India Plastic Packaging Market Size, Share, Trends and Forecast by Packaging Type, Product Type, End User, and Region, 2026-2034

Market Overview:

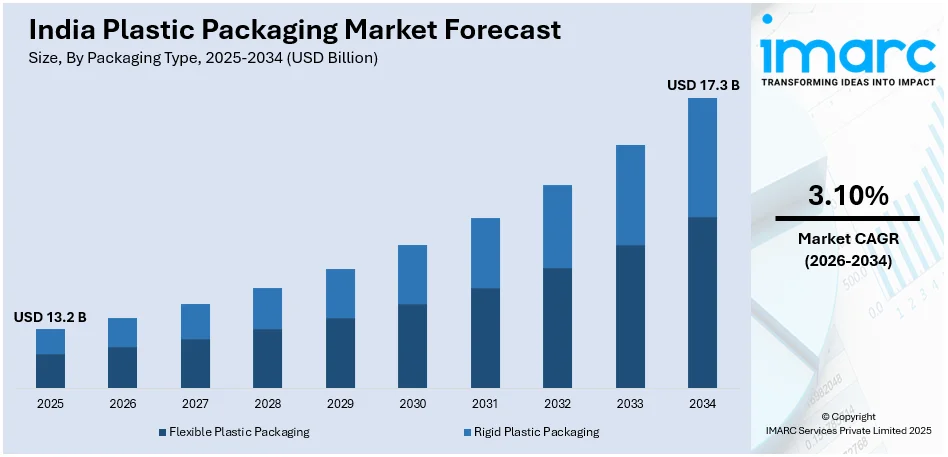

The India plastic packaging market size reached USD 13.2 Billion in 2025. The market is expected to reach USD 17.3 Billion by 2034, growing at a CAGR of 3.10% from 2026-2034. The market is majorly driven by the advancements in plastic materials and technologies, development of lightweight packaging solutions, creation of flexible packaging options, and innovation in barrier-enhanced packaging that extends shelf life and improves product performance.

Market Insights:

- Regional markets include North India, West and Central India, South India, and East and Northeast India.

- The market is segmented by packaging type: flexible plastic packaging and rigid plastic packaging.

- Based on product type, the market has been divided into bottles and jars, trays and containers, pouches, bags, films and wraps, and others.

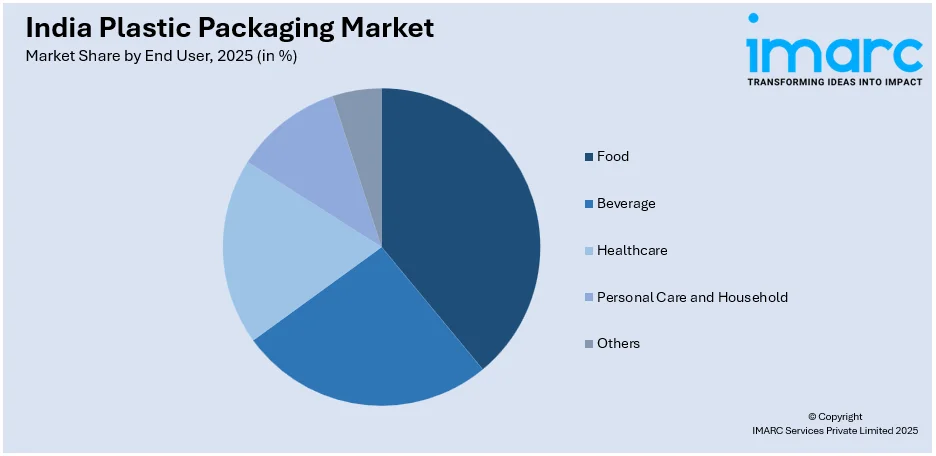

- On the basis of end user, the market has been categorized into food, beverage, healthcare, personal care and household, and others.

