India Pneumatic Cylinders Market Size, Share, Trends and Forecast by Product Type, Motion, End User Industry, Region, 2026-2034

India Pneumatic Cylinders Market Overview:

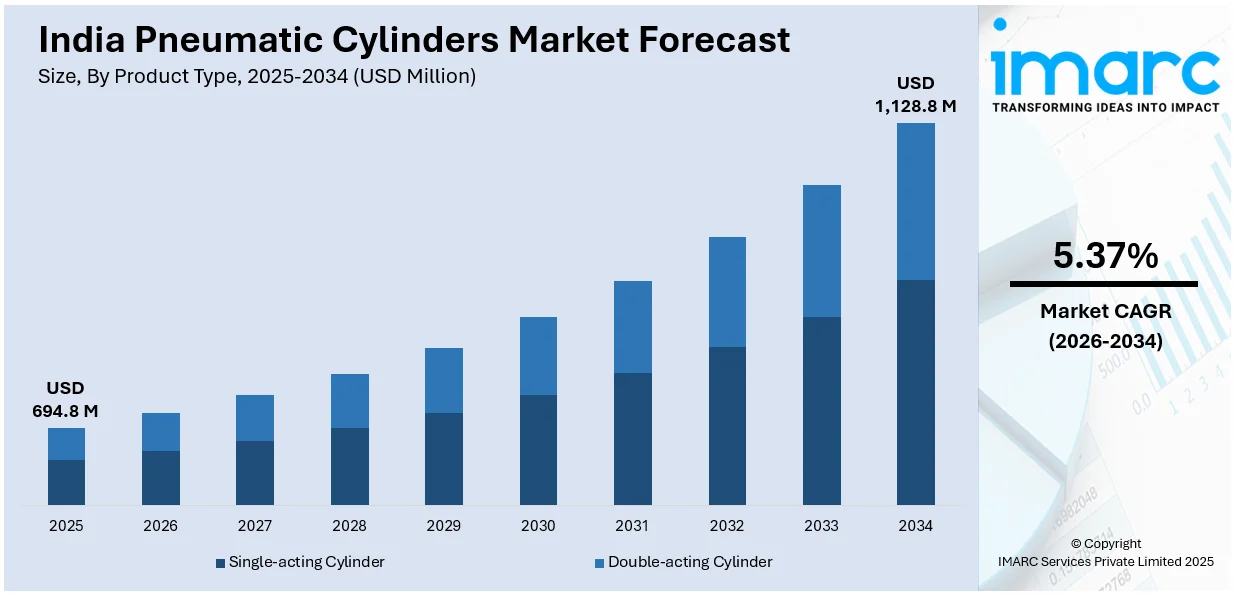

The India pneumatic cylinders market size reached USD 694.8 Million in 2025. Looking forward, IMARC Group expects the market to reach USD 1,128.8 Million by 2034, exhibiting a growth rate (CAGR) of 5.37% during 2026-2034. The market is witnessing significant growth, driven by the widespread adoption of industrial automation and a rising demand for energy-efficient and compact pneumatic cylinders.

|

Report Attribute

|

Key Statistics

|

|---|---|

|

Base Year

|

2025

|

|

Forecast Years

|

2026-2034

|

|

Historical Years

|

2020-2025

|

| Market Size in 2025 | USD 694.8 Million |

| Market Forecast in 2034 | USD 1,128.8 Million |

| Market Growth Rate (2026-2034) | 5.37% |

India Pneumatic Cylinders Market Trends:

