India Plumbing Fixtures Market Size, Share, Trends and Forecast by Product, Location, Application, Distribution Channel, End User, and Region, 2025-2033

India Plumbing Fixtures Market Overview:

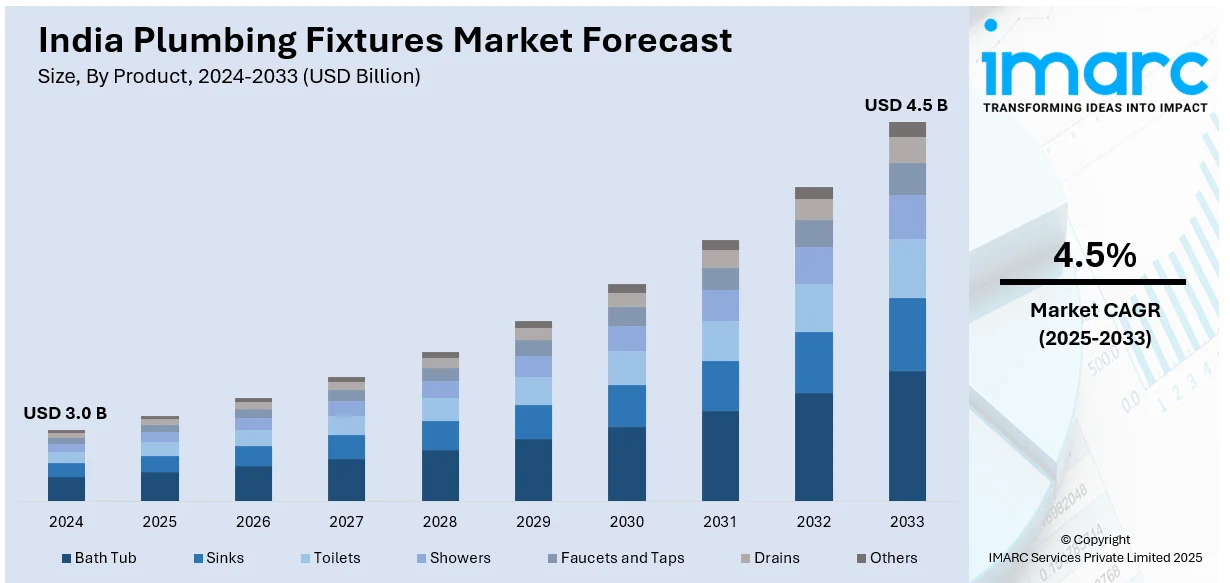

The India plumbing fixtures market size reached USD 3.0 Billion in 2024. Looking forward, IMARC Group expects the market to reach USD 4.5 Billion by 2033, exhibiting a growth rate (CAGR) of 4.5% during 2025-2033. The market is witnessing significant growth, driven by the rising demand for smart and water-efficient plumbing fixtures and growth in premium and aesthetic plumbing fixtures.

|

Report Attribute

|

Key Statistics

|

|---|---|

|

Base Year

|

2024

|

|

Forecast Years

|

2025-2033

|

|

Historical Years

|

2019-2024

|

| Market Size in 2024 | USD 3.0 Billion |

| Market Forecast in 2033 | USD 4.5 Billion |

| Market Growth Rate (2025-2033) | 4.5% |

India Plumbing Fixtures Market Trends:

Rising Demand for Smart and Water-Efficient Plumbing Fixtures

The plumbing fixtures industry in India is undergoing drastic changes towards smart and water-efficient solutions owing to urbanization, stringent laws regarding water conservation, and increasing consumer awareness about sustainable living. Sensor faucets, dual-flush toilets, and water-saving showerheads are increasingly being adopted for use in residential and commercial applications. With the Atal Mission for Rejuvenation and Urban Transformation (AMRUT) Scheme and Smart Cities Mission financially assisting projects related to efficient water management, demand for the fittings is further sprouting. For instance, in January 2025, The Bureau of Water Use Efficiency (BWUE) and Indian Plumbing Association (IPA) hosted a workshop on water efficiency, emphasizing low-flow fixtures and smart sanitary ware for sustainable domestic water conservation. Additionally, the hospitality and healthcare sectors are increasingly investing in touchless and antibacterial plumbing solutions to enhance hygiene standards. Manufacturers are integrating advanced technologies such as IoT-enabled leak detection and automated water flow control to optimize water usage. The growing penetration of green building certifications, such as LEED and IGBC, is also encouraging real estate developers to incorporate water-efficient plumbing fixtures into new construction projects. This trend is expected to drive market expansion as consumers and businesses prioritize cost savings and environmental sustainability. With rising disposable incomes and evolving consumer preferences, the adoption of smart plumbing fixtures is set to become a defining trend in the Indian market over the coming years.