Market Size and Forecast:

- 2025 Market Size: USD 13.2 Billion

- 2034 Projected Market Size: USD 17.3 Billion

- CAGR (2026-2034): 3.10%

Plastic packaging refers to the use of plastic materials to contain, protect, and transport various goods and products. It is widely employed across industries due to its durability, versatility, and cost-effectiveness. Plastic packaging comes in various forms, including bottles, bags, containers, and wraps, catering to diverse needs ranging from food packaging to electronics and pharmaceuticals. Despite its widespread use, plastic packaging poses significant environmental challenges. Efforts to mitigate the environmental impact of plastic packaging include recycling initiatives, the development of biodegradable plastics, and regulations aimed at reducing single-use plastics. Innovations in sustainable packaging materials and designs also aim to minimize waste and pollution while maintaining the functionality and convenience of plastic packaging.

To get more information on this market Request Sample

The plastic packaging market in India is primarily propelled by several key factors. Firstly, the increasing demand for convenience and on-the-go consumption has driven the growth of plastic packaging solutions. Additionally, the versatility of plastic materials enables manufacturers to create innovative packaging designs catering to diverse consumer needs. Moreover, the lightweight nature of plastic packaging reduces transportation costs and carbon emissions, contributing to its widespread adoption across various industries. Furthermore, the durability and flexibility of plastic packaging ensure product protection and longer shelf life, enhancing its appeal to both producers and consumers alike. However, despite these benefits, environmental concerns surrounding plastic pollution have spurred efforts towards sustainable packaging alternatives. Nevertheless, advancements in recycling technologies and the development of biodegradable plastics offer promising solutions to mitigate environmental impacts while sustaining the functionality of plastic packaging. Overall, the plastic packaging market in India is shaped by a complex interplay of consumer preferences, regulatory dynamics, and technological innovations, driving continuous evolution and adaptation within the industry.

India Plastic Packaging Market Trends:

Growth Drivers and Opportunities in the India Plastic Packaging Market

The diversity of applications and the advantages offered by plastics are adding to the demand for plastic packaging in the India market, driven by consumer needs for convenient, on-the-go products. Disposable incomes and urbanization are adding to the consumption of packaged goods, especially food, beverages, and healthcare, contributing to the India plastic packaging market growth. Moreover, packaging design innovations like lighter and flexible plastic packs have also fueled the use of plastic across industries, lowering the costs of transportation as well as extending shelf life. Market opportunities are vast, especially with increasing market demand for sustainable and environmentally friendly options. With increased eco-friendliness awareness among consumers and companies, biodegradable plastics and recyclable packaging are increasingly in demand. Furthermore, the government's support for initiatives that promote sustainable packaging solutions is creating a favorable environment for manufacturers to innovate and offer products that align with global environmental standards. As per the India plastic packaging market forecast, this presents significant growth opportunities, particularly for companies that can integrate sustainability into their packaging offerings.

Challenges and Government Support for the India Plastic Packaging Market

As per the India plastic packaging market analysis, major challenges in the industry concerning environmental issues like plastic waste and pollution, are affecting its growth. As more people are becoming aware of the negative impact of plastic on nature, it has led to immense pressure on companies to abandon the traditional plastic packing alternatives for more sustainable ones. To counter such concerns, the government has been taking steps toward measures such as reducing single-use plastics and encouraging recycling through policies. In 2024, the Indian government launched an initiative to ban single-use plastic items, which is pushing companies to innovate and transition towards eco-friendly packaging solutions, impacting the India plastic packaging market share positively. Additionally, there is a lack of robust recycling infrastructure across the country, which complicates the effective management of plastic waste. Nonetheless, these challenges have driven the discovery of biodegradable plastics as well as the increased use of recycling technologies, which are boosted by government incentives that aim at promoting environmentally friendly manufacturing processes as well as minimizing environmental consequences.

India Plastic Packaging Market Segmentation:

IMARC Group provides an analysis of the key trends in each segment of the market, along with forecasts at the country level for 2026-2034. Our report has categorized the market based on packaging type, product type, and end user.

Packaging Type Insights:

- Flexible Plastic Packaging

- Rigid Plastic Packaging

The report has provided a detailed breakup and analysis of the market based on the packaging type. This includes flexible plastic packaging and rigid plastic packaging.

