India Plastic Molding Market Size, Share, Trends and Forecast by Type, Resin, Application, and Region, 2026-2034

India Plastic Molding Market Overview:

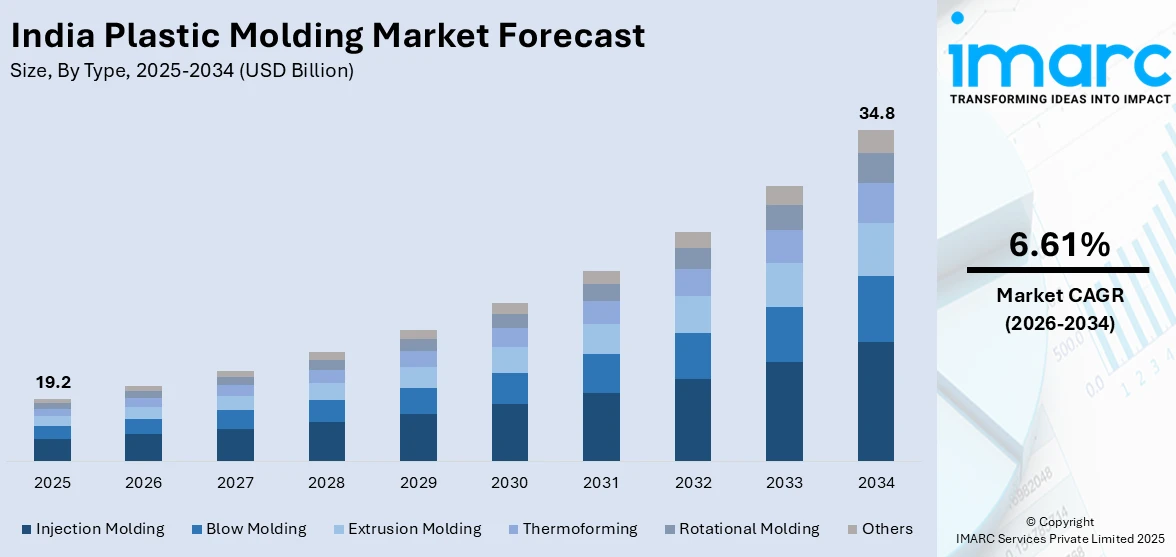

The India plastic molding market size reached USD 19.2 Billion in 2025. Looking forward, IMARC Group expects the market to reach USD 34.8 Billion by 2034, exhibiting a growth rate (CAGR) of 6.61% during 2026-2034. The rising demand in the automotive, packaging, and consumer goods sectors is one of the factors propelling the growth of the market. Growth in construction, technological advancements in molding processes, and increasing adoption of sustainable materials further fuel market expansion.

|

Report Attribute

|

Key Statistics

|

|---|---|

|

Base Year

|

2025 |

|

Forecast Years

|

2026-2034

|

|

Historical Years

|

2020-2025

|

| Market Size in 2025 | USD 19.2 Billion |

| Market Forecast in 2034 | USD 34.8 Billion |

| Market Growth Rate 2026-2034 | 6.61% |

India Plastic Molding Market Trends:

Expansion in Packaging Sector

India’s plastic molding market is witnessing substantial growth, supported by advancements in technology and increasing demand across various industries. Sectors like packaging, automotive, consumer goods, and construction are driving the need for molded plastic products. Additionally, the rise of e-commerce and FMCG has accelerated the demand for innovative packaging solutions. Companies are expanding production capacities and adopting eco-friendly materials, contributing to sustainable growth. With the government promoting domestic manufacturing, the sector is gaining momentum. Investments in automation and infrastructure are further enhancing efficiency and product quality. This upward trajectory is establishing the plastic molding industry as a significant contributor to India’s economic growth and industrial development. The Packaging Industry Association of India reports that the packaging sector currently holds the fifth-largest position in the Indian economy, highlighting its significant contribution to industrial growth and innovation. Growing at a rate of 22-25% annually, the sector has emerged as a leading destination for packaging solutions, driven by technological and infrastructural advancements.

To get more information on this market Request Sample

Rising Demand for Injection-Molded Packaging Solutions

Manufacturers are increasingly expanding production capabilities to meet the surging demand for injection-molded packaging across key sectors like paints, food, and pharmaceuticals. Investments in additional capacity enable companies to cater to evolving consumer preferences and industry needs, particularly in regions with rapidly growing consumption. This expansion also reflects the growing reliance on durable, lightweight, and customizable plastic packaging. By scaling up operations, companies position themselves to capitalize on the increasing adoption of advanced packaging solutions, driven by factors like convenience, product protection, and sustainability initiatives. This development indicates a broader shift toward efficient and scalable manufacturing processes in the packaging sector. For instance, in January 2024, Mold-Tek Packaging Ltd announced its plan to invest INR 120 Crore to expand its production capacity by 5,500 Metric Tons annually. The expansion would support the growing demand for injection-molded products in the paints, food, FMCG, and pharma sectors, further strengthening its presence in the Indian plastic molding market.

India Plastic Molding Market Segmentation:

IMARC Group provides an analysis of the key trends in each segment of the market, along with forecasts at the region/country level for 2026-2034. Our report has categorized the market based on type, resin, and application.

Type Insights:

- Injection Molding

- Blow Molding

- Extrusion Molding

- Thermoforming

- Rotational Molding

- Others

The report has provided a detailed breakup and analysis of the market based on the type. This includes injection molding, blow molding, extrusion molding, thermoforming, rotational molding, and others.

