India Plastisol Market Size, Share, Trends and Forecast by Processing Technique, Application, End-User Industry, and Region, 2025-2033

India Plastisol Market Overview:

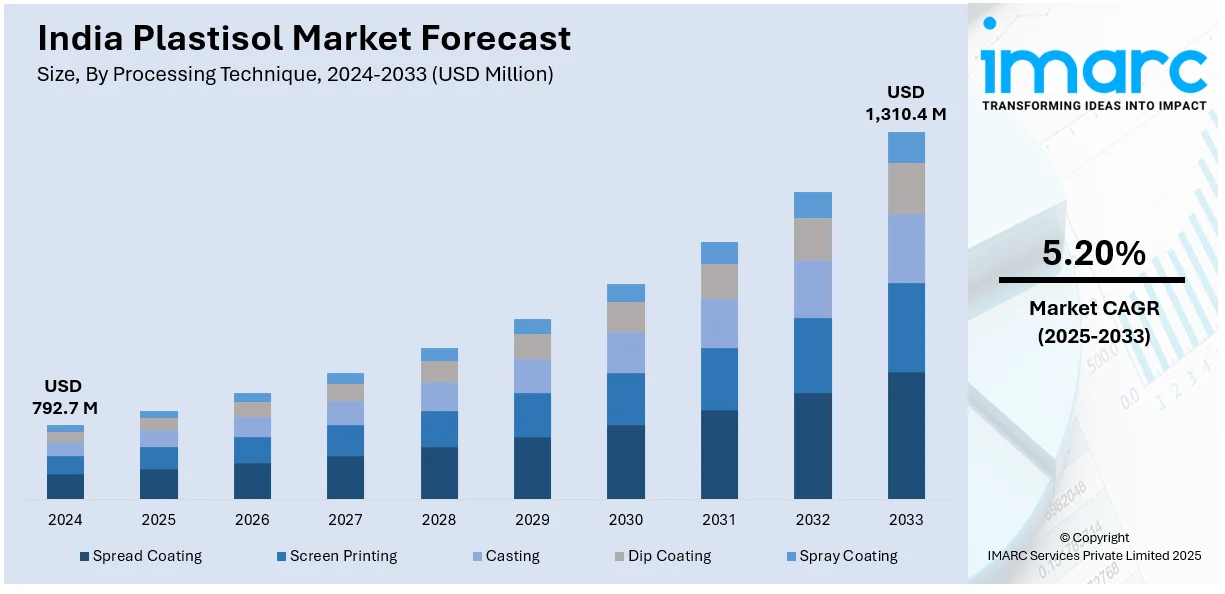

The India plastisol market size reached USD 792.7 Million in 2024. Looking forward, IMARC Group expects the market to reach USD 1,310.4 Million by 2033, exhibiting a growth rate (CAGR) of 5.20% during 2025-2033. The market share is expanding, driven by the rising manufacturing of vehicles where plastisol is required for coatings, seam sealing, and sound-dampening applications, along with increasing investments in infrastructure projects that demand effective solutions for pipe linings.

|

Report Attribute

|

Key Statistics

|

|---|---|

|

Base Year

|

2024 |

|

Forecast Years

|

2025-2033

|

|

Historical Years

|

2019-2024

|

| Market Size in 2024 | USD 792.7 Million |

| Market Forecast in 2033 | USD 1,310.4 Million |

| Market Growth Rate 2025-2033 | 5.20% |

India Plastisol Market Trends:

Increasing production of vehicles

The rising vehicle production is propelling the Indsiia plastisol market growth. According to the IBEF, In September 2024, the overall output of passenger cars, three-wheelers, two-wheelers, and quadricycles reached 27,73,039 units. Automakers use plastisol coatings, adheves, and sealants in vehicle manufacturing processes. Plastisol is widely applied in underbody coatings, seam sealing, and sound-dampening applications due to its strong protective properties and durability. As vehicle production scales up to meet growing consumer demand, particularly in emerging markets, the need for effective coatings that offer corrosion resistance and improve vehicle longevity is rising. Plastisol's flexibility and adhesion capabilities make it ideal for sealing vehicle body parts, enhancing structural integrity, and ensuring better protection against moisture, dirt, and road debris. Additionally, plastisol's application in producing gaskets, caps, and electrical insulation components is expanding as automotive designs become more complex. With automakers focusing on improving vehicle performance and durability, the demand for plastisol products is increasing steadily. This trend is further supported by the automotive sector's emphasis on cost-effective solutions that enhance vehicle quality and lifespan.

To get more information on this market, Request Sample

Rising investments in construction projects

The increasing expenditure on construction projects is offering a favorable India plastisol market outlook. Builders and developers are actively using plastisol coatings, sealants, and protective layers in various applications. Plastisol's ability to provide durable, flexible, and weather-resistant coatings makes it highly effective for metal structures, pipelines, and roofing systems. As construction activities broaden across residential, commercial, and industrial sectors, the need for materials that enhance surface protection and extend structural life is rising. Plastisol coatings are widely employed for metal doors, window frames, and outdoor furniture due to their resistance to corrosion, heat, and UV exposure. Additionally, the high spending on infrastructure projects, such as highways, bridges, and public facilities, is driving the demand for plastisol in protective coatings and pipe linings. Its rising utilization in electrical insulation and industrial equipment is also gaining traction, as new facilities and manufacturing plants are being established. With India's construction sector experiencing rapid expansion, plastisol products are becoming a preferred solution for enhancing structural strength, longevity, and visual appeal.