Increasing Adoption of Industrial Automation

The India pneumatic cylinders market is witnessing a strong demand surge due to the rapid adoption of industrial automation across key manufacturing sectors, including automotive, food and beverage, pharmaceuticals, and packaging. For instance, in March 2024, India’s pneumatic automation market, currently valued at ₹3,000 crores, is projected to reach ₹5,000 crores within five years, driven by industrial automation, manufacturing growth, and increasing demand for advanced pneumatic solutions. As organizations continue to focus on maximizing efficiency while ensuring precision and cost-effectiveness, the spectrum of automated systems harnessing pneumatic actuators is increasing. As countries increasingly evolve into national automated units, most engineers in manufacturing industries and generalized industry use will often prefer pneumatic cylinders, as they highly depend on reliability, energy savings, and capacity to function efficiently in a harsh environment. Initiatives from the government, such as "Make in India," as well as other such initiatives, push the new direction of industrial automation, which has created significant investment opportunity in the sector. Moreover, the promising future for both robotics and Industry 4.0 technologies has bolstered the need for pneumatic systems in automated assembly lines, material handling, and process control applications. In fact, the ever-increasing footprint of global automation solution providers in India seems to increase the rate of diffusion of advanced pneumatic cylinders that boast features such as superior durability and lightweight materials coupled with improved energy efficiency. Moreover, the growth of small and medium enterprises in India has also contributed to the rise of this market as most of these enterprises have embraced the use of automation solutions to enhance productivity and meet increasing demand. Continuous advancement in the field of technology is expected to keep the pneumatic cylinder market alive, considering the movement towards smart and automated manufacturing processes.

To get more information on this market Request Sample

Growing Demand for Energy-Efficient and Compact Pneumatic Cylinders

The India pneumatic cylinders market is experiencing a shift toward energy-efficient and compact designs, driven by the need for reduced energy consumption and space optimization in industrial applications. For instance, in January 2024, Festo India announced an investment of ₹520 crore in a pneumatic components facility in Krishnagiri, Tamil Nadu, producing actuators, valves, and automation equipment, boosting local manufacturing, reducing imports. With rising electricity costs and stringent regulations promoting sustainable industrial practices, manufacturers are focusing on developing pneumatic cylinders that enhance operational efficiency while minimizing energy waste. One of the key advancements in this area is the introduction of lightweight materials, such as aluminum and composite-based cylinders, which improve performance while reducing energy consumption. Additionally, innovations in valve technology and air consumption control mechanisms are further optimizing pneumatic cylinder efficiency. These developments align with India's push for sustainability and energy conservation across manufacturing industries. The increasing adoption of miniaturized pneumatic cylinders is another significant trend, particularly in industries such as electronics and medical devices, where compact automation solutions are required. These smaller cylinders provide high precision and force output while occupying minimal space, making them ideal for modern industrial setups with constrained footprints. As industries continue to prioritize sustainability and energy efficiency, the demand for advanced pneumatic cylinders with improved power-to-weight ratios, lower air consumption, and intelligent control mechanisms is expected to grow, shaping the future of the India pneumatic cylinders market.

India Pneumatic Cylinders Market Segmentation:

IMARC Group provides an analysis of the key trends in each segment of the market, along with forecasts at the region level for 2026-2034. Our report has categorized the market based on product type, motion, and end-user industry.

Product Type Insights:

- Single-acting Cylinder

- Double-acting Cylinder

The report has provided a detailed breakup and analysis of the market based on the product type. This includes single-acting cylinder and double-acting cylinder.

Motion Insights:

- Linear

- Rotary

A detailed breakup and analysis of the market based on the motion have also been provided in the report. This includes linear and rotary.