Resin Insights:

- Polyethylene

- Polypropylene

- Polystyrene

- Acrylonitrile Butadiene Styrene

- Polyvinyl Chloride

- Polyurethane

- Others

The report has provided a detailed breakup and analysis of the market based on the resin. This includes polyethylene, polypropylene, polystyrene, acrylonitrile butadiene styrene, polyvinyl chloride, polyurethane, and others.

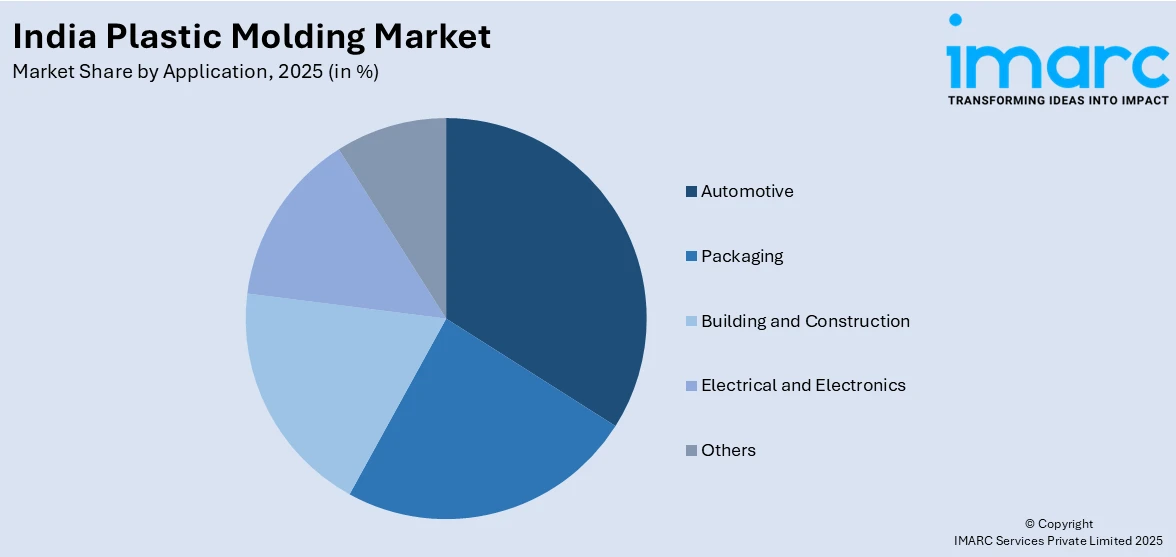

Application Insights:

Access the comprehensive market breakdown Request Sample

- Automotive

- Packaging

- Building and Construction

- Electrical and Electronics

- Others

A detailed breakup and analysis of the market based on the application have also been provided in the report. This includes automotive, packaging, building and construction, electrical and electronics, and others.

Regional Insights:

- North India

- South India

- East India

- West India

The report has also provided a comprehensive analysis of all the major regional markets, which include North India, South India, East India, and West India.

Competitive Landscape:

The market research report has also provided a comprehensive analysis of the competitive landscape. Competitive analysis such as market structure, key player positioning, top winning strategies, competitive dashboard, and company evaluation quadrant has been covered in the report. Also, detailed profiles of all major companies have been provided.

India Plastic Molding Market News:

- In February 2025, Autotech-Sirmax India expanded its Palwal plant, doubling its production capacity from 15,000 to 30,000 tonnes per annum. The expansion focuses on producing polypropylene-based compounds to meet rising demand in automotive, EV, electrical, and industrial sectors, further strengthening its position in the Indian plastic molding market.

- In February 2024, Uniloy Inc. announced its plan to invest USD 1 Million to establish its own facility in Ahmedabad, India, aiming to double its blow molding machine production capacity. The move involves relocating from a shared space with Milacron to a dedicated 20,000-square-foot plant, enhancing manufacturing efficiency. Uniloy plans to increase production from 36 to 60-70 machines annually, catering to sectors like FMCG, pharmaceuticals, and agrochemicals.

India Plastic Molding Market Report Coverage:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2025 |

| Historical Period | 2020-2025 |

| Forecast Period | 2026-2034 |

| Units | Billion USD |

| Scope of the Report |

Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Types Covered | Injection Molding, Blow Molding, Extrusion Molding, Thermoforming, Rotational Molding, Others |

| Resins Covered | Polyethylene, Polypropylene, Polystyrene, Acrylonitrile Butadiene Styrene, Polyvinyl Chloride, Polyurethane, Others |

| Applications Covered | Automotive, Packaging, Building and Construction, Electrical and Electronics, Others |

| Regions Covered | North India, South India, East India, West India |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Benefits for Stakeholders:

- IMARC’s industry report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, market forecasts, and dynamics of the India plastic molding market from 2020-2034.

- The research report provides the latest information on the market drivers, challenges, and opportunities in the India plastic molding market.

- Porter's five forces analysis assist stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyze the level of competition within the India plastic molding industry and its attractiveness.

- Competitive landscape allows stakeholders to understand their competitive environment and provides an insight into the current positions of key players in the market.

Key Questions Answered in This Report

The plastic molding market in India was valued at USD 19.2 Billion in 2025.

The India plastic molding market is projected to exhibit a CAGR of 6.61% during 2026-2034, reaching a value of USD 34.8Billion by 2034.

Growing demand from industries like automotive, packaging, electronics, and consumer goods is driving the India plastic molding market. Factors such as lightweight material preference, design flexibility, cost-effective mass production, and expanding manufacturing activities are further supporting market growth across both domestic consumption and export-oriented production.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)