Product Type Insights:

- Bottles and Jars

- Trays and Containers

- Pouches

- Bags

- Films and Wraps

- Others

A detailed breakup and analysis of the market based on the product type have also been provided in the report. This includes bottles and jars, trays and containers, pouches, bags, films and wraps, and others.

End User Insights:

Access the comprehensive market breakdown Request Sample

- Food

- Beverage

- Healthcare

- Personal Care and Household

- Others

The report has provided a detailed breakup and analysis of the market based on the end user. This includes food, beverage, healthcare, personal care and household, and others.

Regional Insights:

- North India

- West and Central India

- South India

- East and Northeast India

The report has also provided a comprehensive analysis of all the major regional markets, which include North India, West and Central India, South India, and East and Northeast India.

Competitive Landscape:

The market research report has also provided a comprehensive analysis of the competitive landscape. Competitive analysis such as market structure, key player positioning, top winning strategies, competitive dashboard, and company evaluation quadrant has been covered in the report. Also, detailed profiles of all major companies have been provided.

Latest News and Developments:

- In June 2025, UFlex launched an FSSAI-approved single-pellet option for food and beverage packaging, blended with recycled and virgin PET, making it easy for brands to achieve Extended Producer Responsibility (EPR) compliance. The initiative bypasses material mixing requirements in compliance with new FSSAI regulations requiring 30% recycled content in rigid plastic packs by FY26.

- In May 2025, Chemco Group and Kandoi Group of Industries announced a joint venture to invest INR 450 Crore (USD 54.4 Million) in setting up two greenfield manufacturing facilities in Gujarat. These plants will recycle over 10 Million PET bottles daily, operating entirely on renewable energy, and offer sustainable packaging solutions. The facilities will integrate a closed-loop system, transforming PET waste into high-performance industrial packaging.

- In December 2024, the Indian Plast Pack Forum (IPPF) announced PLAST PACK 2025, Central India's largest exhibition for the plastic, packaging, and printing industries, scheduled from January 9th to 12th, 2025, at the Labhganga Exhibition Center, Indore. The event, covering over 10,000 sqm, featured more than 400 exhibitors and attracted over 100,000 visitors, showcasing innovations, technologies, and solutions.

- In September 2024, UFlex participated in World Food India 2024, showcasing its sustainable flexible packaging solutions, including enzyme-based biodegradable packaging and modified atmosphere technology for extending the shelf life of fresh produce. The company highlighted its efforts to address plastic waste pollution by recycling multilayer plastics and incorporating recycled content into packaging.

India Plastic Packaging Market Report Coverage:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2025 |

| Historical Period | 2020-2025 |

| Forecast Period | 2026-2034 |

| Units | Billion USD |

| Scope of the Report | Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Packaging Types Covered | Flexible Plastic Packaging, Rigid Plastic Packaging |

| Product Types Covered | Bottles and Jars, Trays and Containers, Pouches, Bags, Films and Wraps, Others |

| End Users Covered | Food, Beverage, Healthcare, Personal Care and Household, Others |

| Regions Covered | North India, West and Central India, South India, East and Northeast India |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Benefits for Stakeholders:

- IMARC’s industry report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, market forecasts, and dynamics of the India plastic packaging market from 2020-2034.

- The research report provides the latest information on the market drivers, challenges, and opportunities in the India plastic packaging market.

- Porter's five forces analysis assist stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyze the level of competition within the India plastic packaging industry and its attractiveness.

- Competitive landscape allows stakeholders to understand their competitive environment and provides an insight into the current positions of key players in the market.

Key Questions Answered in This Report

The plastic packaging market in India was valued at USD 13.2 Billion in 2025.

The India plastic packaging market is projected to exhibit a CAGR of 3.10% during 2026-2034, reaching a value of USD 17.3 Billion by 2034.

The India plastic packaging market is driven by changing consumer lifestyles, growing demand for convenient and durable packaging, and expansion of e-commerce and retail sectors. Increasing use in food, beverages, and personal care products, along with innovations in eco-friendly and smart packaging solutions, continues to shape the industry’s growth.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)