To get more information on this market, Request Sample

Growth in Premium and Aesthetic Plumbing Fixtures

The Indian plumbing fixtures market is experiencing increasing demand for premium and aesthetically designed products, particularly in urban areas. The expansion of the luxury housing segment, along with rising disposable incomes and changing consumer preferences, is fueling the adoption of high-end plumbing fixtures with superior aesthetics and functionality. Developers and homeowners are prioritizing modern and designer bathroom and kitchen fixtures, including freestanding bathtubs, wall-mounted faucets, and rain showers, to enhance interior appeal. For instance, in January 2025, Kohler announced the launch of $18,500 Alexa-powered smart toilets in Mumbai. The 16,000 sq. ft. showroom also features a $5,800 hand-painted wash basin with Indian fort or wildlife designs. The rise of e-commerce and digital platforms has made premium international and domestic brands more accessible to consumers, further driving demand. Additionally, the growing influence of global interior design trends and the increasing prevalence of home renovation projects are boosting sales of high-quality, stylish plumbing fixtures. Leading manufacturers are introducing innovative designs with advanced materials such as matte finishes, brushed metal coatings, and ceramic-based fixtures to cater to this segment. The hospitality sector, including luxury hotels and resorts, is also a key driver, as high-end establishments seek to enhance guest experiences with sophisticated and customized plumbing solutions. This trend is expected to intensify as consumer aspirations evolve, reinforcing the premiumization of the Indian plumbing fixtures market.

India Plumbing Fixtures Market Segmentation:

IMARC Group provides an analysis of the key trends in each segment of the market, along with forecasts at the region level for 2025-2033. Our report has categorized the market based on product, location, application, distribution channel, and end-user.

Product Insights:

- Bath Tub

- Sinks

- Toilets

- Showers

- Faucets and Taps

- Drains

- Others

The report has provided a detailed breakup and analysis of the market based on the product. This includes bath tub, sinks, toilets, showers, faucets and taps, drains, and others.

Location Insights:

- Bathroom

- Kitchen

- Others

A detailed breakup and analysis of the market based on the location have also been provided in the report. This includes bathroom, kitchen, and others.

