-segment of the India plant-based meat market report, along with forecasts at the country and regional level from 2025-2033. Our report has categorized the market based on product type, source, meat type and distribution channel.

Breakup by Product Type:

- Burger Patties

- Sausages

- Nuggets and Strips

- Ground Meat

- Meatballs

- Others

Breakup by Source:

- Soy

- Wheat

- Peas

- Others

Breakup by Meat Type:

- Chicken

- Beef

- Pork

- Others

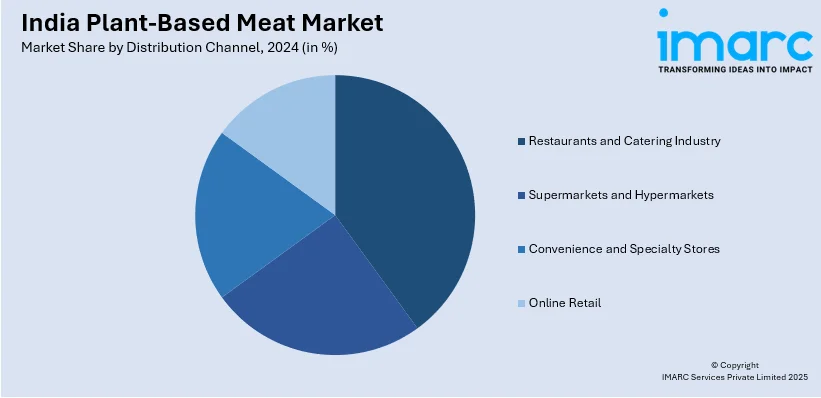

Breakup by Distribution Channel:

- Restaurants and Catering Industry

- Supermarkets and Hypermarkets

- Convenience and Specialty Stores

- Online Retail

Breakup by Region:

- North India

- West and Central India

- South India

- East India

Competitive Landscape:

The competitive landscape of the industry has also been examined along with the profiles of the key players.

Report Coverage:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2024 |

| Historical Period | 2019-2024 |

| Forecast Period | 2025-2033 |

| Units | Million USD |

| Segment Coverage | Product Type, Source, Meat Type, Distribution Channel, Region |

| Region Covered | North India, West and Central India, South India, East India |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Questions Answered in This Report

We expect the India plant-based meat market to exhibit a CAGR of 22.3% during 2025-2033.

The emerging trend of veganism, along with introduction of several awareness programs by numerous animal welfare organizations to reduce excessive animal killing for meat production, is primarily driving the India plant-based meat market.

The sudden outbreak of the COVID-19 pandemic has led to the changing consumer inclination from conventional brick-and-mortar distribution channels towards online retail platforms for the purchase of plant-based meat across the nation.

Based on the product type, the India plant-based meat market has been divided into burger patties, sausages, nuggets and strips, ground meat, meatballs, and others. Among these, burger patties exhibit a clear dominance in the market.

Based on the source, the India plant-based meat market can be categorized into soy, wheat, peas, and others. Currently, soy accounts for the majority of the total market share.

Based on the distribution channel, the India plant-based meat market can be bifurcated into restaurants and catering industry, supermarkets and hypermarkets, convenience and specialty stores, and online retail. Among these, supermarkets and hypermarkets exhibit a clear dominance in the market.

On a regional level, the market has been classified into North India, West and Central India, South India, and East India, where West and Central India currently dominates the India plant-based meat market.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)