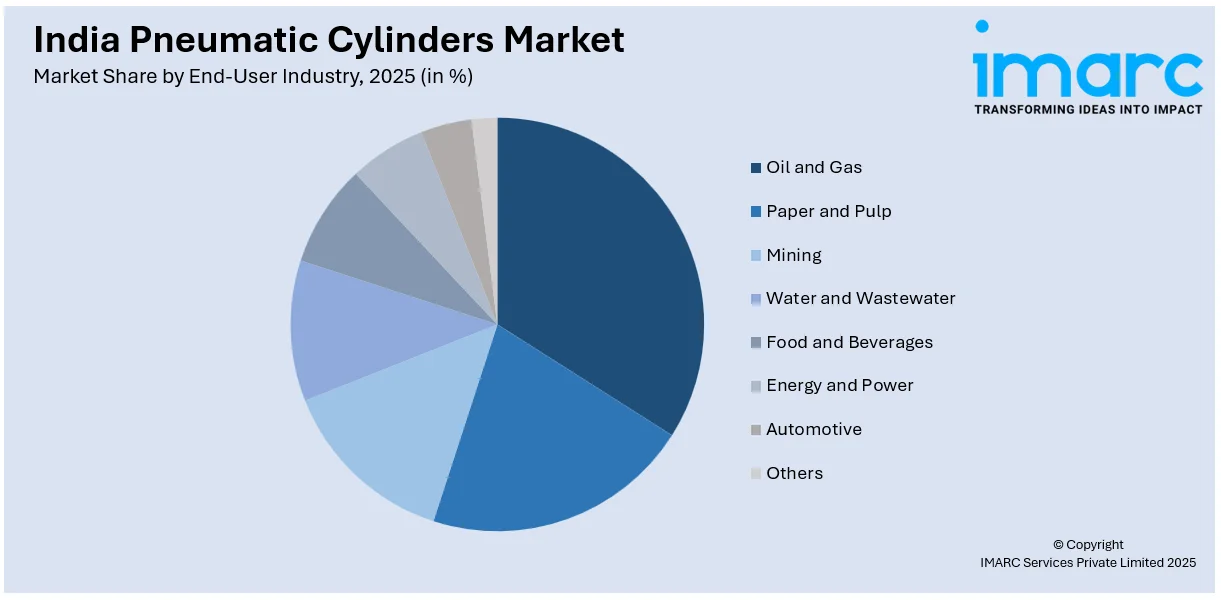

End-User Industry Insights:

Access the comprehensive market breakdown Request Sample

- Oil and Gas

- Paper and Pulp

- Mining

- Water and Wastewater

- Food and Beverages

- Energy and Power

- Automotive

- Others

A detailed breakup and analysis of the market based on the end-user industry have also been provided in the report. This includes oil and gas, paper and pulp, mining, water and wastewater, food and beverages, energy and power, automotive, and others.

Regional Insights:

- North India

- South India

- East India

- West India

The report has also provided a comprehensive analysis of all the major regional markets, which include North India, South India, East India, and West India.

Competitive Landscape:

The market research report has also provided a comprehensive analysis of the competitive landscape. Competitive analysis such as market structure, key player positioning, top winning strategies, competitive dashboard, and company evaluation quadrant has been covered in the report. Also, detailed profiles of all major companies have been provided.

India Pneumatic Cylinders Market Report Coverage:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2025 |

| Historical Period | 2020-2025 |

| Forecast Period | 2026-2034 |

| Units | Million USD |

| Scope of the Report |

Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Product Types Covered | Single-acting Cylinder, Double-acting Cylinder |

| Motions Covered | Linear, Rotary |

| End User Industries Covered | Oil and Gas, Paper and Pulp, Mining, Water and Wastewater, Food and Beverages, Energy and Power, Automotive, Others |

| Regions Covered | North India, South India, East India, West India |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Questions Answered in This Report:

- How has the India pneumatic cylinders market performed so far and how will it perform in the coming years?

- What is the breakup of the India pneumatic cylinders market on the basis of product type?

- What is the breakup of the India pneumatic cylinders market on the basis of motion?

- What is the breakup of the India pneumatic cylinders market on the basis of end user industry?

- What is the breakup of the India pneumatic cylinders market on the basis of region?

- What are the various stages in the value chain of the India pneumatic cylinders market?

- What are the key driving factors and challenges in the India pneumatic cylinders?

- What is the structure of the India pneumatic cylinders market and who are the key players?

- What is the degree of competition in the India pneumatic cylinders market?

Key Benefits for Stakeholders:

- IMARC’s industry report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, market forecasts, and dynamics of the India pneumatic cylinders market from 2020-2034.

- The research report provides the latest information on the market drivers, challenges, and opportunities in the India pneumatic cylinders market.

- Porter's five forces analysis assist stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyze the level of competition within the India pneumatic cylinders industry and its attractiveness.

- Competitive landscape allows stakeholders to understand their competitive environment and provides an insight into the current positions of key players in the market.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)