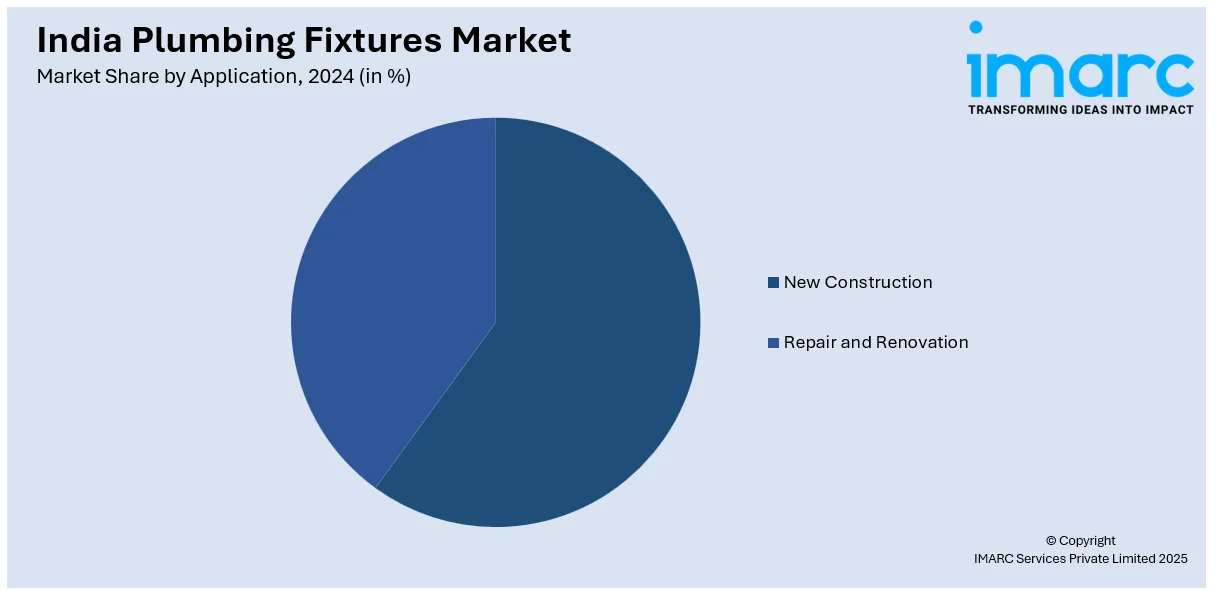

Application Insights:

- New Construction

- Repair and Renovation

A detailed breakup and analysis of the market based on the application have also been provided in the report. This includes new construction and repair and renovation.

Distribution Channel Insights:

- Online

- Offline

A detailed breakup and analysis of the market based on the distribution channel have also been provided in the report. This includes online and offline.

End-User Insights:

- Residential

- Commercial

A detailed breakup and analysis of the market based on the end-user have also been provided in the report. This includes residential and commercial.

Regional Insights:

- North India

- South India

- East India

- West India

The report has also provided a comprehensive analysis of all the major regional markets, which include North India, South India, East India, and West India.

Competitive Landscape:

The market research report has also provided a comprehensive analysis of the competitive landscape. Competitive analysis such as market structure, key player positioning, top winning strategies, competitive dashboard, and company evaluation quadrant has been covered in the report. Also, detailed profiles of all major companies have been provided.

India Plumbing Fixtures Market News:

- In October 2024, Kohler, a worldwide leader in kitchen and bath innovations, inaugurated India’s inaugural Studio Kohler in Banjara Hills, Hyderabad. This creative area combines art and design, transforming bathroom visuals. The studio provides an engaging experience, highlighting luxurious bathroom solutions that spark creativity and enhance contemporary design in India.

India Plumbing Fixtures Market Report Coverage:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2024 |

| Historical Period | 2019-2024 |

| Forecast Period | 2025-2033 |

| Units | Billion USD |

| Scope of the Report |

Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Products Covered | Bath Tub, Sinks, Toilets, Showers, Faucets and Taps, Drains, Others |

| Locations Covered | Bathroom, Kitchen, Others |

| Applications Covered | New Construction, Repair and Renovation |

| Distribution Channels Covered | Online, Offline |

| End-users Covered | Residential, Commercial |

| Regions Covered | North India, South India, East India, West India |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Questions Answered in This Report:

- How has the India plumbing fixtures market performed so far and how will it perform in the coming years?

- What is the breakup of the India plumbing fixtures market on the basis of product?

- What is the breakup of the India plumbing fixtures market on the basis of location?

- What is the breakup of the India plumbing fixtures market on the basis of application?

- What is the breakup of the India plumbing fixtures market on the basis of distribution channel?

- What is the breakup of the India plumbing fixtures market on the basis of end-user?

- What is the breakup of the India plumbing fixtures market on the basis of region?

- What are the various stages in the value chain of the India plumbing fixtures market?

- What are the key driving factors and challenges in the India plumbing fixtures?

- What is the structure of the India plumbing fixtures market and who are the key players?

- What is the degree of competition in the India plumbing fixtures market?

Key Benefits for Stakeholders:

- IMARC’s industry report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, market forecasts, and dynamics of the India plumbing fixtures market from 2019-2033.

- The research report provides the latest information on the market drivers, challenges, and opportunities in the India plumbing fixtures market.

- Porter's five forces analysis assist stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyze the level of competition within the India plumbing fixtures industry and its attractiveness.

- Competitive landscape allows stakeholders to understand their competitive environment and provides an insight into the current positions of key players in the market.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)