India Plastisol Market Segmentation:

IMARC Group provides an analysis of the key trends in each segment of the market, along with forecasts at the regional level for 2025-2033. Our report has categorized the market based on processing technique, application, and end-user industry.

Processing Technique Insights:

- Spread Coating

- Screen Printing

- Casting

- Dip Coating

- Spray Coating

The report has provided a detailed breakup and analysis of the market based on the processing techniques. This includes spread coating, screen printing, casting, dip coating, and spray coating.

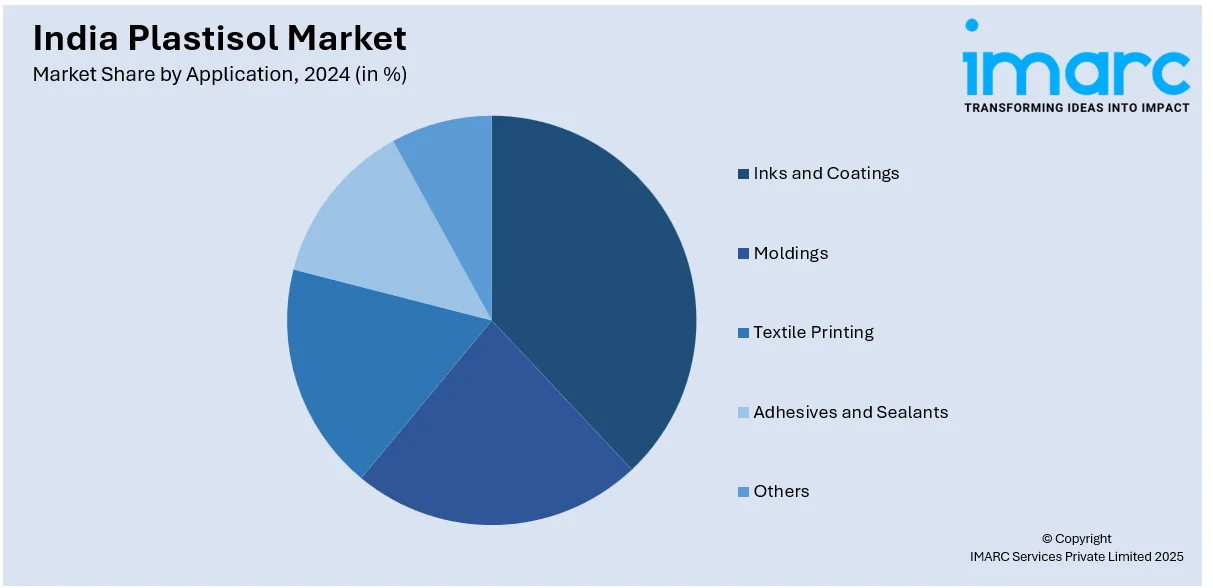

Application Insights:

- Inks and Coatings

- Moldings

- Textile Printing

- Adhesives and Sealants

- Others

A detailed breakup and analysis of the market based on the applications have also been provided in the report. This includes inks and coatings, moldings, textile printing, adhesives and sealants, and others.

End-User Industry Insights:

- Textile and Apparel

- Construction

- Automotive

- Metal Finishing

- Defense and Military

- Medical

- Agriculture

- Others

The report has provided a detailed breakup and analysis of the market based on the end-user industries. This includes textile and apparel, construction, automotive, metal finishing, defense and military, medical, agriculture, and others.

Regional Insights:

- North India

- South India

- East India

- West India

The report has also provided a comprehensive analysis of all the major regional markets, which include North India, South India, East India, and West India.

Competitive Landscape:

The market research report has also provided a comprehensive analysis of the competitive landscape. Competitive analysis such as market structure, key player positioning, top winning strategies, competitive dashboard, and company evaluation quadrant has been covered in the report. Also, detailed profiles of all major companies have been provided.

India Plastisol Market Report Coverage:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2024 |

| Historical Period | 2019-2024 |

| Forecast Period | 2025-2033 |

| Units | Million USD |

| Scope of the Report |

Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Processing Techniques Covered | Spread Coating, Screen Printing, Casting, Dip Coating, Spray Coating |

| Applications Covered | Inks and Coatings, Moldings, Textile Printing, Adhesives and Sealants, Others |

| End-User Industries Covered | Textile and Apparel, Construction, Automotive, Metal Finishing, Defense and Military, Medical, Agriculture, Others |

| Regions Covered | North India, South India, East India, West India |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Benefits for Stakeholders:

- IMARC’s industry report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, market forecasts, and dynamics of the India plastisol market from 2019-2033.

- The research report provides the latest information on the market drivers, challenges, and opportunities in the India plastisol market.

- Porter's five forces analysis assist stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyze the level of competition within the India plastisol industry and its attractiveness.

- Competitive landscape allows stakeholders to understand their competitive environment and provides an insight into the current positions of key players in the market.

Key Questions Answered in This Report

The plastisol market in India was valued at USD 792.7 Million in 2024.

The India plastisol market is projected to exhibit a (CAGR) of 5.20% during 2025-2033, reaching a value of USD 1,310.4 Million by 2033.

The market is driven by increasing demand in the automotive, footwear, textiles, and consumer goods sectors. Plastisol's versatility, long lifespan, and affordability make it the first choice for coatings, inks, and adhesives. Increased industrialization, growth in end-use industries, and greater emphasis on PVC-based products are promoting the use of plastisol solutions throughout India.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)